In the first two months of 2024 the New York State Department of Environmental Conservation (DEC) and the New York Energy Research & Development Authority (NYSERDA) worked on the New York Cap-and-Invest (NYCI) Program stakeholder engagement process requesting comments on the pre-proposal outline of the regulations. Since then, nothing much has happened until a webinar was held on August 15, 2024, where DEC and NYSERDA presented “a draft proposed framework for guiding the allocation of these funds and identification of potential areas that could receive investments.” DEC and NYSERDA also posed a series of questions seeking public feedback. The webinar presentation and recording are now available.

I have followed the Climate Leadership & Community Protection Act (Climate Act)since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 450 articles about New York’s net-zero transition. I have extensive experience with air pollution control theory, implementation, and evaluation of results having worked on every cap-and-trade program affecting electric generating facilities in New York including the Acid Rain Program, Regional Greenhouse Gas Initiative (RGGI) and several nitrogen oxide programs. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% reduction by 2030. Two targets address the electric sector: 70% of the electricity must come from renewable energy by 2030 and all electricity has to be generated be “zero-emissions” resources by 2040. The Climate Action Council (CAC) was responsible for preparing the Scoping Plan that outlined how to “achieve the State’s bold clean energy and climate agenda.” The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan outline of strategies. After a year-long review, the Scoping Plan was finalized at the end of 2022. Since then, the State has been trying to implement the Scoping Plan recommendations through regulations, proceedings, and legislation.

Cap-and-Invest

The Climate Action Council’s Scoping Plan recommended a market-based economywide cap-and-invest program. Since my last post on this subject, I have read a couple of relevant articles that provide background information on this approach. Dr. Lars Schernikau is an energy economist who explained why an emissions market solution for CO2 is not likely to succeed. He explained that CO2 pricing (also falsely called “carbon pricing”) is a terrible idea fit only for discarding in The Dilemma of Pricing CO2. Ron Klutz summarized the article with emphasis and added images. The other article noted explained that the label cap-and-invest is a political marketing term “to boost their appeal and reflect the growing use of funds for climate protection.” In brief, cap-and-invest is a marketing cover for the politically toxic carbon tax.

The program recommended by the CAC works by setting an annual cap on the amount of greenhouse gas pollution that is permitted to be emitted in New York: “The declining cap ensures annual emissions are reduced, setting the state on a trajectory to meet our greenhouse gas emission reduction requirements of 40% by 2030, and at least 85% from 1990 levels by 2050, as mandated by the Climate Leadership & Community Protection Act (Climate Act).” In addition to the declining cap, it is supposed to limit potential costs to New Yorkers, invest proceeds in programs that drive emission reductions in an equitable manner, and maintain the competitiveness of New York businesses and industries.

Late last year DEC and NYSERDA released the pre-proposal outline of issues that included a long list of topics. The Agencies said that they were “seeking and appreciate any feedback provided on these pre-proposal program leanings to inform final decisions in the State’s stakeholder-driven process to develop these programs.” In a post describing my comments I provided additional background information and my concerns. In late June I described my letter to the editor of the Syracuse Post Standard that argued that the delays were primarily due to staffing issues. In my submittals I have expressed two primary concerns. The first is that the sources that are responsible for compliance with NYCI have very few options for on-site control so must rely on somebody else to make the investments for zero-carbon emitting resources to displace their operations. The second concern is that the NYCI feature that “ensures annual emissions are reduced” must be integrated with the investments needed for those zero-carbon emitting resources. If there are inadequate investments, then the only option for the affected sources is to reduce or stop operations. If the affected source is an electric generating station, there could be reliability implications.

Public Webinar August 15, 2024

The meeting description said:

The New York State Department of Environmental Conservation (DEC) and New York State Energy Research and Development Authority (NYSERDA) are seeking public input as they develop a framework for the use of New York Cap-and-Invest (NYCI) proceeds from the Climate Investment Account. The Climate Investment Account is a critical component in supporting New York’s transition to a less carbon-intensive economy by directing NYCI auction proceeds to projects that benefit New Yorkers, prioritizing frontline disadvantaged communities that historically suffered from pollution and environmental injustice.

In the Fiscal Year 2024 State Budget, Governor Kathy Hochul laid out the structure of the Climate Action Fund for NYCI proceeds. The Climate Investment Account is one component of the fund and will be used to direct two-thirds of future NYCI proceeds. The remaining proceeds will go to an account to directly mitigate consumer costs, guided by the Climate Affordability Study, and a third account will support energy affordability for small businesses.

The agenda included the following items:

- Climate Leadership & Community Protection Act Overview

- Introduction to New York Cap-and-Invest (NYCI)

- Use of Proceeds from the Climate Investment Account

- Request for Public Input

- Questions and Answers

- How to Submit Comments and Stay Involved

Nothing new was provided in the first two agenda items. If you are interested in this background information I have linked the start of the video description for each section to the following links: overview of the Climate Act and introduction to NYCI.

The focus of the webinar was on Investment of Proceeds. Maureen Leddy, Director of the Office of Climate Change, described the investments plan. In the first slide she explained that the proceeds from the NYCI auction are distributed to the Climate Action Fund. The Fiscal Year 2021 Budget established this Fund and how the proceeds would be invested and then allocated. There are three parts:

- Consumer Climate Action Account: At least 30% of future NYCI proceeds to New Yorkers every year to mitigate consumer costs.

- Industrial Small Business Climate Action Account: Directs 3% of future NYCI proceeds benefits to help mitigate cost.

- Climate Investment Account: Directs two-thirds of future NYCI proceeds to support the transition to a less carbon-intensive economy

Readers should keep in mind that the ostensible purpose of the Climate Act is to address the existential threat of climate change. To make the reductions necessary to mitigate this threat only two thirds of the proceeds are directed to the “less-carbon-intensive” economy. The other two carveouts appease consumers and small businesses that will be impacted by the increase in energy costs caused by NYCI.

The Consumer Climate Action Account is supposed to mitigate consumer costs. As has been the case throughout the Climate Act implementation, the Climate Affordability Study that recommends how the funds will be delivered is just a list of options with no discernible plan to implement them. The proceeds to small businesses are nothing other than a bribe to try to appease that constituency. The Climate Investment Account is supposed to support the necessary investments in zero-emissions resources necessary for compliance.

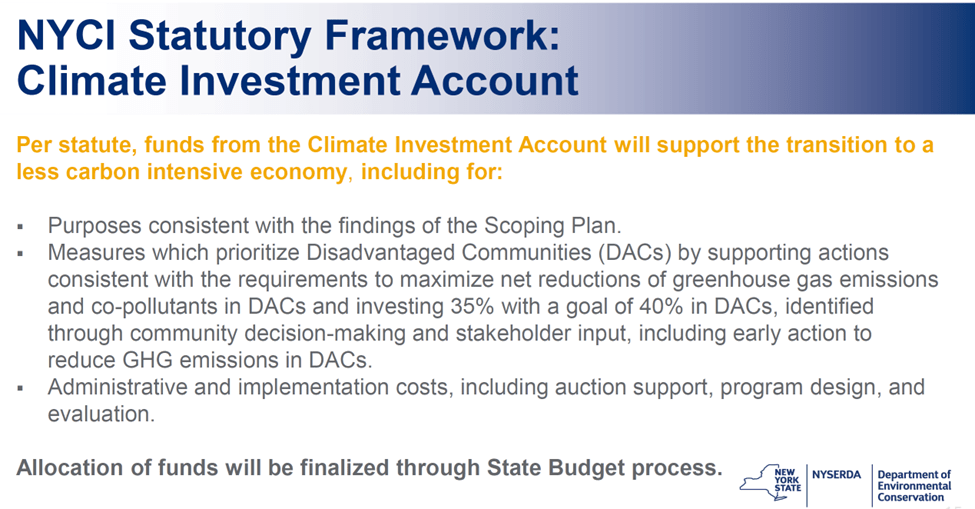

The focus of the webinar is the Climate Investment Account. Even though 67% is supposed to support the emission reductions for the transition, the New York legislators mandated how it will be allocated further diluting the amount targeted for transition investments:

- Purposes consistent with the findings of the Scoping Plan.

- Measures which prioritize Disadvantaged Communities (DACs) by supporting actions consistent with the requirements to maximize net reductions of greenhouse gas emissions and co-pollutants in DACs and investing 35% with a goal of 40% in DACs, identified through community decision-making and stakeholder input, including early action to reduce GHG emissions in DACs.

- Administrative and implementation costs, including auction support, program design, and evaluation.

These allocation requirements reduce the potential effectiveness of the investments to make emission reductions. I find it troubling that this legislative mandate and the webinar presentation made no mention of cost-effective investments to reduce emissions. In a recent post I evaluated the State’s investments from the Regional Greenhouse Gas Initiative. The good news is that investments in energy efficiency were relatively effective investments. As a result, I think the emphasis on DAC investments should be on energy efficiency improvements, but the legislative mandate states that community decision-making and stakeholder input will decide.

The final statement that the “Allocation of funds will be finalized through the State Budget process” is important. In my opinion, taxes must be levied by the legislature and not through a regulatory proceeding. It may be that the process outlined here is intended to fulfill that mandate. As we shall see, the questions posed in the webinar provide a basis for how the revenues (aka the tax) will be allocated.

The next slide outlined the timeline and is consistent with my impression that this is intended to fulfill the legislative mandate. The presentation noted that they “laid out our process for seeking public input on the use of NYCI proceeds under the climate account.” It went on to say that “today we’ll share a draft framework for the investment and start this comment intake to connect, collect initial public input on the use of proceeds.”

Leddy went on to describe the comments received earlier this year. They claimed that “As part of extensive stakeholder engagement since 2023, DEC and NYSERDA received thousands of comments about Cap and Invest implementation.” Previously the comments focused on regulatory program design but 128 organizations and institutions “submitted comments addressing the use of proceeds, equity, and/or affordability.” The presentation claimed that it is a good thing that 39 advocacy organizations,

37 trade associations & 3 labor unions, 35 businesses & 7 utilities, 11 governmental bodies/authorities,

3 think tanks responded with comments about the use of proceeds.

.

The first summary slide describing the comments received listed three main themes. The first is to “advance the deployment of decarbonization technologies in key sectors & enable emissions reductions”. Leddy just read the slide so there was no indication of the necessity to deploy technologies so that the emission reduction trajectories can be met. The second theme was “Support the clean energy workforce & prioritize labor protections”. There is no question that worker training is necessary, but I have two concerns. The first is that the necessary training does not lead to direct emission reductions, and I doubt very much that those costs were included in the Hochul Administration’s estimates of the costs and benefits, so I suspect that those projections underestimate costs. The second point is that emphasizing labor projections is an appeal to a specific constituency not necessarily incorporating the most cost-effective reductions. The final theme was “Prioritize affordability & lower the cost of the energy transition”. The examples are for low-income New Yorkers and business & industry. I worry the average ratepayer will be overlooked.

One of the primary topics emphasized is climate justice as it relates to equity and affordability. The next slide described two themes. The first theme was the specific challenges facing disadvantaged

communities (DACs): air quality impacts, vulnerability to energy price increases, and structural and financial barriers to implementing control strategies. I worry that addressing these concerns make take precedence over strategies that actually reduce emissions. The climate justice aspect of the Climate Act has focused on disadvantaged communities (DACs) and, in my opinion, could be overlooking rural concerns. For example, deployment of clean energy technologies in DACs included transportation concerns: “public transit; electric vehicles (including buses and heavy-duty vehicles); and public chargers/fast charging networks.” All those are primarily urban concerns.

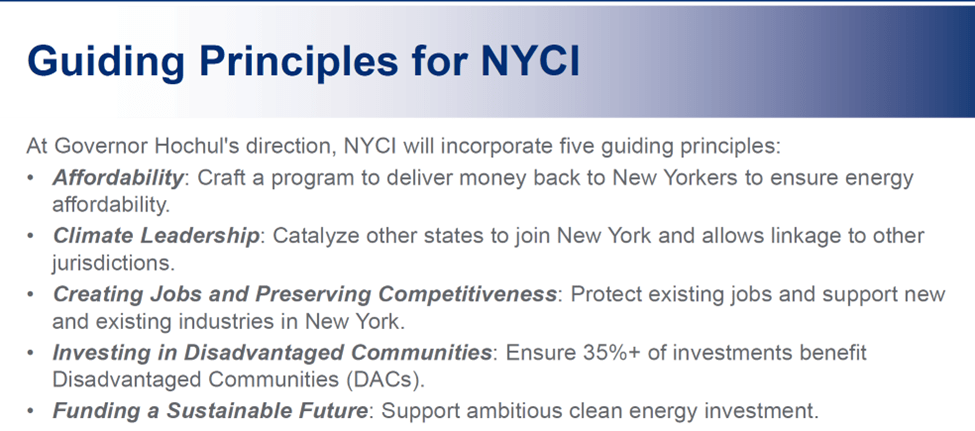

The next item on the agenda was the framework and areas for investment for the proposal. Vanessa Olmer (?) went through the draft proposal to guide the use of NYCI proceeds. Make no mistake that the Climate Act is all about politics and the NYCI proposed plan to use the proceeds is no exception. The draft proposal is “designed to be consistent with the five core principles that the Governor set forth for the cap and invest program”. My comments on the pre-proposal draft addressed these principles. My comments noted that The Hochul Administration has never clearly admitted the expected costs of the Climate Act net-zero transition because the costs are politically toxic. This principle is an attempt to suggest the costs are under control. The climate leadership slogan is inconsistent with the Climate Act unique emissions accounting approach that prevents other states from joining New York or linking programs with New York. Creating jobs is a much-repeated tenet of the Climate Act but I do not believe it is possible to create more jobs than lost due to the increased costs inherent in a net-zero transition. While there is no question that Climate Justice investments in DACs are appropriate it is not clear that those investments will make those least able to afford higher energy prices whole when the full costs of the transition hit the economy. The final principle is funding a sustainable future. My comments emphasized the need for investment in zero-emissions technologies that can displace greenhouse gas emitting technologies.

The presentation went on to describe a framework for the investment of NYCI proceeds. “This framework would inform the identification of draft investment areas that NYCI proceeds will be directed toward.” The agencies asked for public input to “refine the framework and to help identify and prioritize investment areas for the Climate Investment Account.”

As shown in the next slide the description of the proposed investment framework is linked to the guiding principles. It is encouraging that the framework places funding for the sustainable future at the top. Funding investments that reduce greenhouse gas emissions and sequester carbon are necessary to meet the Climate Act mandates. Sadly, the speaker again just read the slide and failed to emphasize the link between effective emission reductions and the NYCI limits to emit. The last framework item is to “Support policy-relevant research and program evaluation tied to emissions reducing projects”. In this instance the presentation noted the importance to use “some NYCI proceeds to conduct policy relevant research and program evaluation tied to emission reducing projects” While this is necessary, NYSERDA has not been a good steward of the proceeds from the similar Regional Greenhouse Gas Initiative. Considerable funding has been diverted away from the original intent of the program to fund peripherally related tasks more appropriately funded by other sources. I fear that this will be an issue with NYCI proceeds. Also note that buried in the administrative costs is the Cost Recovery Fee which is assessed on public authorities by New York State for an allocable share of state governmental costs attributable to the provision of services pursuant to Section 2975 of the Public Authorities Law. This takes a percentage of the funds off the top for bureaucratic administration.

The next four slides gave examples of proposed investment areas. Think of it as a menu for special interest lobbying to get a place at the trough.

The final section of the presentation presented specific requests for public input. The first request was related to the investment framework: in reference to the last slide shown in this summary “Do you have feedback on the proposed draft NYCI investment framework for guiding the use of NYCI proceeds from the Climate Investment Account?” NYSERDA asked specific questions about the proposed investment areas – priorities and other potential projects that could benefit from NYCI-funded investments.

The third question, feedback on appropriate interventions, piqued my interest. It asked, “what interventions do you see as critical to receive investment of NYCI proceeds through the Climate Investment Account?” It included these follow-on prompts:

- What funding needs do you see existing today that seem appropriate for NYCI?

- How should NYS consider costs relative to associated impacts and benefits? For example, should NYS orient investments towards lower-cost opportunities that produce faster emissions reductions or more difficult and/or expensive areas where emissions reductions might otherwise not be achieved or achieved more slowly?

- How should NYS balance funding for mass deployment of market-ready clean energy technologies vs. innovation to address the costs, feasibility, and access barriers for emerging solutions?

My response to the first question about funding needs is simple. The state investments must fund the deployment of emission reduction strategies that provide emission reductions consistent with the availability of NYCI permits to emit GHG emissions. If this is not done correctly, emitters will have no choice but to shut down or limit operations with bad consequences. It is impossible to answer the other two questions because the Scoping Plan documentation is inadequate. There is no indication that there is a plan for investments to achieve the necessary emission reductions that I maintain should have been included in the Scoping Plan. These are all valid questions but other than saying these tradeoffs must be considered I don’t see how anyone can respond meaningfully.

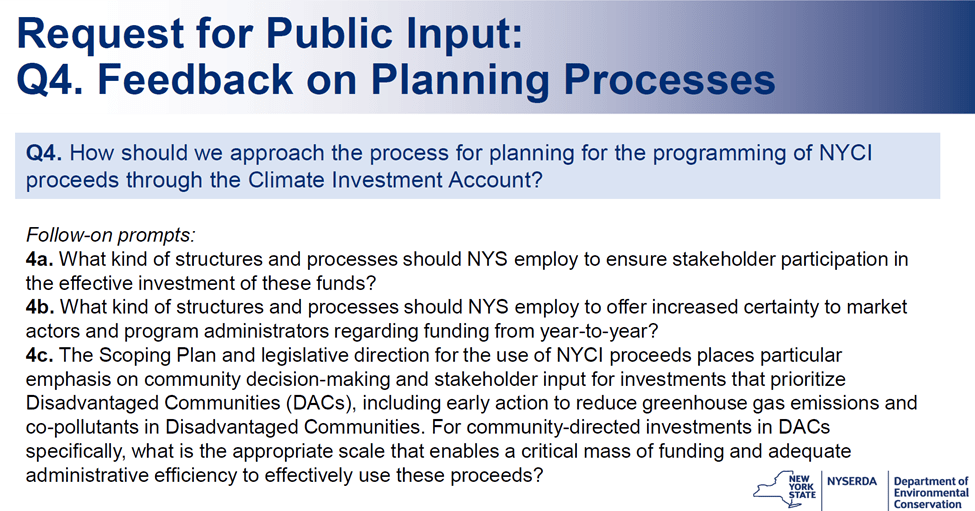

The final question is “How should we approach the process for planning for the programming of NYCI

proceeds through the Climate Investment Account?” The follow-on prompts shown in the following slide raise an important question in my mind. What is more important: emission reductions consistent with the Climate Act mandated schedule or appeasing the community-directed investment requests from the DACs. Will emission reduction effectiveness be considered?

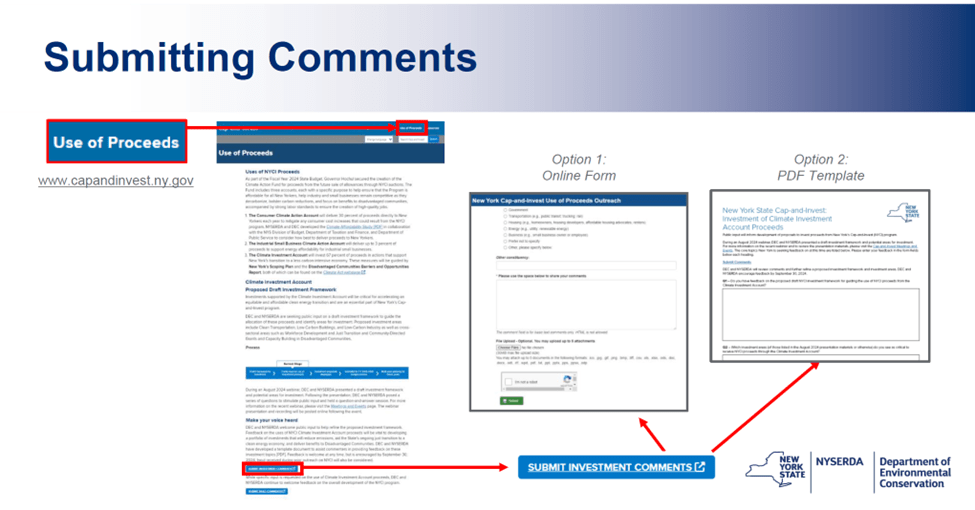

Submitting Comments

If you are interested in submitting comments, then you should check out these instructions and the following slide. They asked for feedback preferably by September 30, 2024:

online at:www.capandinvest.ny.gov

by mail to:New York State Energy Research and Development Authority

Attn: NYCI Investment Planning

17 Columbia Circle

Albany, NY 12203-6399

Discussion

Leddy described the Consumer Climate Action Account noting it states: “At least 30% of future NYCI proceeds to New Yorkers every year to mitigate potential consumer costs.” She says “potential” in relation to consumer costs either because the narrative is to downplay costs or because she thinks the costs are not concerning. Either way I think it reflects the mindset of agency staff that are totally invested in the Climate Act cause. Outside of that bubble costs are going to be an issue.

In response to questions the webinar claimed that draft rules would be out later this year and that appropriations and spending of NYCI proceeds would begin in the next fiscal year beginning April 2025. In the stakeholder engagement process earlier this year DEC and NYSERDA claimed they would propose regulations by summer and the final rules would be in place by the end of the year. This update suggests that the regulations will be pushed back. Although I believe that staffing issues are part of the reason for the delays, the political underpinning of the Climate Act should not be forgotten.

The Hochul Administration is certainly cognizant of costs for environmental initiatives. On June 7, Governor Hochul explained that she reversed the decision to proceed with the New York City congestion pricing plan because of costs. At the Energy Access and Equity Research webinar sponsored by the NYU Institute for Policy Integrity on May 13, 2024 Jonathan Binder stated that the New York Cap and Invest Program would generate proceeds of “between $6 and $12 billion per year” by 2030. Note that the current NYCI proposal outline analyzed allowance prices starting at $23 in 2025 with 5% escalation for 2026, and an increase to $54 in 2027, escalating by 6% annually thereafter. Note that the cost increase comes after the next gubernatorial election year. The New York State legislature elections are coming up in November. I am now convinced that a major reason for the NYCI regulation delays is related to those elections.

The stakeholder process for this framework for guiding the allocation of NYCI funds and identification of potential areas that could receive investments is entirely appropriate. It will guide the legislative process to allocate at least $6 billion per year. Leddy said that the intention of the engagement process is to provide the Governor and the legislature to have the benefit of public input as they develop next year’s budget.

Unfortunately, see no recognition of the challenges of funding the transition. There also is no indication that there is a plan to consider the funding requirements of the Scoping Plan strategies with the mandated emission reduction trajectories. Those two issues are concerning.

One of the characteristics of the proposed net-zero Climate Act transition is over-reliance on the presumption that control strategies that have worked elsewhere will work in this application. NYCI is a prime example. Past performance does not guarantee future success. Given the differences between past successful programs and the one proposed I am convinced that NYCI will fail to deliver as advertised.

My other concern is that I believe that funding ambitious clean energy investments is more difficult than acknowledged. My analysis of the Regional Greenhouse Gas Initiative proceeds shows that the investments were not cost efficient averaging $565 per ton reduced. As noted, the investments to reduce emissions are diluted by other mandates. There is no acknowledgment that NYCI funding priorities should consider observed cost effectiveness results and be consistent with the NYCI allowance allocation reduction trajectory.

Conclusion

The NYCI process is behind schedule, and I think that is primarily because the enormous costs of the transition cannot be hidden when the regulations are proposed. It is getting increasingly difficult to continue to hide the costs. The New York State Comptroller Office audit of the NYSERDA and PSC implementation efforts for the Climate Act found that: “The costs of transitioning to renewable energy are not known, nor have they been reasonably estimated”. The Regulatory Impact Statement for the NYCI regulations must provide costs. Delaying the release of the proposed regulations is very likely politically motivated to continue hiding the costs.

While I agree that a framework for investing the NYCI proceeds is necessary it does not appear that the proposed framework is going to prioritize funding emission reduction strategies consistent with the allowance reduction trajectories consistent with the Climate Act mandates. That could lead to bad outcomes, but the apparent emphasis is on providing funding for favored political constituencies. I believe that the political calculus driving NYCI implementation is perverting the effectiveness of this market-based program to the point that it will not work.