Late last year there was a story going around that New York State was planning to ban firewood in 2022. This post describes the reporting of that rumor and my interpretation of the effect of the Climate Leadership and Community Protection Act (Climate Act) on wood burning.

I have written extensively on implementation of the Climate Act because I believe the ambitions for a zero-emissions economy outstrip available technology such that it will adversely affect reliability and affordability, risk safety, affect lifestyles, will have worse impacts on the environment than the purported effects of climate change in New York, and cannot measurably affect global warming when implemented. The opinions expressed in this post do not reflect the position of any of my previous employers or any other company I have been associated with, these comments are mine alone.

Climate Act Background

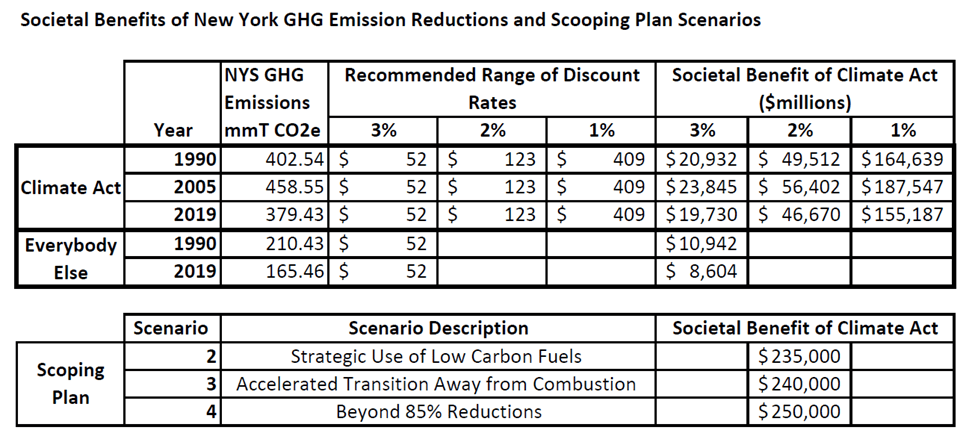

The Climate Act establishes a “Net Zero” target by 2050. The Climate Action Council is responsible for preparing the Scoping Plan that will “achieve the State’s bold clean energy and climate agenda”. The Climate Act requires the Climate Action Council to “[e]valuate, using the best available economic models, emission estimation techniques and other scientific methods, the total potential costs and potential economic and non-economic benefits of the plan for reducing greenhouse gases, and make such evaluation publicly available” in the Scoping Plan. Starting in the fall of 2020 seven advisory panels developed recommended strategies to meet the targets that were presented to the Climate Action Council in the spring of 2021. Those recommendations were translated into specific policy options in an integration analysis by the New York State Energy Research and Development Authority (NYSERDA) and its consultants. The integration analysis was used to develop the Draft Scoping Plan that was released for public comment on December 30, 2021. The public comment period extends through at least the end of April 2022, and will also include a minimum of six public hearings. The Council will consider the feedback received as it continues to discuss and deliberate on the topics in the Draft as it works towards a final Scoping Plan for release by January 1, 2023.

The Climate Action Council claims that the integration analysis was developed to estimate the economy-wide benefits, costs, and GHG emissions reductions associated with pathways that achieve the Climate Act greenhouse gas emission limits and carbon neutrality goal. This integration analysis incorporates and builds from Advisory Panel and Working Group recommendations, as well as inputs and insights from complementary analyses, to model and assess multiple mitigation scenarios that could be used to implement programs to achieve the emission reduction targets of the Climate Act.

Wood Burning Ban News Reports

A quick internet search for New York wood burning ban found four television station reports in response to viewer questions about a possible ban on wood burning in 2022. Syracuse WSYR, Utica WKTV and Watertown WWNY all ran segments that talked to DEC or other state officials and concluded that nothing was imminent. In this post I will use the Rochester News10 article as the illustrative example of the other news reports.

In the article: “Does the new law called the Climate Leadership and Community Protection Act (or “Climate Act“), outlaw woodstoves and fireplaces or just outdoor furnaces?” on 1/5/22, News10NBC’s Nikki Rudd looked into the question:

New York’s Climate Action Council has what’s called a Draft Scoping Plan. Click here to read it.

In scenarios analyzed wood consumption decreases by about 40%. That has led to headlines like this making the rounds online: “No More Heating with Firewood in New York?”

However, Haley Viccaro, a DEC spokesperson, says that 40% decrease in wood consumption is driven by building and device efficiency and increases in electrification of primary heating across all fuel types over time.

“Additionally, the analysis remains consistent across scenarios as to the contribution of remaining high-efficiency, low-emissions wood burning (for example, wood use for primary and secondary heating or industrial use) as well as some recreational wood combustion,” Viccaro said.

In layman’s terms, the plan right now does not include any recommendations specifically about wood burning. Viccaro wants to make it clear, the state is not considering legislation that would ban heating your home with firewood.

So if you read or heard that claim, it’s false.

Frankly, the response from DEC to this and the other reports might be true as presented but in the bigger picture they lack context. In the remainder of this post, I will provide background information for context so readers can judge for themselves whether or not a wood burning ban is inevitable.

Climate Act and Wood Burning

The Draft Scoping Plan document is huge. The document is 861 pages long and the body of the Scoping Plan report itself is 330 pages. There are eight appendices:

- Appendix A: Advisory Panel Recommendations

- Appendix B: CJWG Feedback on Advisory Panel Recommendations

- Appendix C: JTWG Recommendations to the Council on Measures to Minimize the Carbon Leakage Risk and Minimize Anti-Competitiveness Impacts of Potential Carbon Policies and Energy Sector Mandates

- Appendix D: Power Generation Sites Identified by the JTWG

- Appendix E: JTWG Recommendations to the Council on Issues and Opportunities Related to the EITE Entities

- Appendix F: Environmental and Health Data for Quantifying Health Benefits of Climate Policy

- Appendix G: Integration Analysis Technical Supplement

- Appendix H: Adaptation & Resilience Recommendation Components

In order to determine how the Scoping Plan treats the future it is necessary to delve into Appendix G that contains two sections with extensive documentation. Section I Techno-Economic Analysis has five chapters, 76 figures, and 22 tables in its 122 pages. Appendix G Section II Health Co-Benefits Analysis two chapters, 3 tables and 14 figures in its 39 pages. The Inputs Workbook spreadsheet has 49 tabs with data and the Key Drivers spreadsheet has 68 tabs with data. I am 100% sure that DEC spokesperson Haley Viccaro does not know exactly what the Scoping Plan has to say about wood burning. Instead, she is just responding from the public narrative script. I am also sure that most readers have no desire to sift through the document to figure out what the document says about wood burning. In this section I will provide that information.

I believe the primary consideration for those people who asked the question whether the Climate Act would ban wood burning as an energy source were worried about home heating. Home heating is addressed in Chapter 12, Buildings. It (page 129 of 861 in the document) states that:

Decarbonizing building operations describes the elimination of GHG emissions from building end uses through improving the building envelope and switching from equipment and systems powered by burning gas, oil, or other fossil fuels to highly efficient equipment and systems powered by emissions-free energy sources. In addition, embodied carbon associated with building construction can be reduced through building reuse and through using lower carbon materials or carbon-sequestering products.

In this context the question of the wood heating ban comes down to interpretation of the phrase “elimination of GHG emissions from building end uses”. If wood burning emissions are considered GHG emissions then they will be banned someday, somehow.

The Buildings Chapter in the Scoping Plan goes on to describe the vision for 2050, the target date for the net-zero target. The Scoping Plan is all in for heat pump technology:

The Integration Analysis indicates that by 2050, the large majority of buildings statewide will need to use electric heat pumps for heating and cooling to meet the Climate Act requirements. This approach depends upon 100% zero-emissions electricity by 2040 and making energy efficiency improvements in all buildings, with the emphasis on improvements to building envelopes (air sealing, insulation, and replacing poorly performing windows) to reduce energy demand by 30% to 50%. The Integration Analysis finds that widespread building electrification is needed even with the strategic utilization of low carbon fuels that are projected to be available, notably the use of renewable natural gas to meet back-up heating demands in a small proportion (less than 10%) of electrified buildings and the utilization of green hydrogen to power a smaller Con Ed district system by 2050. To manage the impacts of widespread electrification on the State’s electric grid, it will be important for buildings to adopt smart controls, energy storage, and other load flexibility measures. Policymakers also should assess the differential grid impact, costs, and benefits of cold climate air source, ground source, and community thermal heat pump systems; at this writing, related analysis in underway.

In this context the reference to “large majority of buildings” leaves the possibility that a minority of buildings could use wood burning for space heating but the strategic utilization clause does not mention wood burning as an option.

Because it provides context to the emission reduction strategies, let me unpack what they are saying in the rest of this section in layman’s terms. The Scoping Plan presumes that converting the majority of homes to electric heat pumps and upgrading building envelopes will be affordable and safe. Note, however, that the Scoping Plan does not include any cost estimates for consumers which I believe is major criterion for affordability. The safety question boils down to one over-riding concern. What are we supposed to do when there is an extended electricity outage if, for example, there is an ice storm or their plans for 100% zero-emissions that rely on intermittent wind and solar don’t work? When they say “To manage the impacts of widespread electrification on the State’s electric grid, it will be important for buildings to adopt smart controls, energy storage, and other load flexibility measures” what they mean is they want to be able to control your electric appliances to the point that when there are electric system issues, they will decide how much energy you get. When they mention “Policymakers also should assess the differential grid impact, costs, and benefits” of the electric heating options, what they mean is we are not sure this will work but we are crossing our fingers and hoping that it will. In February 2021, there were extended, widespread, expensive, and deadly electric outages in Texas because energy planners there did not develop a resilient energy system. If New York’s plan gets any one of many novel aspects of the Scoping Plan wrong the same thing will happen here.

In Section 12.2 of the Buildings Chapter, strategies are listed for the relevant theme for wood burning in Table 9. The theme is titled “adopt zero emission codes and standards”. The first strategy is to adopt new building codes for new construction that are “all-electric”. The second strategy specifies

“zero emissions equipment” for existing buildings. In my opinion this strategy explicitly prohibits wood burning because it is neither “all-electric” or “zero emissions”.

One final point with respect to the buildings sector strategies is relevant. In Governor Hochul’s 2022 State of the State book, Part VI-B: Decarbonize New York’s Buildings, explains that the strategy to cut emissions from buildings will be “anchored by a robust legislative and policy agenda”. This includes changes to building codes to “commit to zero on-site greenhouse gas emissions for new construction no later than 2027 and enact nation-leading building codes legislation”. I interpret this to mean that in the 2022 legislative session we will see laws proposed to enact whatever they mean by this language. Also note that the interpretation of wood burning as a greenhouse gas affects a possible ban.

Health Benefits

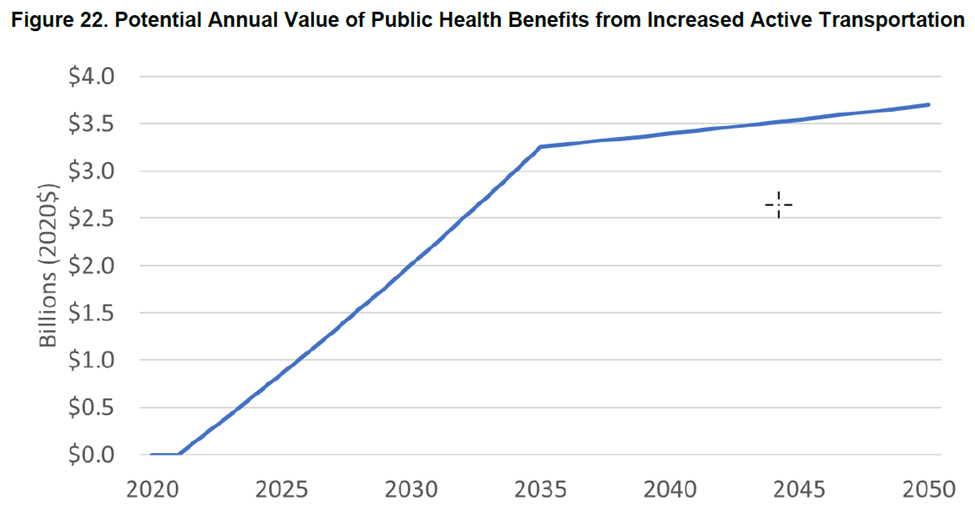

There is another aspect that indirectly bears on the possibility of a potential ban on wood burning. The Scoping Plan claims health benefits totaling $165 to $170 billion across the three mitigation scenarios due to improvements in air quality. According to Appendix G Integration Analysis Technical Supplement Section II page 30: “The health benefits are driven by reductions in all air pollutant emissions, but reductions of primary PM2.5 are the strongest driver of the benefits.” It goes on to say that “Of the one quarter of the PM2.5 emissions that is from combustion sources, nearly all of it is due to residential or industrial wood combustion.” Importantly: “When all fuels are considered, the residential and commercial sector accounts for the majority of the PM2.5 emission reductions, due mostly to reductions in residential wood combustion.” These impacts are illustrated in Figure 11 from the supplement document.

On page 29 in Section II of Appendix G the Scoping Plan states: “approximately 40% of the projected benefits are associated with reduced wood combustion in industrial, commercial, and residential uses.”. It is not clear to me and I have been unable to find an explicit statement describing how the Plan intends to get that 40% reduction. On one hand the authors could be so enamored with the purported benefits of electric heat pumps for heating that they think everyone will willingly convert. I think that it is naïve to believe that many people using firewood for heating will voluntarily convert because heating reliability and affordability is valued so highly by them that they won’t be convinced to switch.

With respect to the wood burning ban, the health results could be used to justify it. There also has been a push to develop “benefits” from the Climate Act so that could also mean they will decide that a ban is appropriate. This is certainly an unresolved issue.

Council and Advisory Panel Membership

The final driver for a wood burning ban comes from some of the more vocal members of the Climate Action Council. The Council has 22 voting members: 12 political appointees who head various state agencies and the rest non-agency experts: two appointed by the governor, three each appointed by majority leaders of the Assembly and Senate and one each appointed by the minority leaders of the Assembly and Senate. All the governor appointments were made by former governor Andrew Cuomo. The ten at large members shall “include at all times individuals with expertise in issues relating to climate change mitigation and/or adaptation, such as environmental justice, labor, public health and regulated industries”. The two minority appointments are from regulated industries. All the other appointees allegedly have expertise in issues related environmental justice, labor, public health or renewable energy. The bottom line is that the recommendations and comments from these people were clearly biased against combustion energy sources.

There is another aspect of the membership of the Council and the Advisory Panels that is relevant for a potential wood burning ban. I have previously described how the precautionary principle is driving the CLCPA based on the work of David Zaruk, an EU risk and science communications specialist, and author of the Risk Monger blog. In a recent post, part of a series on the Western leadership’s response to the COVID-19 crisis, he described the current state of policy leadership that is apropos to this discussion:

“The world of governance has evolved in the last two decades, redefining its tools and responsibilities to focus more on administration and being functionary (and less on leadership and being visionary). I have written on how this evolution towards policy-making based on more public engagement, participation and consultation has actually led to a decline in dialogue and empowerment. What is even more disturbing is how this nanny state approach, where our authorities promise a population they will be kept 100% safe in a zero-risk biosphere, has created a docilian population completely unable and unprepared to protect themselves.”

His explanation that managing policy has become more about managing public expectations with consultations and citizen panels driving decisions describes the membership of the Advisory Panels and Climate Action Council. He says now we have “millennial militants preaching purpose from the policy pulpit, listening to a closed group of activists and virtue signaling sustainability ideologues in narrowly restricted consultation channels”. That is exactly what has happened during the development of the Scoping Plan. Facts, strategic vision, and risk trade-offs were not core competences for the panel members. The elimination of combustion emissions and social justice concerns of many, including the most vocal, were more important than affordable and reliable energy. For example, some of these people argue that the Climate Act bans combustion and when reliability issues are raised, the response is basically tough – it’s the law. At its core people who rely on wood burning for home heating are doing so because they want reliable energy that they can afford. In my opinion, many of the council and advisory panel members just do not relate to the reasons why people rely on wood burning for heat.

Conclusion

Based on my research and review of the Climate Act and the Scoping Plan I agree with the strict interpretation that there will not be a ban on wood burning in 2022. However, the real question is whether a wood burning ban is inevitable someday as part of the Climate Act implementation process. This post lists enough conflicting information to make the point that the answer is not clearly obvious.

There are multiple reasons to believe a wood burning ban is inevitable. If wood burning emissions are considered GHG emissions, then interpretation of the phrase “elimination of GHG emissions from building end uses” means a ban is likely. I believe this is more likely than not. In the Scoping Plan Buildings Chapter, strategies to adopt new building codes for new construction explicitly say “all-electric” and the second strategy specifies “zero emissions equipment” for existing buildings. In my opinion this strategy explicitly prohibits wood burning because it is neither “all-electric” or “zero emissions”. I suspect that the health benefit claims with respect to eliminating wood burning ban will be used to justify it, but this is certainly an unresolved issue. Motivated members of the Climate Action Council clearly advocate for banning all combustion and that includes wood burning.

On the other hand, there is nothing specific that clearly indicates that wood burning bans are necessary. There is clear language noting that wood consumption decreases by about 40% for all the scenarios but I could not figure out how that is supposed to occur. In the description of building description there is a reference suggesting that decarbonization applies to a “large majority of buildings” and that leaves the possibility that a minority of buildings could use wood burning for space heating.

In conclusion, I admit that this is an unresolved issue but I believe the preponderance of information suggests that a wood firing ban is inevitable at some point. The uproar at the end of last year indicates that this is a hot button issue with many people. The official story for the Scoping Plan that there will be no immediate ban on wood burning is consistent with the Scoping Plan. However, if the implementation plan eventually bans the sale of wood stoves wood boilers, or fireplace inserts that is consistent with the Scoping Plan and not a direct ban on wood burning either. Of course it also means that someday you will no longer be able to burn wood because your wood burning appliance is worn out and cannot be replaced.

If you are concerned about a potential ban on wood burning for heating, I recommend that you do the following. Get educated about the Climate Act so that you understand exactly what is involved for New Yorkers to meet the Climate Act targets. Submit comments saying that banning wood burning is a safety risk when there is an electrical outage and will be more expensive so there should be no ban. Contact your legislators to let them know that you are concerned. Of special interest in 2022 is the commitment to zero on-site greenhouse gas emissions for new construction no later than 2027 and to “enact nation-leading building codes legislation” proposed by Governor Hochul. If you aren’t ready for all-electric home mandates then comment. I suggest you also make the point that the Climate Act targets and schedule need to be reassessed with respect to wood burning and many other issues.