My last three published articles described the status of the New York component of the Regional Greenhouse Gas Initiative (RGGI) as administered by the New York State Energy Research & Development Authority (NYSERDA). The ulterior motive for those articles was the need to describe the implications of NYSERDA observed performance relative to historical emission trends for two submittals. NYSERDA’ was taking comments on its Regional Greenhouse Gas Initiative (RGGI) Operating Plan Amendment for 2025 and the New York Assembly Committee on Energy was taking public statements as part of its public hearing on NYSERDA spending and program review. This post summarizes my submittals because advocates of the New York Cap-and-Invest (NYCI) program frequently refer to RGGI as a successful model.

Although I was tempted to state in my submittals that no one in the state has more experience with RGGI than me, I settled on say I was uniquely qualified to comment on issues related to RGGI. I have been involved in the RGGI Program since it was first proposed and continue to review and comment in stakeholder processes including the NYSERDA RGGI Operating Plan stakeholder processes to this day. At one time I even purchased RGGI allowances from an auction and held the allowances for several years. I continue to follow and write about the details of the RGGI program in my retirement because its implementation affects whether I will be able to continue to be able to afford to live in New York. I have extensive experience with air pollution control theory, implementation, and evaluation of results having worked on every cap-and-trade program affecting electric generating facilities in New York including the Acid Rain Program, Regional Greenhouse Gas Initiative (RGGI) and several nitrogen oxide programs. The opinions expressed in this post do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Background

RGGI is a market-based program to reduce greenhouse gas emissions (GHG) (Factsheet). It has been a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont to cap and reduce CO2 emissions from the power sector since 2008. New Jersey was in at the beginning, dropped out for years, and re-joined in 2020. Virginia joined in 2021 but has since withdrawn, and Pennsylvania has joined but is not actively participating in auctions due to on-going litigation.

My last three RGGI articles were related. In the first article I evaluated Environmental Protection Agency (EPA) emission data, determined that the primary reason for the observed 49% reduction in electric sector emissions was due to fuel switching from coal and oil to natural gas. I also evaluated NYSERDA documentation and found that the investments funded by RGGI auction proceeds would have been only 4.2% higher if the NYSERDA program investments did not occur. In the second article I showed that the cost per ton reduced from the NYSERDA RGGI operating plan investments was $582 per ton of CO2. The final article described the program allocations in the 2025 Draft RGGI Operating Plan Amendment. There are unacknowledged ramifications of the emission reduction performance, funding program priorities, and RGGI compliance mandates. I will only summarize the findings in this article because details are available in the previous articles and my comments referenced below.

Operating Plan Amendment

NYSERDA designed and implemented a process to develop and annually update an Operating Plan that summarizes and describes the initiatives to be supported by RGGI auction proceeds. On an annual basis, the Authority “engages stakeholders representing the environmental community, the electric generation community, consumer benefit organizations and interested members of the general public to assist with the development of an annual amendment to the Operating Plan.” I have submitted comments on the annual amendments since 2021. Previously I discussed every program included but because I think the NYSERDA stakeholder process is broken I limited my comments to the implications of the observed emissions trend, the funding program priorities, and RGGI compliance mandates.

Energy Committee Public Hearing

On December 18, 2024, the New York Assembly Committee on Energy held a public hearing to gather information about NYSERDA’s revenues and expenditures in order to gain a broader perspective on effectiveness of NYSERDA’s programs. I submitted testimony describing NYSERDA’s RGGI program effectiveness. My submittal to the Energy Committee included two documents: the public statement and an attachment that documented the analysis of the trends and cost-effectiveness. I believe that it is appropriate for authors who comment on public policy to provide sufficient information so that readers can check my work and come to their own conclusions so I also included a link to the spreadsheet that generated all the trends and graphs.

Electric Sector Emission Trend

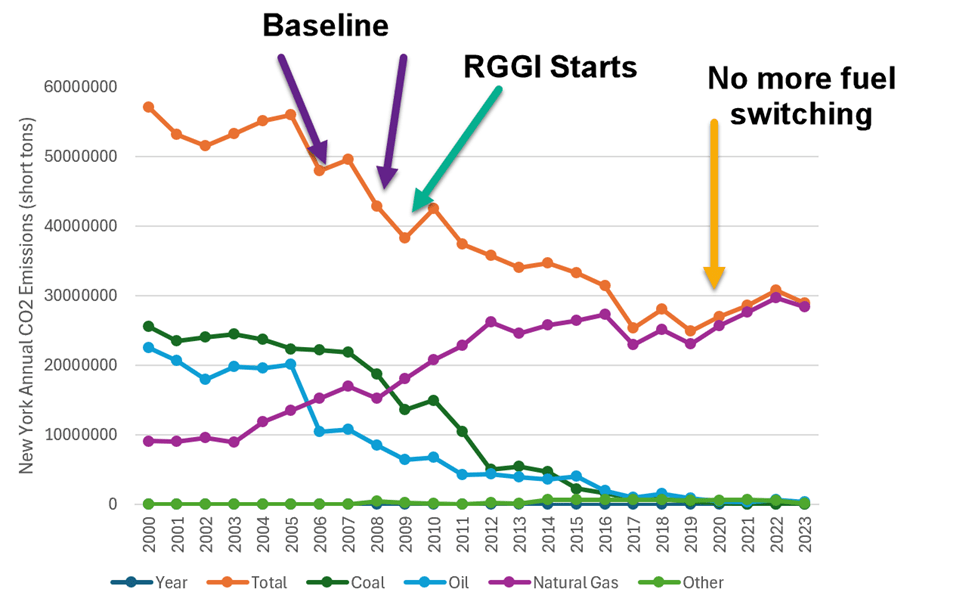

Both submittals discussed the observed emission reduction trend because the effectiveness of RGGI as a pollution control program is determined by the observed emission trend. Figure 1 describes the annual electric sector emissions and emissions by fuel type. It clearly shows that the observed emission reductions are due to fuel switching from coal and oil to natural gas. Natural gas CO2 emissions are lower per MWhr so even though natural gas generation went up the overall CO2 emissions have gone down. The other important finding in Figure 1 is that fuel switching emission reductions are no longer available.

Figure 1: New York State Annual Electric Sector Emissions by Fuel Type

On a regular basis NYSERDA publishes a status update of the progress of their program activities, implementation, and evaluation. According to the latest update, the total cumulative annual emission savings due to NYSERDA program investments through the end of 2023 is 1,976,101 tons. That means that emissions from RGGI sources in New York would have been only 4.2% higher if the NYSERDA program investments did not occur. According to the report, cumulative combined costs for those programs was $1,149 million which means that the cost per ton reduced is $582.

The funding status reports also break out emission savings and costs for NYSERDA programs. NYSERDA RGGI proceed investments can produce CO2 emission savings from RGGI-affected electric generating units in two ways: directly by displacing natural gas generation by deploying zero-emissions resources or indirectly by reducing the amount of load that the affected units must provide. I categorized programs for three categories: direct reductions to RGGI sources, indirect reductions, and those programs that will actually increase electric generating emissions. One program that increases emissions is NYSERDA’s Clean Transportation Program that “has been pursuing five strategies to promote EV adoption by consumers and fleets across New York”. The results in the Funding status reports show that since the start of the program NYSERDA has allocated 10% of its investments to programs that directly reduce utility emissions by 199,733 tons, 58% to programs that indirectly reduce utility emissions by 1,205,780 tons, and 32% to programs that will increase utility emissions by 678,804 tons. When those savings that do not affect RGGI source emissions are removed, total savings are 1,297,297 and the emissions from RGGI sources in New York would have been only 2.8% higher if the NYSERDA program investments did not occur.

The proposed Amendment to the Operating Plan does not address the need to focus on emission reductions. It allocates only 22% to programs that directly, indirectly, or could potentially decrease RGGI-affected source emissions. Programs that will add load that could potentially increase RGGI source emissions total 37% of the investments. Programs that do not affect emissions are funded with 29% of the proceeds and administrative costs total another 8%.

There is one other notable aspect of the NYSERDA funding in the Draft Amendment for 2025. The Funding Status report states that annual cumulative program investments are $1.1 billion through the end of 2023 whereas the cumulative total revenues in the Operating Plan Amendment are $2.4 billion through FY 23-24. There is no discussion of the differences. Most of the difference is probably due to collected but unspent revenues. It is notable that more than half of the money collected has not been spent.

Implications

The Climate Leadership & Community Protection Act (Climate Act) Scoping Plan recommended an economy-wide market-based program as part of the net-zero transition. In response New York regulators have been developing the NYCI program. Advocates for this approach frequently refer to RGGI as the successful model for NYCI citing observed emission reductions and the quantity of funds raised. The prevailing perception of NYCI is exemplified by Colin Kinniburgh’s description in his recent article in New York Focus. He describes the theory of a cap-and-invest program as a program that will kill two birds with one stone. “It simultaneously puts a limit on the tons of pollution companies can emit — ‘cap’ — while making them pay for each ton, funding projects to help move the state away from polluting energy sources — ‘invest.'”

In the real world there are issues.

The missing piece for NYCI is that setting a cap on carbon emissions is all well and good in theory, but where are the emission reductions going to come from. Reducing carbon emissions to zero is hard because the only way to get there is to replace existing technology with something that has zero emissions. In the electric sector, the owners of the generating units are not building zero-emission replacements. NYSERDA must motivate somebody else to do it.

Danny Cullenward and David Victor’s book Making Climate Policy Work describe another related aspect of these programs that has not been acknowledged by NYSERDA or NYCI proponents. The authors note that the level of expenditures needed to implement the net-zero transition vastly exceeds the “funds that can be readily appropriated from market mechanisms”. The RGGI experience corroborates these findings and should be considered by the Energy Committee. It is also concerning that NYSERDA has never addressed my repeated comments describing these issues and the implications on their funding priorities.

There is another inconvenient aspect of cap-and-invest programs. RGGI and NYCI both have defined emission reduction trajectories that determine how many allowances are offered for sale. That means that the implementation of the zero-emission technology that must displace existing technology to get the necessary reductions is on a schedule with ramifications. If the replacement technology deployment is delayed, then it is likely that there will not be enough allowances available for compliance. The only option available for affected sources is to reduce or stop operations. In other words, an artificial energy shortage.

Conclusion

The implication of this work is that the proposed NYCI plan to have NYSERDA manage the investments like they do with RGGI is not likely to succeed as shown by their performance to date.

My comments to NYSERDA argued that their RGGI auction proceed investments have done little to reduce emissions. I always have argued that NYSERDA funding priorities over emphasize Climate Leadership and Community Protection Act (Climate Act) initiatives at the expense of the electric generating unit RGGI emission goals. I take the simple position that RGGI was promulgated as an emission reduction program for the electric generating sector. NYSERDA investments must be revised to displace the generation needed from RGGI-affected sources because that is the only compliance option left with no reliability implications.

My public statement on NYSERDA program effectiveness of the RGGI auction proceeds followed the same reasoning. Observed reductions are mostly unrelated to the NYSERDA investments so that is not a success. The observed cost per ton reduced is very high and funding priorities do not recognize the compliance obligations, so these are not accomplishments. I also argued that the NYSERDA stakeholder process is broken because there are clear problems with the current strategy, but the latest operating plan amendment makes no changes.

There is one final note. If NYSERDA provided a comprehensive explanation of all the emission reduction strategies in the Scoping Plan along with the expected emission reductions, anticipated costs, and potential sources of funding for their strategies then it would be possible to determine if NYSERDA has planned for the necessary reductions via other programs. If NYSERDA published documentation of their response to submitted comments on their Operating Plan amendments, they could have explained their strategy for RGGI compliance. The lack of transparency in both instances precludes any reassurance that NYSERDA can be trusted to continue to operate without more governance and transparency.

2 thoughts on “Comments on RGGI Performance and Implications for NYCI”