This is the third article in a series of three on the status of the New York component of the Regional Greenhouse Gas Initiative (RGGI) as administered by the New York State Energy Research & Development Authority (NYSERDA). This is timely because on December 18, 2024, the New York Assembly Committee on Energy held a public hearing to gather information about NYSERDA’s revenues and expenditures in order to gain a broader perspective on effectiveness of NYSERDA’s programs.

In the first article I evaluated Environmental Protection Agency (EPA) emission data and NYSERDA documentation and found that the investments funded by RGGI auction proceeds would have been only 4.2% higher if the NYSERDA program investments did not occur. In the second article I showed that the cost per ton reduced from the NYSERDA RGGI operating plan investments was $582 per ton of CO2. This article describes the program allocations in the 2025 Draft RGGI Operating Plan Amendment. There are unacknowledged ramifications of the emission reduction performance, funding program priorities, and RGGI compliance mandates.

Background

I have been involved in the RGGI program process since its inception. I blog about the details of the RGGI program because very few seem to want to provide any criticisms of the program. I submitted comments on the Climate Act implementation plan and have written over 480 articles about New York’s net-zero transition because I believe the ambitions for a zero-emissions economy embodied in the Climate Act outstrip available renewable technology such that the net-zero transition will do more harm than good because of impacts on reliability, affordability, and environmental impacts. The opinions expressed in this post do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

RGGI is a market-based program to reduce greenhouse gas emissions (GHG) (Factsheet). It has been a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont to cap and reduce CO2 emissions from the power sector since 2008. New Jersey was in at the beginning, dropped out for years, and re-joined in 2020. Virginia joined in 2021 but has since withdrawn, and Pennsylvania has joined but is not actively participating in auctions due to on-going litigation. According to a RGGI website:

The RGGI states issue CO2 allowances that are distributed almost entirely through regional auctions, resulting in proceeds for reinvestment in strategic energy and consumer programs.

Proceeds were invested in programs including energy efficiency, clean and renewable energy, beneficial electrification, greenhouse gas abatement and climate change adaptation, and direct bill assistance. Energy efficiency continued to receive the largest share of investments.

NYSERDA Operating Plan

NYSERDA designed and implemented a process to develop and annually update an Operating Plan which summarizes and describes the initiatives to be supported by RGGI auction proceeds. On an annual basis, the Authority “engages stakeholders representing the environmental community, the electric generation community, consumer benefit organizations and interested members of the general public to assist with the development of an annual amendment to the Operating Plan.”

The latest Draft RGGI Operating Plan Amendment explains that

New York State invests RGGI proceeds to support comprehensive strategies that best achieve the RGGI greenhouse gas emissions reduction goals pursuant to 21 NYCRR Part 507. The programs in the portfolio of initiatives are designed to support the pursuit of the State’s greenhouse gas emissions reduction goals by:

- Deploying commercially available energy efficiency and renewable energy technologies;

- Building the State’s capacity for long-term carbon reduction;

- Empowering New York communities to reduce carbon pollution, and transition to cleaner energy;

- Stimulating entrepreneurship and growth of clean energy and carbon abatement companies in New York; and

- Creating innovative financing to increase adoption of clean energy and carbon abatement in the State.

The latest Operating Plan process is on-going at the time of this writing. The Advisory Stakeholder meeting was held Thursday, December 5, 2024. The presentation and webinar recording for the meeting are available. The meeting described the proposed programs for the latest amendment. Comments are due on December 23, 2024.

2025 Amendments to Operating Plan

The Stakeholder presentation notes that the 2025 Amendment assumes a future auction allowance price of $15.71. This value is a conservative estimate based on the average price of the past ten auctions. Note, however, that the auction price has settled higher in the most recent auctions so the FY25 Operating Plan budget assumes the allowance price of $19.59 which is the average of actual prices for first two RGGI auctions conducted this fiscal year and $15.71 per ton allowance estimate for the second two auctions.

It is notable that there is no mention of the total revenues expected. That value equals the number of New York allowances in the auctions times the expected allowance prices. I believe that New York will auction 21,783,380 allowances next year which means that the proceeds available in the Amendment total somewhere between $342,216,900 and $426,736,414 for FY 25. At the Assembly Committee on Energy public hearing John Williams, Executive Vice President, Policy and Regulatory Affairs, NYSERDA stated that in the NYSERDA budget “RGGI allowance sales account for $191 million” at 15:30 in the video. I have no idea why there is such a discrepancy between the actual proceeds and the NYSERDA RGGI Budget or why the 2025 Amendment presentation did not provide the totals expected.

Implications

Note that only one of the five goals described previously to “support the pursuit of the State’s greenhouse gas emissions reduction goals” addresses emission reductions. The others are vague cover language to justify the use of RGGI auction proceeds to bury administrative expenses, force ratepayers to cover inconvenient costs related to Climate Act implementation and provide funding for other politically favored projects at the expense of programs that affect CO2 emissions from RGGI affected sources. The question I tried to answer is just how much is allocated to reducing emissions.

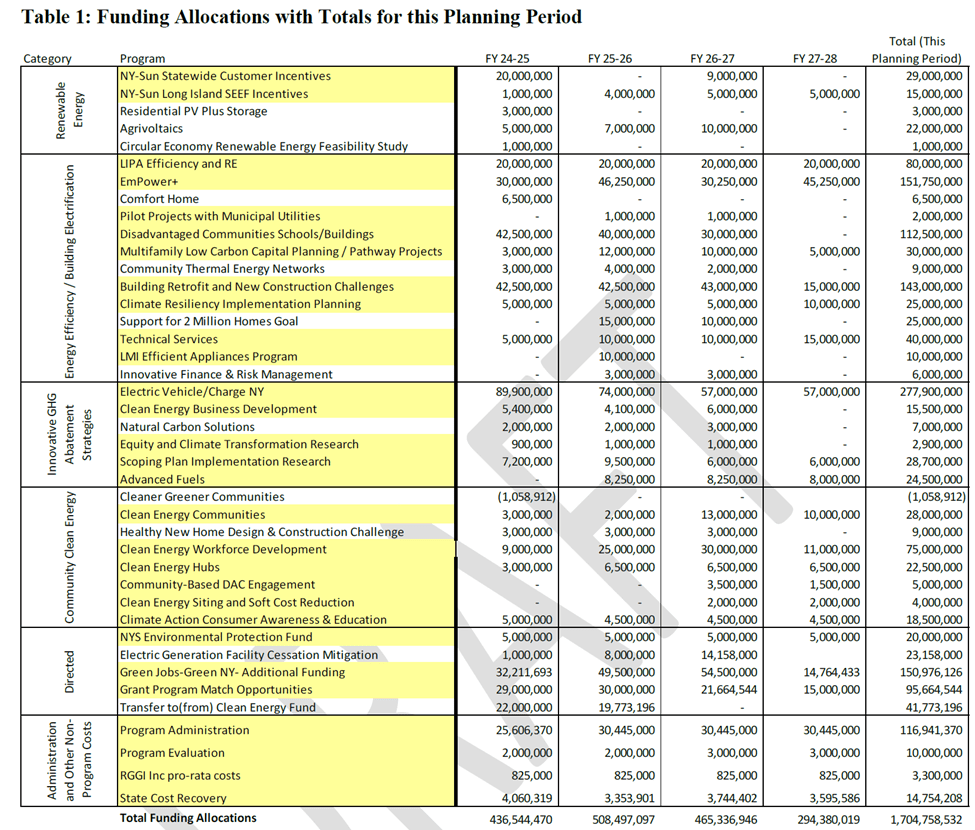

Table 1 from the 2025 Draft RGGI Operating Plan Amendment lists all the proposed programs. Highlighted programs indicate newly funded programs or additional funding to existing programs. The original table highlights programs that “indicate newly funded programs or additional funding to existing programs”. The notes to the table also explain that “Totals may not sum exactly due to rounding and that the fiscal years begin on April 1st and end on March 31st. The document provides brief descriptions of the proposed programs in most instances, but not all the programs have descriptions.

As part of my annual comments, I evaluated these programs in the Operating Amendment relative to their value for future EGU emission reductions. In my comment analysis, I reviewed each proposed program and classified each program relative to six categories of potential RGGI source emission reductions. The first three categories cover programs that directly, indirectly or could potentially decrease RGGI-affected source emissions. I also included a category for programs that will add load that could potentially increase RGGI source emissions such as programs to incentivize electrification. The two other categories consider programs that do not affect emissions and administrative costs respectively.

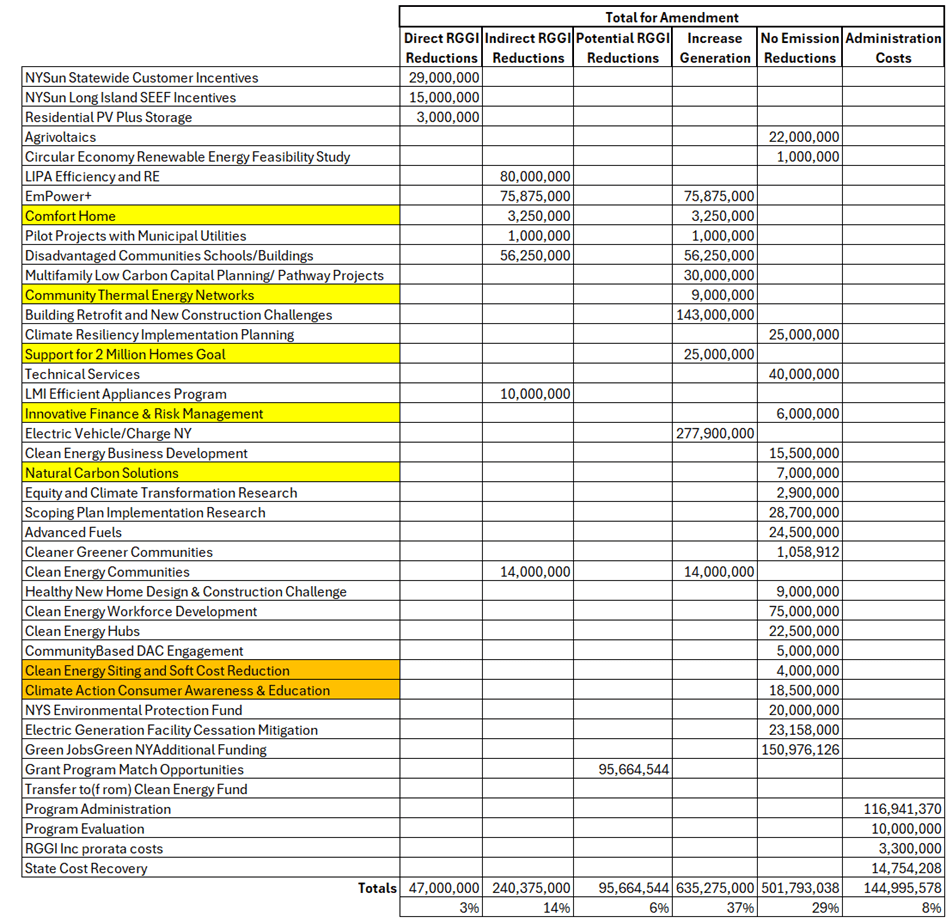

Table 2 presents the results of my interpretation of the potential for RGGI EGU emission reductions for the programs in the proposed amendment. The five programs without documentation highlighted in yellow. The orange highlighted programs will be discussed in a later post. The first three categories cover programs that directly, indirectly, or could potentially decrease RGGI-affected source emissions. They account for only 22% of the investments. Programs that will add load that could potentially increase RGGI source emissions and whose emissions savings are unrelated to the electric sector total 37% of the investments. Programs that do not affect emissions are funded with 29% of the proceeds and administrative costs total another 8%. Clearly there is no preference for reducing emissions.

Table 2: Potential for RGGI Reductions for Funding Allocations for 2025 Operating Plan Amendments

Discussion

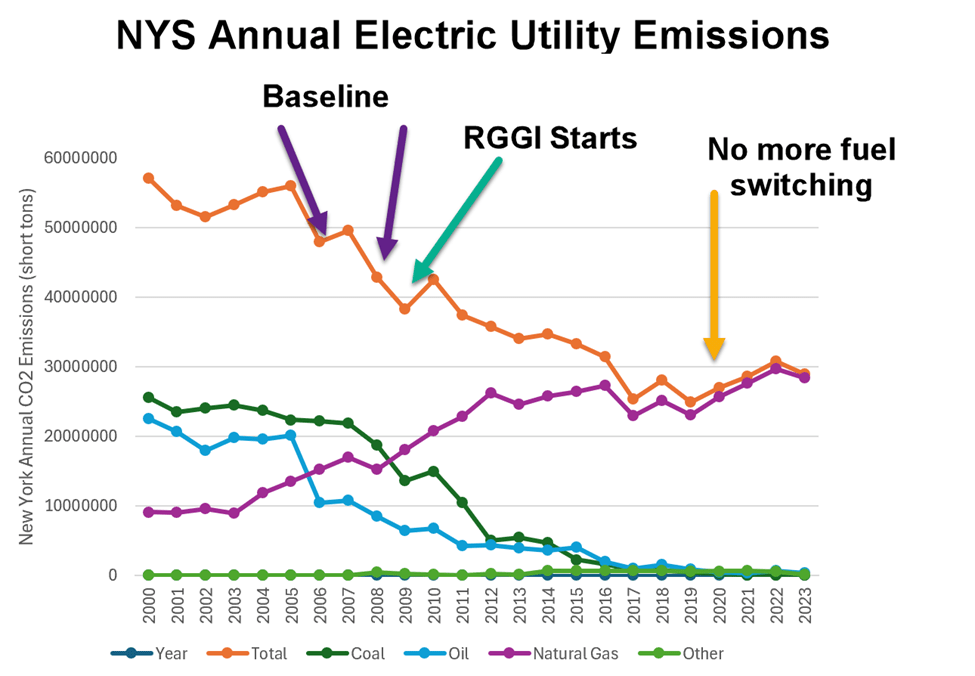

In the previous two RGGi status articles I made the point that the observed emission reductions are the primary reason for the observed reductions. Figure 1 clearly shows this. Since the start of the RGGI program I estimate that emissions from RGGI sources in New York would have been only 4.2% higher if the NYSERDA program investments did not occur and only 2.8% higher when projected savings that do not affect RGGI source emissions are removed.

Figure 1: New York State Emissions by Fuel Type

To date the lack of investment in electric sector emission reduction programs has not been an issue because fuel switching has provided the emission reductions necessary to comply with RGGI reduction requirements. However, eventually there will be a problem because no more fuel switching reductions are available while RGGI allowance allocations continue to decrease.

NYSERDA has shown no indication that it is aware of this concern. In my previous article, I pointed out that the observed investments have not made emission reductions a priority. Since the start of the program NYSERDA has allocated $98.8 million to programs that directly reduce utility emissions by 199,733 tons, $702.7 million for programs that indirectly reduce utility emissions by 1,205,780, and $348.1 million for programs that will increase utility emissions by 678,804 tons. In the last category, the GHG emission savings listed are the benefits for switching from gasoline and diesel to electric vehicles.

Furthermore, this post shows that NYSERDA has not addressed this concern for future investments either. The proposed Amendment to the Operating Plan allocates only 22% to programs that directly, indirectly, or could potentially decrease RGGI-affected source emissions. Programs that will add load that could potentially increase RGGI source emissions total 37% of the investments. Programs that do not affect emissions are funded with 29% of the proceeds and administrative costs total another 8%.

There is one other notable aspect of the NYSERDA funding in the Draft Amendment – there is no mention of the total revenues expected. That value equals the number of New York allowances in the auctions times the expected allowance prices. I believe that NYSERDA will have between $342 and $426 million in FY25-26. John Williams stated that in the NYSERDA budget “RGGI allowance sales account for $191 million” at 15:30. Also note that the Funding Status report annual cumulative investments for the programs described with benefits totals $1.1 billion whereas the cumulative total revenues in the Operating Plan Amendment are $2.4 billion. The difference in those two values represents even more money not likely to address the need for electric sector emission reduction programs. In my opinion, the lack of a clear description reconciling these differences is at least in part due to NYSERDA recognizing that there is no non-incriminating way to explain it.

Conclusion

Given my decades-long background in the electric sector, it is not surprising that I have compliance concerns. In all my comments to NYSERDA on their operating plan amendments I have argued that funding priorities over emphasize Climate Leadership and Community Protection Act (Climate Act) initiatives at the expense of the electric generating unit RGGI emission goals. I take the simple position that RGGI was promulgated as an emission reduction program for the electric generating sector. The failure of affected sources to comply with the RGGI compliance requirements has ramifications. Sas a final point of emphasis, NYSERDA does not acknowledge that because fuel switching opportunities are no longer available that affected sources can only comply by reducing or stopping operations. To prevent that from occurring, NYSERDA investments must displace the generation needed from RGGI-affected sources because that is the only compliance option left with no reliability implications.

I conclude that NYSERDA must reassess its program funding priorities to ensure that sufficient funding is available for programs that displace electric sector generation to zero-emissions sources. If NYSERDA provided a comprehensive explanation of all the emission reduction strategies in the Scoping Plan along with the expected emission reductions, anticipated costs, and potential sources of funding for their strategies then it would be possible to check that NYSERDA has planned for the necessary reductions via other programs. If NYSERDA published documentation of their response to submitted comments on their Operating Plan amendments, they could have explained their strategy for RGGI compliance. The lack of transparency precludes that reassurance.