Last month I published several articles about the experiences of Washington State as they implement their cap-and-invest program because I think it is likely that New York’s experiences will be similar. In one I elevated a comment from Washington resident Paul Fundingsland into a post. He recently did “a bit of research with some comments, thoughts and a more or less rough idea of what seems to be going on in the Washington State cap-and-invest scheme” that I have converted into a guest post.

Paul describes himself as “An Obsessive Climate Change Generalist”. Although he is a retired professor, he say he has no scientific or other degrees specific to these kinds of issues that can be cited as offering personal official expertise or credibility. What he does have is a two decades old avid, enthusiastic, obsession with all things Climate Change related.

Last month I published Washington State Gasoline Prices Are a Precursor to New York’s Future, which was a variation of an article published at Watts Up With That – Do Washington State Residents Know Why Their Gasoline Prices Are So High Now?. I also published Washington State Gasoline Prices and Public Perceptions that consolidated responses from Washington residents in the comments from the Watts Up With That article. The last article, Feedback from Washington State on Gas Prices was from Paul Fundingsland. All the articles addressed recent reports that gasoline prices in the State of Washington are now higher than California.

In this post Fundingsland provides an update after doing a bit of research. I provide his thoughts with my commentary below.

Initial Thoughts

The focus of my articles was the increase in gasoline prices. Not surprisingly that has become a hot topic in Washington. Paul explains:

Pushback on the rise in gas prices associated with the “Cap-and-Invest” scheme (hereafter referred to as “Tax-and-Reallocate” because that is essentially how it works) has caused our Governor to publicly blame the oil companies for price gouging apparently thinking they should absorb the loss of revenue and not pass their state mandated added costs for doing business on to their customers. Apparently he thought these companies should unrealistically absorb the loss of revenue and not pass their state mandated added costs for doing business on to their customers.

The idea that the costs of the program should not be passed on is also present in New York. When the prices necessarily go up it is a shock to many. Why I do not know. It is obvious that the tax-and-reallocate scheme is dealing with a lot of money and not working as planned.

One of our state legislators claims Washington State is now making more money from the sale of a gallon of gas or diesel than the oil companies. Our Department of Ecology (which is running this scheme) scrubbed the website original language indicating this scheme would have a minimal effect on gas prices. The Washington Policy Center claims the proposed climate funding budget is spending 56% of the initial $306 million on expanding government. No real surprise there.

I have concluded that the underlying motive of most of the proponents of these schemes is money. Legislator Reuven Carlyle was a sponsor of the cap-and-reallocate law and provides an example.

Carlyle who chaired the Washington State Senate Environment, Energy & Technology Committee and was a member of the Ways and Means Committee, lead the charge in the Senate for passage of the Climate Commitment Act, Clean Energy Transformation Act, Clean Fuel Standard, hydrofluorocarbon standards, building standards and much more. He left the legislature this year to cash in on his legislative work founding a startup called Earth Finance to “help businesses hit climate goals” based on his legislative accomplishments.

Program Evolution

Fundingsland’s experience with the researching the program is similar to mine:

A cursory review of how this “tax-and-reallocate” scheme is evolving in Washington and what kinds of claims and actual emissions reductions result going forward reveals a quagmire of incredibly convoluted intertwined moving parts. Trying to unravel the threads is proving to be very difficult and quite frustrating.

He notes that descriptive information is not available. That is a common trait in cap-and-invest programs in my experience:

For example under the Department of Ecology one can find a list of the companies who participated in the 2nd auction under “Washington Cap-and-Invest Program Auction #2 May 2023 Summary Report” but no data on how many allowances each company bought or what their total costs were. Interestingly, high profile Washington businesses missing from this list include Boeing, Microsoft, Amazon and Starbucks to name a few.

As to how the monies received from the program are going to be distributed, as of the moment one can find only broad generalized categories with aspirations as to how they will be applied subject to future legislative decision making. For example: “these proceeds will be used to increase climate resiliency, fund alternative-transportation grant programs, and help Washington transition to a low-carbon economy” (my bold).

“Cap-and-Invest Auction Proceeds, consists of these generalized categories with percentages and sub accounts filled with somewhat more specific wish lists of where and how the monies are supposed to be spent. Under “Auction Public Proceeds Report” there is only broad information as to how much money was received.

Nowhere is there documentation of how much CO2 has been or is projected to be reduced by this plan in comparison with past years or how much less warming this plan has resulted in or is projected to result in.

Unfortunately, the problems he described are also present in New York’s implementation of the Climate Leadership & Community Protection Act (Climate Act). The Public Service Commission just published a summary of the implementation status of the Climate Act and the lack of specificity noted here is present in that report.

Washington Emissions

Paul notes that he is “somewhat new at sorting through government bureaucratic documents”. He caveats the following as what “might be better viewed as a rough approximation, subject to revision once more detailed and specific information is obtained.” He does think the following is approximately correct.

According to the Washington State Department of Ecology, the 2019 breakdown of Washington State greenhouse gas emissions is: Residential, Commercial, Industrial heating 25%, Transportation 39%, Electricity 21%, Other 14%.

Electrical power is 64.6% hydro supplied by eight hydro plants owned and operated by the Federal Government. Natural gas is currently at 14.4%, nuclear at 7.8%, wind 8.7%, coal at 2.9%, biomass at 1.3% and a small contribution of solar.

Washington’s natural gas utilities and electric utilities receive a determined (revisable) amount of their required emissions allowances for free. Washington’s only coal fired plant’s emissions are grandfathered in as it will be fully decommissioned in 2024.

So, unlike the lower emissions resulting from a coal to natural gas switch as fortuitously happened during the initial years of the east coast RGGI scheme, there is not a lot of low hanging CO2 emissions fruit to begin with to harvest or claim as a success from the electricity sector in Washington. And with the free emissions allowances the emissions reduction pool from this sector is even further diluted.

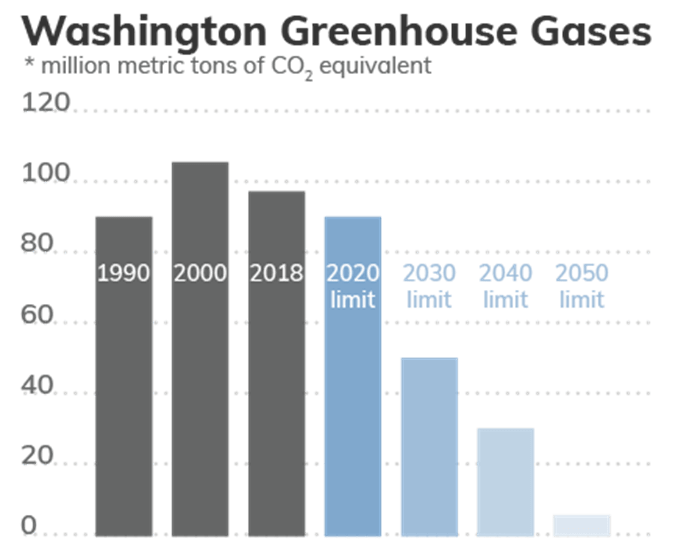

When I skimmed through the Washington regulations one of the things that jumped out to me was the following figure. The 2030 limit is a 45% reduction below 1990 levels. The chart indicates that 2020 emissions were equal to or slightly more than the 1990 emissions. A 45% reduction in ten years seems ambitious. Based on the information from Fundingsland, I cannot imagine this target will be achieved.

In addition, the “tax-and-reallocate scheme” contains all sorts of other emissions exemptions. One classification is termed “EITEs” consisting of over 40 facilities and businesses that qualify as Emissions-Intensive, Trade-Exposed industries even though they qualify for mandated participation in emission allowance auctions.

There are also ”tax-and-reallocate-offsets” being run thru what is designated as an Offset Project Registry that looks to be a California based company called Climate Action Reserve.

That leaves the bulk of the emissions reductions to be garnered from the other three sectors (transportation, residential-industrial-commercial heating, and “other”). At this time, it is difficult to determine how the actual 25% breakdown within the residential-industrial-commercial heating sector works. For instance, residential energy use has been reported as being 60% electric.

I have long argued that a basic flaw in the New York net-zero transition plan is that there was no feasibility analysis. Given this information about Washington I think New York is comparatively better off. Both states need to document how they plan to get where they want to go but the reduction trajectory for New York is lower than Washington.

New York is starting to come to grips with similar sector target issues. If the cap-and-reallocate scheme is supposed to provide significant funds for implementation but there are a limited number of affected sectors, then the price impacts on those sectors is going to be magnified. That is exactly what happened in Washington. It is not price gouging when that happens, it is simply supply and demand.

Assuming the industrial-commercial may be mostly gas, the amount of emissions by individual businesses will be affected by whether they are in the EITEs classification or not, whether they have “offsets” and how many tons of CO2 they emit (250,000 tons being the “trigger” amount for mandatory participation in the tax-and-reallocate emissions auctions). So the number of emissions reduction areas possible in this sector are rather “squishy” and difficult to determine. They most probably will land on the low side of 25%.

The political origins of these rules should not be overlooked. The Progressive backers of both plans cater to the labor union constituencies so both New York and Washington carve out EITE exemptions. Because the net-zero transition plans will necessarily increase the cost of energy I expect that the inevitable result is that the increase will make industries in both states uneconomic relative to other locations whatever the intent of these efforts.

The “other” classification of this sector consists of: agriculture (manure, fertilizer, livestock digestion), industrial processes (aluminum, cement), waste management (landfills, waste water treatment), and natural gas distribution. Of these, waste management and natural gas distribution are negligible.

Agriculture represents a very difficult to find pathway toward lowering emissions without adversely affecting the food supply. That leaves cement and aluminum production which are essential to modern society, are both part of the EITEs exemption legislation and have, as of yet, no known practical, workable, scaleable emission free alternatives.

So the residential-industrial-commercial-heat and “other” sectors also look not to bear much in the way of emissions reductions for various mitigating reasons.

Again, the political calculus affects the treatment of these sectors. I think the decisions are based more on what they think they can get away with than a pragmatic emission reduction plan.

At 39%, transportation is the largest emissions sector. It has been reported that in the latest emissions allowances auction held last May, energy and utilities purchased the bulk of the allowances. With utilities (probably the gas plants) garnering a certain amount of unspecified free allowances from the State, that leaves the energy companies supporting transportation to shoulder the bulk of the latest allowance purchases.

There are five refineries located in our state that serve Washington, Oregon and to a small degree California. Their products include on-road gasoline and diesel, marine fuel, jet fuel and aviation gasoline, railroad fuel, and natural gas used in transportation. However, there are some big allowance exemptions that cover fuels involving watercraft (shipping, cruise ships, navy etc.), agricultural, aviation and exported fuels.

Personal car and truck fuels in Washington have no exemptions and make up over half of the total fossil fuel emissions in this category. With the energy companies probably buying the bulk of emission auction allowances, and with all the exemptions in the other fuel use areas, it’s not a stretch to see why the costs of the allowances were passed along to the personal car and truck consumers causing the rather massive jump in gas prices at the pump.

Overall, a good guess is the Legislature will be more than satisfied for some time with the amount of monies coming in that can be used to fund the expansion of the State bureaucracy and all their manufactured future wondrous climate mitigating projects to help save the world from future computer modeled bad weather. So they will feel they are basically doing their job. It’s doubtful they will want to cause gas prices to accelerate much more in the near future for fear of garnering the wrath of the electorate.

Often the simplest answer is correct. Fundingsland makes a good argument that this is just the start of the cost impacts to transportation in Washington. The mix of sector reductions in New York is different but not enough that fuel prices won’t spike when the New York auctions begin. I agree that the revenue target is entirely a political decision.

If and when a transparent “project report” comes out, it will no doubt tout all the money received (the easy headline grabbing part), be filled with all the virtuous climate change related project accomplishments the monies were or are going to be used for (the hyped glossy political part), with the actual emissions reduction data either completely missing, obscured, massaged, tortured, or glossed over and probably relegated to some vague or indeterminant area of the document with accompanying convoluted language (the important forgotten and reason for the scheme in the first place part).

Based on current Ecology Department documents available and reports from various sources, this already seems to be the case.

New York’s participation in the Regional Greenhouse Gas Initiative (RGGI) portends what will happen in Washington and his description is apt. I have been evaluating the RGGI reports for years and can confirm that the wording and information provided is designed to claim unqualified success. Digging into the numbers shows a much different story.

Questions

Fundingsland lists the following bottom-line questions.

*How much did each “qualified” company pay for the allowances?

*What were the financial consequences to the constituents of these added costs to the companies?

*Which areas and projects did the monies actually go to and how much did each receive?

*What was the overall cost per ton of CO2 reductions (total allowance participant proceeds versus total reduction in CO2 tons).

And the four most important questions:

*How much reduction in emissions compared to recent years has resulted from this scheme?

*How much less global warming has been projected to occur by these emission reduction results?

*How much is this scheme going to cost the residents to completion or are the costs never ending?

*What metric has been identified that will be used to indicate this program is no longer needed because it has done it’s job?

I agree with his take on responses to the questions:

It will be surprising if any of these kinds of questions are going to be addressed. It is looking more and more like just another never ending, forever growing government bureaucratic convoluted way to extract more funds from their constituents for some worthwhile, some okay, and some questionable projects that may or may not have a quantifiable bearing on reducing CO2 emissions.

Summation

Fundingsland summarizes the likely results of the program:

It’s going to be extremely difficult and may not even be possible for Washington State to be able to claim any meaningful or significant emission reductions based on this tax-and-reallocate scheme given the state’s overall energy use configuration combined with all the various emission allowance exemptions.

In fact, there is a very high probability there will be next to zero emission reductions and perhaps even an increase.

The easiest and most efficient way for the 54 companies/businesses listed under the auction #2 May 2023 summery report that have been forced to participate (“qualify” in bureaucratic terminology) in the allowance auctions or face a $10,000 per day fine, is for them to just purchase the allowances, add it to their cost of doing business and pass the increase along to their customers. So in effect they won’t be reducing their emissions at all. And all will be adding their additional State forced costs for doing business on to their customers.

This the ultimate flaw in the cap-and-reallocate plan. The costs to implement emission reductions are greater than the costs of allowances. Moreover, emission reductions may only be possible by displacing fuels. The transportation fuel providers have limited means to reduce their emissions so the sector reductions will come primarily from the introduction of electric vehicles. In the meantime, the fuel providers will simply pass the costs along and if the allowance cap limits the availability of allowances too much then they will stop selling fuel or pass the $10,000 per day fine along to their customers.

Fundingsland concludes:

At the end of the day, the goal of any meaningful, measurable reduction of CO2 emissions or theoretical effective pathway to stop “climate change” looks to become a glazed over afterthought in this quagmire of a Washington State bureaucratic money-making machine.

With this scheme, Washington State Government now joins the lucrative profit side of the climate industrial complex at the expense of its constituents while giving a completely different connotation to the term “Net Zero”.

Conclusion

I think New York’s plan for an economy-wide cap-and-invest program will be a similar disaster. Earlier this year I described the book Making Climate Policy Work. I focused on their discussion about RGGI and the implications for New York’s cap-and-invest program. I noted that I agreed with the authors that these programs generate revenues. However, we also agree that the amount of money needed for decarbonization is likely more than any such market can bear. I highly recommend this book to anyone interested in potential issues with these programs.

Fundingsland picked up on the affordability issues but did not address the compliance implications. Advocates for cap-and-invest tout the claim that as the allowance cap declines, compliance with the program targets is assured. Proponents have not acknowledged or figured out that the emission reduction ambition of the reduction targets is inconsistent with technology reality. Because GHG emissions are equivalent to energy use, limiting GHG emissions before there are technological solutions that provide zero-emissions energy means that compliance will only be possible by restricting energy use. I don’t think that New York can meet its emission reduction targets but compared to Washington’s emission inventory and targets New York has a much better chance. Washington plans to rely primarily on the transportation and building sectors for its reductions and needs to make sharper cuts. I see no scenario where that will end well.

In conclusion, I believe Fundingsland did a good job describing the issues associated with cap-and-invest in Washington. New York’s program will have the same issues. It will be interesting to see how these state programs work out and which one will be the bigger flop.