The implementation plans for the New York Climate Leadership & Community Protection Act (Climate Act) net zero transition relies on inverter-based resources like wind, solar, and energy storage. This article highlights a couple of recent documents that describe the reliability challenges introduced by these resources. These reports are another reason we need to pause implementation because I think they make an argument that these problems are unreconcilable.

I am convinced that implementation of the Climate Act net-zero mandates will do more harm than good because the energy density of wind and solar energy is too low and the resource intermittency too variable to ever support a reliable electric system relying on those resources. I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written nearly 600 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Inverter-Based Resources

I acknowledge the use of Perplexity AI to generate this summary of inverter-based resources (IBR). The Perplexity description of issues notes:

While renewable energy sources such as wind, solar photovoltaic systems, and battery storage are essential for achieving sustainability goals, their fundamental differences from traditional synchronous generators create unprecedented challenges for grid stability and reliability. Unlike conventional power plants that rely on massive rotating machinery to provide inherent system support services, IBRs interface with the grid through power electronic converters that lack the natural physical characteristics essential for traditional grid stability mechanisms

I described a Watt-Logic article in September that gives an overview explanation of the “importance of voltage control and reactive power” that were the root cause of the Spanish blackout. In short, the existing system depends upon synchronous generators that convert mechanical energy (spinning turbines) into electrical energy, producing alternating current that matches the frequency of the electric grid. These generators inherently provide important electric grid functions that are difficult to replicate with inverter-based resources like wind, solar, and energy storage. The problem is that not only do inverter-based resources not perform many of these functions, but they can also de-stabilize the grid in certain, poorly understood circumstances.

NYISO Draft Energy Plan Comments

I have written a couple of articles that described comments submitted by the New York Independent System Operator (NYISO) on the New York Draft State Energy Plan. One article summarized the NYISO comments and the other described their recommendations, This article will highlight a couple of points made that were not covered in those two articles.

NYISO Technology Comments

The NYISO Comments on Emerging Technologies and Other Resource Development describes the resources needed:

The resources the electric system will require must include sufficient reliable, dispatchable, and dependable supply resources to maintain the level of service New Yorkers expect. The electric generation fleet must collectively maintain a balance of the attributes listed below:

- Zero-emission/carbon free (i.e., the qualification criteria for the Zero-Emissions by 2040 Target);

- Dependable Fuel Sources that allow these resources to be brought online when required and to operate based on system needs;

- Non-Energy Limited and capable of providing energy for multiple hours and days regardless of weather, storage, or fuel constraints;

- Dispatchable to follow instructions to increase or decrease output on a minute-to-minute basis;

- Quick-Start to come online within 15 minutes;

- Flexibility to be dispatched through a wide operating range with a low minimum output;

- Fast Ramping to increase or reduce energy injections based on changes to net load which may be driven by changes to load or intermittent generation output;

- Multiple starts so resources can be brought online or switched off multiple times through the day as required based on changes to the generation profile and load;

- Inertial Response and frequency control to maintain power system stability and arrest frequency decline post-fault;

- Dynamic Reactive Control to support grid voltage; and

- High Short Circuit Current contribution to ensure appropriate fault detection and clearance.

My concern is that these resources do not presently exist. More importantly, there are no commercially available technologies for some of these resources and grid operators will eventually have to learn how to employ them to prevent blackouts caused by IBRs and intermittency of wind and solar resources.

NYISO Reliability Metrics

I want to highlight the NYISO recommendations for reliability metrics that were discussed in the Electricity Chapter of the Draft Plan:

Consider whether the current reliability-related metrics should be supplemented given the evolving nature of the grid and increased risks of high-impact reliability events. New York should consider whether the current reliability-related metrics (i.e. loss of load expectation) should be supplemented given the evolving nature of the grid and the increased risks of high-impact reliability events. Establishing criteria for metrics like expected unserved energy (EUE) may help supplement traditional LOLE-based criteria by providing information about risks of long-duration outages. As fuel availability will be incorporated into the NYISO’s capacity accreditation framework, additional consideration should be given to whether this adjustment to capacity accreditation provides sufficient incentives and compensation to resources for attributes needed to ensure energy adequacy and resilience to extreme weather events from both a planning and operational perspective (e.g. compensation for fuel storage capabilities).

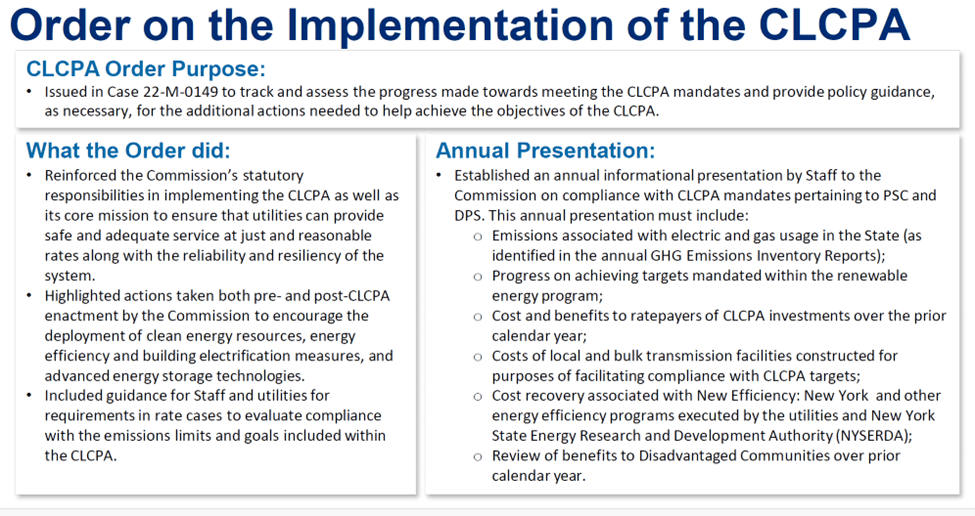

This is important. In my opinion, the biggest unresolved reliability risk associated with Climate Act implementation is addressed in Case 15-E-0302 – Proceeding on Motion of the Commission to Implement a Large-Scale Renewable Program and Clean Energy Standard. Responsible New York agencies all agree that new Dispatchable Emissions-Free Resource (DEFR) technologies are needed to make a solar and wind-reliant electric energy system viable during extended periods of low wind and solar resource availability. In early August I submitted a filing that I prepared with Richard Ellenbogen, Constatine Kontogiannis, and Francis Menton to New York Public Service Commission Case 22-M-0149 – Proceeding on Motion of the Commission Assessing implementation of and Compliance with the Requirements and Targets of the Climate Leadership and Community Protection. Exhibit 4 – Resource Gap Characterization describes the challenges of defining the frequency, duration, and intensity of low wind and solar resource availability (known as dark doldrums) events. I do not believe that policy makers understand the ramifications associated with a fundamental planning component of this resource – how much is needed. The reliability metric for this question is unresolved.

Exhibit 4 describes the issues associated with the resource planning objective for dark doldrum episodes. Comparison of results from different evaluation periods indicates that the longer the evaluation period the more likely that the worst-case event will be discovered. New York has not done an analysis using the longest possible data set. I believe the goal of an evaluation over the longer period would be to define a probabilistic range of return periods for dark doldrum events similar to 100-year floods that could be used for electric system planning. The unresolved issue is how long should the evaluation period be for the metric used to determine how much DEFR is needed.

A fundamental observation is that there is no expectation that the failure of conventional power plants will be correlated. We do not expect that many will fail at the same time. That in turn means that even if we decided to set the reliability metric based on, for example, a one in thirty-year probability instead of one in ten-year probability, there would not be much of an increase in the installed reserve margin. The under-appreciated problem is that the wind and solar resources go to low values over large areas at the same time. This means that the installed reserve margin or any other reliability metric in a wind and solar dependent electric system will increase significantly to cover the worst case. That is a significant challenge because of the tradeoff between the enormous costs of this necessary but infrequently used resource and the risks if insufficient electric energy is available when the de-carbonized energy system is completely electrified. This economic and safety tradeoff is much less of an issue in the existing system.

Until now, my concerns about the wind and solar dependent system have focused on supply during low resource periods. The Iberian Peninsula blackout was caused by IBR operations issue.

April 2025 Iberian Peninsula Blackout

The second document describes what can happen when the existing grid becomes overly reliant upon inverter-based resources without providing sufficient backup resource development. “On April 28, 2025, at 12:33:24 CET, a blackout encompassed Spain, Portugal, and parts of southwest France, leaving over 50 million people without power. The loss of electricity cost Spain an estimated $1.82 billion in economic output and damages.” Deric Tilson writing at the Ecomodernist delves into the minute-by-minute description of exactly what caused the blackout. He includes an excellent description of the technical reasons behind the blackout.

The article also poses the question whether a similar blackout could hit the American grid. He explains:

A month after the blackout, the North American Electric Reliability Corporation (NERC) gave a presentation to the Federal Energy Regulatory Commission in which several potential areas of concern were identified:

- Insufficient voltage regulation to handle large oscillations

- Unreliable voltage regulation to prevent a system collapse

- Poor tolerance of inverter-based resources to handle voltage oscillations

- Potential gaps in operations planning

The key lesson learned by US grid operators and NERC was that if increased voltage leads to generators tripping, which then results in a lowering of frequency, load shedding measures meant to protect the grid will cause voltages to increase further if there is not enough spinning generation.

Tilson presents some reasons why he thinks that the US grid is more resilient than Spain. He argues that:

As technologies have developed and been introduced to energy systems, the grid has grown in its complexity. Intermittent resources and renewables added an extra layer of complexity to what is already a complex system. The structures and institutions that govern the grid were made when all the generation was made up of large fossil fuel plants and hydroelectric turbines; the specific cascading failure seen in Spain would have been unlikely in a more conventional grid. These institutions need to evolve with the technology; if they don’t, the grid will become increasingly unreliable.

He concludes:

Some are waiting expectantly for the results of official investigations into what caused the Iberian blackout; they want some person, policy, or technology to blame. But, electrical systems are not so simple as to care about your pet policies. We need a wide variety of generation sources and types: stable baseload power to always be on and provide generation in all hours of the day; quick, responsive power for when demand is changing rapidly; and emergency power for when there are outages. Grids are more reliable when there is diversity. Nuclear, natural gas, wind, hydroelectric dams, diesel, geothermal, and coal can all contribute to a resilient system.

Conclusion

It is encouraging that the NYISO comments highlighted agreement with points made in the Draft Energy Plan. That suggests that the New York State Energy Research & Development Authority (NYSERDA) is getting the message about reliability issues. Of course, the proof will be if the Final State Energy Plan includes the recommendations based on the points NYISO highlighted.

I think these are two more reasons to pause the Climate Act net-zero transition because the need for “a wide variety of generation sources and types” is recognized but not defined. Adding wind and solar without sufficient support services risks blackouts but necessary support services have not been defined. Should the inverter-based resources have limits on production? How should the limits vary as additional support services are deployed? The electric grid is too complex, and the impacts of a blackout are too severe to risk changing the electric system without a plan committed to reliability.

There is intense pressure to meet an arbitrary decarbonization schedule determined by the naïve authors of the Climate Act. The implementation should be paused until a feasibility analysis determines what is needed, when it can be deployed, and whether we can afford to build those resources. In my opinion it is possible that such an analysis could conclude that the reliability risks of wind and solar- dependent electric systems are too great and that a system based on nuclear power is better.