In my opinion the biggest problem with the Climate Leadership & Community Protection Act (Climate Act) is that it will inevitably lead to extraordinary cost increases. This post summarizes recent residential electric utility customers rate case decisions approved between March 2025 and January 2026. I do not discuss gas rate cases. The New York Public Service Commission (PSC) “approved new multi-year rate plans for five major utilities—Con Edison, National Grid, Central Hudson, and Orange & Rockland—while two additional utilities (New York State Electric & Gas (NYSEG) and Rochester Gas & Electric (RG&E) have pending rate cases seeking significantly larger increases”. These rate increases arrive amid an escalating affordability crisis, as of December 2024, over 1.3 million households are behind on their energy bills by sixty-days-or-more, collectively owing more than $1.8 billion.

I am convinced that implementation of the New York Climate Leadership & Community Protection Act (Climate Act or CLCPA) net-zero mandates will do more harm than good if the future electric system relies only on wind, solar, and energy storage because of reliability and affordability risks. I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 600 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Background

There is a fundamental Climate Act implementation issue. Clearly there are bounds on what New York State ratepayers can afford and there are limits related to reliability risks for a system reliant on weather-dependent resources. The problem is that there are no criteria for acceptable affordability bounds.

Trying to decipher rate case decisions is a difficult task because of the volume of materials associated with each rate case. The PSC maintains a database that compiles all the filed documents and public comments for each rate case. The Matter Master file for the current NYSEG rate case lists 913 filed documents and 1967 public comments. To compile this summary, I acknowledge the use of Perplexity AI to generate summaries and references included in this document. Assume all the results shown are referenced to the original Perplexity response.

Rate Case Results

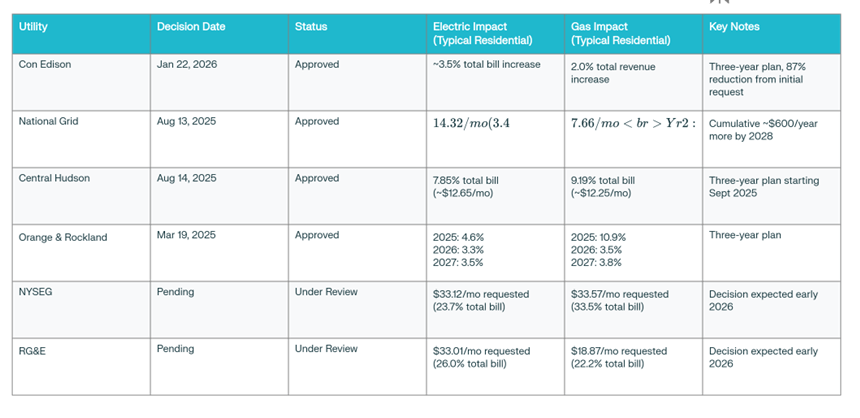

Figure 1 summarizes the recent rates cases for Con Edison, National Grid, Central Hudson, and Orange & Rockland that have been completed since 2025. NYSEG and RG&E have pending rate cases, so their results shown are not directly comparable.

Figure 1: New York Utility Rate Cases Impact on Residential Customer (2025-2026) – Perplexity

The NYSEG and RG&E cases are pending and the results shown represent their initial offer. All the results shown for the other utilities had much higher initial rates. For example, Con Edison initially requested annual revenue increases of $1.612 billion for electric service (18.0 percent increase in base delivery revenues) and $440 million for gas service (18.8 percent increase in base delivery revenues). Following intense public opposition, intervention by Governor Kathy Hochul, and even comments by President Trump, and extensive settlement negotiations, the PSC approved a dramatically reduced three-year rate plan on January 22, 2026. The approved joint proposal represents an 87 percent reduction from Con Edison’s initial request.

Utility Summaries

Con Edison’s service territory covers New York City and Westchester County with 3.6 million residential customers. For typical NYC residential customers using 280 kilowatt-hours monthly, electric bills will increase by approximately $4 per month (3.9 percent) in 2026, $3.55 per month in 2027, and $4.22 per month in 2028, resulting in a cumulative 10.4 percent increase over three years. Westchester County residential customers using 425 kWh monthly face increases of $5.25 (2.6 percent) in year one, $4.84 (2.3 percent) in year two, and $4.95 (2.2 percent) in year three, totaling 10.1 percent over the period

National Grid’s rate case was approved on August 13, 2025. The service territory covers 1.7 million electric customers across 25,000 square miles in Upstate New York. For residential electric customers using an average of 625 kilowatt-hours per month National Grid’s three-year upstate rate plan includes a $14.32 per month increase in year 1, a $6.44 per month increase in year 2, and a $4.34 per month increase in year 3 with an expected total increase over three years of 31%.

Central Hudson 315,000 residential customers in its Hudson Valley and Mid-Hudson region service territory. Central Hudson’s rate case followed a unique trajectory, proceeding through litigation rather than settlement, ultimately resulting in a one-year rate plan approved on July 18, 2024, followed by a subsequent multi-year joint proposal filed on May 13, 2025, and approved on August 14, 2025. Typical residential electric customers will experience total bill increases of approximately 7.85 percent, equating to approximately $12.65 per month.

Orange & Rockland serves 233,000 residential electric customers in Rockland, Orange, and Sullivan counties. On March 19, 2025, the PSC adopted a three-year rate plan for Orange & Rockland that substantially reduced the utility’s initial request, keeping electric revenue flat for the first year while authorizing incremental increases in subsequent years. For residential electric customers using 600 kilowatt-hours per month the 2025 total bill increase will be 4.6 percent, in 2026 the total bill increase will be 3.3 percent and in 2027 the total bill increase will be 3.5 percent total bill increase.

New York State Electric & Gas (NYSEG) and Rochester Gas & Electric (RG&E) filed rate case proposals on

June 30, 2025. The case is currently under review. I am an active party in the rate cases and am unsure what I can say about the status. I don’t think it is inappropriate to note that an evidential hearing is scheduled for early February. The service territories of the two utilities are all over the state but is primarily located in Central and Western New York. NYSEG serves 921,000 customers and RG&E serves 392,00 customers. The initial NYSEG electric request asked for an amount that works out for a typical residential customers (600 kWh electric usage) to a $33.12 per month increase (23.7 percent increase to total bill). The initial RG&E electric request asked for an amount that works to a $33.01 per month increase (26.0 percent increase to total bill).

Climate Act Impacts

It is unfortunate that the utilities fail to provide a breakdown of how much implementation of the Climate Act adds to these rate case costs. I used a Perplexity AI search of the National Grid rate case to provide Climate Act cost estimates. It found that the approved rate plans do not contain explicit breakdowns of specific dollar amounts or percentages of the rate increases allocated specifically to the Climate Act projectsand state mandated programs. The query response included the following:

CLCPA-Related Investments Identified

While specific cost breakdowns are not provided, the orders identify several CLCPA-related investment categories within the approved rate plans:

Electric System CLCPA Investments

Transmission Infrastructure:

- CLCPA Phase 2 Transmission Projects

- Smart Path Connect

- Grid Modernization

Distribution System Enhancements:

- Enhanced grid capabilities for solar, wind, and energy storage interconnection

- Smart grid technologies to manage intermittent renewable resources

- Electric vehicle infrastructure support programs

Historical CLCPA Investment Context

Previous utility filings and planning documents provide context for CLCPA-related costs across New York utilities:

Statewide CLCPA Transmission Investments:

- Phase 1 Projects: Approximately $4.16 billion in transmission investments and $2.64 billion in distribution investments across all New York utilities

- Phase 2 Conceptual Estimates: $7.62 billion in transmission and $2.16-$2.85 billion in distribution investments (conceptual estimates)

National Grid’s Historical CLCPA Share:

- Phase 2 Transmission: $1.37 billion estimated for National Grid transmission projects

- Phase 2 Distribution: $510 million to $1.2 billion estimated for National Grid distribution projects

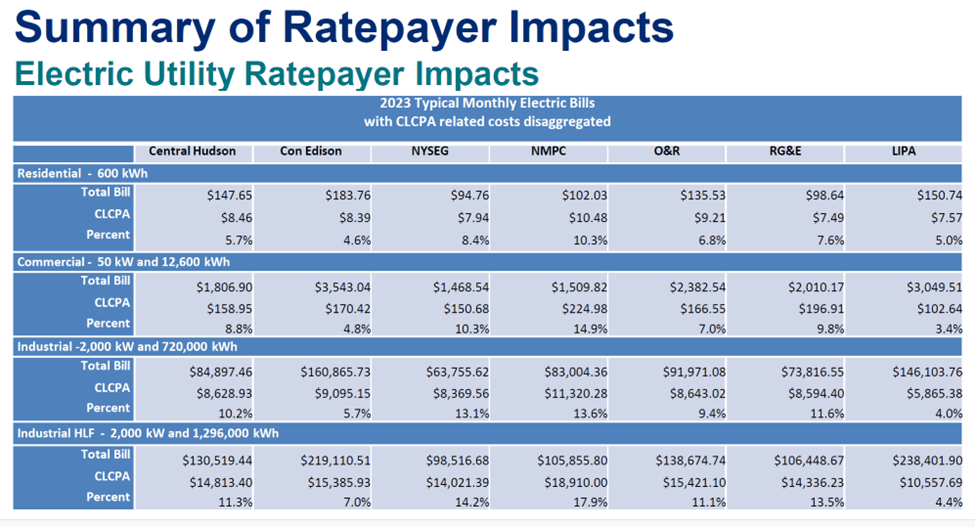

Department of Public Service (DPS) staff is supposed to provide Climate Act information. On September 18, 2025 the PSC announced that they “received an update from DPS staff regarding progress toward the clean energy goals of the Climate Act”. The Second Informational Report prepared by Department of Public Service (DPS) staff “focuses on Commission actions from January 2023 through August 2025, and includes the estimated costs and outcomes from 2023 through 2029 to provide the most up to date information.” According to the Summary of Ratepayer Impact for Electric Utilities table, residential impacts of the Climate Act range from 4.6% to 10.3% of 2023 total monthly electric bills. In my opinion, those estimates are conservative because there is immense pressure on agency staff to minimize the costs of the Climate Act. In addition, the costs necessary to implement the Climate Act were ramping up in 2023. I expect that these costs will continue to climb.

Discussion

The Perplexity summary of the rate cases raised some overarching issues. New York residential utility bills consist of two primary components, each subject to different pricing mechanisms and contributing to overall cost increases through distinct channels.

Delivery Charges account for approximately two-thirds of bills. These charges represent what customers pay utilities to build, maintain, and operate the physical infrastructure that transmits electricity and natural gas to homes and businesses. Delivery charges remained relatively stable historically but have increased substantially in recent years to fund:

- Infrastructure Modernization and Replacement: Utilities must replace aging equipment that has reached the end of its useful life, including transformers, substations, transmission lines, and distribution networks.

- Grid Hardening and Storm Resiliency: Utilities must enhance system resiliency to manage severe weather events. This includes vegetation management, reinforced poles and wires, and backup systems.

- Clean Energy Integration Infrastructure: The Climate Act mandates necessitate substantial transmission and distribution system upgrades to connect renewable energy resources, accommodate distributed generation, manage bi-directional power flows, and handle increased electrification of transportation and heating.

- Property Taxes: Utility companies pay significant property taxes on their infrastructure, which are passed through to customers. Note that the clean energy infrastructure increases the property tax burden.

- Return on Equity (Profit Margin): Regulated utilities earn a PSC-approved rate of return on their capital investments. Approved returns on equity in recent cases range from 9.4 percent (Con Edison) to 9.5 percent (National Grid).

Supply Charges account for approximately one-third of bills. They represent the actual cost of purchasing electricity or natural gas in wholesale markets. These charges fluctuate based on market conditions and are typically adjusted monthly. These have increased for the following reasons:

- Explosive Demand Growth: New York and the broader Northeast region are experiencing unprecedented electricity demand growth driven by several factors that are fundamentally reshaping the supply-demand balance. The New York Independent System Operator (NYISO) reports that the pace of new energy sources coming online is insufficient to keep pace with demand growth.

- Wholesale electricity prices have responded predictably to this supply-demand imbalance. The average monthly wholesale electricity price in New York soared by 67 percent over the past year according to NYISO data.

- Thermal Generation Fuel Costs: Natural gas remains the marginal fuel setting electricity prices in New York’s wholesale markets during most hours. Natural gas commodity prices have increased due to growing domestic demand (particularly for heating during cold winters), export demand for liquefied natural gas, and supply constraints.

- Weather-Driven Consumption: The 2025-26 winter has proven particularly severe, with temperatures 15-20 percent colder than the prior year. Colder weather increases heating demand, driving up both consumption (measured usage) and market prices due to heightened competition for available supply.

Conclusion

These rate case results are unsustainable. For all the noise made by politicians about affordability, the fact remains that the New York State Legislature or Administration has not defined affordable energy. The Public Service Commission has an existing target energy burden set at or below 6 percent of household income for all low-income households in New York State. I have been unable to find any documentation describing how many customers meet the 6% energy burden criteria, much less any information on how those numbers are changing. The biggest problem with this energy burden program is that it only applies to electric and gas utility customers. Citizens who heat with fuel oil, propane, or wood are not covered. There is a clear need for an affordability metric that can be tracked.