Earlier this week I published an article about the enormous ratepayer costs of the Climate Leadership & Community Protection Act (Climate Act). The basis of that article was the Public Service Commission (PSC) first annual informational report on the implementation of the Climate Act. This article documents cost impacts of the Climate Act in the evidentiary hearing comments for the New York State Electric & Gas Corporation and Rochester Gas & Electric rate cases.

I have been following the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 350 articles about New York’s net-zero transition. I have devoted a lot of time to the Climate Act because I believe the ambitions for a zero-emissions economy embodied in the Climate Act outstrip available renewable technology such that the net-zero transition will do more harm than good. The opinions expressed in this post do not reflect the position of any of my previous employers or any other company I have been associated with, these comments are mine alone.

Background

The Climate Act established a New York “Net Zero” target (85% reduction and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% reduction by 2030 and a requirement that all electricity generated be “zero-emissions” by 2040. The Climate Action Council is responsible for preparing the Scoping Plan that outlines how to “achieve the State’s bold clean energy and climate agenda.” In brief, that plan is to electrify everything possible using zero-emissions electricity. The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan. After a year-long review, the Scoping Plan recommendations were finalized at the end of 2022. In 2023 the Scoping Plan recommendations are supposed to be implemented through regulation and legislation. In addition, as the utilities determine what expenditures are necessary to support the Climate Act goals those costs are incorporated into their rate case requests.

Before the utilities in New York were de-regulated there were seven vertically integrated utility companies serving New York. Even though those companies have been re-organized the rate case proceedings are based on the original service territories. Subsequent to de-regulation New York State Electric & Gas (NYSEG) and Rochester Gas & Electric (RG&E) were purchased by Spanish owned Iberdrola and both companies are now in Avangrid. Avangrid Networks, Inc. is a subsidiary of Avangrid, Inc. and “combines the resources and expertise of eight electric and natural gas utilities with a rate base of $11.7 billion, serving 3.3 million customers in New York and New England.” This article documents post

hearing comments related to the NYSEG electric rate case 22-E-0317, RGE electric rate case 22-E-0319, the NYSEG gas rate case 22-G-0318, and the RGE gas rate case 22-G-0320 that address Climate Act costs.

Evidentiary Hearing

The Department of Public Service (DPS) hearing brief explains the purpose of the evidentiary hearing:

An evidentiary hearing was held in these proceedings on July 17, 2023 and July 18, 2023. The

purpose of the hearing was to receive into evidence and evaluate the Joint Proposal (JP) filed on June 14, 2023. The hearing also provided an opportunity to consider the reasonableness of the JP and develop the record to determine whether the JP is in the public interest in accordance with the Settlement Guidelines of the New York Public Service Commission (Commission). At the hearing, Alliance for a Green Economy (AGREE), Multiple Intervenors (MI), Public Utility Law Project (PULP), AARP, Fossil Free Tompkins (FFT), and Ratepayer and Community Intervenors (RCI) conducted limited cross-examination of the Department of Public Service Trial Staff (Staff) and the New York State Electric & Gas Corporation (NYSEG) and Rochester Gas and Electric Corporation (RG&E; collectively, the Companies) Panel who testified in support of the JP.

The hearing addressed specific issues raised by the parties. I am going to focus on the MI’s cross-examination concerning the affordability of the revenue requirements and other comments related to affordability.

DPS Hearing Brief

The DPS hearing brief argued that the JP helps customers with affordability by mitigating the revenue requirement (Note that all the footnote references have been excluded for clarity):

At the evidentiary hearing, MI’s cross-examination implied that Staff did not adequately consider affordability as part of its analysis of the provisions contained in the JP. Furthermore, MI questioned whether Staff was “aware of the relative economic conditions impacting …your handling of these rate proceedings?” In fact, the JP addresses affordability by: 1) reducing the Companies’ proposed expenditures from their initial filing; 2) accelerating the amortization of the excess depreciation reserve (EDR); and 3) phasing in a necessary increase in storm reserve rate allowance over the term of the rate plan. These provisions significantly reduce the revenue requirement to make the rates more affordable for customers.

The DPS explanation claims that the “proposed revenue requirement increases in the current cases are largely due to the impact of the Covid-19 pandemic (Pandemic) during the Companies’ last rate cases.” During the Pandemic the PSC reduced rate increases “to help customers who were facing economic upheaval by limiting rate increases to less than two percent total bill impact in each rate year of the rate plan”. To achieve this reduction, the PSC cut cost recovery for “energy efficiency program and vegetation management spending; limited recovery of certain storm regulatory assets by extending the time period over which the costs would be amortized; and passed back several regulatory liabilities to customers in an expeditious time period.” They note:

These efforts were warranted given the magnitude of the economic impacts that the Companies’ customers faced at that time, however, these costs and resulting build up of regulatory assets at both NYSEG electric and RG&E electric now have to be addressed in the current proceeding. Although there are unavoidable rate drivers in these cases, Staff has worked diligently to mitigate the impact of the revenue requirements on customers, which is reflected in the JP.

The DPS staff claims that they reduced the revenue requirements in several ways. NYSEG and RGE have reduced discretionary capital expenditures. They “reprioritized the Companies’ electric capital budget and delayed several infrastructure projects that do not address immediate safety and reliability needs.” The DPS brief notes states that “When compared to the initial filing, the JP reflects a reduction to the requested electric capital budget from 2024 through 2026 by $2.28 billion for NYSEG and $280.59 million for RG&E.” My interpretation of this is that these projects will still be needed in the future so they are just being delayed so that this rate increase is not so bad.

Another major cost savings related to vegetation management programs. These programs are needed to improve system reliability and reduce tree-related outages. The JP proposes a vegetation management program that sets NYSEG on a longer cycle of vegetation trimming projects. There is a tradeoff here between the desire to reduce outages and costs.

The JP also utilizes additional excess depreciation reserve (EDR) funds to reduce revenue requirements and help address affordability for customers. This looks like accounting magic to reduce costs but the brief claims that they will be “within the 10% band commonly accepted by the Commission.” It goes on to say “Using any additional EDR could negatively impact the Companies’ credit ratings and would lead to an inevitable sharp rate increase or a hockey stick in subsequent rate cases, when there simply is not any additional EDR that can be used.”

In another example of accounting magic to keep the costs down the JP changes the major storm Operations and Maintenance (O&M) expense allowance to lessen the impact on customers. If there is a major storm and more money is needed than set aside this will come back and result in less timely storm restoration. “Although the revenue requirement allowances for major storm restoration should be much higher based on historical levels experienced at the Companies, Staff supports the inclusion of a lesser amount to mitigate the immediate rate impact on customers.

The DPS brief concludes that “even with the proposed increases, the rates for residential customers of both Companies will remain among the lowest in the State, which demonstrates that the provisions referenced above will help to keep rates affordable for customers.”

Conspicuous by its absence was any mention of Climate Act spending.

Climate Act Spending

The costs associated with the Climate Act were not a subject of the evidentiary hearing. In order to estimate those costs I relied on the June 29, 2022 Technical Conference presentation. I did not try to determine if the costs in this initial proposal are still the same as what ended up in the final rate case but I believe the results are indicative. The following slide lists capital expenditure estimates that includes costs for the Climate Act.

The important part of the slide is the following excerpt.

The following table calculates the total and lists percentages for each program.

There are three capital expenditure programs that are directly associated with the Climate Act. The Electric and Common Capital Expenditures Testimony describes plans. The following plans were associated with the search term “CLCPA” that I think are included in the CLCPA category:

- CLCPA Transmission Projects Phase 1

- Project Description: The CLCPA Phase 1 Transmission Projects consist of 23 projects for the purpose of unlocking transmission-connected renewable resources by increasing headroom on the system.

- CLCPA Transmission Projects Phase 2 “Areas of Concern”

- Project Description: The CLCPA Phase 2 “Areas of Concern” Transmission Projects consist of 46 projects for the purpose of unlocking an incremental amount of transmission-connected renewable resources and to increase headroom on the system.

- Low Income Clean Generation

- Program Description: This project will develop one or more solar photovoltaic (“PV”) facilities at both NYSEG and RG&E. NYSEG will install 50 MW of installed capacity while RG&E will install 20 MW of installed capacity

- EV Charging Hub Project

- Project Description: This project is a large-scale, purpose-built facility that will serve 10 corridor charging needs for light-duty, medium-duty, and heavy-duty vehicles within the NYSEG service area.

The other two programs are Make Ready and Ithaca Electrification. Make Ready supports electric vehicle (EV) charging infrastructure:” With our new Make-Ready Program, businesses can now quickly install electric vehicle (EV) charging stations with up to 100 percent reimbursement of costs for the electrical improvements needed to support EV charging.” The Ithaca Electrification project is described as local transmission and distribution projects needed to address existing reliability needs and will help to support timely execution of the City of Ithaca’s electrification initiative.” The following might be another description of this initiative.

In addition to the capital expenditure projects other clean energy initiative within the rate case were described that support the Climate Act.

Another major Climate Act initiative is energy efficiency support. The presentation describes the associated costs as follows:

These energy efficiency programs are part of a New York State Energy Research & Development Authority program. New Efficiency: New York (NE:NY) is a “comprehensive mix of strategies to support building developers, commercial and institutional building owners, industrial facilities, and residential households to pursue improvements that reduce energy consumption across the State. These efficiency improvements will enable New York to meet an ambitious new target of 185 trillion Btus (British thermal units) of end-use energy savings below the 2025 energy-use forecast. That’s equivalent to saving the energy consumed by 1.8 million New York homes.”

Apparently DPS staff had an issue with the proposed costs and this was an issue during negotiations. The following table shows the differences.

Affordability Issue

Three parties addressed affordability. The Public Utility Law Project of New York, Inc. (PULP) post-hearing brief described the JP rate increases as a ratepayer “affordability crisis”. AARP New York called the rate increases “unjust and unreasonable”. Multiple Intervenors commented that the “delivery rate increase are enormous” and “unprecedented”.

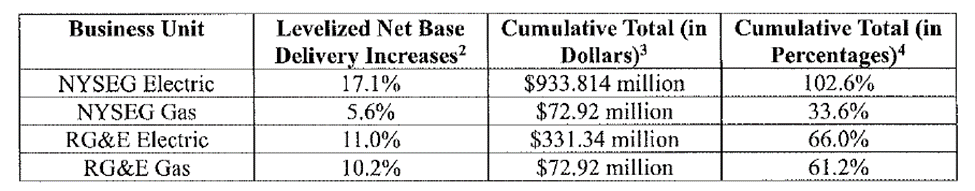

Multiple Intervenors argued that the delivery rate impacts are magnitudes higher than the impacts that the Commission previously found to be unacceptably high and included the following summary table of impacts. The cumulative percentage total reflects the fact that the first rate-year is in effect for all three years, the second rate-year is in effect for two years, and the final rate-year is in effect for one year. That approach projects that NYSEG electric delivery rates will be double the current rate in three years

Safety Valve

None of the comments raised the safety valve conditions for affordability in New York Public Service Law § 66-p (4). “Establishment of a renewable energy program”. §66-p (4) states: “The commission may temporarily suspend or modify the obligations under such program provided that the commission, after conducting a hearing as provided in section twenty of this chapter, makes a finding that the program impedes the provision of safe and adequate electric service; the program is likely to impair existing obligations and agreements; and/or that there is a significant increase in arrears or service disconnections that the commission determines is related to the program”.

Unfortunately, the Hochul Administration has never defined these criteria which I believe should have been a primary responsibility of the Climate Action Council. The criteria used to define “safe and adequate electric service” and “significant increase in arrears or service disconnections” should be defined so that proceedings like this have acceptability limits.

Multiple Intervenors expressed the frustration of ratepayers relative to the desire to support the Climate Act within certain bounds of affordability:

Multiple Intervenors supports reasonable efforts to maintain, if not improve, electric and gas reliability and customer service, and reduce greenhouse gas emissions. Significantly, however, customers of all types need to be able to afford electric and gas service, and that is where the Joint Proposal fails miserably. Although Multiple Intervenors identified many specific areas of concern regarding the Joint Proposal in prior submissions, it is not in a position to unilaterally rebalance often-competing priorities to fix the Joint Proposal’s numerous shortcomings. Rather, that authority and responsibility rests solely with the Commission. Multiple Intervenors urges the Commission to (i) conclude that the balancing of priorities reflected in the Joint Proposal fails to weigh affordability concerns adequately, and (ii) take decisive action to ensure that delivery rate impacts are moderated to acceptable levels. This is no “ordinary” Joint Proposal, the Commission needs to reject or modify it to protect customers from excessive delivery rate impacts.

Climate Act Cost Discussion

The rationale for the increased costs ignores the costs of the Climate Act. I did not find specific information in the Proceeding documentation that summarized all the costs. Note, however, that most of the capital expenditures are related to Climate Act costs which I believe are primarily due to transmission upgrades necessary to get solar and wind project energy to where it is needed. As an aside the primary place it is needed is New York City so Upstate ratepayers are paying to support that need. The bottom line for the Climate Act portion of the capital expense in rate year 4/23 to 3/24 is $603 million of $1,085 million (56%) total. If the costs for advanced metering infrastructure (smart meters) are included as Climate Act costs which I believe is appropriate the rate year costs are $713 million or 66% of the total.

JP Climate Act Implementation

I believe that a major problem with Climate Act implementation is that the vast sums of money attract crony capitalists and rent-seeking opportunists all eager to take advantage of the money. This money is going to come out of the pockets of New Yorkers so these grifters need to be called out. The parent company of NYSEG and RGE is a good example of a company taking advantage of the Climate Act to reduce their risks and make money.

Iberdrola brags about their commitment:

The Iberdrola group has undergone a profound transformation, anticipating the current energy transition by 20 years to meet the challenges of climate change and the need for a clean, reliable and smart business model.

Today, it is a leader in renewables and smart grids, has a diversified portfolio of businesses and geographies, is present in highly rated countries and has demonstrated its financial strength, expertise and execution capabilities. Furthermore, 90% of the group’s long-term investment plan is aligned with the green investment criteria included in the EU taxonomy.

Briefing comments show how they are trying to fleece ratepayers under the guise of supporting the energy transition. Commenters argued that the proposed earning adjustment mechanism, incentive awards for non-wires alternatives and procurement of environmental attributes, and treatment of Climate Act-related capital expenditures all increase the rate case request at the expense of consumers.

This article is already too long so I am not going to delve into specifics of all these adjustments. One example will have to suffice. PULP addressed the 9.2% return on equity (ROE) included in the JP. ROE is considered a gauge of a corporation’s profitability and how efficient it is in generating profits. PULP explains:

The Companies are looking to increase from the current ROE of 8.8%, to the 9.2% ROE, which substantially adds to the already historic rate increases included in this JP. PULP generally urges careful consideration of every aspect of the JP when looking for ways to cut costs. Specifically, we urge the ALJs and the Commission to modify the JP so that the ROE is not set through confidential settlement negotiations, but rather through calculations using the generic finance model, while also providing for an annual recalculation.

The PULP comment argues that uncertainties associated with the Climate Act are not an appropriate reason to increase the ROE as asserted in the JP. They note that it is “reasonable to assume that the risks presented by the CLCPA would be addressed in a manner that is consistent with past Commission policy that utilities should be able to recover all their operating costs and an adequate return on their investments, assuming efficient and economical management”. Cynics like me look at this kind of sweetheart deal and wonder if this part of the political calculus of the Climate Act. The utilities that know that there are enormous affordability and reliability risks for the net-zero transition get a bit more profit for not speaking up about those risks.

Conclusion

The bottom line is that Climate Act costs are a major factor in the extraordinarily large rate case request. No one has stepped up to say that this is an issue in this instance and every future rate case for every New York utility is going to have to have similarly large costs.

Public Service Law §66-p (4) requires consideration of affordability and reliability for Climate Act implementation but the specific criteria have not been defined. New York GHG emissions are less than one half of one percent of global emissions and global emissions have been increasing on average by more than one half of one percent per year since 1990. The Hochul Administration has no plan in place to address affordability. As a result, New York emission reductions are not going to affect climate change, so it is unacceptable to prove that affordability and reliability considerations are not adversely affected.

The PULP briefing notes that recent collection activity reports are a good indication of whether residential customers are currently able to pay their bills. They note:

Unfortunately, these numbers are striking. As of June 2023, 130,637 residential NYSEG accounts were behind on their payments by 60-days or more, for a total of $79.3 million. For RG&E, 78,112 residential accounts were behind on their bills for a total of $61.8 million.

It is unimaginable to me that any reasonable affordability criterion defined per Public Service Law §66-p (4) would find that these rate case impacts would be acceptable. The PSC should temporarily suspend or modify the obligations of the Climate Act until we have a better understanding of the costs to implement the Act.