Update (9/17/23): I corrected an error in this post. Dr. Jonathan Lesser pointed out that I need to adjust the offshore wind costs described here to account for a 30-year accrual.

One of the important renewable energy components of the net-zero transition in New York’s Climate Leadership & Community Protection Act (Climate Act) is offshore wind. I recently did an update on several offshore wind issues that included a description of an offshore wind cost analysis. This is a follow up to that discussion with an emphasis on New York offshore wind costs. The Hochul Administration is doing everything possible to hide the costs of the Climate Act but the immense costs of offshore wind are getting too large to hide.

I have been following the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 350 articles about New York’s net-zero transition. I have devoted a lot of time to the Climate Act because I believe the ambitions for a zero-emissions economy embodied in the Climate Act outstrip available renewable technology such that the net-zero transition will do more harm than good. The opinions expressed in this post do not reflect the position of any of my previous employers or any other company I have been associated with, these comments are mine alone.

Climate Act Background

The Climate Act established a New York “Net Zero” target (85% reduction and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% reduction by 2030 and a requirement that all electricity generated be “zero-emissions” by 2040. The Climate Action Council is responsible for preparing the Scoping Plan that outlines how to “achieve the State’s bold clean energy and climate agenda.” In brief, that plan is to electrify everything possible using zero-emissions electricity. The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan. After a year-long review, the Scoping Plan recommendations were finalized at the end of 2022. In 2023 the Scoping Plan recommendations are supposed to be implemented through regulation and legislation.

Off Shore Wind (OSW) is supposed to be a major renewable resource in the net-zero electric energy system. The Climate Act mandates 9,000 MW of Off Shore Wind (OSW) generating capacity by 2035. The Integration Analysis modeling used to develop the Scoping Plan projects OSW capacity at 6,200 MW by 2030, 9,096 MW by 2035 and reaches 14,364 MW in 2040. On the other hand, the New York Independent System Operator 2021-2040 System & Resource Outlook expects 5,036 MW in 2030 and 9,000 MW in 2035 with no additional development after that. By 2030 the Integration Analysis predicts that 14% of the electric energy (GWh) produced will come from OSW and the Resource Outlook predicts nearly as much (12%). This is an extraordinary build-out for a resource that is currently non-existent. There are significant differences in the buildout projections that deserve to be reconciled.

OSW Transmission Support

In order to determine the total cost to New Yorkers for OSW it is necessary to consider the transmission upgrade costs. I posted an article about this component of the OSW implementation requirements earlier this year. The Department of Public Service has an Order for Public Policy Transmission Need (PPTN) (Case 20-E-0497) regarding Climate Act requirements related to offshore wind that drive the need to expand the number of transmission facilities between Long Island and the rest of the State. These transmission system upgrades are needed to get the generated offshore wind from where it comes on shore to where it is needed in the state.

The draft NYISO Long Island Public Policy Transmission Need (PPTN) report predicts that the transmission upgrades will provide savings to the system:

The Long Island PPTN project simulations all show improvements in the export capability of Long Island by adding tie lines between Long Island and the lower Hudson Valley. This added transfer capacity and upgrades to the internal Long Island system reduce the amount of curtailment from offshore wind resources. The energy produced through reduced curtailment of offshore wind resources can then be used to offset more expensive generation to meet New York’s energy demand and, therefore, produce a production cost savings. Production cost savings are also created by offsetting high-cost energy imports from neighboring regions with lower cost New York-based generation that was previously inaccessible due to transmission congestion.

In general, all of the proposed projects produce savings by unbottling offshore wind resources in Long Island and reducing the amount of imports from neighboring regions. The figure below shows the estimated production cost savings for each project over a 20-year period in 2022 real million dollars.

The New York Independent System Operator (NYISO) Electric System Planning Working Group (March 24, 2023 and April 3, 2023) evaluated independent cost estimates developed by NYISO’s consultant for proposed projects to address this issue. In response to the NYISO’s request for proposals for the PPTN 17 bids were received. The average total cost estimate was $7.1 billion, the maximum was $16.9 billion and the minimum was $2.1 billion. In June 2023, NYISO chose the Propel NY transmission project totaling $3.28 billion.

The transmission upgrades are one of the hidden costs of OSW. Without this connection upgrade as much as 92% of 3000 MW of off-shore wind which costs $15 billion would not be deliverable. However, it comes at an annual average subsidy of $339 million. Unfortunately, the indirect subsidy costs described are not the only costs. These costs are only for the new transmission and do not include additional costs associated with the impacts on the existing transmission and distribution systems on Long Island. In addition, this is the cost associated with 3,000 MW of offshore wind. The Climate Act goal is for 9,000 MW and the Scoping Plan Integration Analysis projects that 12,675 MW of offshore wind will be needed by 2040 in the Strategic Use of Low-Carbon Fuels mitigation scenario. If the transmission costs are proportional that would mean that this indirect subsidy alone would be at least $1,356 million a year for the Integration Analysis.

Offshore Wind Cost Renegotiation

The primary reason for this post is that inflation and supply chain issues have led developers to ask that the contracts be renegotiated. James Hanley writes:

Multiple offshore wind projects that are not even built yet have asked the state’s Public Service Commission (PSC) to renegotiate their strike prices—the amount they will be paid per megawatt hour (MWh) of electricity produced. (A megawatt hour is roughly enough electricity to power 750 homes for one hour.)

One of the glaring deficiencies of the Hochul Administration’s Climate Act implementation is the lack of information about ratepayer impacts. The Informational Report was the first report that provided any estimates of ratepayer impacts and that was a Climate Act mandate. The report provides as little information as possible. In order to get a feel for the ratepayer impacts of the contract renegotiations it is up to outside parties to provide estimates. Multiple Intervenors and the Municipal Electric Utilities Association of New York State2 (“Customer Advocates”) recently submitted Supplemental Comments to the New York State Public Service Commission that includes estimates of the incremental costs to customers for these renegotiated contracts.

The Consumer Advocates comments addressed the NYSERDA submitted comments that estimated the change in contract strike prices that would result from contract modifications requested by offshore wind developers. NYSERDA did not provide any estimate of the effect on consumer costs so Consumer Advocates made their own. Their analysis found that the proposed changes could impose on customers incremental costs of at least $20.8 billion, and as much as $37.6 billion.

Discussion

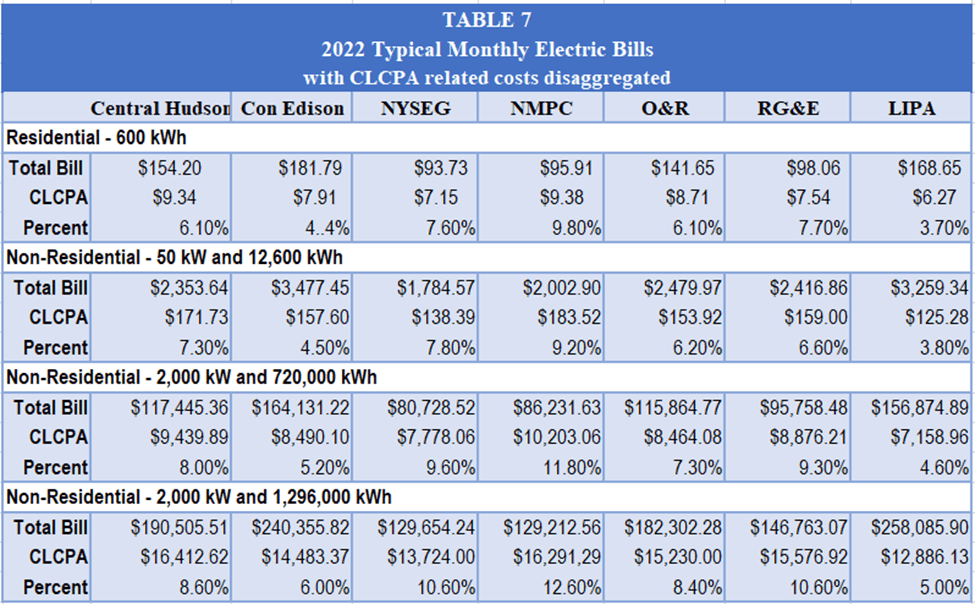

In an earlier post I described the first annual informational report (“Informational Report”) on the implementation of the Climate Act. It summarizes costs recovered in 2022 by utilities for electric programs and estimates that $1,175,788,000 in Climate Act costs were recovered in 2022 and it shows the amount these costs affected utility bills for seven utilities. Table 7: “2022 Typical Monthly Electric Bills with Climate Act related costs” from that report shows that residential ratepayer utility bills already are higher by between 9.8% and 3.7% for the 2022 recovered costs.

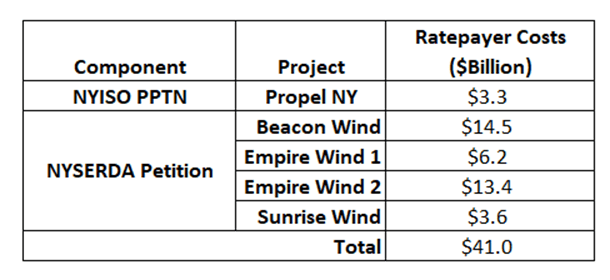

The following table lists the additional offshore wind authorized and incremental relief ratepayer costs that could be on the backs of New York ratepayers. The Informational Report did not include the $3.3 billion Propel NY transmission project needed for offshore wind. The Consumer Advocate petition estimated ratepayer costs for the NYSERDA petitions totaling $37.7 billion. When all these costs are totaled ratepayers could be on the hook for an additional $41.0 billion for offshore wind.

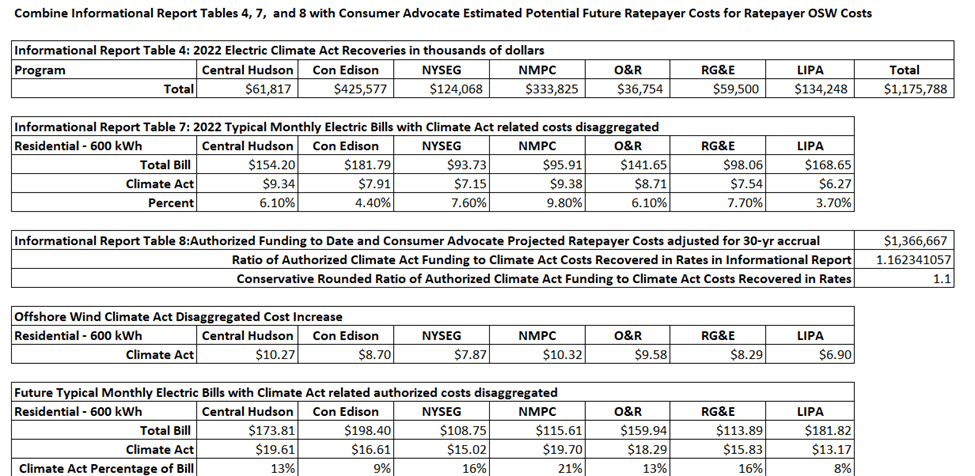

In a previous post I extrapolated the Informational Report ratepayer Climate Act cost recoveries for $43.8 billion in costs for contracts that have been awarded but not yet authorized for cost recovery. I simply calculated the ratio of the authorized Climate Act funding to date ($43.8 billion) to the Climate Act costs that have been authorized and were in the 2022 residential bills ($1.2 billion). I did not account the fact that those costs are not applied to consumer bills in one year but in this analysis, I have assumed a 30-year accrual. For a rough approximation of impacts by utility I simply multiplied the ratio by each of the monthly Climate Act disaggregated cost components reported by the utilities to determine CLCPA future related impacts on customers. This will not give an exact utility-specific estimate because the money authorizations per utility for 2022 and the future will not necessarily be the same. The following table uses the same methodology for all the expected ratepayer costs due to these offshore wind projects. I expect that the supply portion of every electric utility bill will more than double.

In response to similar extraordinary costs the British Government the recent Contracts for Difference (CfD) auction subsidies for renewable electricity generation were specified. Paul Homewood writes:

Participants in the auction bid for guaranteed prices, below a cap set by ministers in advance of the auction. The cap for offshore wind was set at £44/MWh (in 2012 prices, equivalent to around £70/MWh today). This is higher than successful bids in the past, yet no wind farm developers felt able to bid at this price. Wind industry claims that this is due to rising prices are implausible – CfD contracts are index-linked.

While offshore wind’s failure to bid may be surprising to some, perhaps even to the Government, it will come as no shock to those familiar with the long-term capital and operating cost trends for wind power, as revealed in audited financial statements. Costs have not been falling dramatically as the industry claimed. All around the world the wind industry is in trouble for the same reasons; costs remain high, and high levels of subsidy are needed to reward investors.

If New York were to revise its contracts to hold down costs I expect that the results would be the same. That is to say, no one would bid because the industry is in deep financial trouble.

Conclusion

In conclusion it is important to note that all the ratepayer costs that are described in this post are only for the supply portion of utility bills. The Hochul Administration is implementing a Cap-and-Invest program that will increase the costs of delivery. There has been absolutely no hint of the expected costs for this program but it will certainly cause an increase. Furthermore, this is just for the costs of the electricity. The plan is to convert homes and transportation too.

Offshore wind is a key part of the planned Climate Act net-zero transition. The New York Post notes that “In a fresh sign that New York’s state climate agenda is pure fantasy, contractors key to making good on a major piece of the so-called plan just filed to charge 54% more to build their offshore wind farms. “ This post estimates that these costs combined with all the other authorized but as yet unaccounted for ratepayer costs will be extraordinarily high.

The percentage of residential electric bill costs to meet the Climate Act mandates will increase such that between 8% and 21% of bills cover offshore wind costs and other mandates. The only reason that the public is not grabbing pitchforks and torches to march on Albany in protest of these regressive cost increases is that the public is unaware of what is coming. I am extremely disappointed that politicians and the media have not stepped up and demanded transparent accounting of expected Climate Act costs.

Hail the Green Profit$! What a SCAM!

LikeLike