The New York State Comptroller Office released an audit of the NYSERDA and PSC implementation efforts for the Climate Leadership & Community Protection Act (Climate Act) titled Climate Act Goals – Planning, Procurements, and Progress Tracking. The audit found that: “The costs of transitioning to renewable energy are not known, nor have they been reasonably estimated”. This post describes a couple of articles that suggest that when the costs of the Climate Act transition are finally revealed they will be extraordinarily high.

I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 450 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview and Background

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% reduction by 2030. Two targets address the electric sector: 70% of the electricity must come from renewable energy by 2030 and all electricity must be generated by “zero-emissions” resources by 2040. The Climate Action Council (CAC) was responsible for preparing the Scoping Plan that outlined how to “achieve the State’s bold clean energy and climate agenda.” The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan outline of strategies. After a year-long review, the Scoping Plan was finalized at the end of 2022. Since then, the State has been trying to implement the Scoping Plan recommendations through regulations, proceedings, and legislation.

To date, however, the costs of the transition have not been revealed. The Comptroller Report audit found that: “While PSC and NYSERDA have taken considerable steps to plan for the transition to renewable energy in accordance with the Climate Act and CES, their plans did not comprise all essential components, including assessing risks to meeting goals and projecting costs.” It noted that the “PSC is using outdated data, and, at times, incorrect calculations, for planning purposes and has not started to address all current and emerging issues that could significantly increase electricity demand and lower projected generation”. Regarding costs the audit notes that “The costs of transitioning to renewable energy are not known, nor have they been reasonably estimated” and goes on to point out that the sources of funding have not been identified.

Crippling Costs of Electrification and Net-Zero Energy Policies in the Pacific Northwest

Jonathan Lesser and Mitchell Rolling have released a new research report from Discovery Institute’s Reasonable Energy program that will “produce staggering costs to individuals and businesses without providing any meaningful environmental benefits”. The Discovery Institute announcement of the report summarizes the report as follows.

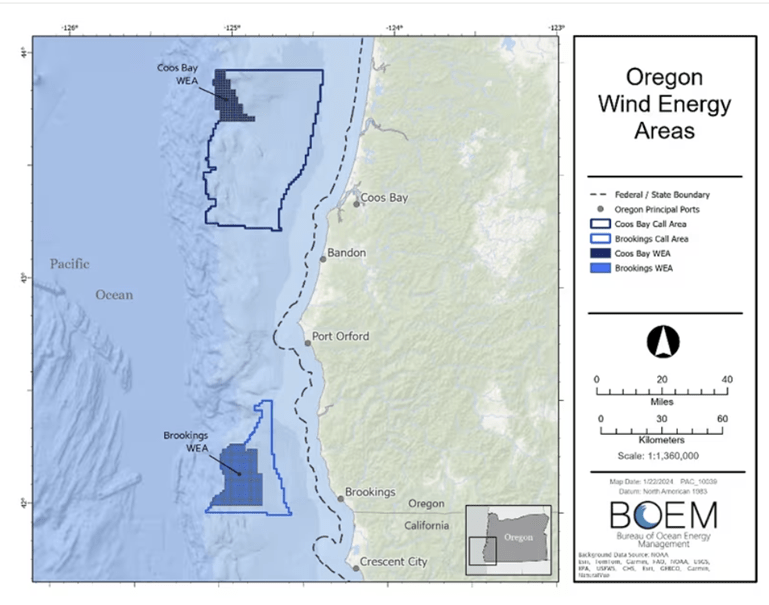

- Authors Jonathan Lesser and Mitchell Rolling conclude that policies in Oregon and Washington State that require their state electrical utilities to eliminate fossil-fuel energy sources to produce 100% of electricity from zero-emissions sources by 2040 (Oregon) and 2045 (Washington) will double existing electricity demand.

- Both states have adopted California’s Advanced Clean Car rules, which require 100% of all new cars and light trucks sold to be electric by 2035.

- Both states intend to reach zero energy-related greenhouse gas emissions by 2050, including replacing all fossil-fuel space- and water-heating systems with electric heat pumps.

- Both states envision replacing existing fossil fuel generation and meeting the projected increase in electricity demand with thousands of megawatts (MW) of wind turbines and solar photovoltaics.

The Climate Act mandates are similar to those in Oregon and Washington.

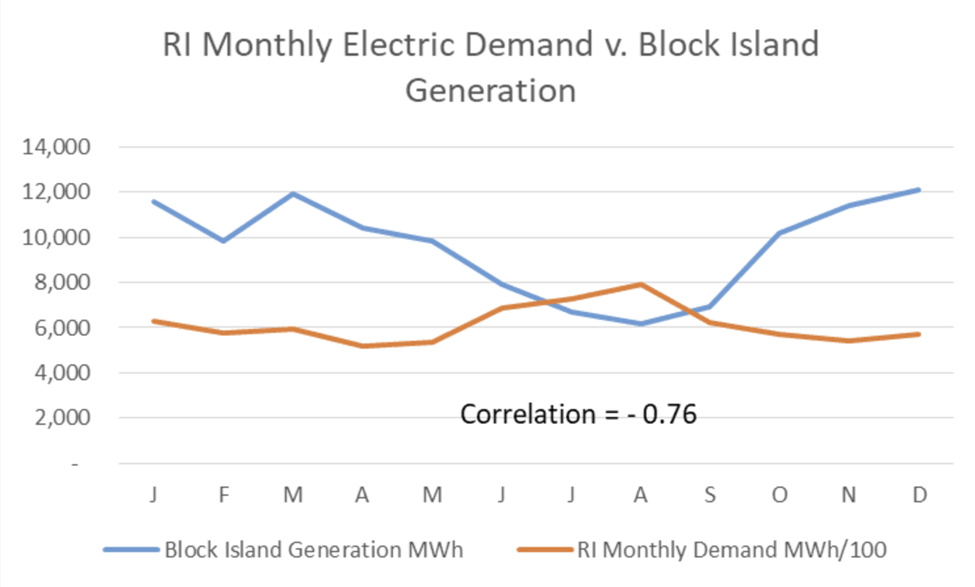

The inherent intermittency of wind and solar power, together with peak electric demands taking place in the early evening hours when there is no solar generation available (and often no wind), means the two states will require large amounts of storage capacity, in addition to the existing hydroelectric storage dams that have been built on the Columbia River and its tributaries.

New York electric system projections highlight the same problem with intermittency as described here.

Because no new hydroelectric dams will be built, the additional storage capacity required will need to come from large-scale battery storage facilities and perhaps a few new pumped hydroelectric storage facilities, whose siting remains controversial.

New York also has no ability to build more hydro so will have to rely on battery energy storage.

- Their research considered the costs by 2050 associated with three scenarios: 1) the renewables-only strategy; 2) a lower-cost renewable strategy (a more optimistic low-cost renewables scenario in which wind, solar, and storage capital costs decrease by 50% in real (inflation-adjusted) terms by 2050); and 3) an alternative scenario in which the electricity goal is achieved with new nuclear plants and additional natural gas generators. The assessed total costs (in inflation-adjusted dollars) are as follows:

- Renewables Only: $549.9 Billion

- Lower-cost Renewables: $418.5 Billion

- Natural Gas and Nuclear: $85.9 Billion

The Climate Act precludes the pragmatic option to consider natural gas and nuclear so our costs will be closer to the high end.

- Their research indicates that the effects on electricity bills will be devastating.

- A typical residential customer’s bill will increase by 450%, from about $110 per month today to over $700 per month in 2050 (assuming a modest inflation rate of just 2.0% annually).

- Commercial customers will see their monthly bills increase from an average of about $600 per month today to approximately $3,800 per month in 2050.

The Hochul Administration has not provided any ratepayer impacts, but I expect the costs will be similar in New York.

- The negative economic impacts will not be limited to soaring electricity bills.

- Prices for virtually all goods and services will dramatically increase.

- Jobs will be lost as businesses relocate to other states with lower-cost energy.

- Energy poverty rates will soar.

Negative economic impacts are a feature not a bug of net-zero transition efforts.

- The enormous costs to consumers and businesses will be accompanied by negligible environmental benefits.

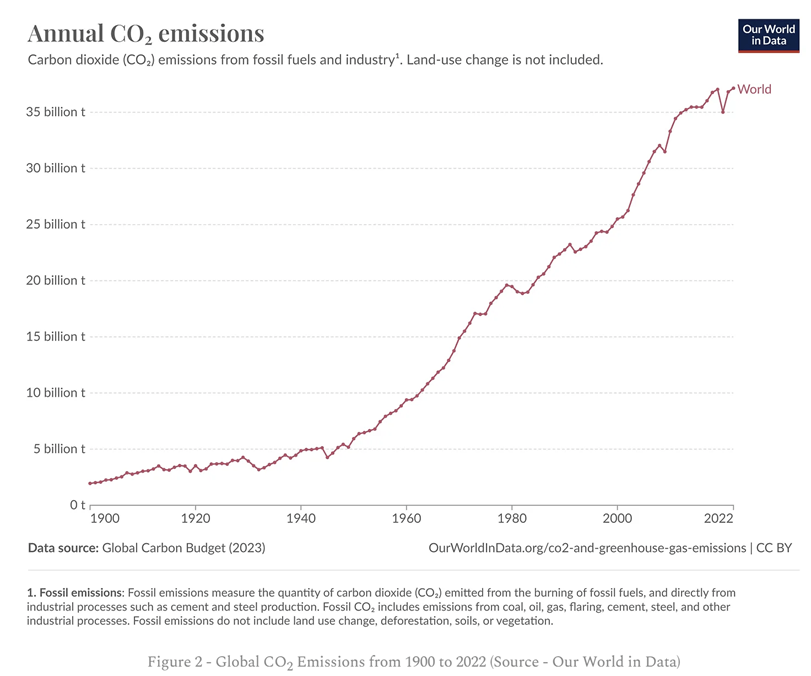

- The reduction in greenhouse gases (GHGs) from the policies would total about 1.8 billion metric tons between 2024 and 2050, which is a small fraction of estimated 35 billion metric tons world carbon emissions in just one year.

- If both states eliminated all energy-related GHG emissions by 2040, the resulting decrease in world temperatures would be only 0.003 ⁰C. By comparison, the best outside thermometers have an accuracy of about +/- 0.5 ⁰C, about 170 times larger.

I estimate that New York reduction in GHG emissions is about the same (1.5 billion metric ton reduction) as the reduction projected from Oregon and Washington so the estimates of environmental benefits are similar.

The report concludes that the two states would be best served by abandoning these goals, focusing instead on providing reliable and far less costly electricity from new natural gas and nuclear plants.

I believe this conclusion would be appropriate for New York.

Catastrophic Costs of Green Energy

Alex Epstein described his testimony in front of the House Budget Committee on the topic “The Cost of the Biden-Harris Energy Crisis.” You can watch his testimony and the Q&A at the link.

The transcript of his testimony states:

The basic idea of government-dictated green energy is that the government should force us to rapidly reduce our use of fossil fuel energy and replace it with so-called “green energy,” mostly solar and wind, such that we reach net zero greenhouse gas emissions by 2050 at the latest.

There are three basic truths you need to know about the costs of government-dictated green energy. And I think these are really under-appreciated even by critics.

One is they have been enormous so far.

Two is they would have been catastrophic had it not been for the resistance of their opponents. This is very important when you hear the Biden administration has record production. That’s in spite of them, not because of them.

And three, they will be apocalyptic if not stopped in the future.

He goes on to summarize the reason for the cost increases:

So let’s talk about the cost so far of government-dictated green energy. All the energy related problems we have experienced in recent years, which have been a lot: high gasoline prices, higher heating bills, higher electricity bills, and unreliable electricity, which is a huge problem we need to talk much more about, are the result of government-dictated green energy.

And its very simple. When you shackle the most cost effective and scalable source of energy, fossil fuels, and you subsidize unreliable solar and wind, that wouldn’t otherwise be competitive, energy necessarily becomes more expensive, less reliable and less secure. So again, it’s very simple.

This is exactly what will happen in New York because of the Climate Act net-zero transition. He goes on to explain why inflation and increased energy costs are inextricably linked:

Prices are determined by supply and demand. If oil and gas companies could control energy prices in their favor, why didn’t they do this from 2015 to 2020 when they were losing money? The truth is that government-dictated green energy policies are fundamentally responsible for all the energy related costs we experience today compared to a decade ago.

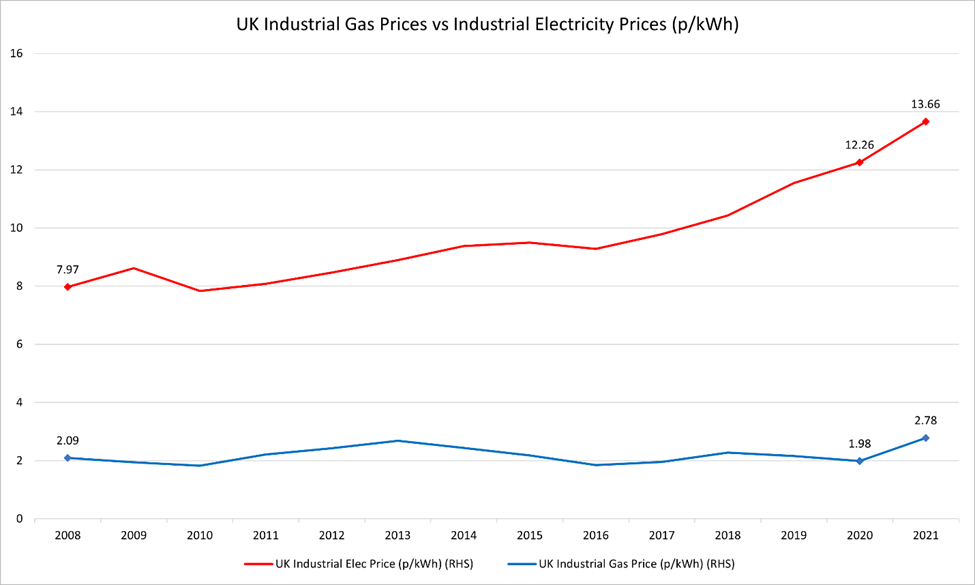

And in fact, it’s worse than that. There’s an opportunity cost. Because were it not for these policies, energy would have gotten considerably cheaper and more reliable, especially with lower natural gas prices, which should have lowered electricity prices. Instead, they’ve gone up because we’ve added a bunch of wasteful energy and unreliable stuff. And it gets worse, since energy is the industry that powers every other industry. By making energy more expensive and less reliable, we make everything more expensive and less reliable, which means government-dictated green energy drives price inflation. Very important point.

His testimony notes that at least on the Federal level that the attempts to rapidly eliminate fossil fuel use have failed. Consequently, the nation has been spared energy ruin and a third-world grid. Of course, reality has not stopped the Climate Act. His testimony is a grim warning of our future if this madness continues.

Conclusion

In the absence of a clear accounting of costs for the Climate Act we can only guess what will happen here. I believe that the crippling and catastrophic adjectives used by these authors will surely describe our energy costs.