I worry that the implementation of New York’s Climate Leadership & Community Protection Act (Climate Act) is going to increase the cost of energy to those least able to afford it. New York State does not have a clearly defined affordability threshold for the Climate Act nor does it track energy burden metrics. The only metric referenced in the Climate Act Scoping Plan is a Public Service Commission target energy burden set at or below 6 percent of household income for all low-income households in New York State. This post addresses that metric.

I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 350 articles about New York’s net-zero transition. I have devoted a lot of time to the Climate Act because I believe the ambitions for a zero-emissions economy embodied in the Climate Act outstrip available renewable technology such that the net-zero transition will do more harm than good by increasing costs unacceptably, threatening electric system reliability, and causing significant unintended environmental impacts. The opinions expressed in this post do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Climate Act Background

The Climate Act established a New York “Net Zero” target (85% reduction and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% reduction by 2030 and a requirement that all electricity generated be “zero-emissions” by 2040. The Climate Action Council is responsible for preparing the Scoping Plan that outlines how to “achieve the State’s bold clean energy and climate agenda.” In brief, that plan is to electrify everything possible using zero-emissions electricity. The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantifies the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan. After a year-long review, the Scoping Plan recommendations were finalized at the end of 2022. In 2023 the Scoping Plan recommendations are supposed to be implemented through regulation and legislation.

Renewable Energy Program Affordability Concerns

Proponents of the Climate Act don’t acknowledge that there is a affordability safety valve. New York Public Service Law § 66-p (4). “Establishment of a renewable energy program” includes constraints for affordability and reliability that could be used to limit the damage of Climate Act implementation. § 66-p (4) states: “The commission may temporarily suspend or modify the obligations under such program provided that the commission, after conducting a hearing as provided in section twenty of this chapter, makes a finding that the program impedes the provision of safe and adequate electric service; the program is likely to impair existing obligations and agreements; and/or that there is a significant increase in arrears or service disconnections that the commission determines is related to the program”.

There are affordability considerations regarding the constraint “significant increase in arrears or service disconnections”. I believe that the Hochul Administration’s Climate Action Council should define what that means. For example, Addressing Energy Poverty in the US offers possible criteria:

According to the U.S. Department of Energy, the average energy burden for low-income households is 8.6%. That is three times higher than for non-low income households, which is about 3%. And according to the Kleinman Center for Energy Policy at University of Pennsylvania, more than one-third of US households are experiencing “energy poverty,” having difficulty affording the energy they need to keep the lights on and heat and cool their home.

I think that New York should define its energy poverty targets and track them. Once the standard is defined, the status of the standard in New York should be monitored and made publicly available, and a threshold for acceptability established. For example, if the New York state low-income standard is 8.6% and the baseline energy burden level is 9%, then if the average energy burden increases to 10% provisions to temporarily suspend or modify the obligations should be triggered.

In order to implement my recommendation, the first task would be to establish the energy burden standard. As far as I can determine there is only one existing candidate. The Public Service Commission has a target energy burden set at or below 6 percent of household income for all low-income households in New York State. Reviewing it raises questions about its suitability for this purpose.

Order Adopting Low Income Program Modifications and Directing Utility Filings

The six percent target was included as part of Public Service Commission (PSC) Case Number: 14-M-0565, the Proceeding on Motion of the Commission to Examine Programs to Address Energy Affordability for Low Income Utility Customers. According to the PSC: “The primary purposes of the proceeding are to standardize utility low-income programs to reflect best practices where appropriate, streamline the regulatory process, and ensure consistency with the Commission’s statutory and policy objectives.” On May 20, 2016 the Order Adopting Low Income Program Modifications and Directing Utility Findings adopted “a policy that an energy burden at or below 6% of household income shall be the target level for all 2.3 million low income households in New York.”

The order notes that:

There is no universal measure of energy affordability; however, a widely accepted principle is that total shelter costs should not exceed 30% of income. For example, this percentage is often used by lenders to determine affordability of mortgage payments. It is further reasonable to expect that utility costs should not exceed 20% of shelter costs, leading to the conclusion that an affordable energy burden should be at or below 6% of household income (20% x 30% = 6%). A 6% energy burden is the target energy burden used for affordability programs in several states (e.g., New Jersey and Ohio), and thus appears to be reasonable. It also corresponds to what U.S. Energy Information Administration data reflects is the upper end of middle- and upper-income customer household energy burdens (generally in the range of 1 to 5%). The Commission therefore adopts a policy that an energy burden at or below 6% of household income shall be the target level for all low-income customers. The policy applies to customers who heat with electricity or natural gas.

The energy burden statistics cited in the Staff Report suggest a significant energy divide exists for low-income households. About 2.3 million households are at or below 200% of FPL, with an energy affordability “gap,” i.e., an average annual energy burden above the 6% level. Approximately 1.4 million of these households receive a HEAP benefit; however, for the 2013-2014 program year, only about 316,000 of those households received a benefit for utility service.

The Order notes that reducing this energy burden will be a challenge:

Closing such a wide gap for 2.3 million low-income households is a non-trivial pursuit, and will require a comprehensive effort that involves all of the tools at the state’s disposal, including, but not limited to, utility ratepayer-funded programs. A central role in achieving energy affordability for low income customers is played by the financial assistance programs administered by the Office of Temporary and Disability Assistance (OTDA), including the Home Energy Assistance Program (HEAP). Another important role is played by low income energy efficiency programs such as the Weatherization Assistance Program administered by New York State Homes and Community Renewal (HCR) and the ratepayer–funded EmPower-NY program administered by the New York State Energy Research and Development Authority (NYSERDA). Utility ratepayer funded programs also include the rate discount programs under discussion here, as well as investments designed to create opportunities for low income households to benefit from the cost savings offered by Distributed Energy Resources.

The Order goes on to offer suggestions to close the gap. It argues that a holistic approach among many state agencies is needed. For that to work there must be better coordination “among the various governmental and private agencies” that address this issue. The Order suggests that “achieving an optimal design will require building new partnerships and new mechanisms for identifying and enrolling eligible households”.

The most tangible aspect of the Order to address the energy burden problem was to establish low-income bill discount programs for each of the major electric and gas utilities. This included standardization of utility energy affordability programs statewide to “reflect best practices where appropriate, streamlining of rate cases, and greater consistency between the programs and the Commission’s statutory and policy objectives.”

On Augst 13, 2021 a press release describing the expansion of the low-income affordability program noted:

To reach the target of no more than a 6 percent energy burden for low-income New Yorkers, it would be necessary to coordinate and leverage all available resources at the State’s disposal, including multiple sources of financial assistance to lower customers’ bills, energy efficiency measures to reduce usage, and access to clean energy sources to lower the cost of the energy itself. As part of the Commission’s decision, Commission staff will work closely with other entities, including OTDA and the utilities, to ensure that low-income customers receive the assistance they need.

The utility companies submit quarterly reports documenting the number of low-income customers receiving discounts and the amount of money distributed. However, I have been unable to find any documentation describing how many customers meet the 6% energy burden criteria, much less any information on how those numbers are changing. The biggest problem with this energy burden program is that it only applies to electric and gas utility customers. Citizens who heat with fuel oil, propane, or wood are not covered.

Sc=oping Plan Energy Burden

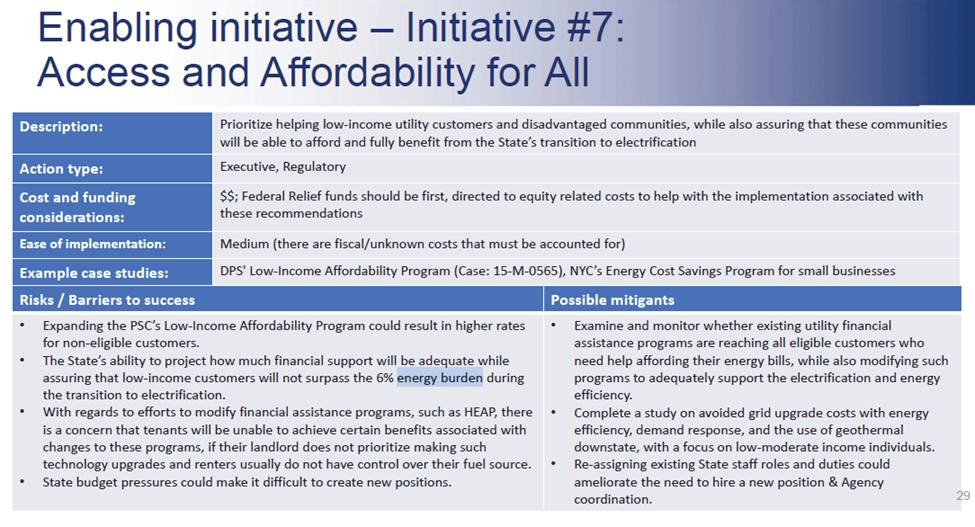

The only reference in the Scoping Plan to the PSC low-income energy burden target of 6% was in Appendix A, the Enabling Initiative #7 slide in the Power Generation Advisory Panel Considerations. The relevant sentence states a potential barrier to success is “The State’s ability to project how much financial support will be adequate while assuring that low-income customers will not surpass the 6% energy burden during the transition to electrification”. As noted previously, this ignores citizens who do not heat with electricity or natural gas.

I am aware of only one other suggestion for an affordability metric. In the 2021-2022 legislative session there was a proposal that included a requirement for state agencies to identify policies to ensure affordable housing and affordable electricity using an “affordability of electricity” metric that was defined as “electricity does not cost more than six percent of a residential customer’s income.”

I don’t think either is the appropriate metric for the Climate Act transition. The legislative proposal only addresses electricity and the PSC energy burden target only addresses only utility bills. This fails to address the concerns of citizens who heat their homes with fuels not provided by a utility such as heating oil or propane. The Climate Action Council has proposed a cap-and-invest program that will put a price on gasoline and diesel fuels. Those should also be considered part of the energy burden.

Reality Disconnect

The Order Adopting Low Income Program Modifications narrative on the clean energy transition is inconsistent with the experience of every jurisdiction that has tried to replace existing sources of electrical generation with wind, solar, and storage. The total costs to integrate intermittent and diffuse wind and solar inevitably increase costs. The argument in the Order claims:

In addition, the best solution for all customers, including low income, lies in facilitating opportunities to invest in clean energy and the means to reduce energy costs. Greater access and support for low income and underserved communities to Distributed Energy Resources is the best way to narrow the affordability gap that needs to be filled with direct financial assistance for customers with low incomes. Greater access to advanced energy management products to increase efficiency for low-income customers will empower those for whom these savings may have the greatest value, as well as allowing the most disadvantaged customers more choice in how they manage and consume energy.

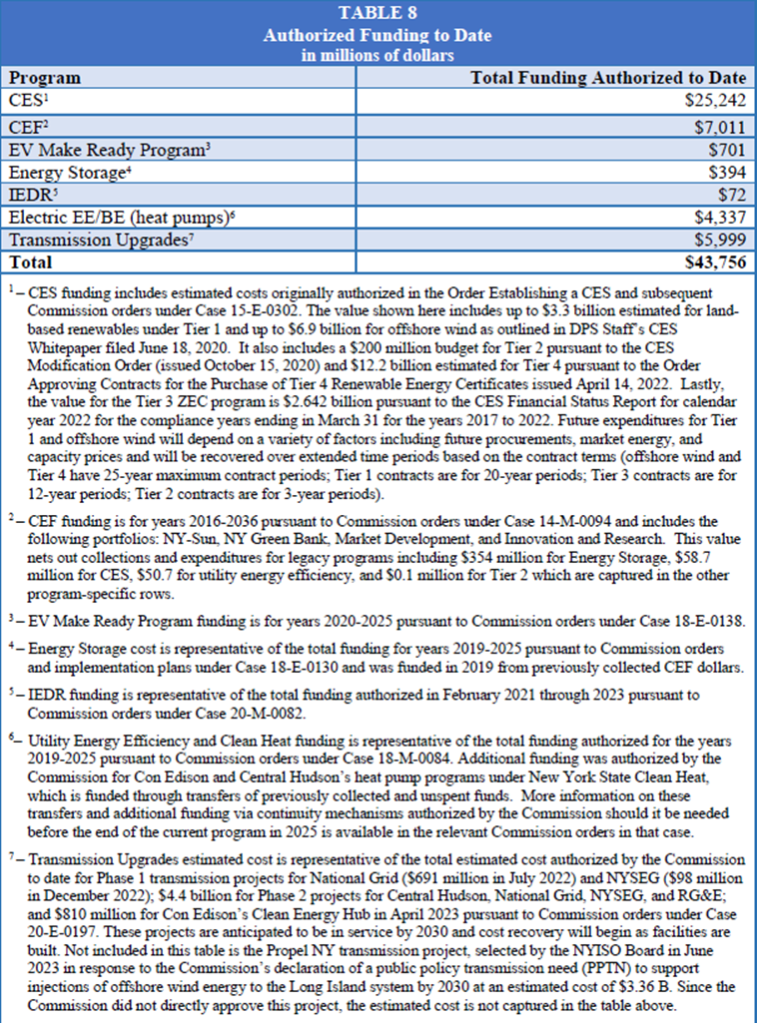

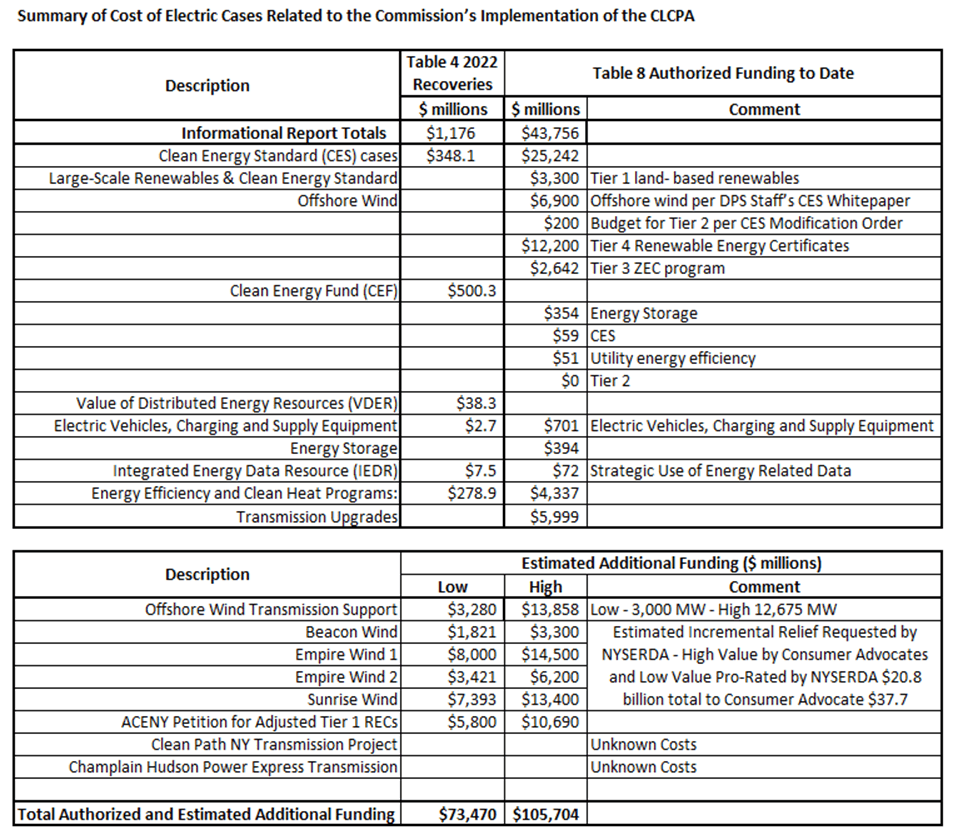

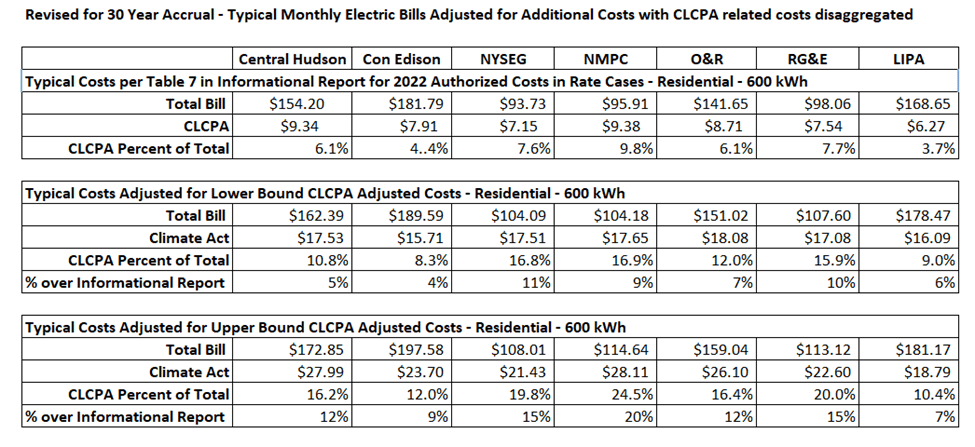

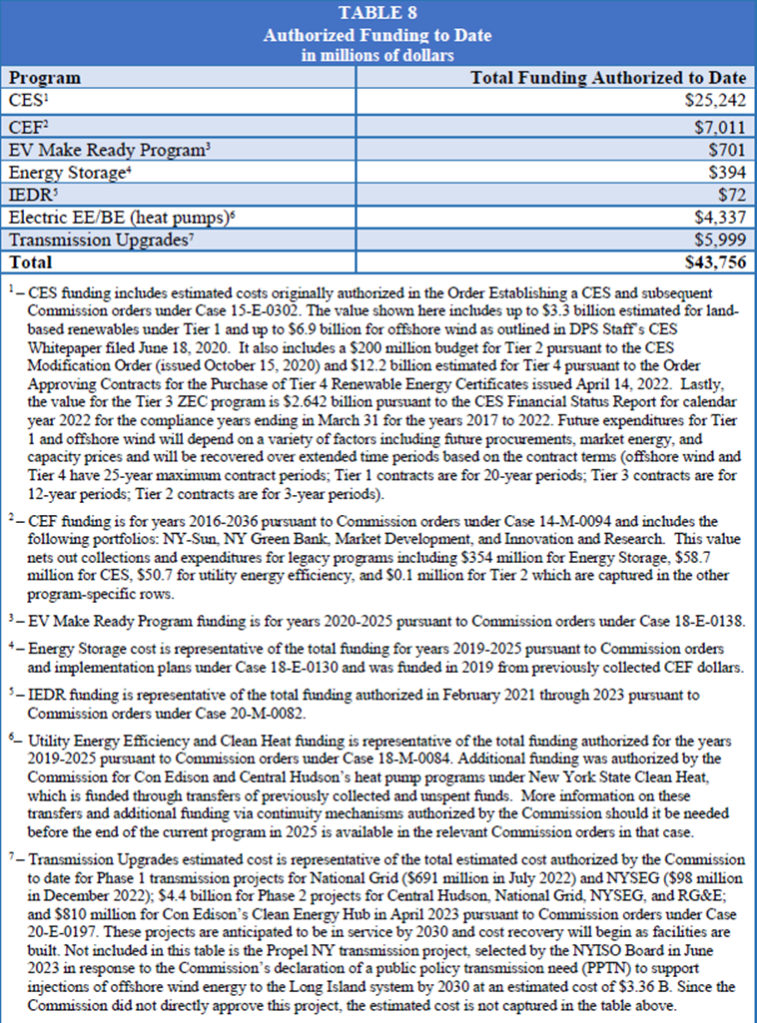

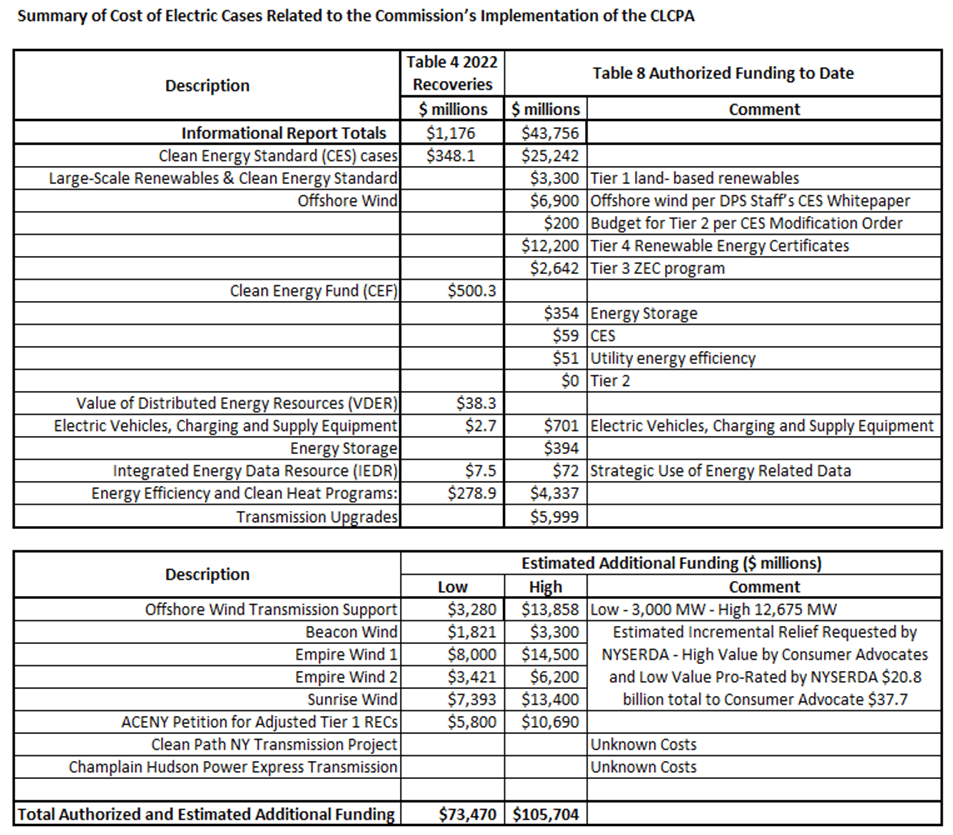

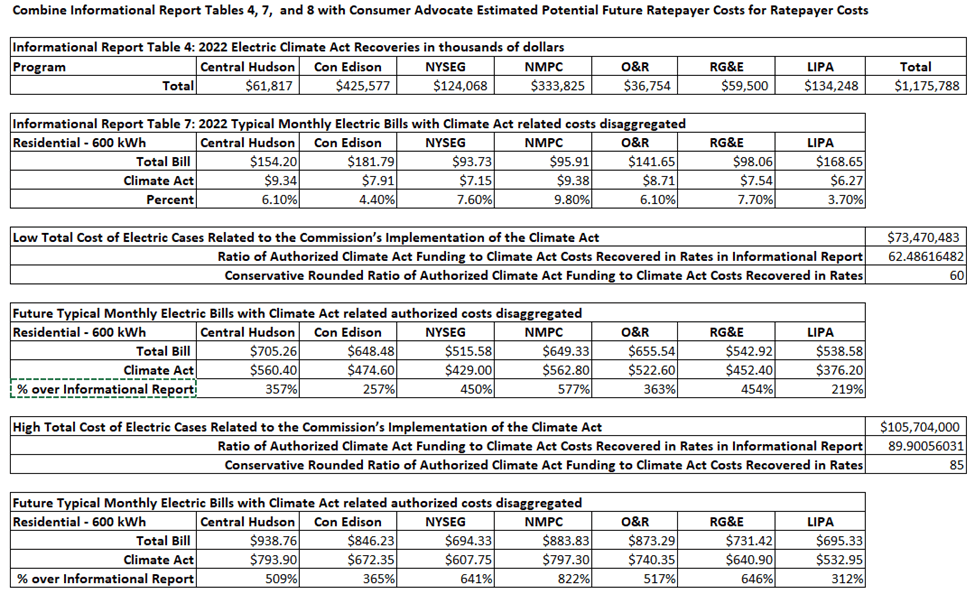

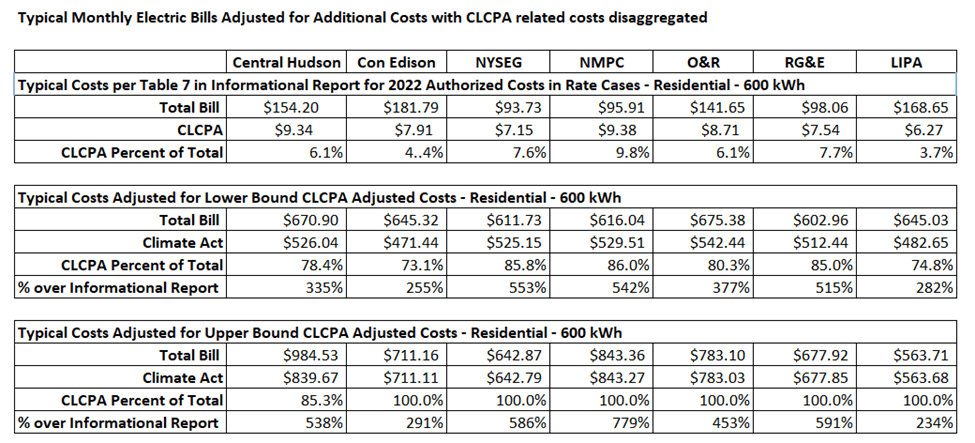

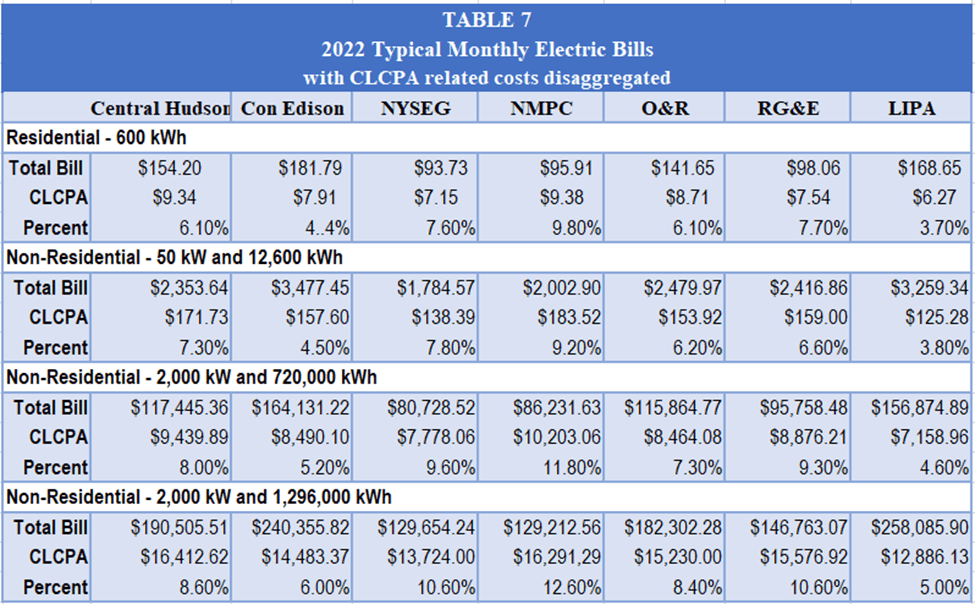

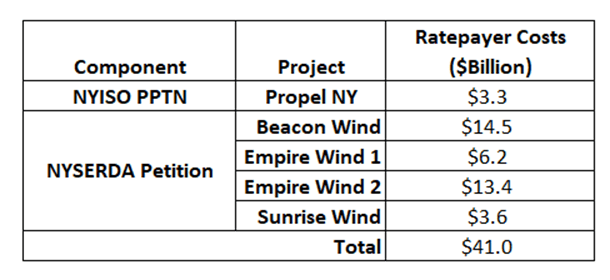

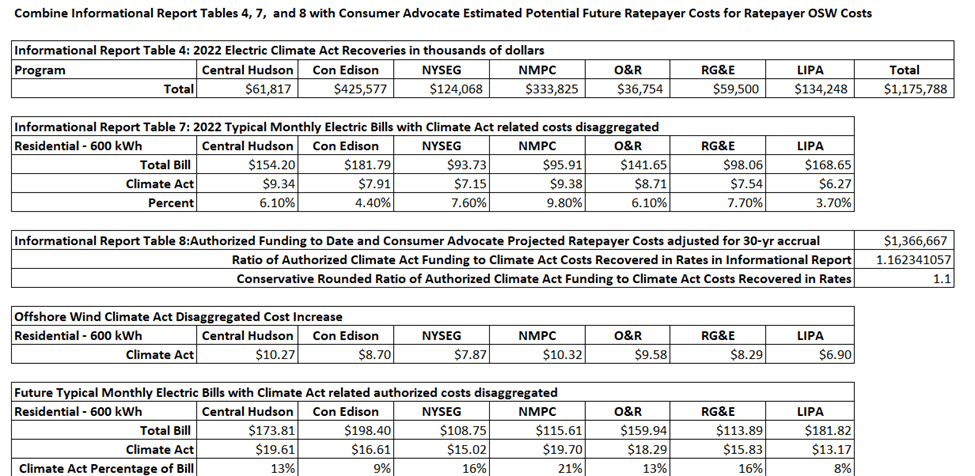

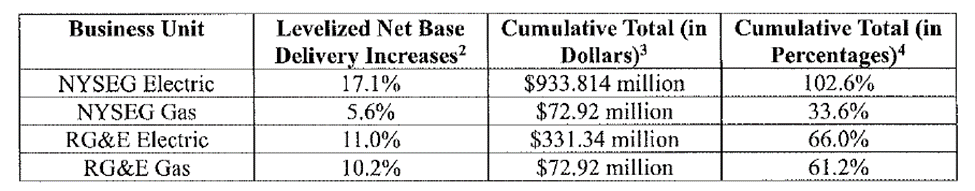

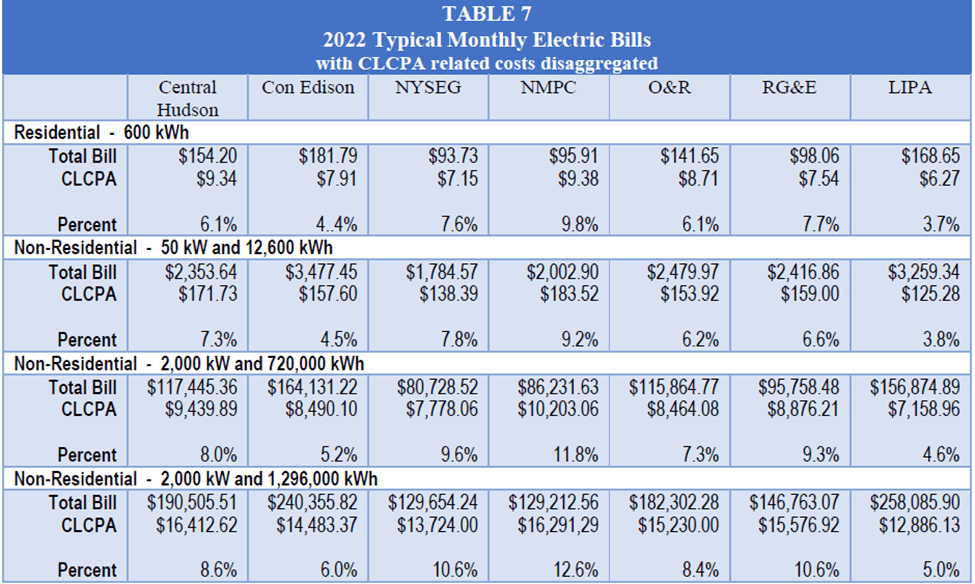

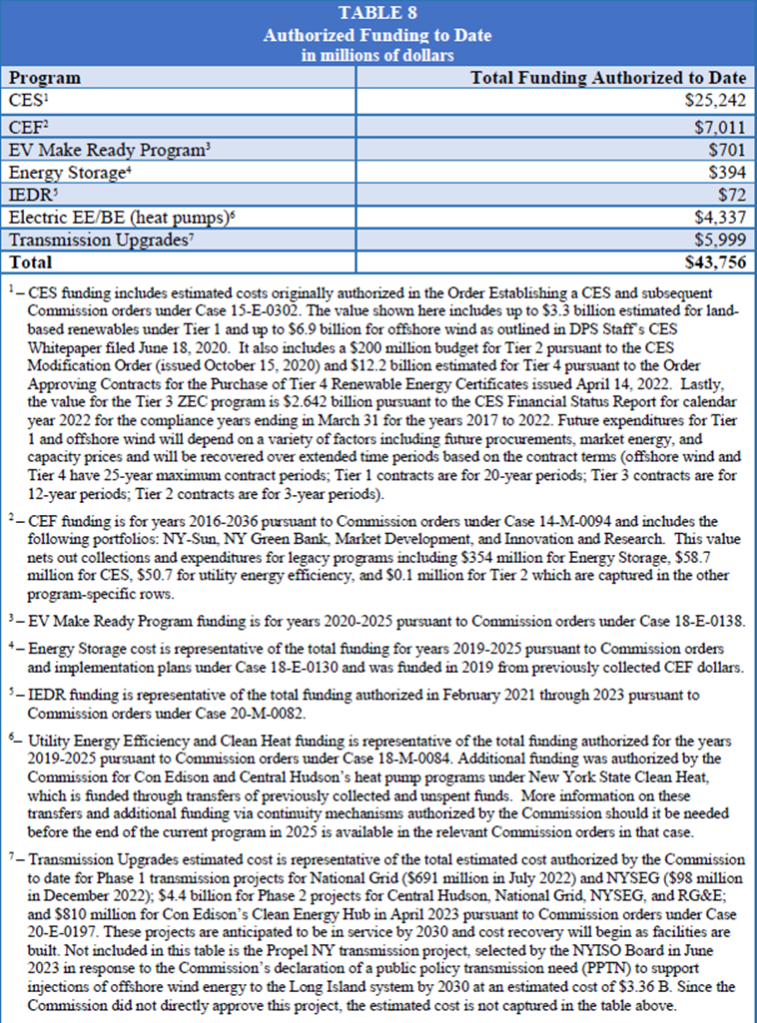

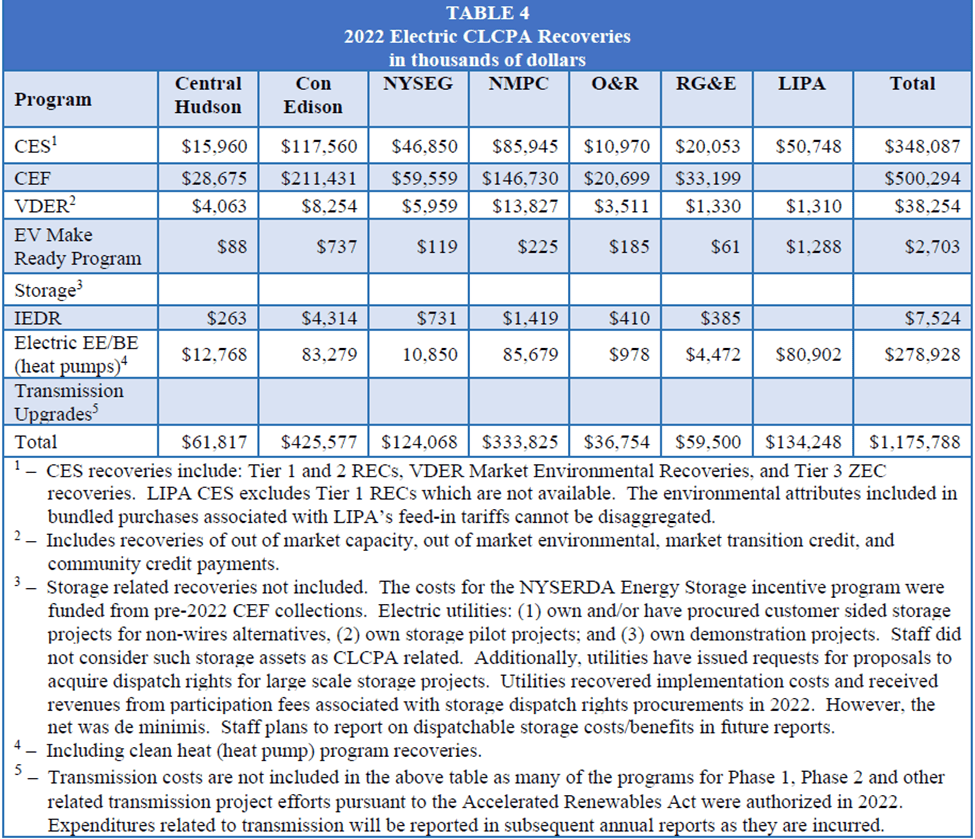

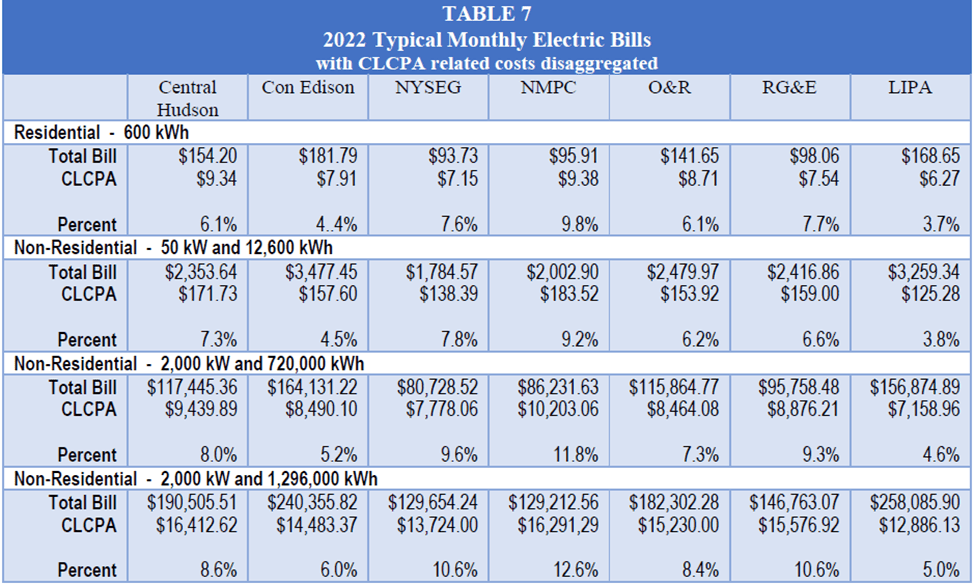

There are two aspects to the claim that clean energy will reduce energy costs that are problems. The first problem is the cost of new generating capacity in general. The New York State Energy Research & Development Authority recently announced that investments in three offshore wind and 22 land-based renewable energy projects totaling 6.4 gigawatts. For the offshore wind projects “the average bill impact for customers over the life of the projects will be approximately 2.73 percent, or about $2.93 per month.” For the other projects the average bill impact for customers over the life of the projects will be approximately 0.31 percent, or about $0.32 per month. If future projects somehow stay at the same price despite the costs of inflation, supply chain issues, and all the other reasons that developers for existing projects recently argued when calling for renegotiation of their project contracts, then the average monthly bill impacts will be $16.40 per month for the projected offshore wind, onshore wind, and solar capacity needed in 2030. That is just the cost of additional generating capacity and does not include the energy storage needed to address intermittency or transmission upgrades needed to address diffusivity. The Order’s claim that clean energy will reduce energy costs is unsupportable.

The second problem is that those additional costs necessitate changes to low-income customer support. In order to maintain the same relative level of energy burden more money will be required for these higher costs. Furthermore, the higher costs will mean more people will qualify for energy burden support. That additional money must be covered by the remaining ratepayers, driving their costs higher, and increasing the number of people that quality for energy burden support. At some point this spiral of costs will become unsustainable.

Conclusion

Increased energy costs are regressive taxes and impact those least able to afford them the most. I believe that the net-zero transition will inevitably increase energy costs. Surely there is a point when the costs are unaffordable overall or the impacts to low-income ratepayers are unacceptable.

I believe it is necessary to establish a energy burden standard. The first step to address this problem is to develop a transparent metric for energy burden. The Public Service Commission target energy burden of 6 percent of household income only applies to utility costs. A metric that considers all energy costs including transportation has to be developed. The second step would be to establish energy burden acceptability criteria that could be used to comply with the New York Public Service Law § 66-p (4) affordability considerations associate with the constraint “significant increase in arrears or service disconnections”. Finally, a transparent and readily available tracking system needs to be established.

Clearly there is a reluctance by any of the politicians supporting the clean energy transition to be accountable for costs. There is an existing energy burden metric but the status of ratepayers relative to the 6 percent metric is not documented. It is almost as if the State does not want us to know where we stand. As such, the possibility of properly tracking energy poverty is unlikely. I think that is to the great shame of the proponents of the clean energy transition.