The New York Independent System Operator recently released the 2023-2042 System & Resource Outlook (“Outlook”). It examines “a wide range of potential future system conditions and compares possible pathways to an increasingly greener resource mix.” This post summarizes the key findings of the report.

I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 400 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% GHG reduction by 2030, a 70% electric system renewable energy mandate by 2030, and a requirement that all electricity generated be “zero-emissions” resources by 2040. The Climate Action Council (CAC) was responsible for preparing the Scoping Plan that outlined how to “achieve the State’s bold clean energy and climate agenda.” The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies used to reduce greenhouse gas emissions. That material was used to develop the Draft Scoping Plan outline of strategies. After a year-long review, the Scoping Plan was finalized at the end of 2022. Since then, the State has been trying to implement the Scoping Plan recommendations through regulations, Public Service Commission orders, and legislation.

Recently two reports have come out that raise specific concerns about Climate Act implementation: schedule ambition and costs to implement.

The Public Service Commission (PSC) recently released the Clean Energy Standard Biennial Review Report (“Biennial Report”) that compares the renewable energy deployment progress relative to the Climate Act goal to obtain 70% of New York’s electricity from renewable sources by 2030 (the 70% goal). It found that 2030 goal will likely not be achieved until 2033

The New York State Comptroller Office released an audit of the NYSERDA and PSC implementation efforts for the Climate Act titled Climate Act Goals – Planning, Procurements, and Progress Tracking (“Comptroller Report”). The audit found that: “The costs of transitioning to renewable energy are not known, nor have they been reasonably estimated”.

The Outlook provides a third analysis that addresses issues that could affect electric system reliability.

Overview of the Outlook Report

The document and 11 appendices are available at the NYISO website:

- 2023-2042 Outlook Report

- Appendix A – Production Cost Model Benchmark

- Appendix B – Production Cost Assumptions Matrix

- Appendix C – Capacity Expansion Assumptions Matrix

- Appendix D – Modeling & Methodologies

- Appendix E – Renewable Profiles & Variability

- Appendix F – Dispatchable Emission-Free Resources

- Appendix G – Production Cost Model Results

- Appendix H – Capacity Expansion Model Results

- Appendix I – Transmission Congestion Analysis

- Appendix J – Renewable Generation Pockets

- Appendix K – Capacity Expansion Model Sensitivities

The Executive Summary explains that:

The Outlook examines a wide range of potential future system conditions and compares possible pathways to an increasingly greener resource mix. By simulating several possible future system configurations and forecasting the transmission constraints for each, the NYISO:

- Postulates possible resource mixes that achieve New York’s public policy mandates, while maintaining reserve margins, and capacity requirements;

- Identifies regions of New York where renewable or other resources may be unable to generate at their full capability due to transmission constraints;

- Quantifies the extent to which these transmission constraints limit delivery of renewable energy to consumers; and

- Highlights potential opportunities for transmission investment that may provide economic, policy, and/or operational benefits.

This overview uses slides included in the presentation made by Zachary Smith from the NYISO to the New York State Reliability Council on July 12, 2024. I include all the slides in the presentation with my comments. The first slide is the introduction.

The analysis identified key findings that are grouped into three main drivers of the changes to the system: demand, resources, and transmission. The presentation described nine themes that characterize the state of the grid and incorporate the key findings.

The first theme is that “Public policies continue to drive rapid change in the electric system in the state.” As shown in the following slide there are numerous specific mandates in the Climate Act that will affect the electric grid. Another key theme is that “The wholesale electricity markets administered by the NYISO exist as an important tool to attract necessary investments to facilitate the transition of the grid in the coming decades.” The NYISO is a product of the de-regulated electric system that relies on market-based policies to maintain a “reliable, sustainable grid”. I mention this because the following slide states: “Competitive markets will channel investment to achieve these goals while maintaining reliability at the lowest possible cost” and I want to make a point. Transforming the electric grid to the extent mandated by the Climate Act is an enormous technological challenge. It is hard enough to figure out how this can be accomplished, but the NYISO has the added task of creating market mechanisms to implemeent the proposed technological solutions. Despite my tremendous respect for the technical capabilities of the NYISO I am worried that these two challenges may be too great to maintain reliability at a reasonable cost.

Two key findings were described relative to demand.

Electric energy consumption is projected to increase significantly in response to the economic development and decarbonization energy policies. The figure showing the new large load projects lists 10 projects totaling 1,846 MW.

Another of the Demand key findings was “Siting large loads in electrical proximity to renewable resources, or siting resources near large loads, may benefit both the loads and the resources, particularly if located upstream of known constraints.” It is not clear to me whether this has any relevance to the new load projects. The four North Country projects are near the St Lawrence hydro projects but all the power there is spoken for. On the other hand, there are no obvious renewable resources close to the 480MW Micron project in Central New York. The projected increase in demand shown in the next slide is extraordinary.

The NYISO has been arguing for a long time that the peak annual load will shift from the summer to the winter. The timing of the shift depends on the electrification of heating and transportation.

The next slide shows that the summer peak will increase due to building and transportation electrification. Note that the increase in load is not large.

One of the key themes in the presentation was that “New York is projected to become a winter-peaking system in the 2030s, primarily driven by electrification of space heating and transportation.” The next slide shows that they expect demand to nearly double in the winter.

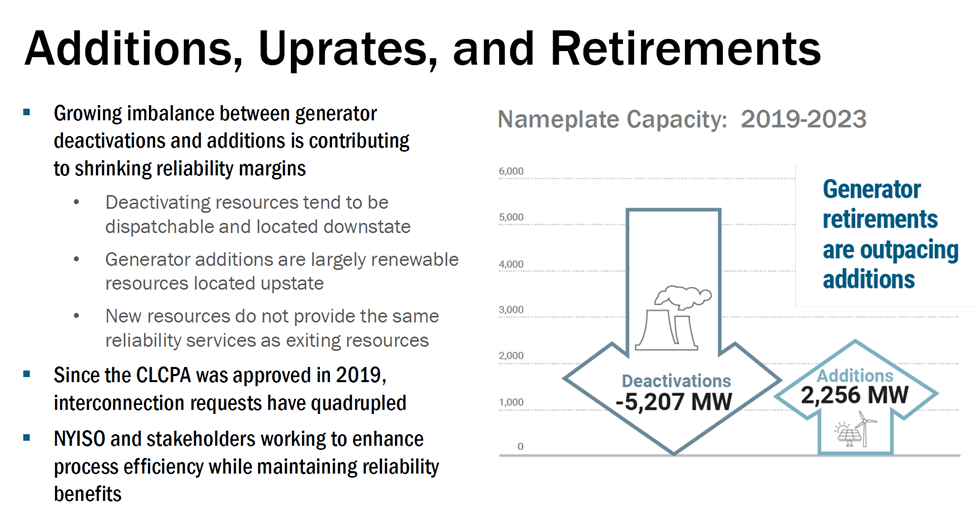

The second main driver of changes to the system is supply resources. The following slide identifies four key findings.

A primary NYISO concern is narrowing reliability margins. One of the key themes noted that “electrification programs and economic development initiatives are driving projected demand higher” and at the same time “Generator deactivations are outpacing new supply additions.” This was addressed as a key finding for supply resources: “The coordination of new generator additions and existing generator retirements is essential to maintain the reliability of the New York power system while simultaneously pursuing achievement of CLCPA” and “Uncertainty in siting new renewable generation could lead to delays in or inefficient expansion of the transmission and distribution systems.” The following slide illustrates the problem.

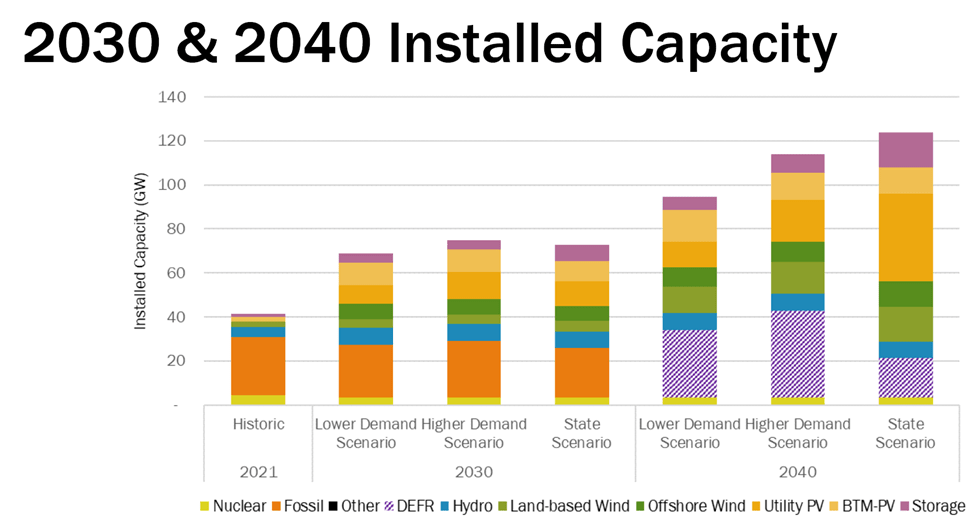

Another key finding for supply resources is that “New York will require three times the capacity of the current New York generation fleet to meet projected future electricity demands.” The following slide shows the expected changes in capacity.

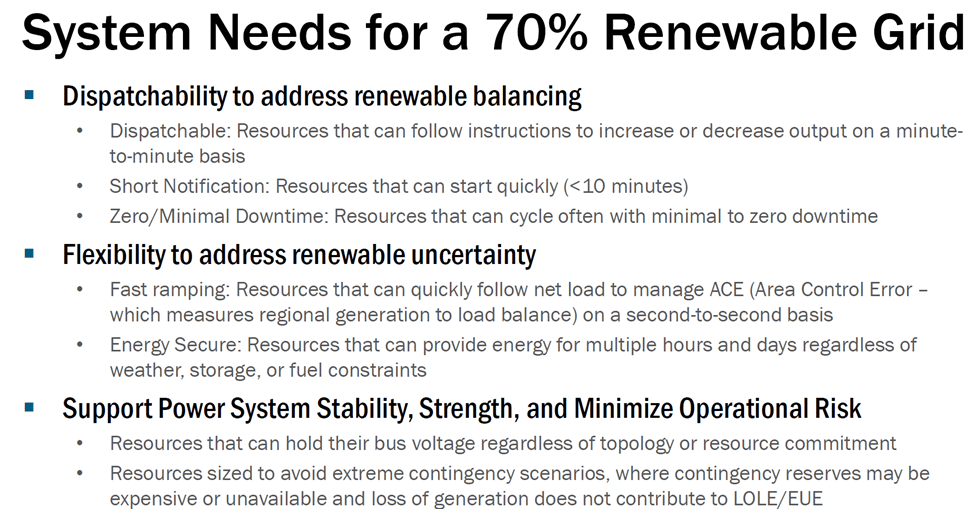

A key point is that the challenge is not just building more capacity there are other features needed in the future grid. The following slide notes that renewable energy needs to be supported by dispatchable resources. Those resources need to be able to respond quickly and be ‘energy secure”. In addition, there are other grid support services required to support “power system stability, strength, and minimize operational risk”.

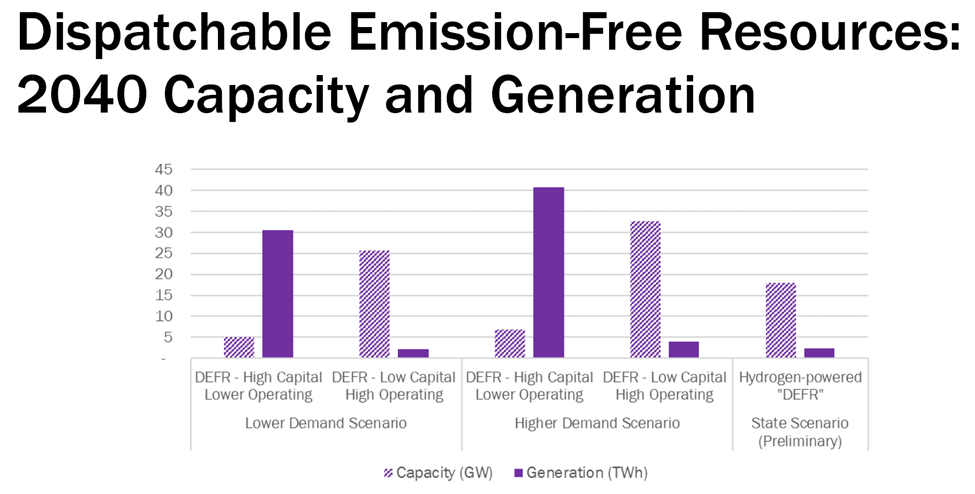

One of the key themes for the transition is “To achieve the mandates of the CLCPA, new emission-free supply capable of providing the necessary reliability services are needed to replace the capabilities of today’s generation. Such new supply is not yet available on a commercial scale. “ One of the key findings for supply resources states “Dispatchable emission-free resources must be developed to provide the capacity, energy, and other essential grid services required to achieve the policy mandate for a zero-emissions grid by 2040.” In other words, this is the resource that is needed to provide the system needs described in the previous slide. Appendix F is devoted to this resource. Dispatchable Emissions-Free Resources (DEFR) are needed for a future grid that depends upon wind, solar, and energy storage resources to keep the lights on during periods of extended low wind and solar resource availability. In my opinion, one of the important unresolved issues is the resource allocation difference between the NYISO projections and the Integration Analysis State Scenario shown in the following slide.

There are enough issues associated with this topic that I will come back to this in a subsequent post For this overview I will continue with the final main driver of electric system change – transmission. The following slide lists four key findings.

The first key finding is that “Historic levels of investment in the transmission system are happening but more will be needed.” The following slide lists seven ongoing transmission projects.

As noted, more transmission will be needed. The following slide describes the process for more transmission projects.

Another key finding is that there are “Actionable expansion opportunities: To fully utilize the transmission facilities already in place, additional dynamic reactive power support must be added to the grid in upstate New York to alleviate curtailment over the Central East interface.” This is illustrated in the following slide. I am not conversant in the technical details of this issue so I will quote from the Outlook report:

To fully utilize the transmission facilities already in place, additional dynamic reactive power support must be added to the grid in upstate New York to alleviate congestion caused by the Central East interface voltage performance. Reactive power supports the overall voltage performance of the grid and maybe provided by generators, dedicated fast responding dynamic reactive power devices, such as synchronous condensers or other power electronics (e.g., STATCOMs], or potentially other specialized Grid-Enhancing Technologies (GETs). This kind of specialized technology can improve the delivery of electricity via existing transmission lines. As the fossil fuel generators tied to the Central East voltage collapse limit are deactivated by 2040 to comply with the CLCPA mandate, the full benefits of the Segment A transmission project will be diminished leading to transmission congestion and renewable curtailment if left unaddressed.

The Outlook finds that by replacing the dynamic support services from these fossil fuel generators to support the Central East interface voltage performance, the future potential congestion across Central East could be largely eliminated and curtailment of renewable energy reduced by approximately 40-220 GWh in 2035.

The important point is that someone is going to have to pay for the dynamic support services necessary to get the renewable electric energy to where it is needed. When wind and solar supports brag about the low costs of solar and wind generation they are most certainly not including hidden costs like this in their estimates.

There were no slides specifically associated with the following key themes. Three themes address current reliability concerns:

- The potential for delays in construction of new supply and transmission, higher than forecasted demand, and extreme weather are threatening reliability and resilience to the grid

- Summer 2024: Electricity supplies are adequate to meet expected summer demand under normal conditions, but extreme weather and other factors pose reliability risks.

- On the coldest days, the availability of natural gas for power generation may be limited and significant interruptions to natural gas supply can disrupt reliable operations.

Lastly, in order to expedite new renewable development, the NYISO processes have to be accelerated. Note however, that NYISO must worry about the unintended consequences of these new resources so there are limits on this:

- NYISO’s interconnection processes continue to evolve to balance developer flexibility with the need to manage the process to more stringent timeframes.

Discussion

The key themes that describe the Resource Outlook state of the grid outline potential issues. In this section I describe the themes that posed issues threatening reliability and resilience to the grid but add some context that was not included in the slide presentation.

The themes describe the status of the electric system. This summer the electric system should be able to meet demand but “extreme weather and other factors pose reliability risks.” In the winter, “the availability of natural gas for power generation may be limited and significant interruptions to natural gas supply can disrupt reliable operations.” Unsaid were the ramifications of State policy decisions to limit natural gas pipelines to alleviate this availability problem.

The themes also address changes to the electric system. Public policies are one of the causes of rapid changes to New York’s electric system in the state. One of the consequences of the electrification mandate is that New York peak loads will occur in the winter in the 2030s. Another driver of change is the marked increase in loads partially due to electrification mandates but also due to economic initiatives and increased demand for computing resources. These changes have resulted in narrower reliability margins compounded by the unmentioned State policy decisions to force generator deactivations and preclude replacement with new fossil-fired generation.

Another issue raised in the themes is the schedule. There have been and will be delays in construction of new supply and transmission. NYISO recognizes that the interconnection process must change to keep up with the schedule but in this presentation did not describe the technological changes that complicate interconnection of inverter-based intermittent wind and solar resources.

I maintain that NYISO does not acknowledge that the need for “significant changes to the wholesale electricity markets administered by the NYISO” significantly complicates the transition. NYISO not only must identify the technology needed to provide a reliable and resilient system but must also conjure up a market mechanism that will entice developers to provide those resources.

A primary concern expressed in the presentation was the need for “new emission-free supply capable of providing the necessary reliability services are needed to replace the capabilities of today’s generation.” NYISO descriptions of DEFR always mention that “such new supply is not yet available on a commercial scale” but never articulate the risk to the reliability and resilience of the system of a policy that presumes that the resource will be developed as required. Another related concern is that planning for this resource in a weather-dependent electric grid must address the challenge that wind and solar resource output is frequently low at the same time. Alarmingly, the low resource availability typically occurs when the loads are highest which exacerbates the importance of a reliable DEFR solution.

Conclusion

The NYISO System and Resource Outlook describes issues that threaten reliability and resilience of the electric system. In my opinion, it is frustrating that the issue descriptions are couched in qualifying statements that disguise the magnitude of the challenges. It is left up to the reader to figure out that it is unlikely that the Climate Act mandates can be implemented without causing reliability crises. In my opinion, the requirements of the Climate Act demand too much, too soon and the proposed plan to rely on wind and solar will cause catastrophic blackouts.

The OBVIOUS question: ‘

IF (you have a scalable DEFR), THEN (why would you need wind and solar?)

That’s still doubling the infrastructure necessary to produce Baseload Power.

Why not just use the DEFR?

MDee

LikeLike

If that scalable DEFR is a Hydrogen-powered DEFR, you need even more wind and solar, plus sea water desalinization and hydrolyzers and a bunch of storage vaults.

https://www.therightinsight.org/The-Great-Green-Hope

https://www.therightinsight.org/Great-Green-Challenges

LikeLiked by 1 person

Exactly. Why they don’t go all in for nuclear is a mystery

LikeLike