Frequent readers of this blog know that many of my posts are long because I get document all my statements and get bogged down in details. This is because of my background in industry where it is necessary to prove my arguments to have credibility. This is an update of articles that I have read that I want to mention but do not require a detailed post. Previous commentaries are available here.

I have been following the Climate Leadership & Community Protection Act (Climate Act) since it was first proposed and most of the articles described below are related to the net-zero transition. I have devoted a lot of time to the Climate Act because I believe the ambitions for a zero-emissions economy embodied in the Climate Act outstrip available renewable technology such that the net-zero transition will do more harm than good. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Natural Gas Politics and Production

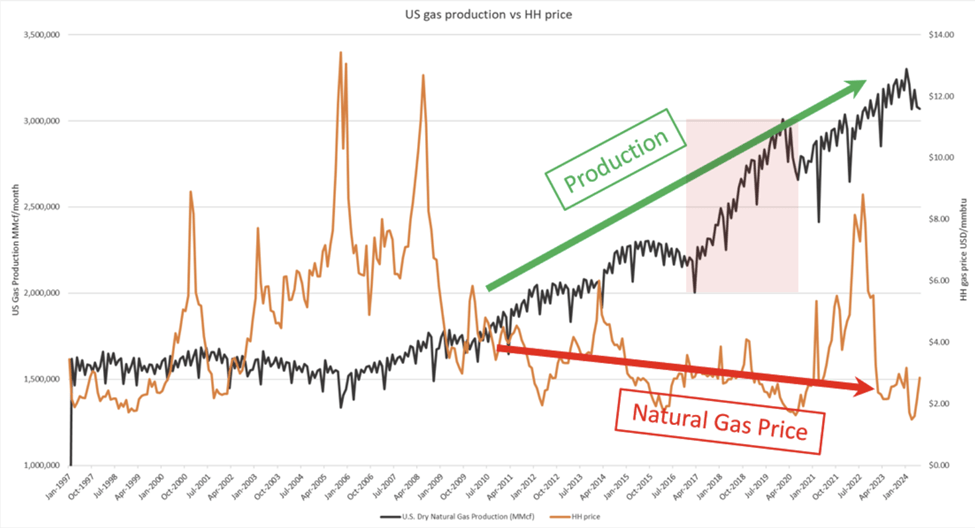

Canadian Terry Etam describes the natural gas conundrum in which the widespread deployment of fracking technology enabled producers to accelerate the production of natural gas “while simultaneously driving prices into the toilet”.

Etam describes the graph:

First, the gradual increase in production from about 2006 onwards was the result of the high prices of 2002-2006, which spurred development and led to the unlocking of the US’ vast shale gas resource. High prices footed the bill for shale exploration and experimentation, which set the stage for future growth.

One of the biggest reasons for these wild trajectories is that the industry just keeps getting better and better at getting gas out of tough formations. (While there are many ways drilling and completions are improving, these advancements should not be confused with the simple act of drilling longer horizontals which is often viewed as an efficiency gain – it is a capital efficiency gain, no doubt, but not like an improved frac is – a longer lateral simply chews up the reservoir faster. One day in a decade or two we will look back and go, oh yeah, maybe that was significant…).

Those technological/fracking improvements drove the first waves of growth, but don’t completely explain the steepest part of the curve. Note in particular the pinkish shaded box, corresponding to roughly April 2017 to April 2021. Over that four-year period, the US added about 27 bcf/d, which is about 1.5 times Canada’s entire output, while prices fell from about $3.00/mmbtu to $2.00. That’s the sort of antics a guy like Warren Buffett really frowns on.

He goes on to explain that the future is not clear:

Today, here in mid 2024, the future is murky. We know a few things: that the US (and Canada) are both capable of a lot more natural gas production. We know that demand is going to go up over the next half decade at a minimum, possibly by as much as 30 percent, due to new LNG export terminals and data center/AI demand.

What we don’t know is how easy it will be to build any new infrastructure to enable new volumes to get to where they need to be. We’re well used to this problem in Canada, of course, which is a basket case; it is a miracle that Coastal GasLink was built at all, and it is hard to imagine any entity having the intestinal fortitude to attempt any new greenfield interprovincial infrastructure, which is federally regulated, which means the ruling alliance would laugh you off Parliament Hill for even showing up with your briefcase

The US is not far behind; the only significant interstate gas pipeline to go into service in the past few years has been the Mountain Valley Pipeline which was many years delayed by swarming activist attacks, and was completed at double the initial cost estimate (MVP was first proposed in 2014, and was scheduled to come onstream in 2018; it finally started flowing gas in 2024). A more realistic reading of the current US natural gas interstate pipeline system is this: In July 2020 the Atlantic Coast Pipeline, a large and critical new pipe that would have taken excess Appalachia gas to a thirsty US east coast, which was six years in planning, was shelved despite receiving a 7-2 vote of approval from the United States Supreme Court (from the project cancellation news release: “A series of legal challenges to the project’s federal and state permits has caused significant project cost increases and timing delays. These lawsuits and decisions have sought to dramatically rewrite decades of permitting and legal precedent including as implemented by presidential administrations of both political parties. As a result, recent public guidance of project cost has increased to $8 billion from the original estimate of $4.5 to $5.0 billion… This new information and litigation risk, among other continuing execution risks, make the project too uncertain to justify investing more shareholder capital.”)

To emphasize just how tough it is to actually build a new pipeline, Dominion Energy, one of the Atlantic Coast partners, took a $2.8 billion charge to earnings in cancelling the project. Think about that. A public company chose to eat a $2.8 billion loss rather than attempt to build a new, approved pipeline.

He concludes that there is so much uncertainty in the gas markets that any projections for the future are speculative. I conclude that politicians and energy policies don’t work well together.

National Center for Energy Analytics

I received an email from an interesting organization that can help is all understand energy policies. The National Center for Energy Analytics is a “new energy think tank devoted to data-driven analyses of policies, plans, and technologies surrounding the supply and use of energy essential for human flourishing.” Executive Director Mark P. Mills explains:

Modern civilization hinges on abundant, affordable, and reliable energy. Policies ignoring those fundamentals are doomed to fail. There is of course the constant refrain that an energy transition—a shift away from oil, natural gas, and coal—is not only underway, but accelerating. However, hydrocarbons continue to supply over 80 percent of America’s and the world’s energy, a proportion largely unchanged in two decades. The Inflation Reduction Act (IRA), designed to expedite a transition, is projected to cost between $2 trillion and $3 trillion, far exceeding initial claims. That level of spending, alongside similar state-level initiatives, means that energy issues are unavoidably a central feature of U.S. economic and policy debates.

Energy policies are essentially bets on how we can meet future demands. But, setting aside the usual aphorisms about predicting the future, history shows that innovators have always created far more ways to consume energy than to produce it. Thus effective energy policies must not only anticipate the future but also do so while simultaneously meeting the three core energy metrics of ensuring abundance, affordability, and reliability. The energy transition is a popular narrative, but the practicalities of physics, engineering, and economics point to a future that will see an enduring reliance on hydrocarbons.

Claptrapping

Irina Slav captures my frequent feeling of helplessness when I try to see how uninformed political pressures are adversely affecting the energy system.

One of the marks of helplessness is the frequent use of a specific word or a group of words to describe a situation you cannot change, which fact invokes the feeling of said helplessness.

I know this because I frequently use the word stupid and synonyms to describe the people leading us into the energy transition. This is in part because they are, indeed, stupid, and in part because I cannot do anything to stop them. On a positive note, it seems some of the most devout transitionistas are also feeling quite helpless.

She goes on to describe a recent article:

In a commentary piece for the Financial Times on Wednesday, its business columnist and associate editor Pilita Clark called out Elon Musk and Donald Trump for what she described as “misleading, misinformed or just plain baffling utterances that continue to gush forth in the face of an increasingly evident problem.”

She also described the pushback against the climate change narrative as “claptrap”. A total of seven times. In an 800-word piece. Ms. Clark was not a happy associate editor when she wrote that piece.

Slav describes the whole commentary. Ms. Clark complains that there are people who have the audacity to make “rubbish claims” about the green technologies that are supposed to save us from climate Armageddon. Slav responds that despite the obvious issues with the technologies and the cost of implementing them that the UK political war on fossil fuel companies is driving the companies away:

“If the government implements the kind of windfall taxes they are talking about, then you end up with a cliff edge in UK energy production because the industry will be taxed into uncompetitiveness,” Chris Wheaton from Stifel said. “That is going to cause a very dramatic decline in investment and therefore production and jobs, and a big hit to energy security.”

I recommend reading the whole article. She offers several more examples of the cost and environmental impacts of the “clean energy” transition in an entertaining way.

Billion Dollar Disasters

One of the arguments used by activists is that we must address climate change because we are seeing the effects now. As proof the apparent increase in the costs of disaster losses from the National Oceanic and Atmospheric Administration (NOAA) are frequently cited. Roger Pielke, Jr. called their numbers out noting that their dataset is “a clever public relations gimmick, to be sure, but it should never be used in scientific research, climate assessment reports, or as a grounding for policy.”

Early this year he submitted a “request for correction” and notes that NOAA did respond. They admitted that the documentation and transparency of the disaster loss dataset needs to be improved. Pielke suggested that NOAA align their methods to be consistent with the Intergovernmental Panel on Climate Change but, not unlike New York, the response blew off the issue and suggested that they will continue to do what they are doing. Pielke concludes “Based on what NOAA has found, no one should be using the dataset in research or in a scientific assessment — Unless of course the goal is PR, not science.”

Lomborg Newsletter

The always informative Bjorn Lomborg newsletter had several interesting articles. He explained why a scare story of polar bears dying out is a tactic that leaves us poorly informed. I agree with his argument that in order to achieve the transition proposed that clean energy innovation is necessary. He also makes persuasive argument that it is not in the best interests of the third world to decarbonize with existing technology that is so expensive. In my opinion that underscores the need for clean energy innovation. Even though there are green energy subsidies of almost $2 trillion each year he explains that “when societies add more renewable energy, most of it never replaces coal, gas or oil. It simply adds to energy consumption”.

Follow the Energy Transition Money

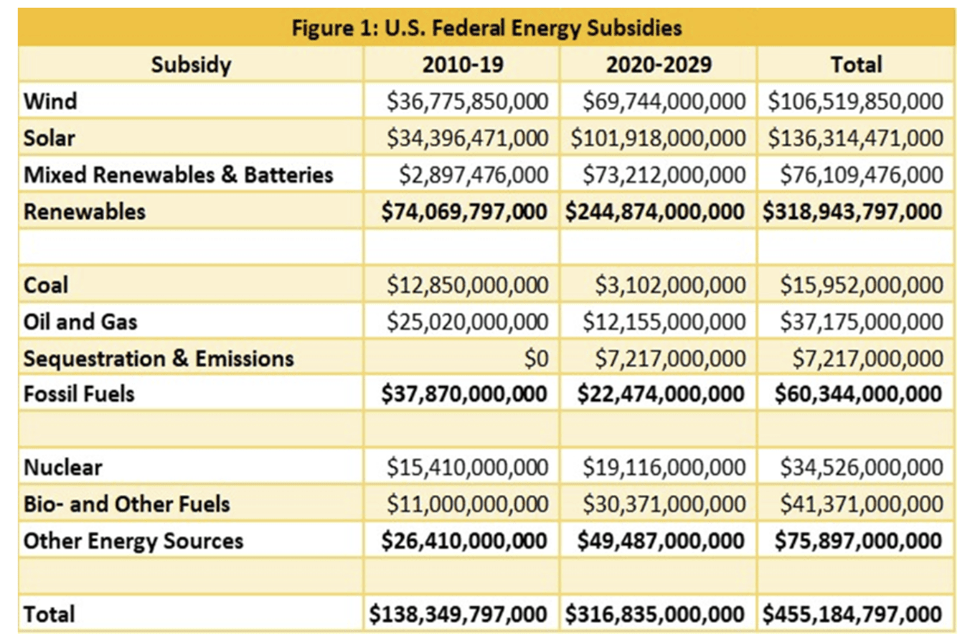

Bill Peacock quantifies the subsidies given to fossil fuels, nuclear and renewables. He includes a table based on information sourced from Bennett, et al; U.S. Joint Committee on Taxation 2019 & 2023; U.S. EIA; Congressional Budget Office.

Peacock notes:

Perhaps these claims are efforts to distract from massive renewable energy subsidies that are driving the “energy transition” from fossil fuels to renewables. As seen above, renewables received $74 billion from the U.S. government in 2010–19. They are expected to increase to $244 billion from 2020 to 2029. The subsidies are the only reason that wind and solar generation exist on the U.S. grid at commercial scale.

He also provides costs per energy produced or MWh:

Peacock goes on to document the impacts on reliability and increased costs that are a direct result of these subsidies. I agree with his conclusion:

When politicians take over markets, bad things happen. Costs increase, consumer choices are thwarted, and well-connected businesses get rich off taxpayers. We see all these things happening in the U.S. energy transition from fossil fuels to renewables. The only way to eliminate these and other harms is to let the market work and eliminate all energy subsidies—federal and state—in America.