I submitted comments on the 2025 Operating Plan Amendment (“Amendment”) for the Regional Greenhouse Gas Initiative (RGGI). This is the sixth time I have comments on Operating Plan amendments and this post summarizes my latest submittal.

Dealing with the RGGI regulatory and political landscapes is challenging enough that affected entities seldom see value in speaking out about fundamental issues associated with the program. I have been involved in the RGGI program process since its inception and have no such restrictions when writing about the details of the RGGI program. I have worked on every cap-and-trade program affecting electric generating facilities in New York including RGGI, the Acid Rain Program, and several Nitrogen Oxide programs, since the inception of those programs. I also participated in RGGI Auction 41 successfully winning allowances and holding them for several years. The opinions expressed in this post do not reflect the position of any of my previous employers or any other organization I have been associated

Background

RGGI is a market-based program to reduce greenhouse gas emissions (GHG) (Factsheet). It has been a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont to cap and reduce CO2 emissions from the power sector since 2008. New Jersey was in at the beginning, dropped out for years, and re-joined in 2020. Virginia joined in 2021 but has since withdrawn, and Pennsylvania recently decided not to join. According to a RGGI website:

The RGGI states issue CO2 allowances that are distributed almost entirely through regional auctions, resulting in proceeds for reinvestment in strategic energy and consumer programs.

Proceeds were invested in programs including energy efficiency, clean and renewable energy, beneficial electrification, greenhouse gas abatement and climate change adaptation, and direct bill assistance. Energy efficiency continued to receive the largest share of investments.

NYSERDA Operating Plan

The New York State Energy Research & Development Authority (NYSERDA) designed and implemented a process to develop and annually update an Operating Plan which summarizes and describes the initiatives to be supported by RGGI auction proceeds. The latest Draft RGGI Operating Plan Amendment explains that

New York State uses RGGI proceeds to promote and implement programs for energy efficiency, renewable or non-carbon emitting technologies, and innovative carbon emissions abatement technologies with significant carbon reduction potential, in accordance with 21 NYCRR Part 507 and in compliance with the Climate Leadership and Community Protection Act (CLCPA).

This year, consistent with authorized RGGI uses, and to highlight the link between RGGI programmatic investments and core state priorities, we have organized our RGGI programmatic investments in terms of four themes, which are the following:

- Affordability: The programmatic investments under this theme focus on creating affordable, efficient, healthy, and comfortable homes and workplaces by deploying commercially available energy efficiency, building electrification, and renewable energy technologies.

- Energy abundance, diversity, and reliability: The programmatic investments under this theme focus on understanding and building out diverse energy options, including responsible renewable generation and storage, as well as modernizing energy system infrastructure, planning, and markets.

- Energy innovation and economic development: The programmatic investments under this theme focus on supporting economic growth and competitiveness, including enabling job, tax revenue, and supply chain growth; stimulating entrepreneurship and company growth in New York; and expanding public-private partnerships and investments.

- Thriving communities and environments: The programmatic investments under this theme focus on helping New Yorkers equitably participate and share in the benefits of the clean energy future; ensuring the energy transition provides meaningful benefits to local communities and disadvantaged communities; and improving climate resiliency and adaptation and public and environmental health.

Investment Priorities and RGGI Compliance

As far as I can tell I have submitted comments on six amendments to the Operating Plan. Given my decades-long emission and allowance reporting responsibilities in the electric sector, it is not surprising that the primary concern in all my comments has been related to compliance obligations. In my opinion, NYSERDA ignores the fact that RGGI is not just a pot of money to exploit but is at its core a pollution control program that includes compliance obligations for electric generating units in the program. This year is particularly important because of the more stringent RGGI caps proposed in the 6 NYCRR Part 242 CO2 Budget Trading Program amendments that I discussed recently.

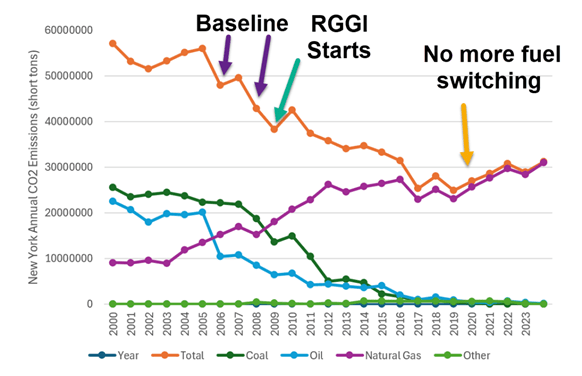

The compliance challenge is illustrated in Figure 1. Relative to the three baseline years before RGGI started New York RGGI emission are down 33%. The primary reason for the observed reduction is due to fuel switching from coal and oil to natural gas. I believe that the fuel price differential for natural gas use was much greater than the added cost of RGGI allowances, so the main driver of the observed reductions was economic fuel switching. Also note that this option is not available anymore.

Figure 1: New York State Emissions by Fuel Type

NYSERDA RGGI Funding Emission Savings

The estimated emission savings from historical NYSERDA investments are described in the Semi-Annual Status Report through December 2024. The description states that:

This report is prepared pursuant to the State’s RGGI Investment Plan (2024 Operating Plan) and provides an update on the progress of programs through the quarter ending December 31, 2024. It contains an accounting of program spending; an estimate of program benefits; and a summary description of program activities, implementation, and evaluation. An amendment providing updated program descriptions and funding levels for the 2024 version of the Operating Plan was approved by NYSERDA’s Board in January 2025.

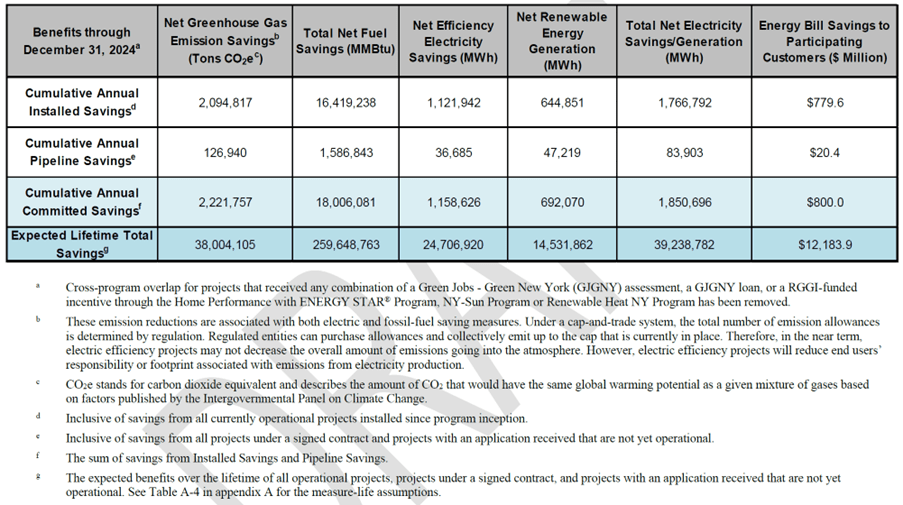

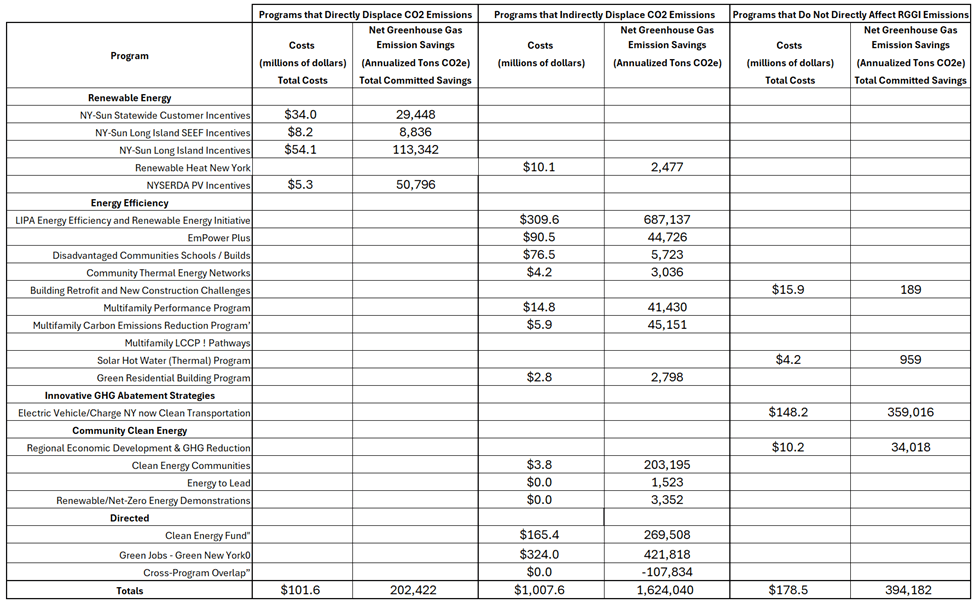

Table 1 is a copy of Table 1 in the latest full-year Semi-Annual Status Report. It summarizes the effectiveness of the NYSERDA investments and lists expected cumulative portfolio benefits including emissions savings.

Table 1. Summary of Expected Cumulative Portfolio Benefits through December 31, 2024

Comparison of NYSERDA Cumulative Emissions Savings to Observed Emission Reductions

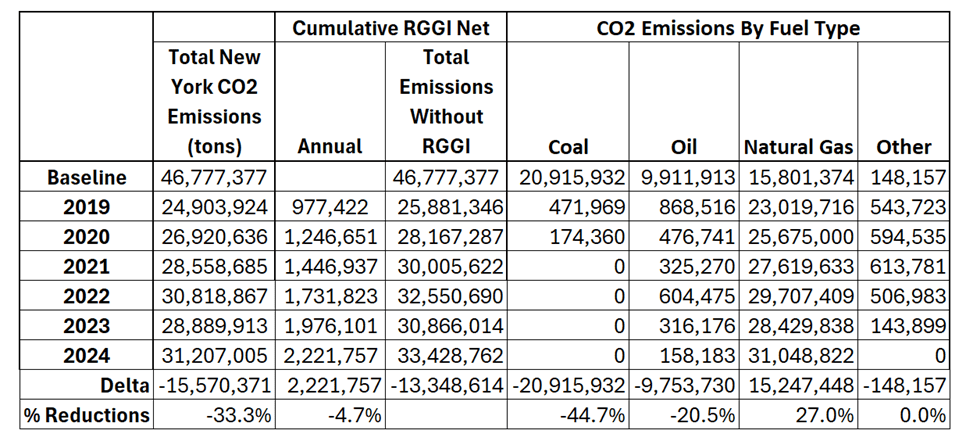

Table 2 presents the relevant data to compare the observed reductions and NYSERDA RGGI investment emission savings. I list the last five years of data starting in 2019 when the emissions went up because of the closure of Indian Point. Reductions from the 2006-2008 average baseline are listed. The emissions savings listed are cumulative annual emissions. If the RGGI proceeds were invested, then the total emissions would be higher by the amount of the savings. The total cumulative annual emission savings through the end of 2023 is only 1,976,101 tons and that represents a reduction of 4.2% from the pre-RGGI baseline. Emission reductions by fuel type clearly show that fuel switching is the primary cause of reductions.

Table 2: NY Electric Generating Unit Emissions, NYSERDA GHG Emission Savings from RGGI Investments, and Emissions by Fuel Type

New York RGGI Program Investment Reductions

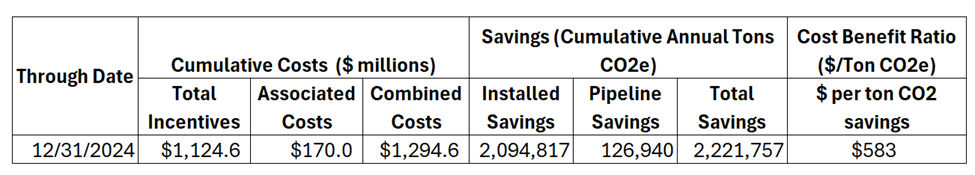

Another finding that has been ignored or possibly covered up by NYSERDA is the poor emission reduction cost effectiveness of NYSERDA investments. Table 3 lists data from Semi-Annual Status Report through December 2024 Table 2. The report presents “expected quantifiable benefits related to carbon dioxide equivalent (CO2e) reductions, energy savings, and participant energy bill savings with expended and encumbered funds” but I only considered the CO2e reductions. Note that the emission savings evaluated in the report include carbon dioxide, methane, and nitrous oxide that are not included in RGGI. I did not use “lifetime” savings data because I am trying to compare the RGGI program benefits emission savings reductions to the RGGI compliance metric of an annual emission cap. Lifetime reductions are clearly irrelevant. The observed cost per ton of emissions savings is $583.

Table 3: RGGI Funding Status Report Table 2: Summary of Total Expected Cumulative Annual Program Benefits

Program Benefit Impacts on RGGI

I categorized programs relative to RGGI compliance obligation support based on the Semi-Annual Status Report through December 2024. The table breaks down the program allocations and expected annualized CO2 savings for three categories: direct reductions to RGGI sources, indirect reductions, and those programs that will increase electric generating emissions. An example of a program that increases RGGI emissions is NYSERDA’s Clean Transportation Program that “has been pursuing five strategies to promote EV adoption by consumers and fleets across New York”. The emission reductions claimed are from decreased internal combustion engine vehicles, so the reductions do not reflect reductions in RGGI electric generating units. In addition, increased electricity for charging will require RGGI facilities to operate more thus increasing their emissions.

The results in the Funding Status reports summarized in Table 4 show that since the start of the program NYSERDA has allocated $101.6 million to programs that directly reduce utility emissions achieving emission savings of 202,422 tons, $1,007.6 million for programs that indirectly reduce utility emissions savings by 1,634,000 tons, and $178.5 million for programs that will increase utility emissions by 395,152 tons. When emissions savings from non-RGGI sources are removed, total savings are 1,827,575 tons instead of 2,221,757.

Table 4: Summary of Expected Cumulative Annualized Program Benefits through 31 December 2024 for Programs that Directly, Indirectly, or Do Not Affect RGGI CO2 Emissions

Reduction Potentials

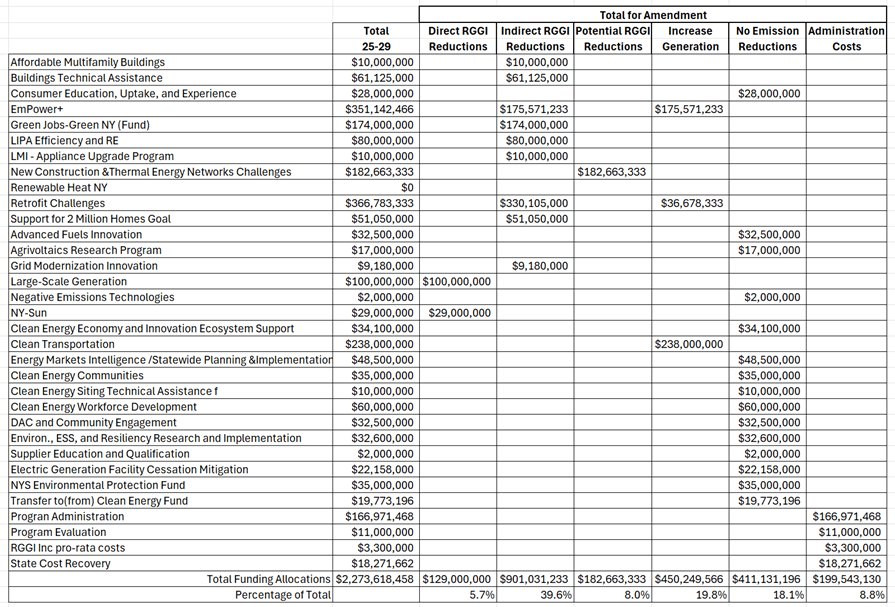

I evaluated the potential effectiveness of the proposed funding allocations relative to RGGI compliance support. I reviewed each proposed program and classified each program into six categories of potential RGGI source emission reductions. The first three categories covered programs that directly, indirectly or could potentially decrease RGGI-affected source emissions. I also included a category for programs that will add load that could potentially increase RGGI source emissions such as programs to incentivize electrification. The two other categories considered programs that do not affect emissions and administrative costs respectively.

The results are in Table 5. The first three categories cover programs that directly, indirectly, or could potentially decrease RGGI-affected source emissions and account for 53% of investments which is up sharply from the 2025 Amendment which only allotted 31% of the investments. This positive development occurred because Empower+ funding doubled and the Retrofit Challenges Programs funding increased sharply. Programs that will add load that could potentially increase RGGI source emissions and whose emissions savings are unrelated to the electric sector total 20% of the investments. Programs that do not affect emissions are funded with 18% of the proceeds and administrative costs total another 9%. The increased preference for funding that could reduce RGGI emissions is a good development. On the other hand, Administration costs are 8.8% of the total and programs that have nothing to do with emissions total 18%. In my opinion, those are programs that should be funded from other sources.

Table 5: Potential for RGGI Reductions for Funding Allocations for 2025 Operating Plan Amendments

RGGI Compliance Summary

Figure 1 shows that no further fuel switching emission reductions are available. Affected sources have no remaining options to comply with RGGI mandates other than limiting operations. Future emission reductions are only possible if zero-emission resources displace the generation of RGGI-affected sources. However, there is a complicating factor that makes emphasis on reducing RGGI-affected emissions more important. The New York State Department of Environmental Conservation (DEC) recently announced revisions to 6 NYCRR Part 242 – CO2 Budget Trading Program the regulation that sets the New York RGGI allowance cap.

Comparison of the revised cap starting in 2027 with the New York State Energy Plan shows that in 2029 projected emissions are double the RGGI cap. Table 10 lists projections starting in 2027 that range from 49.3 to 40.3 MMT. The 2023 observed emissions from RGGI sources was 28.7 MMT. Table 6 lists the proposed RGGI cap or limit on tons of CO2 permitted. There is a big difference between the Pathways Analysis projection and the RGGI cap. There are some mitigating factors because of the Climate Act accounting methodology, but I believe that the Pathways Analysis emissions are well more than the cap.

Table 6: Comparison of RGGI Proposed Part 242 Cap and State Energy Plan Pathways Analysis Electric Power Scenario Projections

Discussion

My primary concern is that RGGI is an electric sector emissions reduction program. I have shown that the observed electric sector emission trends indicate that the observed reductions occurred because of fuel switching from coal and oil to natural gas and that there are no more fuel switching opportunities. Therefore, programs that materially decrease electric sector emissions directly or indirectly through energy use reductions should be a priority because affected sources have no other compliance options. There are programs in the amendment that do not meet these criteria. It is only appropriate to fund the non-priority programs if sufficient funding has been allocated to make the emission reductions necessary to meet RGGI compliance mandates.

These results should be used to determine funding priorities. There are significant differences in the expected emission reductions for different programs and that should also be considered when allocating revenues. While the fraction of funding allocations that could potentially decrease RGGI source emissions has gone up I think that more emphasis is needed to assure compliance and avert compliance problems.

Conclusion

NYSERDA has treated RGGI allowance auction revenues as a convenient slush fund totaling 18% of total funding for whatever politically connected program needs money. As a result, investments that reduce emissions and support those most impacted by increased costs received less funding.

One thought on “My New York State 2026 RGGI Operating Plan Amendment Comments”