One of the planned implementation components of the Climate Leadership & Community Protection Act (Climate Act) is a cap-and-invest program that sets a price on Greenhouse Gas (GHG) emissions. The first round of stakeholder comments were due in early July and this post provides an update on the process. There also is another upcoming advocacy dogma and reliability conundrum that must be addressed. I recently noted that the retirement of peaking power plants is considered non-negotiable by environmental justice advocates but those facilities are needed for electric system reliability. The same advocates are demanding removal of certain components that are in every emissions trading program variation, such as the New York cap-and-invest, that must be included or the claimed affordability and cost-effectiveness benefits will not be produced.

I have been following the Climate Act since it was first proposed. I submitted comments on the Climate Act implementation plan and have written over 350 articles about New York’s net-zero transition. I have extensive experience with air pollution control theory, implementation, and evaluation having worked on every cap-and-trade program affecting electric generating facilities in New York including the Acid Rain Program, Regional Greenhouse Gas Initiative, and several Nitrogen Oxide programs since the inception of those programs. I follow and write about the RGGI cap and invest CO2 pollution control program so my background is particularly suited for the cap-and-invest plan. I have devoted a lot of time to the Climate Act because I believe the ambitions for a zero-emissions economy embodied in the Climate Act outstrip available renewable technology such that the net-zero transition will do more harm than good. The opinions expressed in this post do not reflect the position of any of my previous employers or any other company I have been associated with, these comments are mine alone.

Climate Act Background

The Climate Act established a New York “Net Zero” target (85% reduction and 15% offset of emissions) by 2050 and an interim 2030 target of a 40% reduction by 2030. The Climate Action Council is responsible for preparing the Scoping Plan that outlines how to “achieve the State’s bold clean energy and climate agenda.” In brief, that plan is to electrify everything possible and power the electric grid with zero-emissions generating resources by 2040. The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to write a Draft Scoping Plan. After a year-long review the Scoping Plan recommendations were finalized at the end of 2022. In 2023 the Scoping Plan recommendations are supposed to be implemented through regulation and legislation. The cap and invest initiative is one of those recommendations.

The New York State Department of Environmental Conservation (DEC) and NYSERDA have developed an official website for cap and invest. It states:

An economywide Cap-and-Invest Program will establish a declining cap on greenhouse gas emissions, limit potential costs to New Yorkers, invest proceeds in programs that drive emission reductions in an equitable manner, and maintain the competitiveness of New York businesses and industries. Cap-and-Invest will ensure the state meets the greenhouse gas emission reduction requirements set forth in the Climate Leadership and Community Protection Act (Climate Act).

I have written other articles that provide background on NYCI. I recently posted a Commentary overview for the New York Cap & Invest (NYCI) program that was written for a non-technical audience. In late March I summarized my previous articles on the New York cap and invest proposal in a post designed to brief politicians about the proposal if you want more technical information. There also is a page that describes all my carbon pricing initiatives articles that includes a section listing articles about the New York Cap and Invest (NYCI) proceeding.

NYCI Status

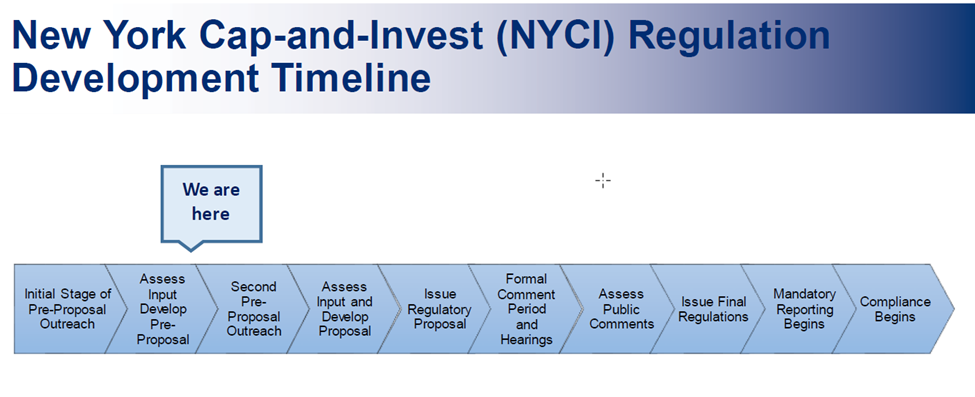

Recently there was an update on the status of the NYCI process at the Equity & Climate Justice Roundtable (Equity and Climate Justice Roundtable Presentation [PDF] and Session Recording). Jonathan Binder showed the regulation development timeline that shows that DEC is near the end of the “assess input and develop pre-proposal phase” shown in the slide below. I think there are two takeaways from this update. To date DEC has not given any indication of any particulars regarding implementation and there will be an opportunity to provide comments on the preproposal details. This is important because once the official regulatory proposal is released the agencies can no longer discuss the contents. The other point is that this timeline confirms that there is no way this program is going to be issued this year. Binder said the goal is to have revenue coming in during 2025.

In June DEC hosted a series of webinars designed to spur discussion and get input on specific questions. The comments received are available and now DEC is assessing the input. After giving an overview of the general plans Binder described what they have heard in the comments. His presentation listed the following points that they have been hearing from environmental justice, climate justice, and equity-related shareholders. Note that there was no substantive discussion of the following in the presentation:

- Prohibit or limit emissions trading solutions

- Set caps with timetables

- Minimize cost, emissions, and other impacts on DACs

- Ensure adequate investments

- Ensure emission reductions are verifiable & enforceable

- Track GHG and co-pollutant emissions from all sources

- Provide transparent demonstration of emissions and investments

- Ensure Disadvantaged Community representation in oversight and program review

- Consider burdens and job impacts on businesses located in or near DACs

In addition. he noted that stakeholders had proposed the following recommended steps:

- Identify stakeholder groups

- Establish robust communication

- Implement target programs based on stakeholder feedback

- Track and measure progress

- Conduct regular reviews

The primary point I want to make in this post is that there are tradeoffs that I do not think the environmental justice, climate justice, and equity-related shareholders understand. Binder mentioned that stakeholder expectation setting is important but the rhetoric of these stakeholders is at odds with that goal. Binder emphasized that DEC is trying to prioritize disadvantaged community (DAC) concerns saying that they need to “ensure emission reductions are prioritized in DACs while also:

- Raising revenue to adequately fund investments into DACs,

- Keeping high quality jobs and businesses available within DACs, and

- Decreasing energy burden and maintaining reliability.

He went on to summarize a few of the specific regulatory provisions and options being considered. He said the following are under consideration:

- Prohibit DAC sources from purchasing allowances from outside of the DAC.

- Set source specific caps on DAC sources (declining caps)

- Require DAC sources to surrender allowances at some multiple of GHG emissions rather than 1:1

He did note that there have been requests to prohibit allowance trading but that DEC expects that there will be some allowance trading. Allowance trading is a key to ensure “overall affordability and cost effectiveness of the program”.

Emissions Market Program Overview

Earlier this year I published an overview of cap-and-invest programs and the proposed New York program. I concluded that New York policy makers have glommed on to Cap and Invest because they think it is a solution that will easily provide revenues and compliance certainty. Unfortunately, that presumption is based on poor understanding of market-based emissions programs. The reality is that successful programs used emissions reduction strategies that are not available in the quantity or quality necessary for New York to meet its emission targets.

The deference being given to environmental justice, climate justice, and equity-related shareholders further endangers any hopes that the program will work. The proposed New York Cap-and-Invest policy is a type of an emission trading pollution control program. EPA explains that:

Emissions trading programs have two key components: a limit (or cap) on pollution, and tradable allowances equal to the limit that authorize allowance holders to emit a specific quantity (e.g., one ton) of the pollutant. This limit ensures that the environmental goal is met and the tradable allowances provide flexibility for individual emissions sources to set their own compliance path. Because allowances can be bought and sold in an allowance market, these programs are often referred to as “market-based”.

Points Heard

In this section I will address the environmental justice, climate justice, and equity-related shareholders points that DEC has been hearing.

At the top of the list was “prohibit or limit emissions trading solutions”. Binder did note that DEC expects that there will be some allowance trading. EPA notes that this is a key component of any market-based program. Binder admitted that allowance trading is a key to ensure “overall affordability and cost effectiveness of the program”. Obviously if there is no trading then this cannot be called a cap-and-invest program and it won’t work as expected.

The suggestion that there will be “some” trading necessarily means that there will be “some” limitations. One slide notes that the following are under consideration:

- Prohibit DAC sources from purchasing allowances from outside of the DAC.

- Set source specific caps on DAC sources (declining caps)

- Require DAC sources to surrender allowances at some multiple of GHG emissions rather than 1:1

It is one thing to consider these options but it is an entirely different thing to implement any of them. For starters note that there are several thousand DACs. In order to prohibit DAC sources from purchasing allowances from outside of the DAC it would be necessary to label the ownership of each allowance which is unprecedented. Setting source specific caps on DAC sources is another can of worms; what basis for each cap would be used and would there be different caps for different sectors within the DAC. A requirement that DAC sources would have to surrender allowances at some multiple of GHG emissions rather than 1:1 sounds simple enough but the unintended consequences on the market would be immense. In my opinion implementing something to address these options would necessitate an independent market for each DAC. That way you could limit trading from outside the DAC, set source specific caps, and structure the market to address the multiple surrender concept. However, given that there are several thousand DACs this clearly is not workable.

There are unappreciated problems associated with setting caps with timetables. I have previously written about setting caps that do not account for potential strategies for making the reductions. In other programs such as the EPA Cross State Air Pollution Rule (CSAPR) the cap was set based on historical emissions, existing control technology, and potential improvements or additions for all the sources in the CSAPR-affected states. The CSAPR cap was determined using this control technology evaluation to set a feasible limit. The NYCI will be a binding cap set by the Climate Act mandates that did not include any such feasibility evaluation. GHG emissions are closely associated with energy use so a NYCI binding cap essentially limits energy use.

Another of the recommendations heard was to “minimize cost, emissions, and other impacts on DACs”. I think this is a general goal that should apply to the entire state. The tradeoff between trying to address past injustices while meeting these goals will be challenging.

The “ensure adequate investments” recommendations is important. In order to address it the first thing needed is to define what to fund. Presumably, the priority is providing the funds necessary to implement the control strategies necessary to make the emission reductions. The Hochul Administration must provide an estimate of how much these investments will cost in order determine how much money must be raised by the Cap-and-Invest program. If the investments are insufficient then the energy system will fail to meet the cap limits. Also needed is a feasibility analysis for the transition schedule that considers supply chain and trained labor constraints. Even if the money is available, it may not be possible to build it fast enough to meet the arbitrary CLCPA schedule.

There are several recommendations that are all characterized by a lack of understanding of what regulatory requirements are already in place. The “ensure emission reductions are verifiable & enforceable”; “track GHG and co-pollutant emissions from all sources”; and “provide transparent demonstration of emissions and investments” all fall into this category. There are regulations in place such that affected sources report GHG and co-pollutant emissions that are verifiable and enforceable and in the case of power plant emissions the CO2 data are completely transparent. The whole economy requirements of the Climate Act mean that additional reporting will be necessary. I agree that transparency for emissions and investments is important and have recommended that in my comments.

I do not disagree that the program should “ensure Disadvantaged Community representation in oversight and program review”. Unfortunately, from what I have observed to date, environmental justice, climate justice, and equity-related shareholders believe this means that they get to set the policies. They should have a voice but their unconditional demands have no place in the development of a pragmatic program. Simply put there are tradeoffs that must be incorporated in a rational program.

The Bider presentation emphasized the need to “ensure emission reductions are prioritized in DACs while also: “keeping high quality jobs and businesses available within DACs, and “decreasing energy burden and maintaining reliability”. These are related to the last recommendation, “consider burdens and job impacts on businesses located in or near DACs”. These statements exemplify my concern about tradeoffs. All of the proposed trading limitations mentioned above necessarily impact businesses located in or near DACs and would increase the costs to do business relative to the costs of businesses outside of DACs. How can those affected businesses keep high quality jobs and stay in business when confronted with extra costs inherent in the allowance limitations?

There is another aspect of the emphasis on emissions within DACs that is apparently not recognized by the environmental justice, climate justice, and equity-related shareholders. While emissions are related to the air quality impacts in a particular location, there are other factors that affect impacts. Air quality is determined by the transport and diffusion of emissions. At any one time, the wind direction determines which areas are impacted while the state of the atmosphere (stable or otherwise) and the characteristics of the emissions (height of release, type of release (stack or over an area), and temperature of the effluent determines how much of an impact is observed. Importantly, there are laws in place that ensure that all sources consider these factors when proving compliance with the National Ambient Air Quality Standards. It is unclear how these stakeholders can be placated in this regard.

Discussion

I do not think that NYCI is going to live up to the expectations of its proponents. This program is supposed to provide funding for Climate Act implementation and ensure compliance with the Climate Act emission targets. Earlier this year I described the book Making Climate Policy Work that shows how the politics of creating and maintaining market-based policies render them ineffective nearly everywhere they have been applied. I think that proponents of NYCI should read that book to understand what needs to be done to make the proposed program work.

In my earlier post I noted that I agreed with the authors that the results of RGGI and other programs suggest that the NYCI will generate revenues. However, we also agree that the amount of money needed for decarbonization is likely more than New Yorkers will accept. The problem confronting the Administration is that in order to make the emission reductions needed they have to invest between $15.5 and $46.4 billion per year. I don’t think that range is politically palatable.

The use of Cap and Invest as a compliance mechanism is more of a problem. The Hochul Administration has not acknowledged or figured out that the emission reduction ambition of their Climate Act targets is inconsistent with technology reality. Because GHG emissions are equivalent to energy use, limiting GHG emissions before there are technological solutions that provide zero-emissions energy means that compliance will only be possible by restricting energy use. Unless a miracle occurs in 2030 when there are insufficient allowances someone must choose who gets to operate.

When the concerns of the environmental justice, climate justice, and equity-related shareholders are layered on top of these design flaws, the challenge to make a workable cap-and-invest program is increased. I fear that the louder voices among these stakeholders will demand that their concerns be incorporated. If that happens then I am sure that the program will fail. Allowance costs will soar and those costs will get passed on to consumers disproportionally affecting the DACs. If the insane idea to limit allowances within specific DACs is implemented then an artificial energy shortage within DACs is possible.

Conclusion

The New York cap-and-invest program is slowly coming together. Implementation of something this complicated takes time (California took several years to set up their program) and must be developed by people with technical expertise. Unfortunately, as was the case with the Scoping Plan development, the State’s approach is to excessively defer to ideologues with little relevant background experience.

Consider this example from the Scoping Plan. The Scoping Plan electric system recommendations rely on the ideological belief that existing technology is sufficient for the transition. The Hochul Administration allowed a few ideologues to push that narrative despite conflicting information in the Integration Analysis and arguments from the New York Independent System Operator to the contrary. The New York State Public Service Commission (PSC) recently initiated an “Order initiating a process regarding the zero-emissions target” that will “identify innovative technologies to ensure reliability of a zero-emissions electric grid” that recognizes a new technology that can be dispatched without generating emissions is necessary if the state is to not go nuclear. Failing to acknowledge this requirement means that there is no “Plan B” if this new resource cannot be developed and deployed as needed to maintain the Climate Act schedule.

The Hochul Administration appears to be doing it again in the cap-and-invest process. Presuming that past performance of emissions trading programs would be indicative of future reduction success and establishing an arbitrary emissions target that is incompatible with realistic emission reduction trajectories has established a very difficult challenge. Addressing ideological concerns about emissions trading programs and trying to incorporate social justice concerns makes the challenge that much more difficult. The environmental justice, climate justice, and equity-related shareholders are demanding removal of certain components that are in every emissions trading program and that were essential to past success. Deferring to ideology rather than historical precedent can only end in failure.

6 thoughts on “New York Cap-and-Invest Update and Another Conundrum”