One of the reasons that I decided to submit a statement in opposition to the Niagara Mohawk Power Corporation dba National Grid (NMPC) rate case proceeding was the lack of transparency on costs of the Climate Leadership & Community Protection Act (Climate Act) net zero transition. This article describes a Climate Act cost to New Yorkers that uncaring Albany policy makers pass down to localities.

I am convinced that implementation of the Climate Act net-zero mandates will do more harm than good because of reliability and affordability risks. I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 500 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim target of a 100% zero emission grid by 2040. The Climate Action Council (CAC) was responsible for preparing the Scoping Plan that outlined how to “achieve the State’s bold clean energy and climate agenda.” After a year-long review, the Scoping Plan was finalized at the end of 2022. Since then, the State has been trying to implement the Scoping Plan recommendations through regulations, proceedings, and legislation.

Another Renewables Subsidy

One missing piece in the implementation of the Climate Act is an honest admission of costs. Not only has the State failed to provide required cost information, but there is no accounting of all the costs like the property tax exemption for renewable projects. Peter Carney explains the basis of the property tax subsidy:

New York State laws encourage projects that are aligned with specific public policies such as the development of renewable energy or infrastructure that supports the economy, in a variety of ways including Real Property Tax exemptions.

The laws provide the local county, town, and schools with the option of negotiating Payment In Lieu of Tax (PILOT) agreements to compensate the local jurisdictions for some of the lost tax revenue.

There are three outcomes for these potentially tax-exempt projects:

- The projects can be accepted as fully exempt (no tax revenues are collected) (TCSD has not done this).

- The local entities can negotiate Payment In Lieu of Taxes (PILOT) agreements that compensate the local jurisdictions for some of the lost tax revenue. (TCSD has done this with the recent energy projects.)

- The law also provides the affected governments with the several or joint ability to opt out of the tax exemptions provided by the state law, in which case the energy projects would be fully taxable. (The TCSD has not enacted such an opt-out provision and thus none of the energy projects will be taxed at their full value.)

New York State’s Real Property Tax Law (RPTL) Section 487 provides a 15-year tax exemption for properties with renewable energy systems, including solar, wind, and other clean energy technologies. The costs of this tax forgiveness from PILOTs are not “hidden” rather the policy makers in Albany just don’t care about the costs imposed on local taxpayers. It is setup as an “opt-out” rule that requires local jurisdictions to jump through hoops if they decide not to participate. It automatically applies otherwise.

PILOT agreements provide a structured payment system to developers that reduce their initial property tax burden to help support the new projects. Their benefits include “multifaceted effects on local economies, ranging from stimulating redevelopment to reshaping municipal revenue streams”. PILOT agreements in New York cover the following types of projects:

- Manufacturing and industrial developments

- Not-for-profit organizations

- Renewable energy installations, particularly solar projects

- Commercial and residential real estate developments

- Economic revitalization initiatives

In my opinion, four of these five types of projects will provide value to the jurisdictions once the development is complete. On the other hand, renewable energy installations do not. New York GHG emissions are less than one half of one percent of global emissions and global emissions have been increasing on average by more than one half of one percent per year since 1990 so emission reduction projects in New York will be supplanted by increases elsewhere in a year.. Furthermore, New York’s statewide impact on global temperature is unmeasurable so no new project is going to impact global warming.

The response to my Perplexity AI query “How do New York Payment in lieu of tax agreements benefit jurisdictions for transmission or renewable energy projects?” claimed other benefits PILOT proponents thought these agreements would provide. The query claimed seven benefits to the jurisdictions granting the PILOT:

- Predictable revenue streams – The basis of this is that traditional property tax arrangements can fluctuate with changes in assessment values, so the PILOT payments provide predictability. I think that one thing that is predictable is that the tax revenues will be less than the traditional property tax proceeds.

- Growth-oriented payment structures – If the jurisdiction negotiates an escalation clause, then payments can increase.

- Revenue preservation mechanisms – “While PILOT agreements offer tax exemptions, they are designed to preserve a significant portion of the potential tax revenue that would have been generated without compromising project viability. Under New York law, PILOT amounts cannot exceed what the tax amount would have been without the exemption, creating a natural ceiling that balances developer needs with jurisdictional interests.”

- Economic development benefits – Proponents of PILOTs argue that the agreements support broad economic development but that only benefits New York if the installed infrastructure is manufactured in New York.

- Job creation and industry growth – The AI response claimed that there was remarkable growth in the renewable energy sector, but this is a weak argument in my opinion. For an individual jurisdiction PILOT agreements for manufacturing or industrial projects will provide local jobs but the construction of a transmission line will only impact a local jurisdiction during construction and those jobs will not be local. I do not think this is a benefit for a renewable project.

- Supporting the transition to clean energy – As noted previously, the Climate Act transition will have no tangible effect on global emissions or temperature, so it is only a virtue-signaling exercise.

- Jurisdictional control and flexibility – The Perplexity AI explanation states: “PILOT agreements provide local governments with significant control over how renewable energy projects are incentivized and taxed.” It is not clear to me why local jurisdictions would care about incentives and taxation for renewable energy.

The Perplexity AI response claiming benefits for renewable energy projects from PILOT agreements gave an example of a successful agreement. Note that the only reference cited for the following quotation was a Bethlehem Central School description of the PILOT:

The Champlain Hudson Power Express Project (CHPE) demonstrates how PILOT agreements work for large-scale transmission projects. This underground transmission line, delivering renewable energy from Canada to New York City, spans multiple jurisdictions including four towns, two villages, and four school districts

.

The Albany County Industrial Development Agency (IDA) structured a 30-year PILOT agreement for this project, significantly longer than typical 10-11 year terms. Payments are apportioned based on geographical coverage, with the Bethlehem Central School District receiving benefits proportional to the 2.14 miles of pipeline within its boundaries.

After reviewing the proposed PILOT terms, the school district found them reasonable, highlighting how these agreements can satisfy the needs of both developers and local jurisdictions.

After the acceptance of a PILOT agreement there is no way a school district is going to acknowledge any issues. Before describing an example, here are more details on CHPE.

Champlain Hudson Power Express (CHPE)

This transmission project is intended to bring zero-carbon electricity from Quebec to New York City: “Two five-inch-diameter cables will be placed underwater or underground and run 339 miles from the U.S.-Canadian border, south through Lake Champlain, along and under the Hudson River, and eventually ending at a converter station that will be built in Astoria, Queens.” This project has been underway for a long time. The first regulatory filing was posted on March 30, 2010. Construction finally started in September 2023 and the developers claim that as of April 2025 it is on schedule for an in-service date of May 2026. The New York Independent System Operator (NYISO) 2023-2032 Comprehensive Reliability Plan notes that the reliability of the grid is “heavily reliant on the timely completion of planned transmission projects, chiefly the Champlain Hudson Power Express (CHPE) project.”

Note that it was designed with no substations or interconnections to the local or regional transmission system between Quebec and New York City along the CHPE route. The transmission line was designed as a point-to-point HVDC link, running continuously from the Hydro-Québec system at Hertel to the Astoria converter station. This is not to say that an interconnection could be added later but for now it means that there are no local benefits once the line is in place.

CHPE Ticonderoga Central School PILOT

Peter Carney authored “A review of the Ticonderoga Central School District’s energy project PILOT agreements and impacts on taxpayers” (White Paper) that breaks down the effect of the PILOT agreements on local taxpayers that the Bethlehem Central School district description did not. Carney prepared the white paper to “document missed opportunities for the TCSD Board of Education (BoE) to increase non-tax school revenues, estimated at more than $1 million annually, from seven new energy projects. Consequently, rather than the energy projects paying their fair share of taxes, the taxpayers of Hague and Ticonderoga will need to make up the difference.”

The White Paper analyzed six solar projects and CHPE. It explains the impacts related to CHPE as follows:

This project is for the installation of a 1,250 MW DC transmission system from Hydro Quebec to New York City. Without the successful completion of this project, load shedding and blackouts are projected for NYC as soon as 2026vii. Clearly, this project will go forward to completion with or without a PILOT tax exemption.

Despite this, TCSD agreed to several disadvantageous terms:

- The PILOT is a small fraction of the full tax: The PILOT Agreement forecasts that in the first year, TCSD will receive $122,770 or approximately one quarter of the fair share of taxes due from CHPE if taxed at full value.

- The PILOT is calculated based on estimated construction costs, almost certain to be lower than the actual costs incurred several years later. Any costs above the preconstruction estimate will be fully tax exempt.

- There are no PILOT payments until CHPE decides that the PILOT agreement should begin.

- The payment schedule is back-end loaded with most of the payments due to be delivered in the last several years of the 30-year PILOT agreement.

The route for this system passes through TCSD jurisdiction for 9.26 miles. The first year PILOT payment for Essex County is fixed at $1,532,592 which will be divided among Essex County, seven host towns and six school districts based on a formulation that considers route distance, and full value tax rates for each jurisdiction for the first year the PILOT is effective.

TCSD copied the Town of Ticonderoga’s agreement, which copied the Essex County agreement, without considering that TCSD includes Hague and what impact that would have.

To the extent that Hague’s total Full Market Value assessment (FMV) increases compared to Ticonderoga’s, the Ticonderoga school tax rate decreases and therefore the TCSD will receive a reduced portion of the Essex County PILOT payments.

Discussion

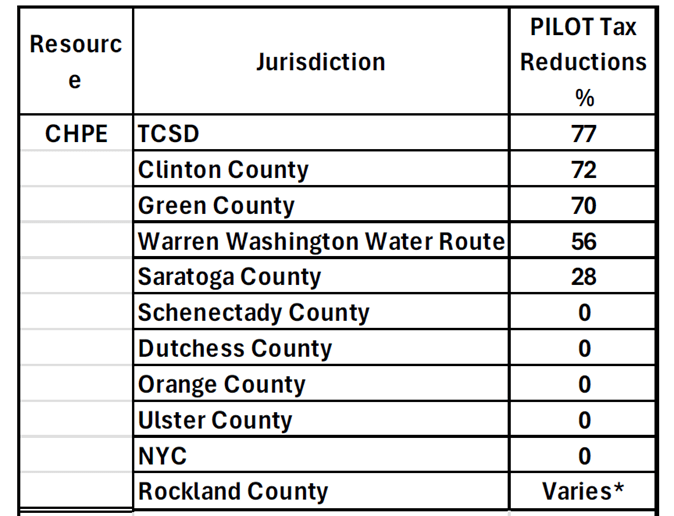

The White Paper included the following table that reports the level of PILOT tax exemptions reported in NY. Unfortunately, TCSD clearly passed up opportunities to be more protective of its taxpayers in its negotiations with CHPE. The only jurisdiction that gets value for providing tax breaks is New York City and they are taxing CHPE at the full value. The opt-out provisions of New York’s Real Property Tax Law contributed to the sad state of affairs where a rural upstate school district unwittingly subsidizes a renewable energy project that provides no direct benefits to its taxpayers while the only entity that benefits charges the project as much as it can.

There are other costs associated with CHPE that are not obvious. Carney wrote me that “Not only will CHPE receive New York State Energy Research & Development Authority subsidies that are many multiples of the New York City Locational Based Marginal Pricing (LBMP) they are also going to significantly increase the Locational Capacity Requirements for New York State thus increasing the capacity cost to New York City. Through the magic of Perplexity AI, I have an explanation of his comment if you are interested. Finally, if Niagara Mohawk/National Grid, Transco, and Con Ed built the CHPE it would be fully taxable, so the developers are unquestionably getting millions of dollars of tax breaks each year for 30 yrs on top of being paid many multiples of the LBMP in New York City.

Conclusion

CHPE offers a perfect example of the many subsidies and programs set up to facilitate renewable energy development. The Department of Public Service is required to report annually on the status of the implementation of the Climate Act and include cost impacts. Not only is the 2024 report overdue, but it will not account for hidden costs like those described here. Anyone who thinks that special interests are not taking advantage of these complexities at the expense of New Yorkers is naïve.