Offshore wind (OSW) is a key component of the Climate Leadership & Community Protection Act (Climate Act). This article highlights material on costs and the leasing process that suggests it is not going to end well. Affordability is a major concern of mine and the costs for offshore wind are extraordinarily high. David Stevenson prepared a summary of costs that deserves wider distribution. Bud’s Offshore Energy blog argued that unrealistic power generation deadlines should not be the focus of the Bureau of Ocean Energy Management (BOEM) leasing policy.

I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 400 articles about New York’s net-zero transition. The opinions expressed in this post do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% reduction by 2030 and a requirement that all electricity generated be “zero-emissions” by 2040. Because nothing says sound energy policy like one designed politicians, the Climate Act also includes a requirement for 9 GW of offshore wind by 2035. The Climate Action Council (CAC) is responsible for preparing the Scoping Plan that outlines how to “achieve the State’s bold clean energy and climate agenda.” In brief, that plan is to electrify everything possible using zero-emissions electricity. The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan outline of strategies. After a year-long review, the Scoping Plan was finalized at the end of 2022. In 2023 the Scoping Plan recommendations were supposed to be implemented through regulation, PSC orders, and legislation. Not surprisingly, the aspirational schedule of the Climate Act has proven to be more difficult to implement than planned and many aspects of the transition are falling behind.

Offshore Wind Costs

Richard Ellenbogen recently submitted comments that compared nuclear costs to other proposed dispatchable emissions-free resources which I cover in another post. His analysis included an assessment of OSW, but he was unable to come up with good cost numbers. David Stevenson has some numbers available which are shown below. David has spent the last twelve years as the Director of the Center for Energy & Environment for the Caesar Rodney Institute, a bipartisan free market think tank. He has published over 150 analytic studies including major studies on the Regional Greenhouse Gas Initiative, the EPA Clean Power Plan, electric grid reliability, the public policy drivers of energy cost, offshore wind, electric vehicles, carbon capture, nuclear energy, and climate change.

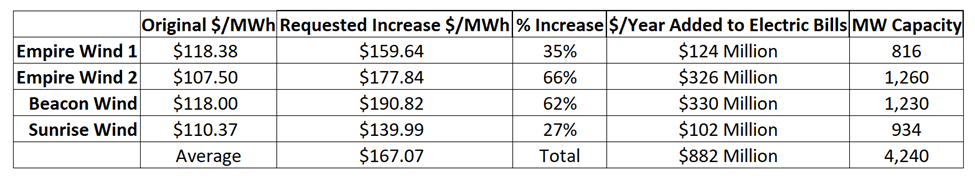

Some background on New York’s OSW plans. The New York State Energy Research & Development Authority (NYSERDA) issues competitive solicitations for offshore wind energy and contracts with offshore wind developers to purchase offshore renewable energy certificates. Early last summer four previously approved New York OSW projects requested higher price guarantees as shown in the following table. James Hanley wrote an article The Rising Cost of Offshore Wind that describes two issues affecting all OSW projects across the world that accounts for some of the cost increases requested:

But this recent growth in the offshore wind industry does not necessarily reflect its long-term health. Two substantial headwinds threaten to make projects uneconomical. One is the recent high inflation, which raised the costs of materials and labor across all industries, and the other is bottlenecked supply chains that are causing a bidding-up of the prices of materials and components needed for building wind turbines.

Hanley explained the ramifications to the OSW projects in New York and linked to the request for increases:

Stevenson produced this summary of the costs associated with these requests for more money.

Requested increased price guarantees in New York

On October 12, 2023 the Public Service Commission turned down this request to raise the prices. Times Union writer Rick Karlin summarizes:

At issue was a request in June by ACE NY, as well as Empire Offshore Wind LLC, Beacon Wind LLC, and Sunrise Wind LLC, which are putting up the offshore wind tower farms.

All told, the request, which was in the form of a filing before the PSC, represented four offshore wind projects totaling 4.2 gigawatts of power, five land-based wind farms worth 7.5 gigawatts and 81 large solar arrays.

All of these projects are underway but not completed. They have already been selected and are under contract with the New York State Energy Research and Development Authority, or NYSERDA, to help New York transition to a clean power grid, as called for in the Climate Leadership and Community Protection Act, approved by the state Legislature and signed into law in 2019.

Developer response suggests that “a number of planned projects will now be canceled, and their developers will try to rebid for a higher price at a later date — which will lead to delays in ushering in an era of green energy in New York”. Karlin also quotes Fred Zalcman, director of the New York Offshore Wind Alliance: “Today’s PSC decision denying relief to the portfolio of contracted offshore wind projects puts these projects in serious jeopardy,”

Later in October new projects were approved by NYSERDA with an average nominal cost/ MWh of $145.07 which compares to $167.07 in the table above. Stevenson explains that the table prices were requested in December 2023 while the new projects bids were probably made in early 2023 and may not reflect the true cost needed to obtain financing today. The original four projects cancelled most likely would have started construction in 2025 while the new projects are slated to start in 2030.

Here is what NYSERDA reported about the recent projects that include Attentive Energy One at 1,404 MW, Community Offshore Wind at 1,314 MW, and Excelsior Wind at 1,314 MW:

“The weighted average strike price of the awarded offshore wind projects over the (25 year) life of the contracts is $96.72 per megawatt hour in 2023 (real) dollars, which equates to a nominal weighted average strike price of $145.07 per megawatt hour. The strike prices comprising the weighted average cited above are subject to certain adjustments in accordance with the terms of the awarded contracts, including, in some cases, adjustments based on certain price indices, interconnection costs and/or receipt of qualifying federal support.”

Stevenson said “it looks to me that the award allows prices to increase 3% a year”. The strike price is the guaranteed price. The premium payment to the wind developer will be reduced by any revenue they receive from selling the wholesale power and any capacity value which might total about $60/MWh over the life of the projects so the net premium price might be about $85/MWh. In addition, there may be other inflation adders based on NYSERDA’s wording.

Soon after the Public Service Commission refused to approve the higher costs for four contracts last October, the Hochul Administration announced that expedited offshore wind solicitations for the state will be held early in 2024.

Projects that previously petitioned the New York State Public Service Commission for financial relief can choose to participate, though the solicitation will also emphasize competition between these and other projects, ensuring the integrity of the process and best value for New York electricity consumers, according to the press release.

The solicitations were announced in January and the deadline for submittals recently passed. The results will be announced soon.

Stevenson also provided cost estimated for two new projects have been approved in New Jersey that he expects will be similar to the expedited New York solicitations. The 2,400 MW Invenergy project will average $152.91/MWh, and the 1,342 MW Attentive One will average $187.83 over their twenty-year life considering their 2.5% and 3% per year allowed price increases. In addition, each of the 2032 startups expect 30% federal Investment Tax Credits, and New Jersey is allowing up to 15% additional inflation adjusters that could bring average costs to $175.84 and $216.01/MWh. The New York projects may have a similar inflator.

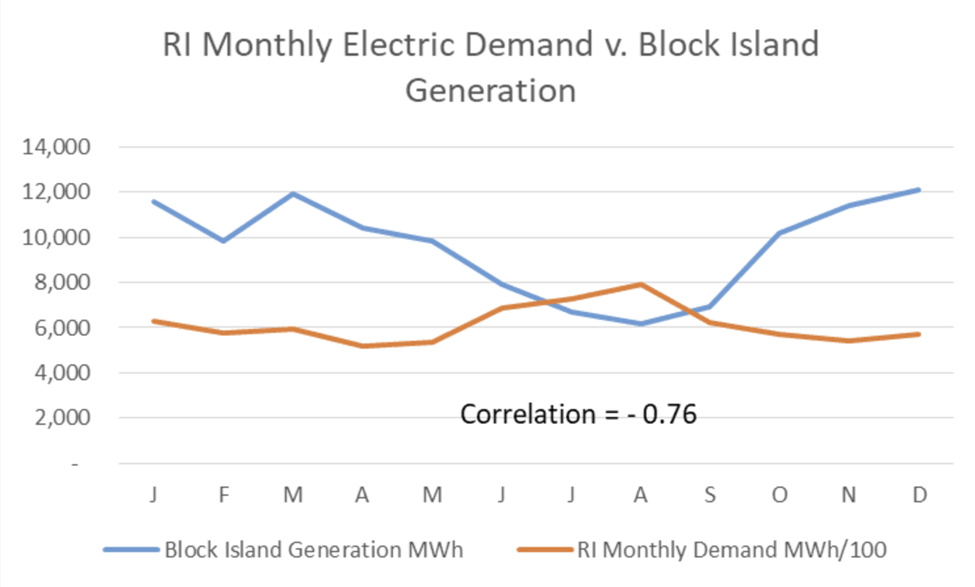

He notes that Attentive Wind One is projecting a ridiculously high 56% capacity factor. Most projects estimate capacity factors of 42% to 44%, like actual results from the five turbine Block Island and two turbine Coastal Virginia projects. Two factors suggest much lower capacity factors for larger projects. Below is the annual production curve for six years at Block Island. Notice the highest generation occurs in the spring and fall when electric demand is lowest. The Virginia turbines show a similar pattern. With many large projects all doing the same the regional grids will not be able to take all the power produced so turbines will have to be shut down, or curtailed. PJM expects average capacity factors will be 37% because of this curtailment.

European studies of offshore wind show a second impact known as the “Wake Effect”. The first row of turbines absorb wing power leaving succeeding rows with less wind energy. The impact could be to drop electric generation another 5% to 10%. Lower generation means higher guaranteed prices will be needed. We will most likely see future nominal strike prices routinely above $200/MWh.

Deadlines and Wind Deployment

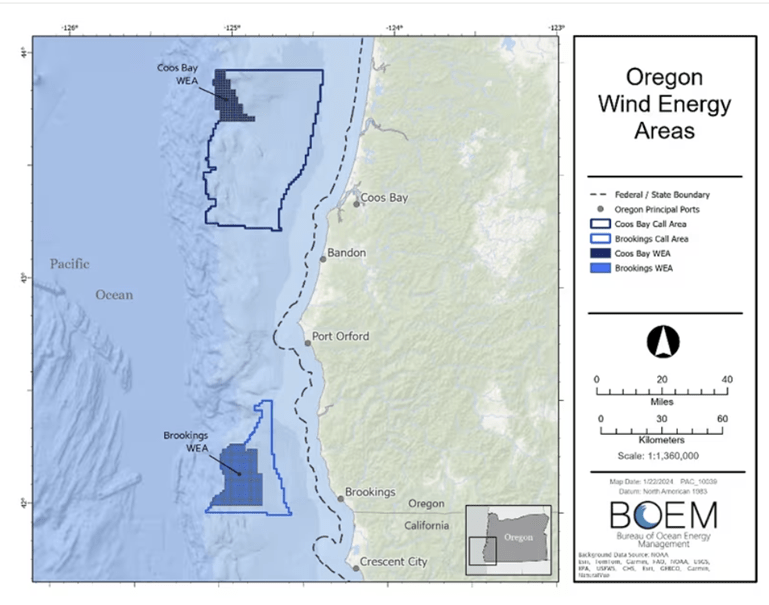

Bud’s Offshore Energy blog points out that unrealistic power generation deadlines should not be the focus of the Bureau of Ocean Energy Management (BOEM) leasing policy. This argument also applies to the Climate Act’s arbitrary offshore wind deployment requirements. In reference to wind leasing issues in Oregon he explained:

As concerns about wind leasing mount, it is becoming increasingly apparent that the rush to hold auctions may not be in the best long-term interest of the wind program. The primary objective should be cost-effective and responsible development, not gigawatt deadlines. The administration’s vision for wind energy capacity, particularly the 15 GW goal for floating turbines by 2035, is unlikely to be achieved and rushing the process is not helpful.

The current wind program is reminiscent of James Watt’s ill-fated approach to oil and gas leasing. Watt’s “lease-everything now” agenda had the opposite effect of that which was intended, the result being that 96.3% of our offshore land is now off-limits to oil and gas leasing.

Affected parties in Oregon have not held back in voicing their displeasure with BOEM’s wind energy announcement.

“BOEM wants offshore wind come hell or high water and they don’t care who they harm to get it.

Heather Mann, executive director of Midwater Trawlers Cooperative”

The Confederated Tribes of Coos, Lower Umpqua and Siuslaw tribal council unanimously passed a resolution opposing offshore wind energy development off the Oregon coast.

“The federal government states that it has ‘engaged’ with the Tribe, but that engagement has amounted to listening to the Tribe’s concerns and ignoring them and providing promises that they may be dealt with at some later stage of the process. The Tribe will not stand by while a project is developed that causes it more harm than good – this is simply green colonialism.”

Coos, Lower Umpqua and Siuslaw tribal council Chair Brad Kneaper

Discussion

These two perspectives address my concerns about affordability and reliability. The Climate Action Council got bogged down in its Scoping Plan review with ideological discussions. For example, an inordinate amount of time was spent arguing whether natural gas should instead be called fossil gas in the Scoping Plan.. As a result, the Council never established criteria for affordability and reliability presuming that because the Integration Analysis projections supported their narrative that those issues would not arise.

I believe that the issues are rapidly approaching the fan of reality and they will hit soon. Soon the reality that the aspirational schedule is untenable, the costs are higher than admitted, and there are ramifications to reliability because no new fossil power are being built to replace the irreplaceable aging fossil plants before the magical resources are developed. There is a safety valve that can be used by the Public Service Commission that gives me hope that this mess can be averted. New York Public Service Law § 66-p (4). “Establishment of a renewable energy program” includes safety valve conditions for affordability and reliability. § 66-p (4) states: “The commission may temporarily suspend or modify the obligations under such program provided that the commission, after conducting a hearing as provided in section twenty of this chapter, makes a finding that the program impedes the provision of safe and adequate electric service; the program is likely to impair existing obligations and agreements; and/or that there is a significant increase in arrears or service disconnections that the commission determines is related to the program”. The political ramifications of employing this would be enormous but the impacts of the failure to pause this absurd energy plan would be much worse. I believe that the Public Service Commission should assure that New Yorkers can continue to have access to reliable and affordable electricity by defining standards for those affordability and reliability criteria.

Conclusion

I cannot over-emphasize how much I agree that the primary objective of offshore wind development “should be cost-effective and responsible development, not gigawatt deadlines”. With the addition of evolving development costs as supply chain and infrastructure support requirements become clear, it is not in the interests of New York to continue the mad rush to try to meet arbitrary gigawatt deadlines. This also applies to the development of ll solar and wind. Legitimate affordability, reliability, and environmental concerns are being ignored in the rush to build as much as possible as soon as possible.