My previous post summarized the presentation given by Zachary Smith from the New York Independent System Operator (NYISO) describing Dispatchable Emissions-Free Resources (DEFR). All credible projections for the generating resources needed for the zero emissions target in New York’s Climate Leadership & Community Protection Act (Climate Act) include this new category of generating resources called Dispatchable Emissions-Free Resources (DEFR). It is necessary to keep the lights on during periods of extended low wind and solar resource availability. This post uses the cost projections for recently awarded United Kingdom contracts for commercial scale green hydrogen production projects to estimate how much Climate Act DEFR might cost.

I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 380 articles about New York’s net-zero transition. The opinions expressed in this post do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% reduction by 2030 and a requirement that all electricity generated be “zero-emissions” by 2040. The Climate Action Council (CAC) is responsible for preparing the Scoping Plan that outlines how to “achieve the State’s bold clean energy and climate agenda.” In brief, that plan is to electrify everything possible using zero-emissions electricity. The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan outline of strategies. After a year-long review, the Scoping Plan was finalized at the end of 2022. In 2023 the Scoping Plan recommendations were supposed to be implemented through regulation, PSC orders, and legislation. Not surprisingly, the aspirational schedule of the Climate Act has proven to be more difficult to implement than planned and many aspects of the transition are falling behind. DEFR is a particularly challenging problem. When political fantasies meet reality, reality always wins.

New York Net-Zero Transition DEFR

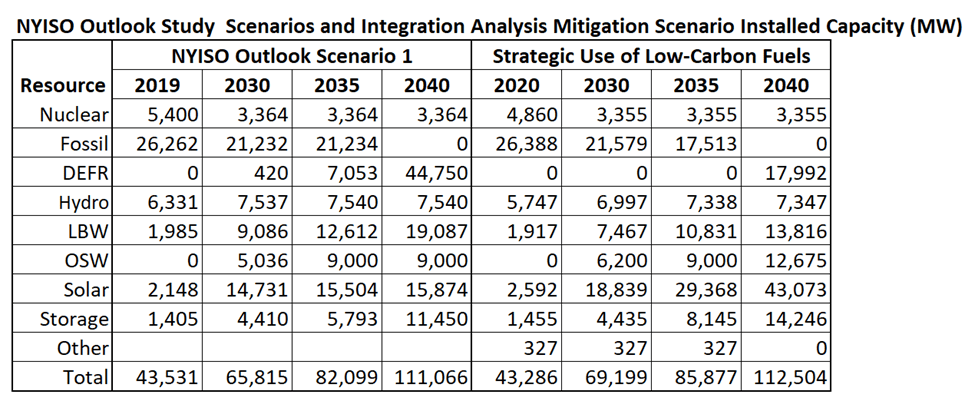

The presentation given by Zachary Smith summarized in my recent post gave an overview of the DEFR issue. I am not going to repeat the descriptive information again. For the purposes of this article, the Integration Analysis identified the need for a generating resource that could be dispatched as needed and did not have any emissions. The placeholder technology listed in the Integration Analysis was green hydrogen. The following table lists the projected capacity for DEFR in the NYISO the 2021-2040 System & Resource Outlook and the Integration Analysis. Note that the Resource Outlook projecta that 44,750 MW of DEFR will be needed by 2040, that the Integration Analysis Strategic Use of Low-Carbon Fuels scenario projects 17,992 MW by 2040, and that in 2019 the fossil fuel generation in the state was 26,262 MW.

The energy production projected for DEFR from the NYISO Resource Outlook and the Integration Analysis are shown in the following table. The largest difference between the two projections is that NYISO projects that DEFR will generate ten times more energy. It turns out that NYISO has DEFR generating 14% of the total energy in 2040 but Integration Analysis projects only 1%. I am very disappointed that the Hochul Administration has not reconciled the two projections.

Green Hydrogen Production

Proponents of zero emissions energy sources tout the use of “green” hydrogen. This is hydrogen that is produced using renewable energy rather than other fossil fuels or other sources. It is recognized that over-building wind and solar is a necessary part of an electric system that relies on these intermittent sources of power. One of the purported benefits of green hydrogen is that when the wind and solar availability is higher than the system load instead of curtailing excess wind and solar power that it could be used to power electrolyzers to create hydrogen. That is the theory, but the reality is that no one is producing hydrogen at commercial-scale yet.

Paul Homewood writing at the Not a Lot of People Know That blog described the recent announcement that the United Kingdom’s Department of Energy Security & Net Zero awarded contracts for green hydrogen projects. The announcement states:

Following the launch of the first hydrogen allocation round (HAR1) in July 2022, we have selected the successful projects to be offered contracts. We are pleased to announce 11 successful projects, totaling 125MW capacity.

HAR1 puts the UK in a leading position internationally: this represents the largest number of commercial scale green hydrogen production projects announced at once anywhere in Europe. This round will provide over £2 billion of revenue support from the Hydrogen Production Business Model, which will start to be paid once projects become operational. Over £90 million from the Net Zero Hydrogen Fund has been allocated to support the construction of these projects.

We have conducted a robust allocation process to ensure only deliverable projects that represent value for money are awarded contracts. The 11 projects have been agreed at a weighted average [footnote 1] strike price of £241/MWh (£175/MWh in 2012 prices). This compares well to the strike prices of other nascent technologies such as floating offshore wind and tidal stream.

The thing that caught my eye in Homewood’s article was that there were cost numbers: “The 11 projects have been agreed at a weighted average strike price of £241/MWh”. In renewable energy contracts the government agrees to a “strike price” per megawatt-hour that the renewable energy developer will receive for its delivery of electric energy produced by the renewable energy source. In this case electric energy from the green hydrogen source. The previous table lists the DEFR electric energy expected so as a first cut estimate I simply multiplied the expected MWh by the strike price. The following table shows that green hydrogen production could cost between $10.4 billion and $1.1 billion per year by 2040. This is the annual cost and does not include any construction subsidies.

Discussion

This just represents the start of the costs for the green hydrogen DEFR support. Making it is just part of the process. It has to be stored, transported to where it will be used, and, if the zealots on the Climate Action Council have their way, used in fuel cells. Each of those components adds costs. Homewood points out two other issues:

What is interesting is that the strike prices will be tied to changes in the market price of gas: “The subsidy will vary relative to changes in the reference (natural gas) price”.

The schemes all appear to be electrolyzers, and they all claim that only renewable electricity will be used, an absurd assumption! None of them say what they will do when there is not enough wind and solar power to meet demand – will they idle their plants, or will they carry on as usual taking whatever power the grid can supply?

That is not all. One of the things I have wondered about is process efficiency. When making anything the most efficient thing to do is to get the process up and running efficiently and just let it go. Depending on variable wind and solar makes that a challenge. Is New York’s plan going to include its own energy storage to make the process work well? I see no realistic scenario where this will work.

Conclusion

The Climate Action Council did not fully acknowledge the necessity or the challenge of the DEFR technology. The Department of Public Service Proceeding 15-E-0302 is intended to “identify technologies that can close the gap between the capabilities of existing renewable energy technologies and future system reliability needs, and more broadly identify the actions needed to pursue attainment of the Zero Emission by 2040 Target” directly contradicts the Council’s position. This post suggests that the placeholder DEFR option of green hydrogen could adversely affect affordability even if viable DEFR technologies can be identified.

We departed CA, PG&E service territory, a couple years back so we missed the latest kWh cost increases my father-in-law experienced all the while having his power cut during PSPS’s and being forced to evacuate due to wildfires started by failures of grid equipment.

The CA grid almost experienced rolling black outs in September of 2022 during a regional heat wave similar to the one back in July of 2006. In 2005 my father-in-law convinced us to try out a time of use rate schedule as it worked for him. We both paid PG&E 7.5 cents a kWh for our baseline usage. He now pays an average of 44.8 cents a kWh- https://www.pge.com/tariffs/electric.shtml#RESELEC_INCLUTOU

CA is looking at nudging folks into dynamic pricing schedules to reduce physical stress on grid hardware and to reduce the frequency of high wholesale prices as discussed here-

Campbell, Andrew. “Convincing Consumers to Adopt Dynamic Electricity Pricing” Energy Institute Blog, UC Berkeley, January 16, 2024, https://energyathaas.wordpress.com/2024/01/16/convincing-consumers-to-adopt-dynamic-electricity-pricing/

Does NY plan on using a similar program to keep its grid up?

Mark Miller

LikeLike