Energy Bad Boys Isaac Orr and Mitch Rolling describe nine takeaways in the JP Morgan Chase 15th Annual Energy Paper that provide more reasons why the New York net-zero transition should be paused.

I am convinced that implementation of the New York Climate Act net-zero mandates will do more harm than good if the future electric system relies only on wind, solar, and energy storage because of reliability and affordability risks. I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 500 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Background

The Climate Leadership & Community Protection Act (Climate Act) established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. The Climate Action Council (CAC) was responsible for preparing the Scoping Plan that outlined how to “achieve the State’s bold clean energy and climate agenda.” The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantified the impact of the electrification strategies. After a year-long review, the Scoping Plan was finalized at the end of 2022.

Orr and Rolling introduce their post:

On March 4th, JP Morgan Chase released its 15th Annual Energy Paper (hereinafter “JPMC”). The report, written by Michael Cembalest, is a 55-page analysis with hundreds of graphs and charts on the state of the energy industry. It spans most aspects of the energy industry, discussing costs for wind and solar, conventional fuels, electrification and heat pump adoption, a status update on the deindustrialization of Europe, and the use of green hydrogen.

I am documenting reasons to pause the Climate Act and this article explains how the takeaways are relevant to the Climate Act implementation and why the findings are more reasons to pause the Climate Act implementation until the issues raised are resolved.

Takeaways

Wind and solar prices continue to rise.

According to the JP Morgan Chase Report, power purchase agreement (PPAs) prices for wind have more than doubled since 2019, and solar PPAs are near $60 per megawatt hour. Prices are rising due to US tariffs on Chinese solar panels, a tripling of insurance premiums in MISO, ERCOT, and SPP due to weather events, supply/demand gaps due to permitting delays, higher interest rates, and increased corporate demand for green power. Keep in mind that PPAs almost always show the subsidized cost of an energy source, so in reality, the cost of these resources is even higher.

The Scoping Plan was based on the Integration Analysis quantitative assessment of emission reduction strategies and cost estimates. The Integration Analysis included projections starting in 2020. I believe that the cost projections for wind and solar were projected to decrease and here is evidence that is not happening. It is time to verify that the projections in the Scoping Plan are tracking with reality.

Battery costs are coming down

Battery storage prices are falling again after a price spike in 2022. According to Energy Storage News, the main drivers of the fall are cell manufacturing overcapacity, economies of scale, low metal and component prices, a slowdown in the EV market, and increased adoption of lithium iron phosphate (LFP) batteries, which are cheaper than nickel manganese cobalt (NMC) batteries.

On the face of it this is good news. However, the costs are still extraordinarily high. The Scoping Plan needs to be re-assessed to determine consistency with the cost observations and whether the main drivers in the cost decreases will continue to lower prices. Most importantly, there must be an honest assessment of the battery price point that makes battery energy storage “affordable”.

US Transmission Line Growth is far below DOE Targets

The JPMC report notes that annual additions of transmission lines are far, far below the levels envisioned by the Biden Administration’s Department of Energy, as you can see in the graph below.

I do not know where New York transmission line growth stands relative to the needs of the Climate Act. The status of the buildout relative to the Scoping Plan needs to be assessed to determine if the Climate Act schedule is achievable.

Wind and solar do not replace reliable capacity

The JPMC report acknowledge just how ineffective wind and solar are at reducing our dependency on dispatchable generators. The graph below from the report shows that for every megawatt of wind or solar installed in various regions, it only offsets 10 to 20 percent of gas capacity.

Making the numbers easier to understand, installing 10 MW of wind or solar in MISO would only offset the need for natural gas capacity by 2 MW. In the Southeast, adding 10 MW of wind or solar would only offset the need for 1 MW.

Adding 10 MW wind or solar in New York would only offset the need for natural gas capacity by a little over 1 MW. I do not believe that the Integration Analysis modeling incorporates this observed effect. There are clear implications for the Climate Act transition of this observed effect.

MISO and PJM Are Concerned About Reliability

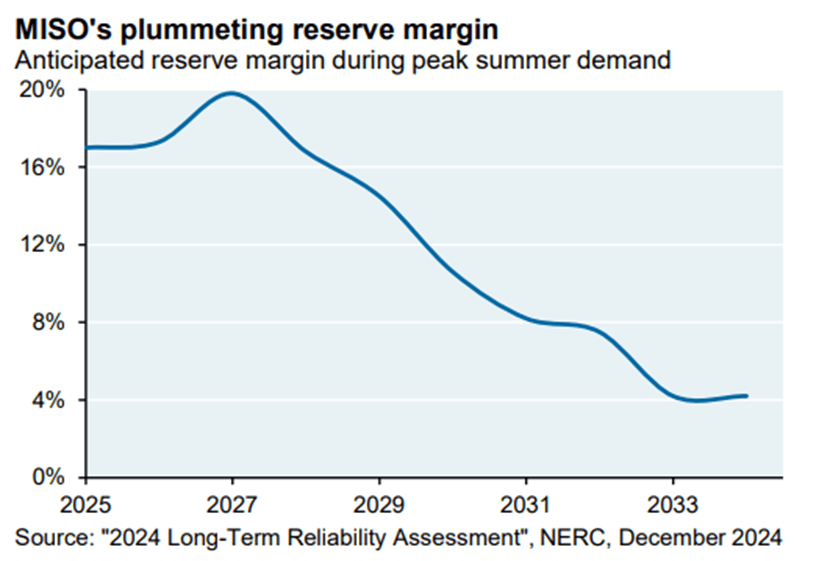

MISO continues to see its reserve margin dwindle as its margin for error sits at just four percent. The JPMC report notes MISO’s warnings of “serious challenges to grid reliability due to increased exposure to wind/solar intermittency, having averted a capacity shortfall in 2023 only due to postponement of planned thermal capacity retirements.”

The post also includes a figure showing the risks for different regional transmission operators.

Fortunately, New York’s strong commitment to reliability means that there is a low likelihood of electricity supply shortfall assuming that the Progressive politicians keep their paws off the electric sector. Nonetheless, the Scoping Plan presumes significant imports from outside new York and this result indicates that those imports may not be available. This risk should be evaluated.

Fossil Fuels, Nuclear, and Hydro Power U.S. Data Centers

The JPMC report notes, “Hyperscalers will probably have to walk back green power commitments and run data centers primarily on natural gas, as they have been. The pie chart shows power consumption of US data centers based on their respective locations, their MW of maximum power consumption and the grid mix in that state.”

Projections for New York load also show increases. The plans for the proposed Micron chip fab plant that will add load equivalent to the load of New Hampshire and Vermont call for the use of renewables. This major source of load was not included in the Scoping Plan and needs to be considered in a reassessment.

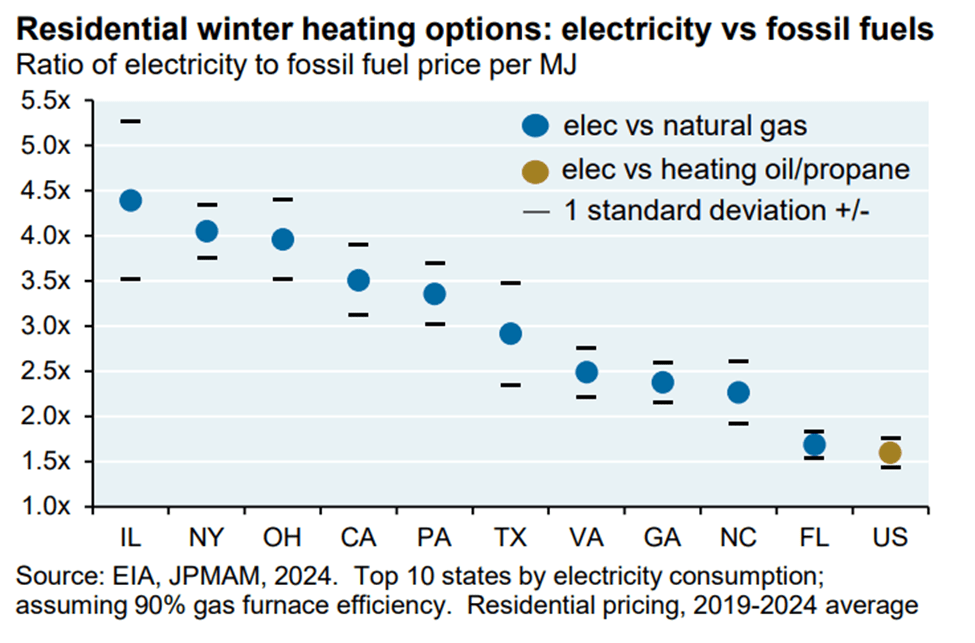

High Electricity Prices Impede Electrification

Wind and solar advocates argue we must rapidly “electrify everything” by using electric vehicles and converting our home heating systems from natural gas, propane, or fuel oil to electric heat pumps. The problem? Doing so costs much more than using natural gas to keep warm in winter.

The JPMC report states:

“The high cost of electricity compared to natural gas (particularly in places without a carbon tax) is another impediment to electrification that is not easy to solve since this ratio reflects relative total costs of production and distribution.”

Natural gas remains much more affordable than using electricity for home heating in states throughout the country, and even heating oil and propane are more affordable than electricity on a nationwide basis.

The high cost of electricity versus natural gas is a major hinderance to converting to heat pumps. The Scoping Plan presumption that New Yorkers would willing convert to a more expensive, less resilient, and likely less comfortable source of heating is not likely to occur. How will this affect implementation?

Green Deindustrialization Continues Apace in Europe

The JPMC report notes: “Europe is the world leader with respect to the pace of decarbonization. However, Europe is paying a steep price for this transition. Its energy prices have risen from 2x to 4x US levels, and its residential electricity prices are now 5x-7x higher than in China and India.

The report also touched on Germany’s coming Energieweimar. Despite Deutschland’s heavy investments in wind and solar, the country has become a net importer of electricity. Long story short, installed power capacity continues to rise but actual generation is falling. The same story is unfolding in the United Kingdom.

The Scoping Plan claims that special carve outs and concessions to energy intensive and trade exposed industries will keep them viable in New York. The results in the UK and Germany indicate otherwise. The State needs to reassess these impacts.

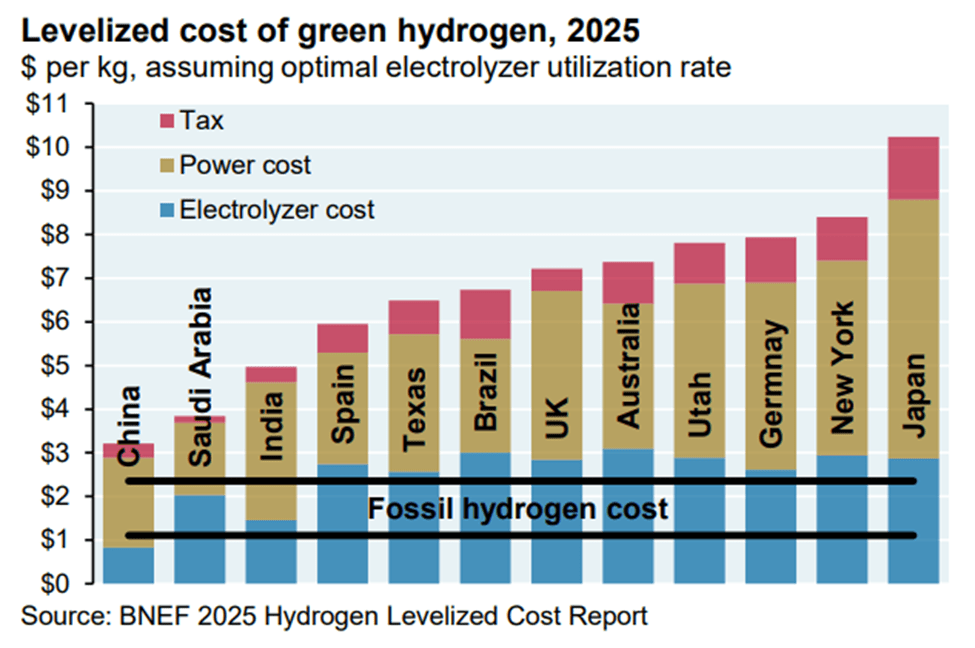

Grim Realities for the Green Hydrogen Hype Train

Despite heavy subsidies and much hype, the so-called green hydrogen industry is floundering. Quarterly mentions of hydrogen project delays and cancelations are skyrocketing in the news and in company disclosures.

The report included this quote, with the caveat that it somewhat exaggerates the plight of green hydrogen:

“Electrolyzers, which do not exist, are supposed to use surplus electricity, which does not exist, to feed hydrogen into a network that does not exist in order to operate power plants that do not exist. Alternatively, the hydrogen is to be transported via ships and harbors, which do not exist, from supplier countries, which – you guessed it – also do not exist.”

According to the report:

“Hydrogen has an “original sin” problem: early estimates of lectrolier costs were too low. It started with an influential IRENA paper in 2020 estimating electrolyzer costs at $750 per kW. The European Energy Transitions Commission now concedes that costs are far higher, at least when sourced from Western manufacturers; the latest estimates for 2024 range from $2,100 to $3,200 per kW. This revised assessment had led to a 5x increase in Western 2030 electrolyzer cost projections from BNEF and the Hydrogen Council relative to initial projections.”

This quote pretty much sums up the “energy transition.” Boosters of unproven and expensive technologies assure us that their preferred energy sources are already cheaper, or will soon be much cheaper, than the reliable, affordable technologies we already use. Within a few years, the promises fail to materialize, and they move on to some other unicorn technology, and the hype cycle repeats itself.

A key reason for the problems plaguing green hydrogen is the cost. Even after assuming optimal electrolyzer utilization rates (which won’t materialize in the real world if they are, in fact, powered by wind and solar), the cost is still massive. In Texas, green hydrogen production is around $6.50 per kilogram (kg). In New York, the cost is around $7.50 per kg.

It takes approximately 7.4 kg of hydrogen to produce 1 million British thermal units (MMBtu) of energy, and it takes 10 MMBtus to produce one megawatt hour (MWh) of electricity in a combustion turbine power plant. This means the fuel cost of green hydrogen is approximately $481/MWh in Texas and $555/MWh in New York. At that price, it’s no wonder the industry is hitting hard times.

The Scoping Plan placeholder technology for the dispatchable emissions-free resource (DEFR) acknowledged as necessary is green hydrogen. These results show that the “solution” is unlikely to be viable. The fundamental problem is that the wind, solar, and energy storage approach envisioned in the Scoping Plan will only work if DEFR is developed and deployed. In my opinion, the most promising DEFR backup technology is nuclear generation because it is the only candidate resource that is technologically ready, can be expanded as needed, and does not suffer from limitations of the Second Law of Thermodynamics. If the only viable DEFR solution is nuclear, then renewables cannot be implemented without it. But nuclear can replace renewables, eliminating the need for a massive DEFR backup resource. It is obviously prudent to pause renewable development until DEFR feasibility is proven because nuclear generation may be the only viable path to zero emissions

Conclusion

Orr and Rolling conclude:

There is a lot to digest in the report, but the long and short of it is that the so-called energy transition is hitting the brick wall of reality. Let’s hope policymakers come to their senses and end the subsidies for wind and solar so we can get back to rational energy policies.

I hope that the brick wall of reality reaches New York. I believe the best way to ensure that policymakers come to their senses is to pause the program and reevaluate the presumptions and projections.