The first regulation associated with the New York Cap and Invest (NYCI) Program is currently out for comment. The regulation establishes mandatory greenhouse gas (GHG) emission reporting requirements. Accurate and reliable emissions information is a cornerstone for any market-based p program, so this is a necessary first step. This post describes the status of that rulemaking.

I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 540 articles about New York’s net-zero transition. I have worked on every market-based program that affected electric generating facilities in New York including the Acid Rain Program, Regional Greenhouse Gas Initiative (RGGI), and several Nitrogen Oxide programs. I follow and write about the RGGI and New York carbon pricing initiatives so my background is particularly suited for NYCI. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. The Climate Action Council (CAC) was responsible for preparing the Scoping Plan that outlined how to “achieve the State’s bold clean energy and climate agenda.” After a year-long review, the Scoping Plan that outlines how to achieve the targets was finalized at the end of 2022. Since then, the State has been trying to implement the Scoping Plan recommendations through regulations, proceedings, and legislation. NYCI is but one example of that effort.

Cap-and-Invest

The CAC’s Scoping Plan recommended a market-based economywide cap-and-invest program. NYCI is supposed to work by setting an annual cap on the amount of greenhouse gas pollution that is permitted to be emitted in New York: “The declining cap ensures annual emissions are reduced, setting the state on a trajectory to meet our greenhouse gas emission reduction requirements of 40% by 2030, and at least 85% from 1990 levels by 2050, as mandated by the Climate Act.” Affected sources purchase permits to emit a ton (also known as allowances) and then surrender them at the end of the year to comply with the rule. Colin Kinniburgh’s description in New York Focus describes the activist’s theory of a cap-and-invest program as a program that will kill two birds with one stone. “It simultaneously puts a limit on the tons of pollution companies can emit — ‘cap’ — while making them pay for each ton, funding projects to help move the state away from polluting energy sources — ‘invest.'”

As is the case with all aspects of the Climate Act, this approach is not simple and is riddled with complications that make it unlikely that it will work as advocates expect. I have summarized my concerns on my Carbon Pricing Initiatives page.

I have written a couple of articles about the status this year. Going into the year, the climate activist cult was confident that Governor Hochul would say that NYCI implementation would be a priority and that a schedule for the first auctions would be announced. However, that did not happen which has goaded the cult into an extensive lobbying campaign. For example, lobbyists cajoled my Assemblyman into writing a letter to the editor in the Syracuse paper saying that Governor Hochul should “get moving on cap and invest.” I responded explaining that proponents claims that the program will simultaneously raise money, ensure compliance, and be affordable are wishful thinking.

Regulation Implementation Status

To implement the carbon pricing initiative, the Department of Environmental Conservation (DEC) has proposed three regulations: mandatory GHG emissions reporting, a cap-and-invest rule that sets the cap or limit on emissions, and an auction rulemaking that establishes how the allowances will be allocated. There hasn’t been any update on when the cap-and-invest rule and auction rulemaking will be released. Part 253 Mandatory GHG Reporting was released for comment in late March and comments are due on July 1, 2025.

Colin Kinniburgh recently described the status of the NYCI response by climate activists. They have used every opportunity to push for the cap-and-invest rules to be implemented as quickly as possible. I made the mistake of attending a Part 253 hearing and lasted through two speakers before I had to leave. The first speaker made the oft-repeated argument that there are dire health effects like asthma that are the result of fossil fuel emissions which was met by cheers from the audience. Nothing was said about the Part 253 reporting rule that was the subject of the hearing. I could not face listening to other speakers parrot similar talking points, so I left.

Before getting into the specifics, I want to make a general point about NYCI. For the uninitiated, implementing a rule like others already in place seemingly should be simple and straightforward. The reasoning goes something like this: California has a similar program in place, so all New York needs to do is to convert their rules for use in New York. It is not that easy. For starters, California took upwards of ten years with a large staff to develop their rules. NYCI implementation started in early January 2023 and DEC has many fewer staff. Furthermore, the Climate Act has unique emissions definitions which makes simple substitution impossible. Finally, there are significant differences between the energy system nomenclature in the states. In my opinion, the New York Department of Environmental Conservation has done a remarkable job getting something out. Unfortunately, the proposed rule shows signs of haste and lack of understanding.

Consider this from my standpoint. This is the first market-based program proposed rule in 30 years affecting the electric industry that I have no responsibilities to review. So, I have not spent any time looking at that aspect of the rule. However, I have a cousin who owns and operates a small heating oil and propane distribution company. When I glanced at the web page for the draft rule I saw that fuel supply companies were required to report emissions if they supply “any quantity” of fuel. Programs like this always have reporting thresholds so I thought there had to be a mistake in the summary. When I dug into the rule, I found it very difficult to follow the rationale and requirements but convinced myself that DEC did intend to require everyone to report emissions. That is such an extraordinary requirement that I contacted a former colleague who I knew was reviewing the rule to ask for his impression. He confirmed that it was not just me but everyone was having trouble interpreting the proposed rules and had found similar inconsistencies with past practices.

Mandatory GHG Reporting Rule

This description is limited to fuel suppliers in the Part 253 rule. I am going to submit comments and draft a letter for my cousin’s company to submit their own comments. The proposed Part 253 Mandatory Greenhouse Gas Reporting Program rules (“Draft Rule”) would require most if not all small heating oil and propane distributors to report emissions that would be a significant time and expense resource burden. As a more efficient alternative, I will recommend that primary supply terminals that provide fuel to the small distribution companies be the entities responsible for reporting emissions and complying with the allowance trading rules.

Applicability

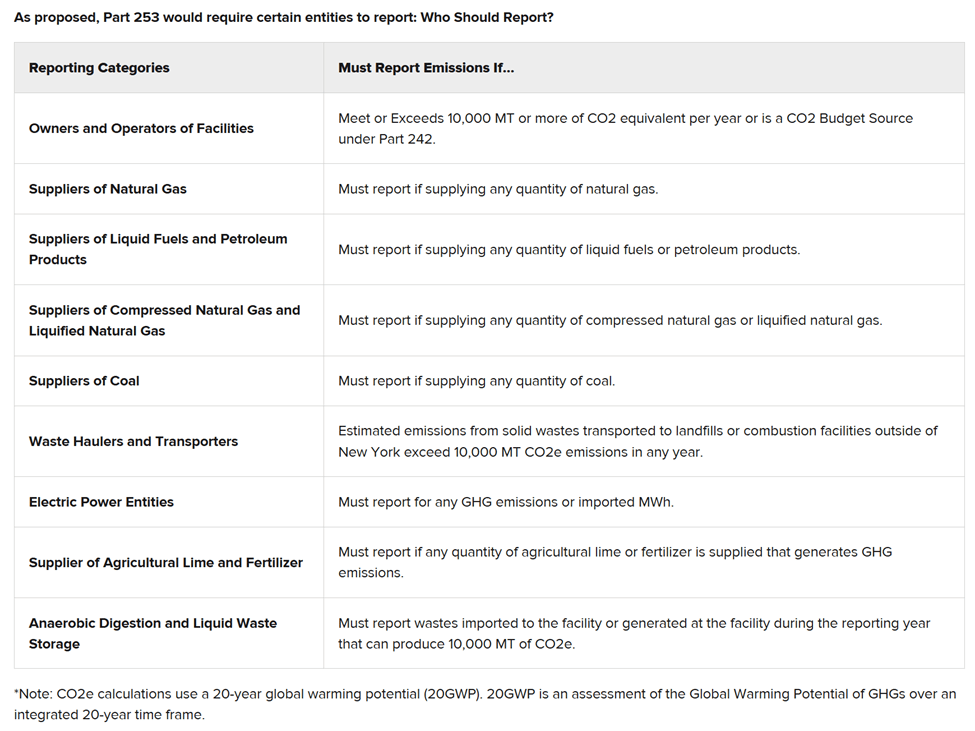

The summary of the Draft Rule includes Figure 1 that describes the entities that must report. There are four categories that “must report emissions” if they supply “any quantity” of fuels. There is a category for “owners and operators of facilities” that has a 10,000 metric ton (MT) threshold but no threshold is provided for fuel suppliers. The Draft Rule should be revised to include a consistent reporting threshold for emissions. Smaller sources could be required to report fuel use instead of emissions.

Figure 1: New York Department of Environmental Conservation (DEC) Mandatory Greenhouse Gas Reporting webpage (accessed on 6/11/25 and last updated 4/30/25)

Large Emission Sources

The rule includes another provision that would require small retail distributors to report emissions. Section 253-1.2 Liquid Fuel Suppliers – Applicability, (f) Large Emission Sources, (2) Fuel supplier has an applicability threshold for suppliers of liquid fuels and petroleum products of 100,000 gallons or more of affected liquid fuels per emission year.

According to the Department of Environmental Conservation GHG Estimation Tool 100,000 gallons of distillate fuel oil number 2 emits 1,351 metric tons of CO2. The California GHG reporting rule uses a threshold of 10,000 metric tons which is equivalent to 740,126 gallons. The United States Environmental Protection Agency GHG emission reporting rule threshold is 25,000 metric tons which is equivalent to 1,850,314 gallons. Using a higher threshold that targets primary supply terminals will cover the fuel emissions while reducing the overall industry reporting burden and the DEC processing burden.

The 100,000 gallon threshold is so low that it would require most retail distributors to report emissions. These small companies have NO experience reporting GHG emissions. In addition, the rules include a verification mandate for large emissions sources. This would require hiring a third party to verify that the data they submit is accurate. Retail heating oil and propane suppliers do not have ready access to resources to report emissions so this would be burdensome.

Other NYCI Compliance Obligations

The Part 253 GHG reporting rule is one component of the regulations for NYCI. The reporting emissions requirement for fuel suppliers that process 100,000 gallons suggests that those facilities could be required to participate in the NYCI allowance market. If that happens then small companies will require significant training or need to hire an experienced consultant to develop a compliance strategy. They need to estimate their expected emissions. They would then be required to purchase allowances either through an auction or a broker, incorporate the allowance price into their retail price, generate compliance reports, and surrender allowances for compliance. This would be an extraordinary financial and resource burden for small businesses.

Recommendation

The draft rules impose an unnecessary and expensive burden on retail fuel suppliers because the applicability thresholds are so low. This challenge to small fuel supply businesses can be addressed by setting the Part 253 emissions reporting and the allowance compliance rule threshold at 25,000 metric tons. It is more efficient and appropriate to make the primary fuel terminal suppliers responsible for reporting emissions and complying with the NYCI allowance regulation. The only obligation for small distributors should be reporting annual fuel sales.

I would appreciate it if readers would submit a comment to the online DEC portal. After filling out your name, location, and other information there is a spot to insert a comment. Please just copy the preceding paragraph in that location. Tell them you are not a robot and submit. Thank you.

Discussion

NYCI is floundering. Governor Hochul is not pushing to get it implemented. I suspect that it is because when the other rules are promulgated it will be necessary to set a price on the allowances. At that point it will become clear to the public that their costs will increase. Climate activists don’t seem to grasp that raising money by making the “polluters pay” will just mean consumer costs will increase.

It is also clear that in the rush to get rules drafted, that some decisions were made without considering the ramifications. The inconsistency between the large emission source GHG associated with 100,000 gallons (1,351 MT) and the 10,000 MT threshold for other sources is unexplained. As a result, of that definition, many small businesses will be required to learn how to report emissions. If they report their fuel use to DEC, then DEC can calculate the emissions and remove the chance for calculation errors. If the primary fuel terminals are the reporting entity reporting burdens and processing burdens will be reduced and all the emissions will still be counted.

Conclusion

Activists continue to agitate for implementing NYCI faster in the hopes that this magical solution will work as advertised. However, it is not moving quickly. Maybe the Administration has caught on to the fact that it won’t work out as advertised and that accounts for the delay. I have no idea if that is the reason, but I am sure that NYCI has more downside risk than proponents realize.