New Yorkers now have hard numbers showing that the Climate Act is not just ambitious environmental policy – it is a massive, regressive cost shift onto households that Albany never honestly explained. The good news is New Yorkers can demand that the Public Service Commission consider Public Service Law 66‑p(4), which explicitly authorizes the Commission to temporarily suspend or modify Renewable Energy Program obligations if they impede safe, adequate, and affordable electric service. Clearly the Climate Act impedes affordable electric service and this article explains how you can submit a comment.

I am convinced that implementation of the Climate Act net-zero mandates will do more harm than good if the future electric system relies only on wind, solar, and energy storage because of reliability and affordability risks. I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 600 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim reduction target of a 40% GHG reduction by 2030. Two targets address the electric sector: 70% of the electricity must come from renewable energy by 2030 and all electricity must be generated by “zero-emissions” resources by 2040. The Climate Action Council (CAC) was responsible for approving the Scoping Plan prepared by New York State Energy Research & Development Authority (NYSERDA) that outlined how to “achieve the State’s bold clean energy and climate agenda.” NYSERDA also prepared the recent State Energy Plan that was approved by Energy Planning Board (EPB). Three recent events call the timeline and ambition into doubt.

Safety Valve

New York Public Service Law § 66-p (4) “Establishment of a renewable energy program” includes safety valve conditions for affordability and reliability. Section 66-p (4) states: “The commission may temporarily suspend or modify the obligations under such program provided that the commission, after conducting a hearing as provided in section twenty of this chapter, makes a finding that the program impedes the provision of safe and adequate electric service; the program is likely to impair existing obligations and agreements; and/or that there is a significant increase in arrears or service disconnections that the commission determines is related to the program”.

The Legislature included Section 66-p(4) precisely to address the situation New York now faces: implementation challenges that threaten reliability and affordability as the aggressive timelines and technology requirements of the Climate Act confront real-world constraints. The Commission has both the authority and the obligation to act.

New York Cap-and-Invest

A leaked NYSERDA memo to the Hochul administration finally quantifies what the Climate Act economy-wide New York Cap-and-Invest program would mean for everyday energy prices. By 2031, the memo projects that cap‑and‑invest could add $2.23 to a gallon of gas on top of whatever motorists are already paying at the pump. It also warns that upstate oil and natural gas households could face gross annual cost increases in excess of $4,000, with New York City gas households seeing around $2,300 more per year.

The response from supporters has been negative. On March 5, 2026, a group of 29 New York Democratic state senators responded with a letter (“Democratic Letter”) to Governor Hochul saying they “categorically oppose any effort to roll back New York’s nation leading climate law” and urging Hochul to “stand strong in the face of misinformation” about affordability. The letter states that the memo is “based on a specific Cap & Invest program design that has not been shared with the public and clearly does not include any price guardrails, with a completely unrealistic carbon price.” I agree that this is a new design scenario but what the senators fail to understand is that this design forces compliance.

Those numbers do not come from critics of the law; they come from the state’s own modeling of a cap-and-invest program that includes no guardrails for high carbon allowance prices. The modeling shows that allowance prices starting around $120 per ton and rising toward $180 per ton by 2031 are necessary to force emissions cuts fast enough to comply with the Climate Act mandates. In other words, the policy path required by the statute to meet Climate Act goals is intentionally designed to drive up fossil fuel prices until families change behavior, whether they can afford to or not.

State Energy Plan Affordability

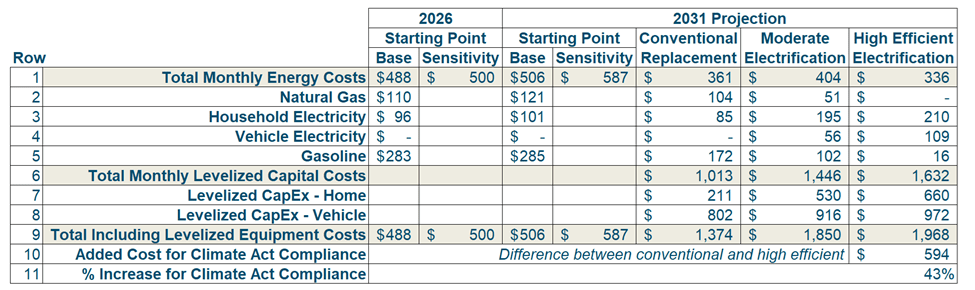

While there has been much discussion about the cap-and-invest costs, the household costs buried in the NYSERDA Energy Affordability analysis underpinning the 2025 State Energy Plan have not made the news. In public‑facing materials, the agency emphasized that electrification and efficient equipment could lower monthly utility bills for many households when you look only at energy expenditures. But a close look at the data annex and the underlying analysis reveals a very different story once the cost of buying the required equipment is included.

For an upstate, moderate‑income household that uses natural gas for heat, NYSERDA’s own analysis shows that the levelized costs to replace fossil fuel systems and vehicles with the “zero‑emission” equipment required to comply with Climate Act goals adds about $594

per month—roughly a 43% increase in monthly energy‑related costs in 2031 compared to a conventional replacement path. That equates to $7,000 per year and reflects the combined impact of new electric heating systems, building envelope upgrades, and electric vehicles necessary to match the state’s mandated trajectory. When people ask what “decarbonization” means for their pocketbook, an extra $7,000 a year for a moderate‑income upstate family is a concrete, sobering answer.

Coalition for Safe and Reliable Energy Petition

The Public Service Commission’s recent notice on the Coalition for Safe and Reliable Energy’s petition is a major crack in the façade. That petition invokes Public Service Law §66‑p(4), which explicitly authorizes the Commission to temporarily suspend or modify Renewable Energy Program obligations if they impede safe, adequate, and affordable electric service. In response, the PSC issued a formal notice on January 28, 2026, soliciting comments on whether the Climate Act’s 66‑p renewable targets should be suspended or adjusted.

That step is not routine housekeeping; it is a legal acknowledgment that the Legislature included a safety valve into the statute because it recognized that rigid mandates could collide with grid reliability and affordability. The Coalition—representing businesses and civic groups—argues that current renewable procurement obligations, layered on top of rising costs and reliability concerns flagged by the New York Independent System Operator, meet exactly that standard. When the agency charged with keeping the lights on invites public input on whether to invoke the safety valve it is effectively admitting that “full speed ahead” on the current timeline may no longer be responsible public policy.

Discussion

Taken together, these three developments paint a consistent picture that should worry anyone who cares about both the environment and ordinary New Yorkers’ standard of living. NYSERDA’s cap‑and‑invest memo admits that hitting statutory targets on the current schedule requires fuel price shocks and thousands of dollars per year in added household energy costs. The PSC’s notice shows that the state’s own regulator is now weighing whether renewable mandates under the Climate Act have crossed the line into threatening safe, adequate, and affordable service—the core mission it cannot ignore. And NYSERDA’s Energy Affordability analysis, once you include levelized capital costs, demonstrates that “electrify everything” is not a free lunch but a sustained 40‑plus percent increase in monthly costs for a representative upstate family.

Supporters will argue that long‑term climate benefits justify near‑term pain and that subsidies or future technology breakthroughs will ease the burden. But the state’s own documents show that the current design front‑loads costs onto today’s ratepayers and motorists, with no guarantee that promised benefits will materialize on schedule or be distributed fairly. Given that New York emissions are less than half a percent of global emissions there is no reason to expect any climate benefits. When an environmental law collides this sharply with affordability, reliability, and public acceptance, clinging to the original timetable becomes less about science and more about political stubbornness.

Nothing in the Climate Act’s text requires New York to ignore new information or double down on obvious implementation problems. In fact, §66‑p(4) explicitly anticipates the need to pause or modify obligations when they jeopardize safe, adequate, and affordable service. The leaked NYSERDA memo, the PSC’s comment solicitation, and the energy affordability findings together meet that threshold: they show that the current path imposes disproportionate burdens on moderate‑income households, risks higher fuel and power prices statewide, and may stress a grid already wrestling with reliability warnings.

What You Can Do

The Commission invited interested stakeholders to submit comments by March 30, 2026, on the Petition filed by the Coalition. Comments provided in response to the notice should reference “Case 22-M-0149.” Comments should be submitted electronically by going to http://www.dps.ny.gov, clicking on “File Search” (located under the heading “Commission Files”), entering “22-M-0149” in the “Search by Case Number” field, and then clicking on the “Post Comments” box located at the top of the page.

If you do not want to develop your own comments please consider the following that can be copied into the post comment prompt.

I support the Coalition for Safe and Reliable Energy’s petition requesting that the Commission hold a hearing pursuant to Public Service Law (PSL) Section 66-p(4) to evaluate whether to temporarily suspend or modify the targets or provisions under the Renewable Energy Program established as part of the Climate Leadership and Community Protection Act (CLCPA).

PSL 66-p(4) provides that the Commission “may temporarily suspend or modify the obligations under such program provided that the commission, after conducting a hearing as provided in section twenty of this chapter, makes a finding that the program impedes the provision of safe and adequate electric service; the program is likely to impair existing obligations and agreements; and/or that there is a significant increase in arrears or service disconnections that the commission determines is related to the program”. A PSL 66-p(4) hearing is essential to evaluate whether the Renewable Energy Program, as currently implemented, is compatible with safe, adequate, and affordable electric service.

Safe and adequate service is imperiled by declining reliability margins documented by the New York Independent System Operator. Acceptable reliability risks associated with the Renewable Energy Program have not been defined so the public has no assurance that the declining margins are safe.

Transmission deficiencies threaten reliable delivery. New transmission is needed to get the renewable energy collected to where it is needed. If this transmission is not available, then the energy supply will not be adequate.

The affordability crisis demands a hearing because safe and adequate is only possible if it is affordable. The PSL 66-p(4) hearing must define acceptable affordability metrics that can be tracked.

Multiple independent sources confirm the need for a hearing. State agencies, the Attorney General Office, the NYISO and others have identified schedule and ambition issues associated with the Climate Act implementation that affect the Renewable Energy Program.

The Legislature included Section 66-p(4) precisely to address the situation New York now faces: implementation challenges that threaten reliability and affordability as the aggressive timelines and technology requirements of the Climate Act confront real-world constraints. The Commission has both the authority and the obligation to act.

Conclusion

Reconsidering the Climate Act does not mean abandoning climate goals; it means aligning them with reality. A hearing should find that that the program as currently structured impedes the provision of safe, adequate, and affordable electric service. Then it could layout a path going forward that would include revisiting timelines, allowing a broader range of low‑carbon technologies, and explicitly capping household cost impacts so that climate policy does not become a de facto energy tax on working families. New Yorkers were promised a “clean, resilient, and affordable” energy future; now that the state’s own analysis shows how far current plans fall from that promise, it is not only appropriate but necessary for the Public Service Commission to address their obligation to provide safe, adequate, and affordable electric service.