In response to claims by New York State officials that the Regional Greenhouse Gas Initiative (RGGI) has been instrumental in reducing electric generating unit emissions I have evaluated the latest New York State Energy Research & Development Authority (NYSERDA) funding status report. This article addresses the observed CO2 emissions reductions relative to the claimed CO2 emission reductions in the NYSERDA reports. There are ramifications of the emission reduction claims and NYSERDA program investments affecting compliance mandate requirements for RGGI that will be addressed in a subsequent article.

Background

I have been involved in the RGGI program process since its inception. I blog about the details of the RGGI program because very few seem to want to provide any criticisms of the program. I submitted comments on the Climate Act implementation plan and have written over 480 articles about New York’s net-zero transition because I believe the ambitions for a zero-emissions economy embodied in the Climate Act outstrip available renewable technology such that the net-zero transition will do more harm than good because of impacts on reliability, affordability, and environmental impacts. The opinions expressed in this post do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

RGGI is a market-based program to reduce greenhouse gas emissions (GHG) (Factsheet). It has been a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont to cap and reduce CO2 emissions from the power sector since 2008. New Jersey was in at the beginning, dropped out for years, and re-joined in 2020. Virginia joined in 2021 but has since withdrawn, and Pennsylvania has joined but is not actively participating in auctions due to on-going litigation. According to a RGGI website:

The RGGI states issue CO2 allowances that are distributed almost entirely through regional auctions, resulting in proceeds for reinvestment in strategic energy and consumer programs.

Proceeds were invested in programs including energy efficiency, clean and renewable energy, beneficial electrification, greenhouse gas abatement and climate change adaptation, and direct bill assistance. Energy efficiency continued to receive the largest share of investments.

I have written multiple articles that argue that RGGI advocates mis-lead the public when they imply that RGGI programs were the driving force behind the observed 50% reduction in power sector CO2 emissions since 2000. I did an article on CO2 emissions based on the funding status reports in December 2022. This article updates the information through 2023.

New York Power Sector CO2 Emissions

The first step in evaluating the effect of RGGI on CO2 emissions is to determine the observed trend of New York electric utility emissions. EPA’s Clean Air Markets Division maintains a database of all the emissions data collected by every power plant in the United States since the mid-1990’s. I used that data for this analysis.

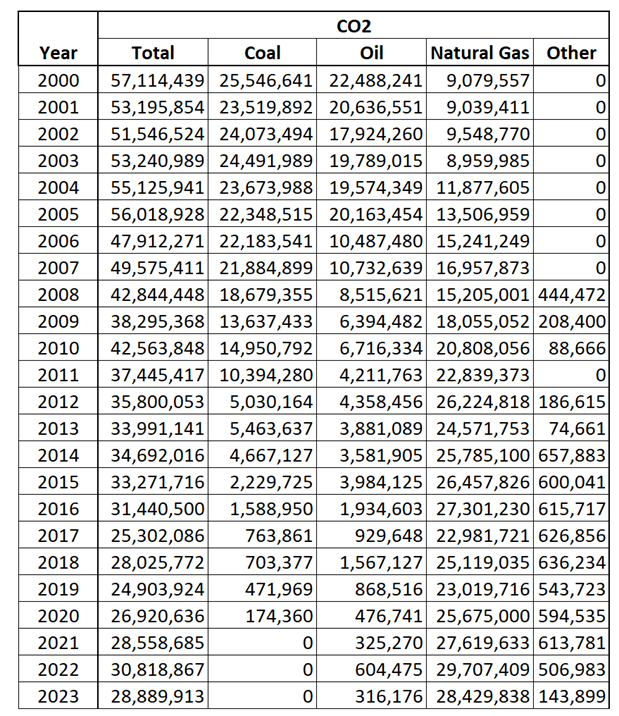

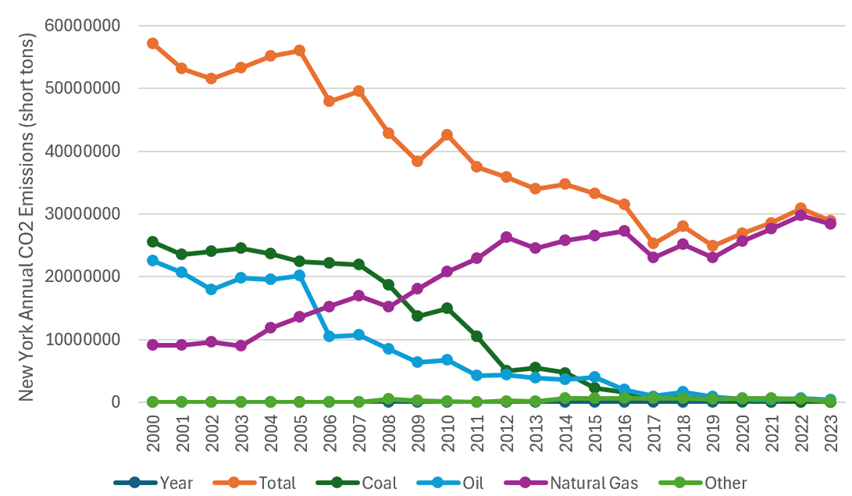

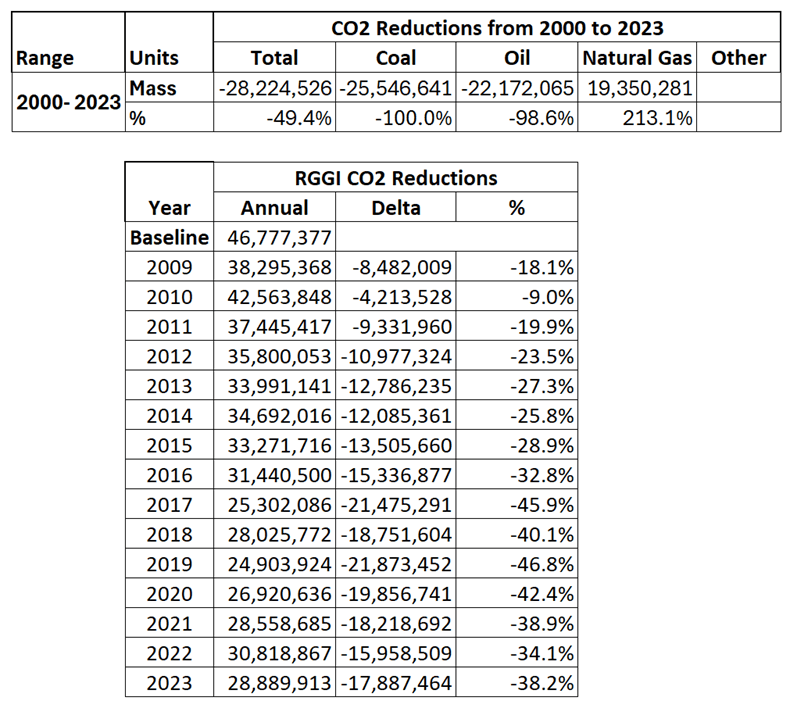

The EPA database includes information such as the primary fuel type of each generating unit. Table 1 lists the total annual CO2 data from all New York units that are required to report to EPA for any air pollution control program by fuel type. In 2000, New York EGU emissions were 57,114,439 tons and in 2023 they were 28,889,913 tons, a decrease of 49%. Figure 1 plots these data. Table 2 lists the reductions in New York since the start of RGGI. I calculated a pre-RGGI baseline by averaging annual data from 2006-2008. In NYS 2023 CO2 emissions are 38% lower than baseline emissions. Note that the reduction percentage peaked in 2019 before Indian Point shut down and emissions increased. The most important feature of these tables is that coal and oil emission reductions are the primary drivers of the total emission reductions. Natural gas has increased to cover the generation from those fuels but because it has lower CO2 emission rates the New York emissions have gone down.

Table 1: New York Clean Air Markets Division Emissions Data for All Regulatory Programs

Figure 1: New York State Emissions by Fuel Type

Table 2: New York State Emission Reductions

NYSERDA RGGI Funding Status Reports

The latest New York RGGI funding report prepared by the New York State Energy Research & Development Authority (NYSERDA) is the Semi-Annual Status Report through December 2023. It states that:

This report is prepared pursuant to the State’s RGGI Investment Plan (2022 Operating Plan) and provides an update on the progress of programs through the quarter ending December 31, 2023. It contains an accounting of program spending; an estimate of program benefits; and a summary description of program activities, implementation, and evaluation. An amendment providing updated program descriptions and funding levels for the 2022 version of the Operating Plan was approved by NYSERDA’s Board in January 2023.

The State invests RGGI proceeds to support comprehensive strategies that best achieve the RGGI CO2 emission reduction goals. These strategies aim to reduce global climate change and pollution through energy efficiency, renewable energy, and carbon abatement technology.

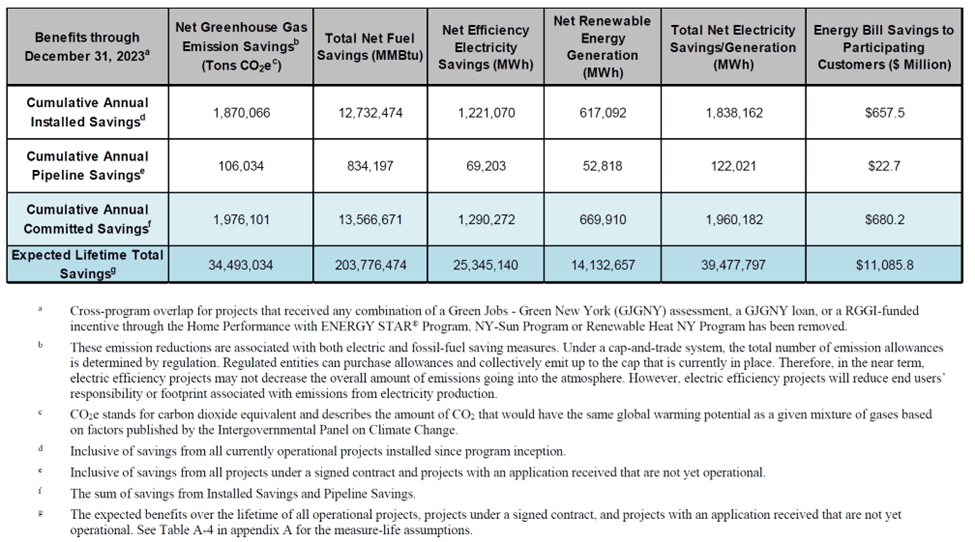

Table 3 from Table 1 in the latest the Semi-Annual Status Report summarizes the effectiveness of the NYSERDA investments and lists expected cumulative portfolio benefits including emissions savings. This report notes that NYSERDA “begins tracking program benefits once project installation is complete and provides estimated benefits for projects under contract that are not yet operational (pipeline benefits).” There is an important distinction between the cumulative annual committed savings and the expected lifetime total benefits. For the purposes of this analysis, I did not use “lifetime” savings data because I am trying to compare the RGGI program benefits emission savings reductions to the RGGI compliance metric of an annual emission cap. Lifetime reductions are clearly irrelevant to that metric. Similarly, the Climate Act emission reduction metrics are annual emissions relative to a 1990 baseline so expected lifetime benefits are immaterial.

Table 3. Summary of Expected Cumulative Portfolio Benefits through December 31, 2023

Comparison of NYSERDA Cumulative Emissions Savings to Observed Emission Reductions

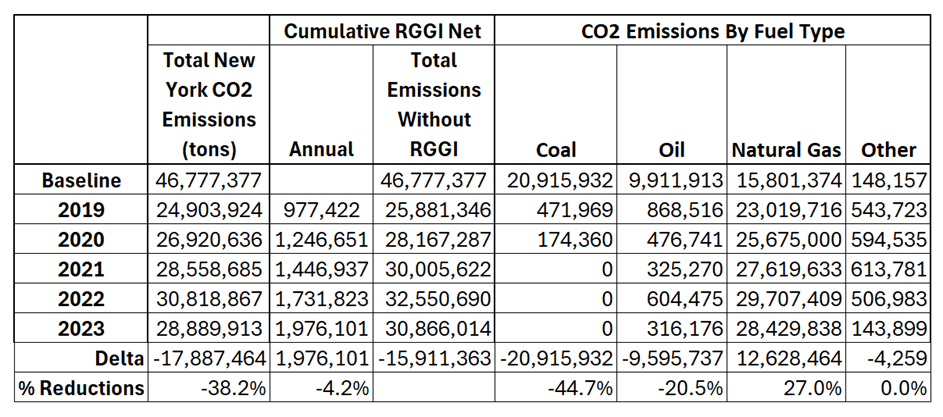

Table 4 presents the relevant data to compare the observed reductions and NYSERDA RGGI investment emission savings. I list the last five years of data starting in 2019 when the emissions went up because of the closure of Indian Point but the decreases since the 2006-2008 average baseline are listed. The emissions savings listed are cumulative annual emissions. If the RGGI investments were not made then the total emissions would be higher by the amount of the savings. The total cumulative annual emission savings through the end of 2023 is only 1,976,101 tons and that represents a reduction of 4.2% from the pre-RGGI baseline. Emission reductions by fuel type clearly show that fuel switching is the primary cause of reductions.

Table 4: NY Electric Generating Unit Emissions, NYSERDA GHG Emission Savings from RGGI Investments, and Emissions by Fuel Type

Discussion

Whenever there is a public meeting about RGGI, the overview presenters state that there has been a large reduction in electric sector emissions. For example, at the NYSERDA RGGI Stakeholder meeting on 5 December 2024, Jon Binder from the New York Department of Environmental Conservation said:

Together, we have cut New York’s power sector emissions of carbon dioxide by more than 50 %. And we’ve done this by establishing regulations that set limits on pollution while also making investments through this operating plan process in parallel with so many other critical policies at the state level and commitments to implement the Climate Leadership and Community Protection Act.

EPA emission data and NYSERDA documentation on the results of the investments funded by RGGI auction proceeds contradict this narrative that RGGI has substantially reduced emissions. This article shows that the primary reason for the observed 38% reduction from the start of RGGI is fuel switching and retirements caused by low natural gas prices. Since the start of the RGGI program I estimate that emissions from RGGI sources in New York would have been only 4.2% higher if the NYSERDA program investments did not occur.

On December 18, 2024, the Assembly Committee on Energy held a public hearing on New York State Energy Research & Development Authority (NYSERDA) spending and program review. John Howard, a seasoned Albany hand who retired from his post on the Public Service Commission earlier this year gave a statement. He opened his remarks noting that “the subject of today’s hearing is the fiscal and operational oversight of NYSERDA” and went on to explain that NYSERDA is now exclusively responsible for procuring vast amounts of renewable energy consistent with the Climate Act mandates but there is no oversight of the contracts. The RGGI investments are one example of the programs managed by NYSERDA. I will follow this post with another article describing the unacknowledged implications of these numbers.

Conclusion

Implementing the net-zero transition mandated by the Climate Leadership & Community Protection Act is a massive challenge consisting of many moving parts. The RGGI program is touted as a successful model for proposed components of the transition. However, upon close review the narrative that RGGI Auction proceed investments have substantially contributed to the observed emission reductions is not true.