My last post took an initial look at the impact of the January 23-27 winter storm on wind and solar energy production. This post shows that this type of weather event shows dispatchable emissions free resources (DEFR) are necessary to achieve net-zero in New York.

I am convinced that implementation of the Climate Leadership & Community Protection Act (Climate Act) net-zero mandates will do more harm than good if the future electric system relies only on wind, solar, and energy storage because of reliability and affordability risks. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

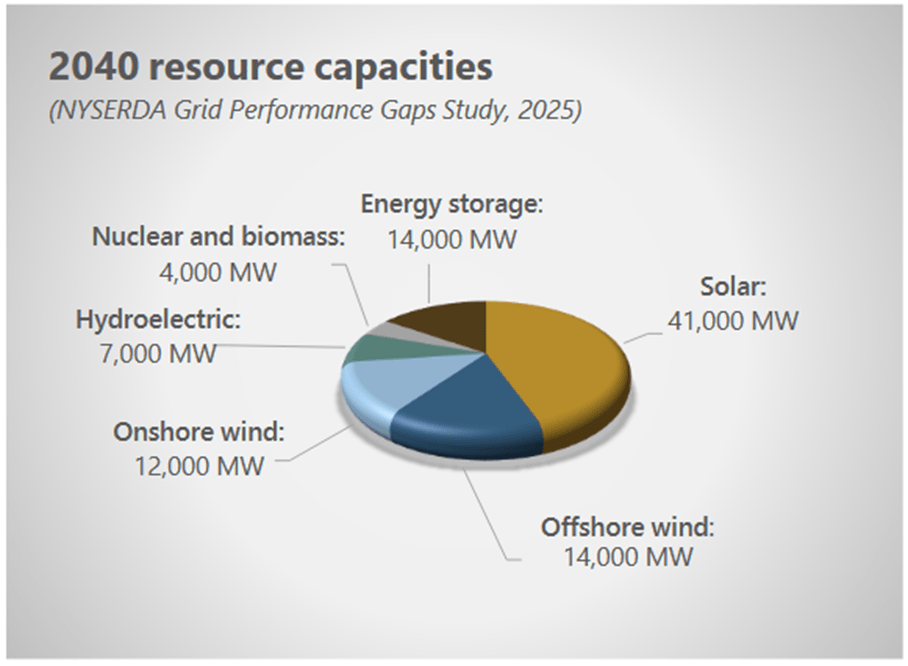

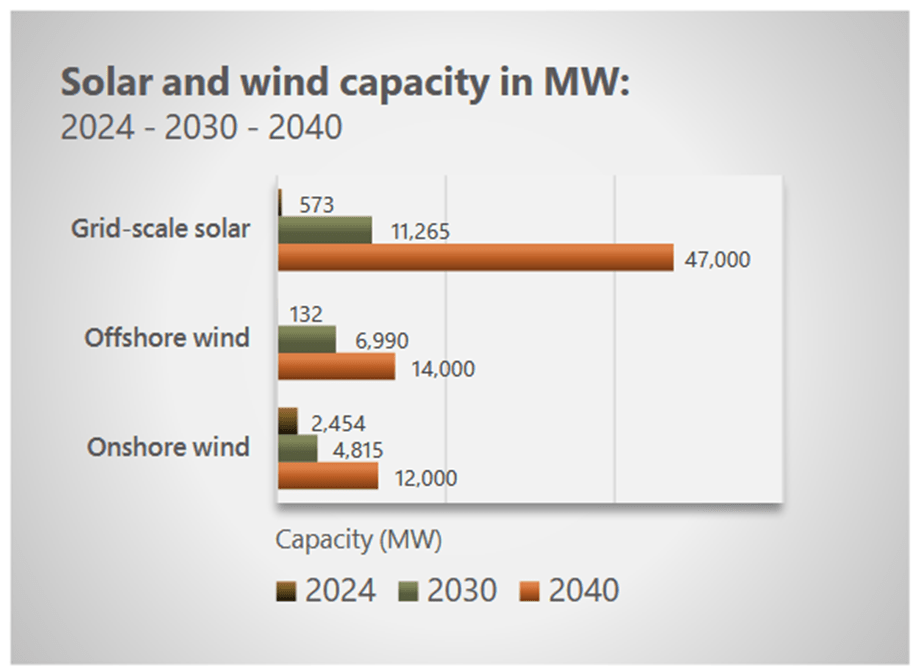

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. Among its interim 2030 targets is a 70% renewable energy electricity mandate and 100% zero emissions electric generation in 2040..

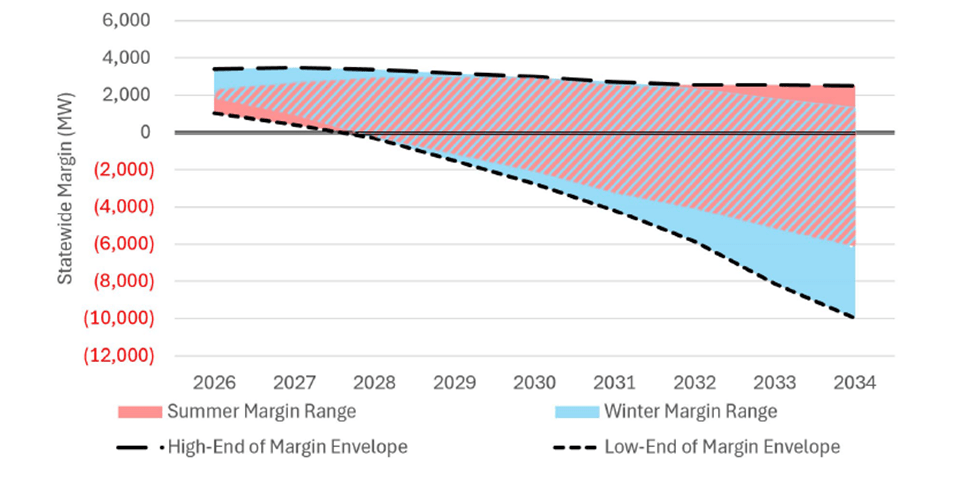

Electric systems must be built around reliability during peak demand. One of my primary concerns with the Climate Act weather-reliant renewable energy mandates is correlated variability because the conditions that characterize the highest loads also have the weakest expected wind resource availability. That makes electric resource planning for reliability during the peak period especially challenging.

From January 23 to January 27, 2026, a very large and expansive winter storm caused deadly and catastrophic ice, snow, and cold impacts from Northern Mexico across the Southern and Eastern United States and into Canada. In New York total snow/sleet accumulation ranged from 8-13” near the coast and 12-17” across the interior. As the precipitation ended a glaze of freezing rain occurred. Following the storm there was a period of prolonged sub-freezing weather.

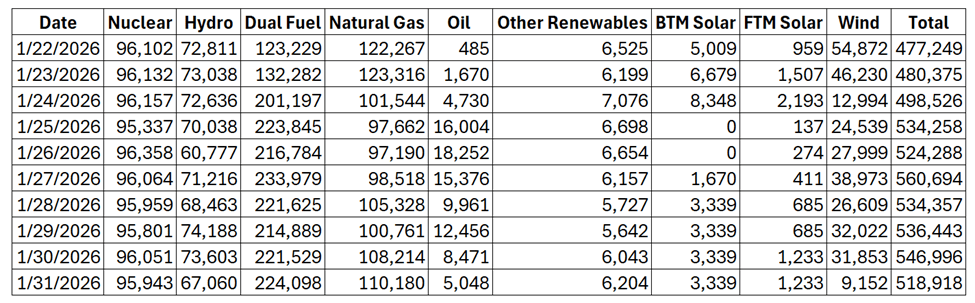

I relied on two sources of New York Independent System Operator (NYISO) data for this analysis. New York fuel-mix load data are available at the NYISO Real-Time Dashboard. The second source of data is the Operations Performance Metrics Monthly Report prepared by the NYISO Operating Committee. I looked at data from January 22-31, 2026 to bound conditions before the storm and after. Note that the cold weather went into February but the Metrics Report data for February are not available yet.

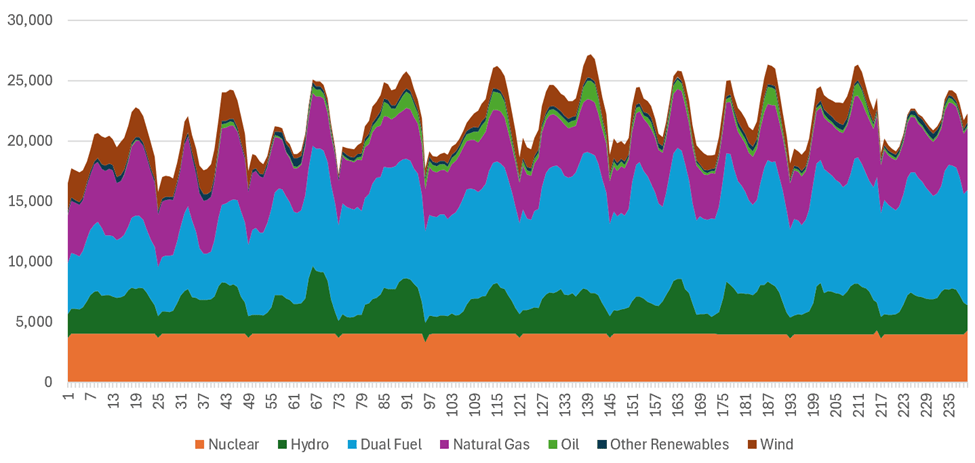

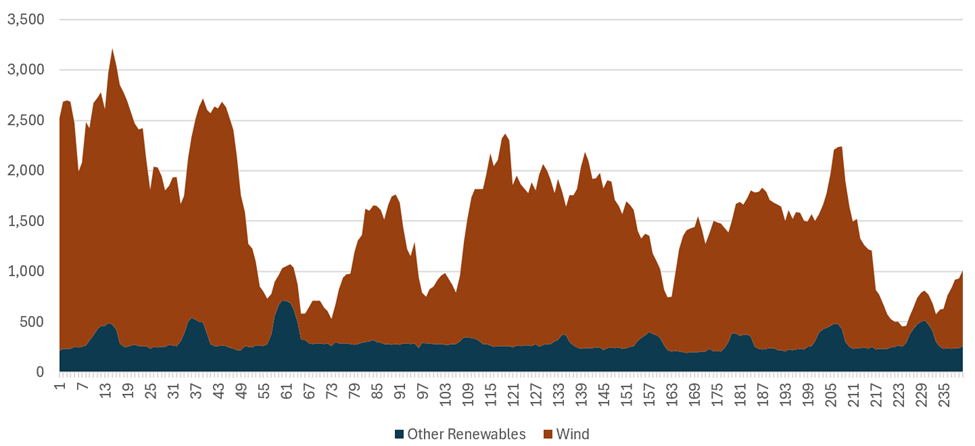

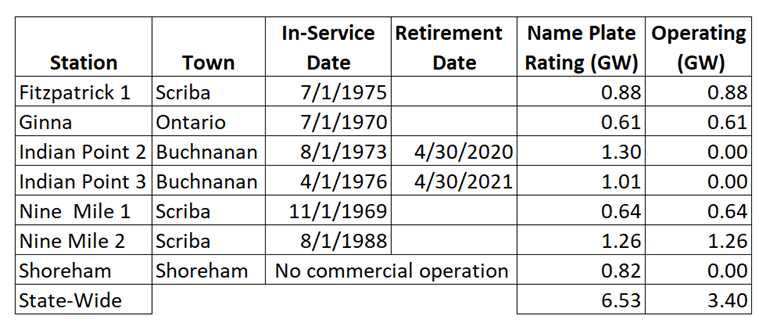

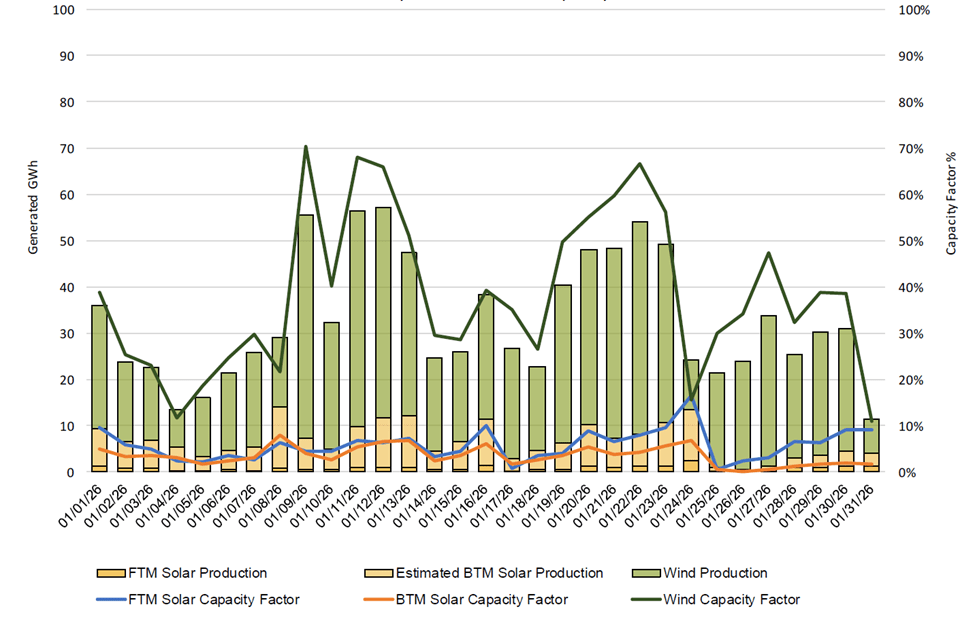

NYISO Daily Energy Production

As noted in my previous post, the dashboard real-time fuel mix data includes links to current and historical five-minute generation (MW) for energy generated in New York State that I used to calculate daily energy use (MWh). I also used the NYISO January Operations Performance Metrics Monthly Report. Figure 1 from that document breaks out the wind, utility-scale solar, also known as Front of the Meter (FTM) solar, and the rooftop top solar, also known as Behind the Meter (BTM) solar total daily production and capacity factors. Multiplying the capacity factor by the current capacity determines the daily energy production.

Figure 1: Net Wind and Solar Performance Total Daily Production and Capacity Factors

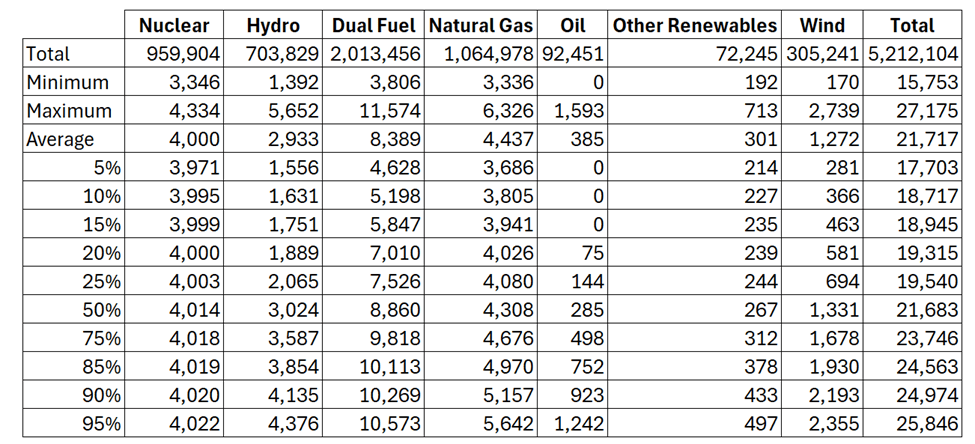

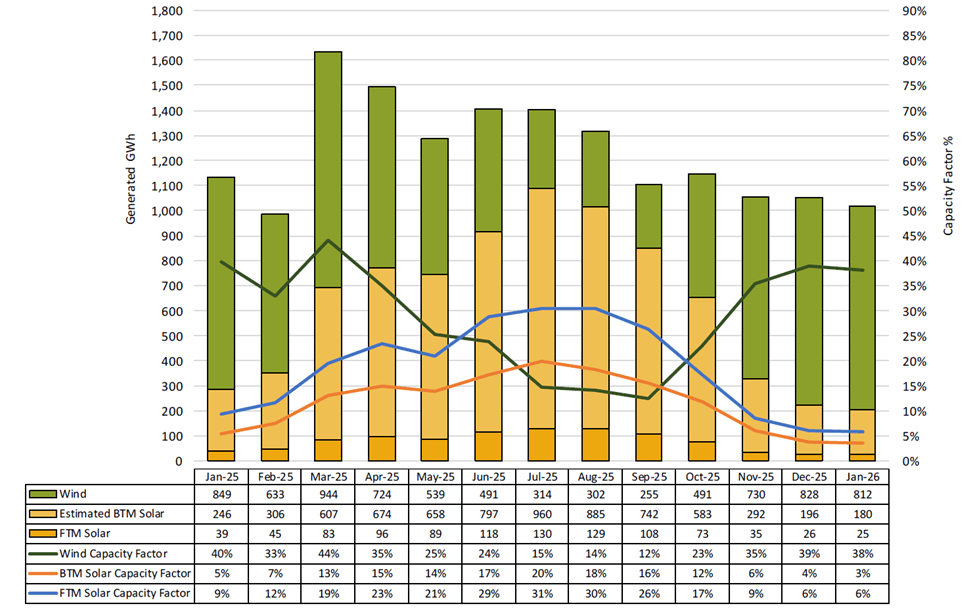

Table 1 combines data from the two NYISO sources to list daily energy production. The generator types include real-time fuel mix data base “Hydro” that includes pumped storage hydro; “Other Fossil Fuels” is oil; “Nuclear”; “Natural Gas”; and “Dual Fuel” which are units that burn both natural gas and oil. Two renewables are shown. “Wind”, mostly land-based wind but does include 136 MW of offshore wind from the NYISO real-time fuel mix data base. That source is also used for “Other Renewables” that covers solar energy (394 MW of “front-of-the-meter solar”), energy storage resources (63 MW), methane, refuse, or wood. However, in this table, I subtracted the FTM solar data from the January Performance Metric Report. Both the BTM solar and FTM solar are derived from that report. As an aside, I contacted NYISO to get the actual data for these parameters but did not get a response so I extractoplated values from Figure 1.

Table 1: Daily NYISO Energy Production (MWh) January 22 to January 31, 2026

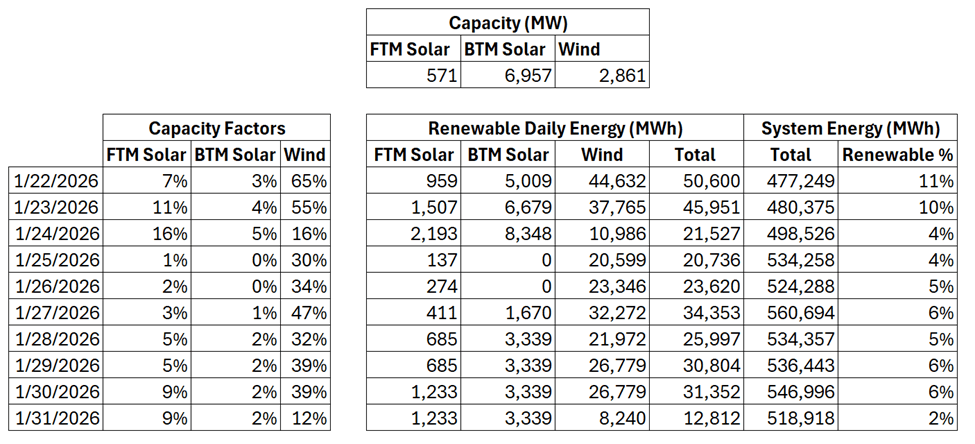

Table 2 consists of three smaller tables. On the left, capacity factors obtained from Figure 1 are listed for each day of the episode. At the top, resource capacity (MW) from the Operations Performance Metrics Monthly Report are listed for solar and wind resources. The main body of the table lists the calculated renewable daily energy (MWh) for each parameter and the renewable percentage of the total system energy that I calculated using the real-time fuel mix data. The most notable finding in this table is the observation that there were eight consecutive days when the total wind and solar production was 6% or less than maximum possible energy production.

Table 2: Capacity Factors Derived from Figure 5, Resource Capacity (MW) from Operations Performance Metrics Monthly Report, and Calculated Renewable Daily Energy (MWh)

Note the differences in wind production in these tables. Table 1 uses the estimated real-time fuel mix data and Table 2 the Performance Metrics Monthly Report. The differences are due to my real-time averaging assumptions and crude interpolation of values from Figure 1. While these energy production values are not precise, using the correct values will not change the conclusions.

Projections

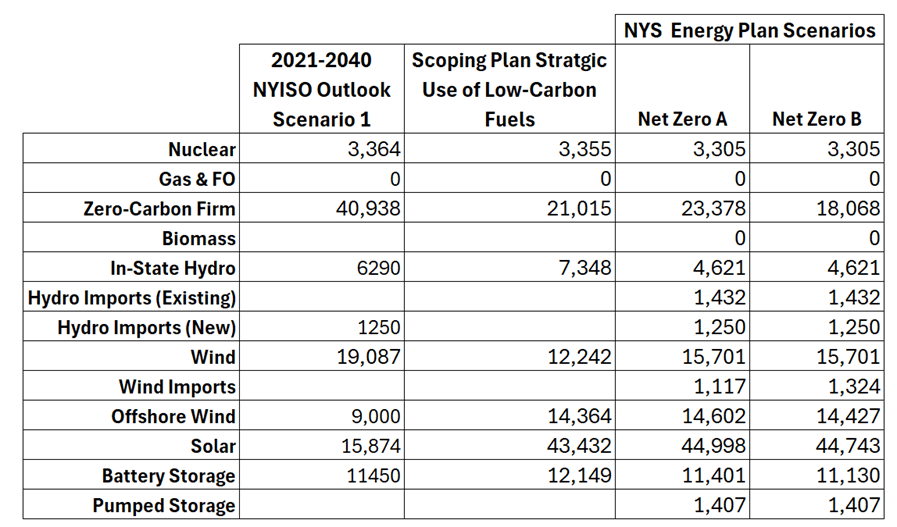

These results can be used to evaluate projections made for the generating resources necessary to meet the 2040 100% zero emissions electric generation mandate. Table 3 lists the projected 2040 capacity (MW) for four scenarios. I have included one from the NYISO, the primary projection from the Scoping Plan, and two “Net Zero” scenarios from the draft Energy Plan last summer. These scenarios represent four ways to achieve the 2040 mandate.

Table 3: Projected Electric Resource Capacity in 2040.

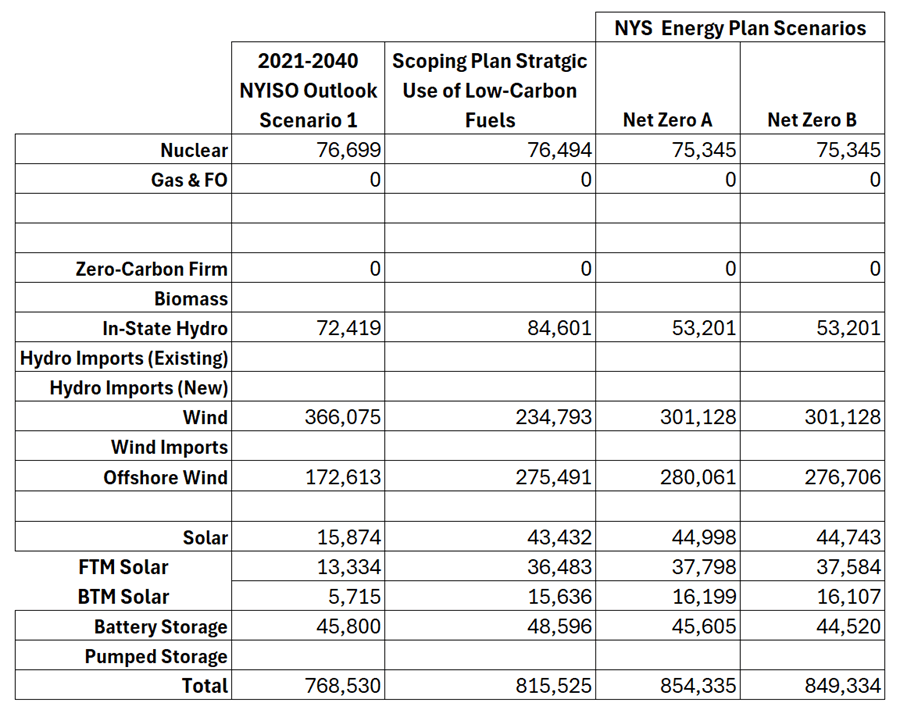

I estimated the daily energy production for the projected generating resources in Table 3. Daily production equals the capacity in MW times the capacity factor times 24 hours in the day. Capacity factors were derived from the real-time fuel mix or taken from the Operations Performance Metrics Monthly Report data in Table 2. I estimated the 2040 daily energy production for each scenario by multiplying those factors by the Table 3 resource capacities.

Table 4 is an example of the daily production for January 22, 2026. Note that consistent with the zero-emissions mandate there are no fossil fuel (Gas and Fuel Oil) emissions. Consistent with the NYISO projection for the winter peak no imported hydro generation is included. I calculated the battery storage energy production by multiplying the projected capacity times four hours (the current default discharge time). This assumption is included every day but note that if the batteries need to be charged using renewables there are instances where there would not be insufficient energy to recharge the batteries. This is a good example of the nuances that a NYISO detailed analysis can include.

Table 4: Daily Production (MWh) for January 22, 2026

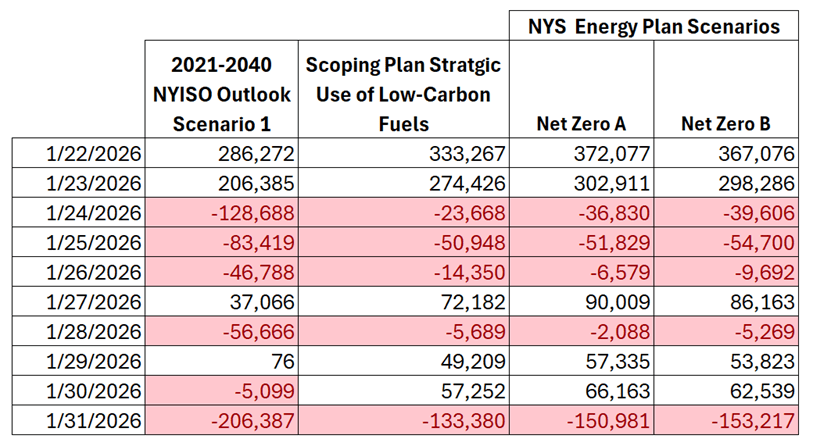

The goal was to compare the observed daily observed energy load in Table 1 against the projected energy projection in Table 4 to see if the resources provided enough energy to cover the observed generation load from the real-time fuel mix data during the conditions of the January 2026 storm. I did not have ready access to imports and exports so could not calculate the total system load. The results are presented in the following three tables. Each table lists the estimated total daily production minus the observed daily energy load for each scenario. If there is a deficit, then the results are highlighted in red. That means there would be a resource availability crisis which would require imports beyond what occurred on those days and load shedding to prevent a blackout.

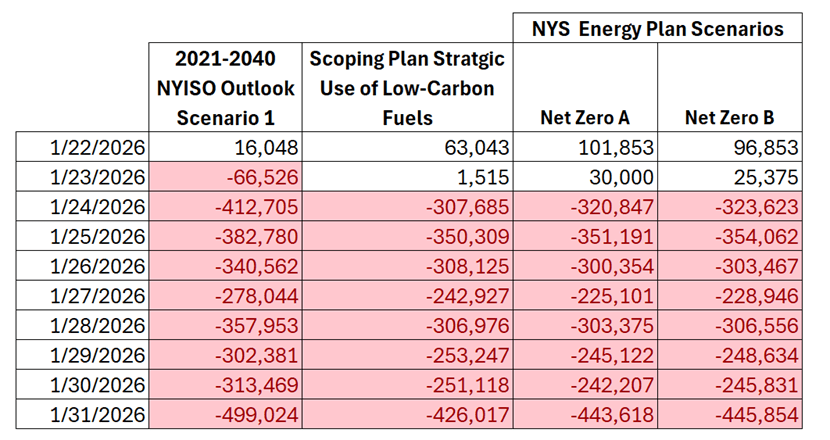

Table 5 lists daily projected energy production minus the observed load on each day during this episode. Because there are no existing dispatchable emissions free resources (DEFR) the methodology assumes no production from those resources. There are five days when none of the projected resource scenarios prevent a deficit.

Table 5: Projected Daily Energy Production Minus Current Energy Load (MWh) – Without DEFR Capacity

Table 6 lists daily projected energy production minus the estimated 2040 load on each day during this episode. The 2025 Load & Capacity Data Report aka Gold Book states that:

The New York electric system is projected to become a winter peaking system in future decades due to electrification, primarily from space heating and EVs. The timing of a crossover to a dual-peaking or winter peaking system is uncertain, and mainly influenced by the timing and composition of heating electrification.

I estimated the 2040 future load by prorating the observed load by the 2025-26 baseline winter coincident peak demand forecast and the 2040-41 forecast loads using Table I-1d: Summary of NYCA Baseline Winter Coincident Peak Demand Forecasts in the Gold Book. Because there are no existing dispatchable emissions free resources (DEFR) the methodology assumes no production from those resources. Not surprisingly, after the storm hit on January 24 none of the projected resource scenarios prevent a deficit of energy production without DEFR resources..

Table 6: Projected Daily Energy Production Minus 2040 Projected Energy Load (MWh) – Without DEFR Capacity

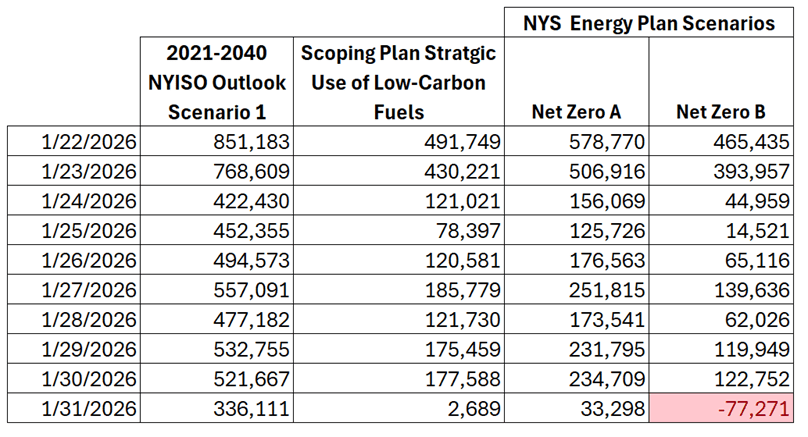

This preliminary analysis shows that DEFR is necessary. Table 7 lists daily projected energy production with the projected DEFR capacity operating minus the estimated 2040 load on each day during this episode. For the results shown, I assumed the capacity factor was 85%. Because no DEFR technology has been identified the capacity factor value is arbitrary. I found that if the capacity factor was equal or greater than 85% all the emissions-free mandate scenarios except “Net Zero B” shows a surplus of energy production. Net Zero B never shows a surplus even with a 100% capacity factor.

Table 7: Projected Capacity Daily Energy Totals (MWh) – Projected 2040 Loads with DEFR Capacity at 85%

Dark Doldrum and DEFR

The most notable finding in Table 2 is the observation that there were eight consecutive days when the total New York wind and solar production was 6% or less than maximum possible energy production. This is a perfect example of what the Germans call “Dunkelflaute”. That term refers to dark doldrums period when solar is reduced due to the length of day or clouds and there are light winds. This event was exacerbated by the snowstorm that covered solar panels with enough snow to eliminate production (Figure 1). Note that most rooftop solar in New York City is essentially flat so snow cover is a significant issue. In this case the episode was exacerbated by the snow depth, a crust of ice from a glaze of freezing rain that occurred at the end of the storm ,and the subsequent period of prolonged sub-freezing weather. Perhaps we should amend the worst weather label to “snowy dark doldrums”.

These conditions are the fundamental driver of the need for DEFR. It is disappointing that the clean energy advocates have continued to argue that the size of the DEFR gap has been overstated even after all the agencies responsible for electric system reliability argue otherwise. These results should put those arguments to rest.

Discussion

Isaac Orr and Mitch Rolling explain that there is another planning issue besides DEFR:

Most public discussions about renewables focus on energy production, but power systems are built around reliability during peak demand. Once you look at the grid through the lens of accredited capacity, that is, capacity that can be relied upon during peak demand—instead of annual energy, the resource allocations for different technologies look radically different. This is the energy vs. capacity distinction that most renewable resource debates miss.

The large projected wind and solar capacities do no good when the sun doesn’t shine and the wind doesn’t blow. This period exemplifies a period where that situation is evident even in this preliminary assessment. I have no doubt that NYISO staff will eventually evaluate these data in a more refined analysis because of its importance to planning policy. Their results will only differ in degree but I believe will conclusively show that DEFR is necessary. They may also show when DEFR is necessary as more renewables come online and existing dispatchable resources are shut down.

Conclusion

On January 31, 2026, the total renewable energy production was 2% of the potential amount available because of the weather conditions and there were at least eight consecutive days when the production was less than 6%. These are the conditions that require DEFR. Without that resource, intermittent, diffuse, and correlated electric generating resources are not viable.