I recently had a letter to the editor of the Albany Times Union published asking readers how much they would be willing to pay for the New York Cap-and-Invest (NYCI) Program. There is a word limit on submittals so this post provides supporting information for that letter.

I have followed the Climate Leadership & Community Protection Act (Climate Act) since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 380 articles about New York’s net-zero transition. The opinions expressed in this post do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% reduction by 2030 and a requirement that all electricity generated be “zero-emissions” by 2040. The Climate Action Council (CAC) is responsible for preparing the Scoping Plan that outlines how to “achieve the State’s bold clean energy and climate agenda.” In brief, that plan is to electrify everything possible using zero-emissions electricity. The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan outline of strategies. After a year-long review, the Scoping Plan was finalized at the end of 2022. In 2023 the Scoping Plan recommendations were supposed to be implemented through regulation, PSC orders, and legislation. Not surprisingly, the aspirational schedule of the Climate Act has proven to be more difficult to implement than planned and many aspects of the transition are falling behind. When political fantasies meet reality, reality always wins.

Published Letter to the Editor

I could not find a link to the letter available to non-subscribers but did get this assortment of opinion pieces from a friend. The letter is in there somewhere. The following is the text:

The article “State’s Cap and Invest program unveiled,” Dec. 22, explained that it is intended to fund the transition to zero-emissions energy alternatives. The Hochul administration claims that the costs of inaction are more than the costs of action, but this is just a soundbite slogan. Most benefits are to society, so they do not directly offset the costs of electrification for consumers.

The question New Yorkers want to know is: How much will this cost me? Wind and solar costs increased sharply in 2023 due to changes in commercial conditions driven by inflation, interest rates and supply chain disruptions. Cap-and-invest will add even more costs. Last year, Washington state started a similar program. At the beginning of 2023, gasoline prices in Washington were 72 cents higher than the national average. By October, prices were $1.25 higher. The cost differential relative to the national average increased 88 percent because of the cost of their cap- and-invest program. A similar spike in gas prices will occur here. New York’s program covers all energy sectors, so all energy costs will necessarily increase.

New York greenhouse gas emissions are less than one-half of one percent of global emissions, and global emissions have been increasing by more than one-half of one percent per year since 1990. Therefore, anything New York does will be supplanted by emissions elsewhere in less than a year. That doesn’t mean we should not do something, but it does mean the state should document expected future costs to consumers.

Questions

Before the letter was published, I was asked to respond to questions. The first requested confirmation of the numbers included. The second asked about my claim that New York emissions are less than half a percent of global emissions. This section responds to those questions.

My first claim was that “The cost differential relative to the national average increased 88% because of the cost of their cap-and-invest program.” I responded:

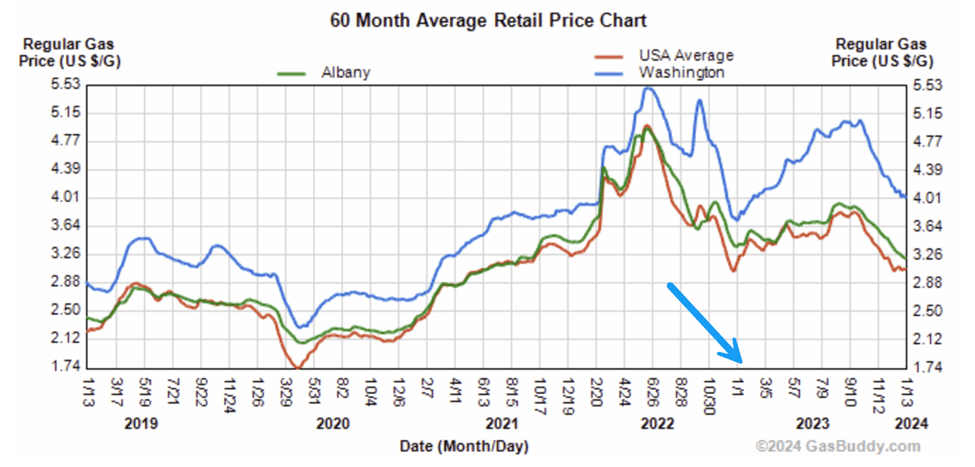

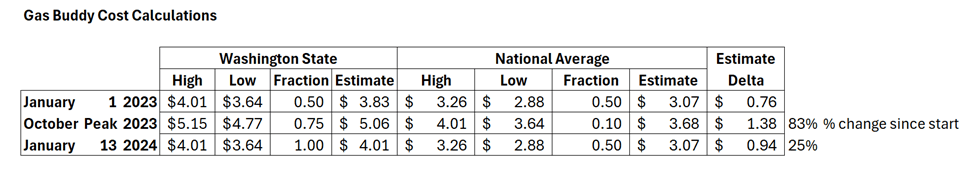

The Gas Buddy website includes a historical gas price graph that I used to estimate the effect on gasoline prices there. In the following graph I plotted the average gas price in Washington in blue, USA average in red, and the Albany, NY average in green. The blue arrow points to January 2023 when the Washington cap-and-invest program started and gasoline prices in the state increased relative to the national average. At the beginning of 2023 gasoline prices in Washington were $0.76 higher than the national average. By October prices peaked $1.38 higher. The cost differential relative to the national average increased 83% because of the cost of their cap-and-invest program.

My second claim was that “New York greenhouse gas emissions are less than one half of one percent of global emissions, and global emissions have been increasing by more than one half of one percent per year since 1990.” I responded:

I used information from my post Climate Act Emission Reductions in Context dated January 20, 2022 that documented how New York GHG relate to global emission increases. In response to your questions I updated the analysis. I found CO2 and GHG emissions data for the world’s countries and consolidated the data in the attached spreadsheet. There is interannual variation, but the five-year annual average has always been greater than 0.79% until the COVID year of 2020. The Statewide GHG emissions inventory came out in December but the comparable GWP-100 data that I used from Open Data NY through 2021 are not available. The analysis relies on last year’s data. New York’s share of global GHG emissions is 0.42% in 2019 so this means that global annual increases in GHG emissions are greater than New York’s total contribution to global emissions.

Additional information was provided in my post Washington State Gasoline Prices Are a Precursor to New York’s Future. That post showed that there is an obvious link between Washington’s new cap and trade program and gasoline prices. I found that the cost of Washington gasoline has risen more relative to the price increases elsewhere so that now Washington has the highest prices in the nation. The first two auctions for the Washington cap-and-invest program sold 14,770,222 allowances and raised $780,829,117 averaging $52.87 per allowance. According to the US Energy Information Administration 17.86 lbs of CO2 are emitted per gallon of finished motor gasoline which means that 112 gallons burned equals one ton. That works out to $0.47 a gallon needed to cover the cost of allowances necessary to purchase the allowances and that is a unique Washington cost adder.

Discussion

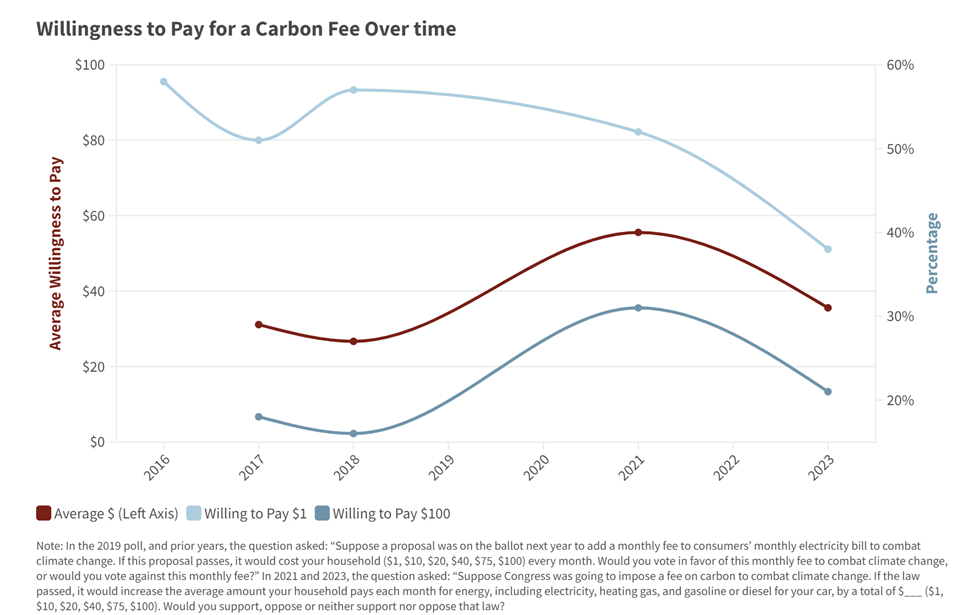

The Energy Policy Institute at the University of Chicago did a poll in early 2023 poll with “the Associated Press–NORC Center for Public Affairs Research” explored Americans’ attitudes on climate change, their views on key climate and energy policies, and how they feel about electric vehicles and the policies to encourage them. The following chart from that report shows that 38% would be willing to pay an additional $1 a month for a fee to combat change and only 21% would be willing to pay $100 a month. Based on my analyses I think the total all-in cost for a household to comply with proposed carbon fee is going to be a lot closer to $100 than $1 a month.

Conclusion

My next post is going to describe a recent webinar, “Preliminary Scenario Analyses” (slides and recording) that is part of this year’s New York Cap-and-Invest (NYCI) Program stakeholder engagement process. The webinar offered the first glimpse of potential costs for NYCI and I will compare some of the expected costs with the poll results described above.

There is no question in my mind that most New Yorkers have no clue how much this will cost. I also believe that the Hochul Administration is keeping the costs hidden as much as possible because they know that support for the program would evaporate. I appreciate the Albany Times-Union publishing my letter as part of my quixotic quest to stop implementation before it is too late.

Before I realized the weakness of using creative usernames when making public comments on NYS energy policy in my local newspaper, I was Quixote. Now I use my real name, but I’m still Don Quixote to some!

LikeLike