Christopher Walsh’s latest article in the Easthampton Star, South Fork Wind’s Electricity Generation Proves Reliable repeats claims from the developer that the facility provides reliable energy. An infographic prepared for the U.S. Department of War’s Defense Counterintelligence Security Agency, defines malinformation as sabotage because it is based on fact but is used out of context to mislead, harm, or manipulate. Walsh’s article is based on fact but the information presented is used out of context to mislead readers into believing that the South Fork offshore wind facility provided reliable electric generation to the grid during this winter’s extreme period.

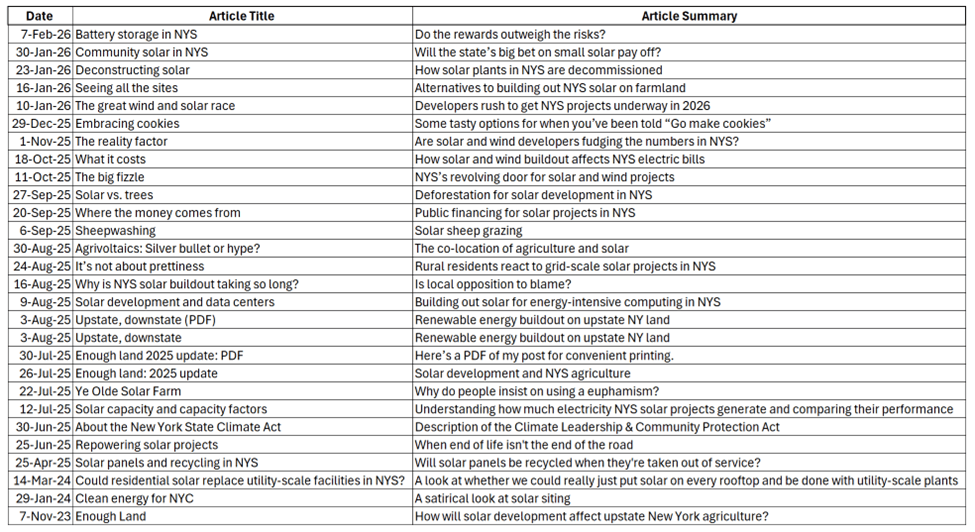

I am convinced that implementation of the New York Climate Act net-zero mandates will do more harm than good if the future electric system relies only on wind, solar, and energy storage because of reliability and affordability risks. I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 600 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

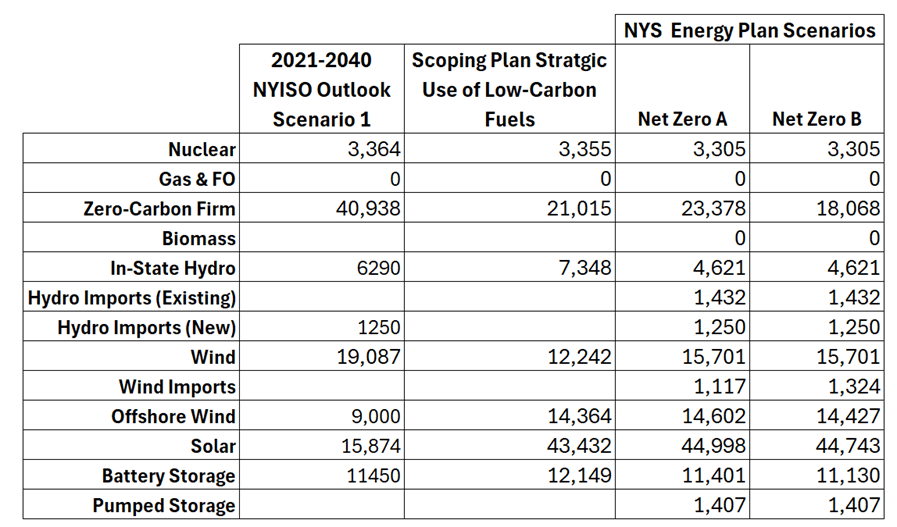

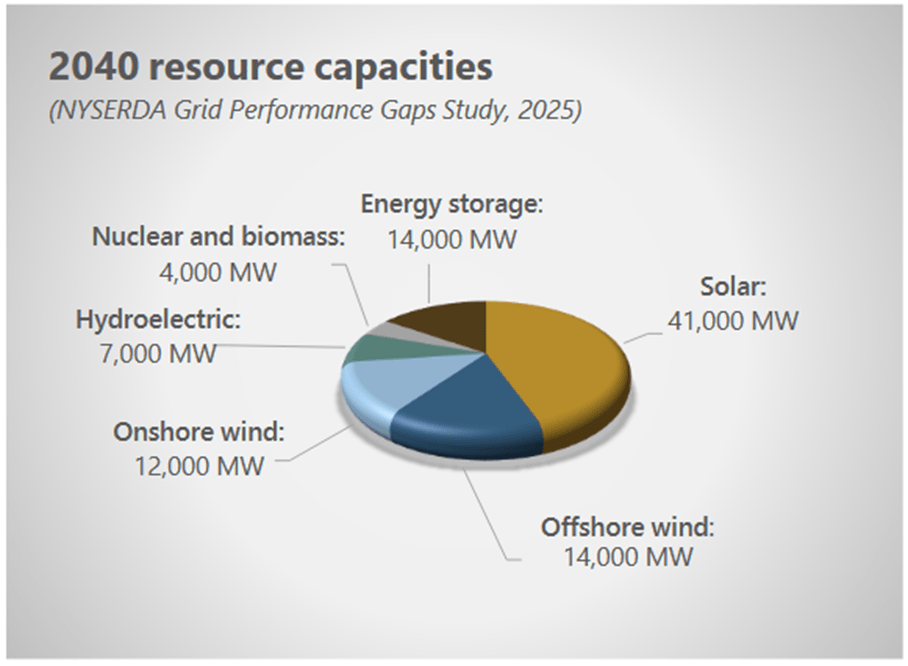

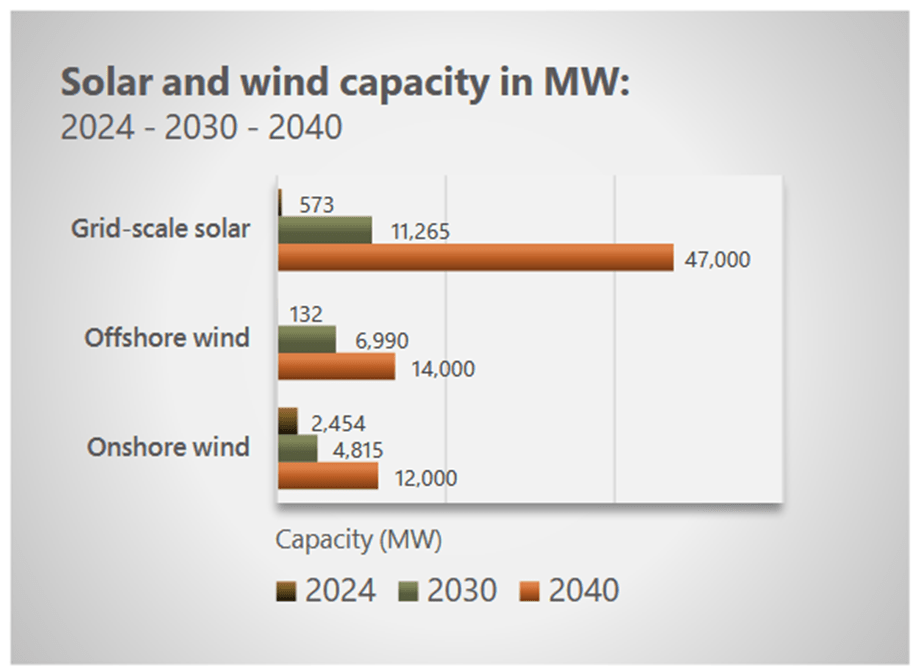

The Climate Leadership & Community Protection Act (Climate Act) established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes a specific target for 9,000 MW of offshore wind capacity by 2035.

Ørsted’s South Fork Wind is the only New York operational offshore wind facility. It has 12 turbines with 132 MW of capacity. There are two other New York offshore wind facilities under construction but both had work suspended in December when the Trump administration issued a stop-work order suspending the lease. A federal judge issued a temporary injunction in January 2026 allowing construction to resume while the legal case proceeds.

Empire Wind 1 (810 MW), developed by Equinor, is the first offshore wind project that will deliver power directly into New York City. The project was approximately 60% complete when work was suspended. Empire Wind aims to deliver first electricity by late 2026 and reach commercial operation by 2027. Supporting transmission support is proceeding. As of late 2025, export cable installation was actively underway. Equinor reported that trenching, cable-laying, and cable pulling were ongoing on the outer continental shelf, and the export cable was brought onshore in 2025. The onshore substation at SBMT was under construction with transformer delivery completed in early 2025. An offshore substation was scheduled for installation in early 2026.

Sunrise Wind (924 MW), developed by Ørsted, also suspended work in December but work was cleared to resume in early February. Approximately 44 of 84 monopile foundations were installed, and the HVDC offshore substation arrived from Norway and was installed in September 2025. The project is expected to be completed and operational in 2027. It is the first U.S. offshore wind project to use High Voltage Direct Current (HVDC) transmission, which reduces the number of cables needed and improves efficiency. As of December 2025, onshore transmission work — including the converter station and duct bank — was over 90% complete. Offshore, the export cable was being tunneled through the surf zone (at 11–60 ft deep), with nearshore installation to follow.

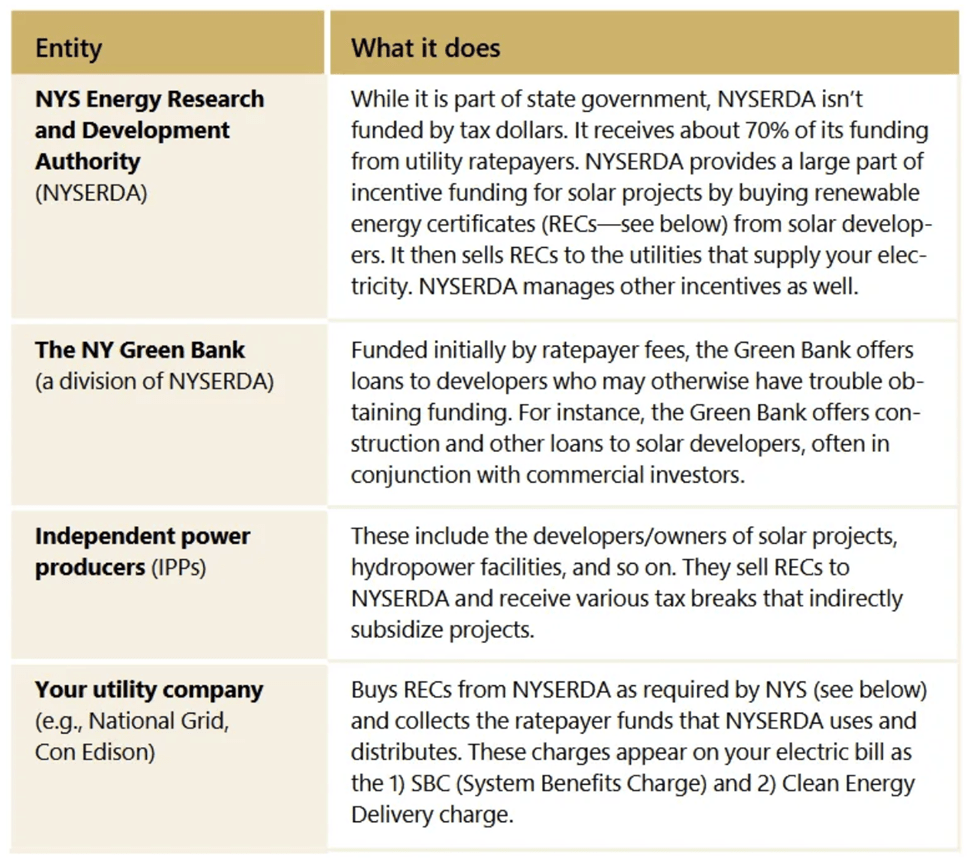

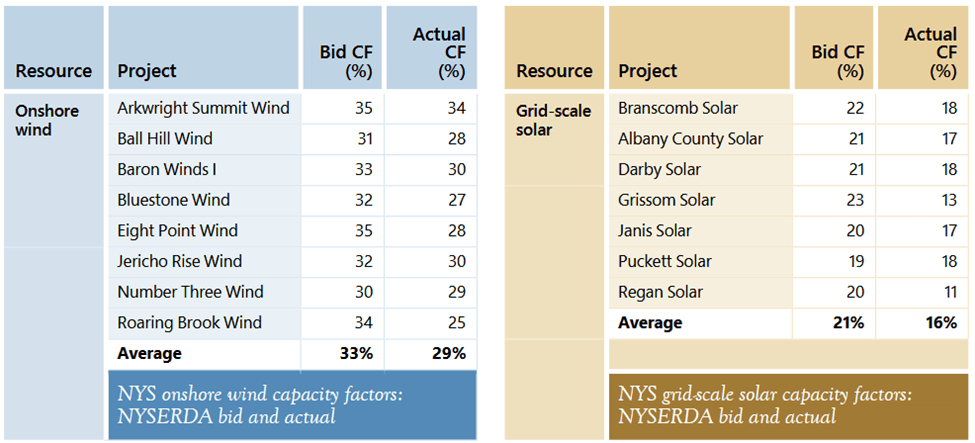

The prices for offshore wind are significantly higher than land-based renewables. Empire Wind 1 and Sunrise Wind contracts were repriced by the New York State Energy Research & Development Authority (NYSEDA) in early 2024 to prevent cancellation. Their combined weighted average price is $150.15/MWh. The 2024 NYSERDA Tier 1 solicitation average strike price was $94.73 for 23 projects totaling ~3.5GW. That makes the offshore wind costs 59% higher.

Clearly, the Climate Act mandate for 9,000 MW of offshore wind is in jeopardy. The question is whether that is a bad thing or not. Walsh’s article argues that it is a bad thing.

“Reliable” South Fork Wind

Christopher Walsh’s article in the Easthampton Star, South Fork Wind’s Electricity Generation Proves Reliable is quoted below with my annotations.

As the Trump administration pledges to appeal all five court rulings that sided with offshore wind farms under construction on the Eastern Seaboard, and Canadian officials call on the industry to shun the United States in favor of the ocean off its shores, developers of South Fork Wind, the nation’s first commercial-scale offshore wind farm, are pointing to its reliable generation of electricity in its second year of operation and during this winter’s extreme cold.

Renewable advocates focus on energy production, but power systems are built around reliability during peak demand. If you look at the grid through the lens of accredited capacity, that is, capacity that can be relied upon during peak demand – instead of average energy, the resource allocations for different technologies look radically different. This is the energy vs. power capacity distinction that Walsh ignored.

The 12-turbine, 132-megawatt farm, electricity from which makes landfall in Wainscott, achieved a 46.3-percent capacity factor in 2025. “Capacity factor” refers to real-world performance, or the ratio of energy generated versus the maximum theoretical output of an installation running at its full rated capacity around the clock. For offshore wind, typical values are between 20 and 40 percent, reflecting intermittent wind speeds, maintenance downtime, and site efficiency.

In January of this year, South Fork Wind delivered a 52-percent capacity factor, comparable to New York State’s most efficient gas plants. Output at offshore wind farms in the Northeast — South Fork Wind, the smaller Block Island Wind, and Vineyard Wind 1, which is still under construction — is typically at its strongest during winter months, when energy supplies on Long Island are often constrained.

I take exception to the claim that the 52% capacity factor is comparable to gas plants. If a gas plant was only limited by maintenance downtime it can easily achieve an 85-percent annual capacity factor but more importantly they can be dispatched by the New York Independent System Operator (NYISO) as necessary to match loads including peak load conditions.

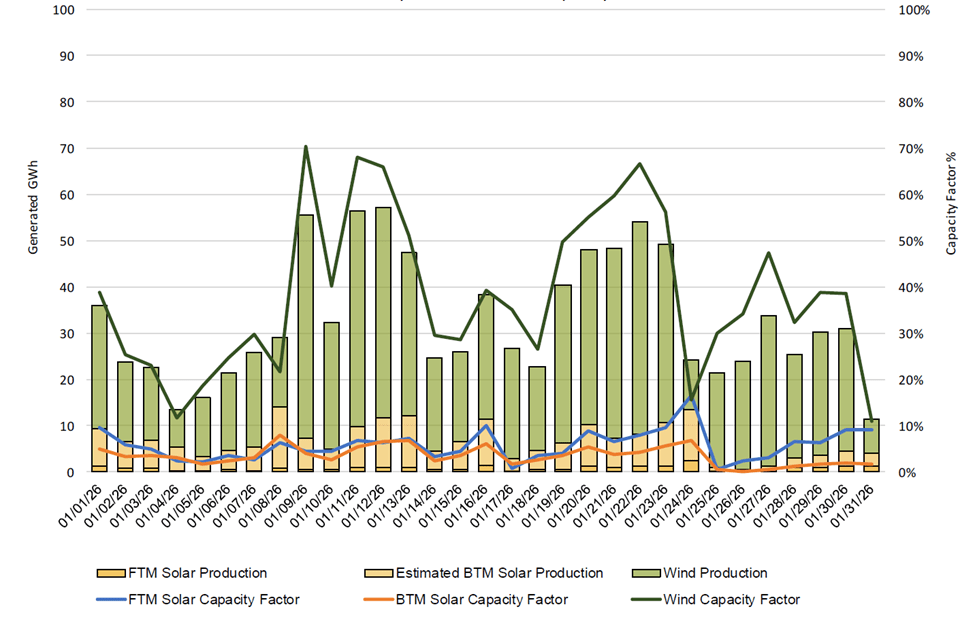

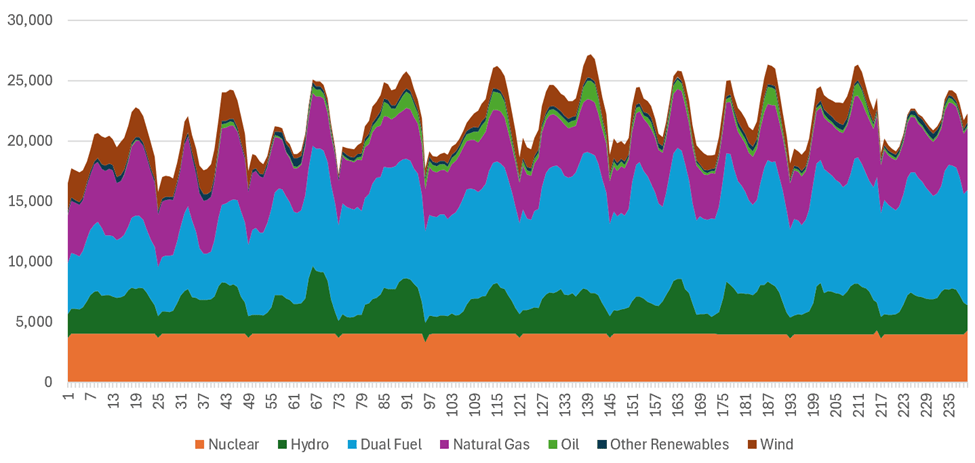

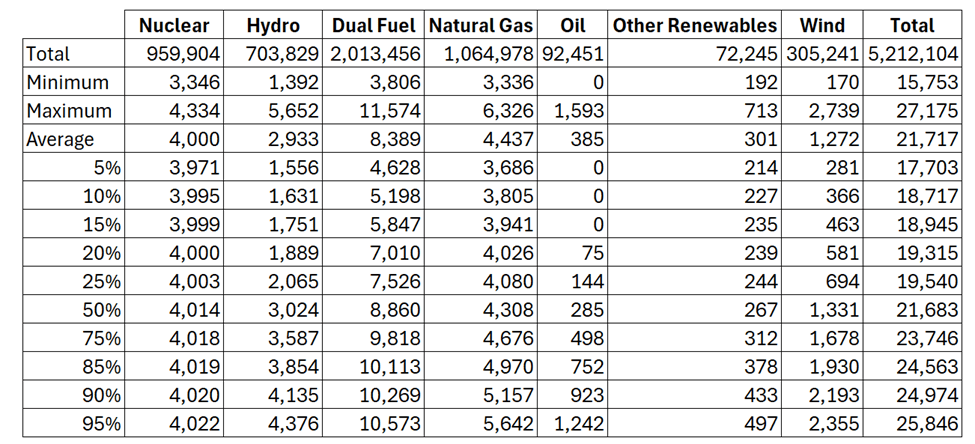

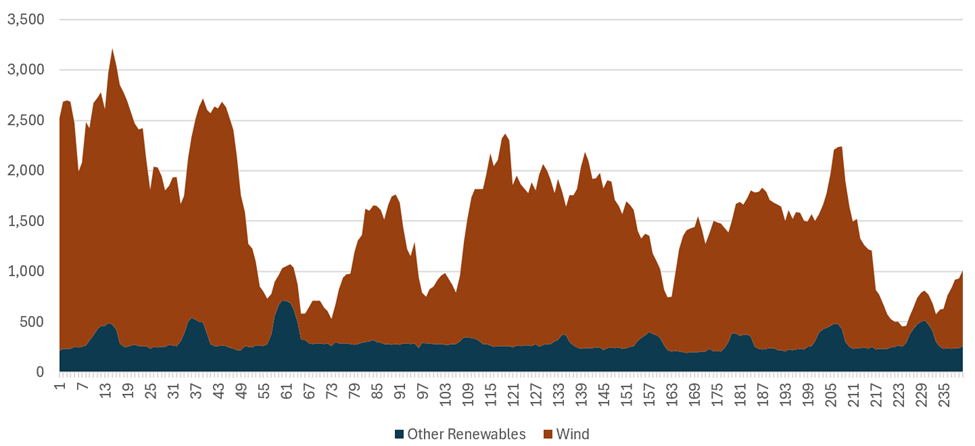

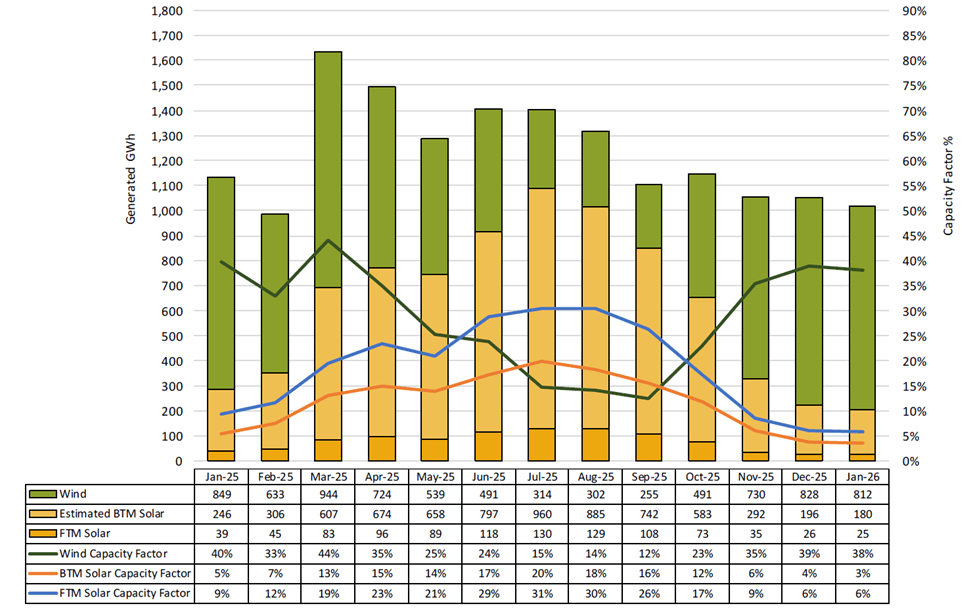

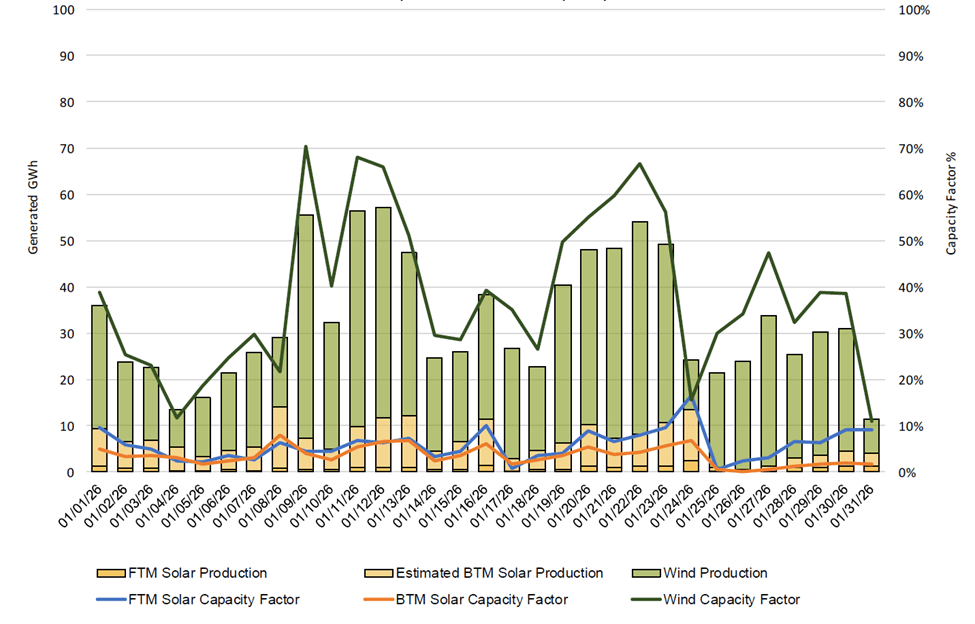

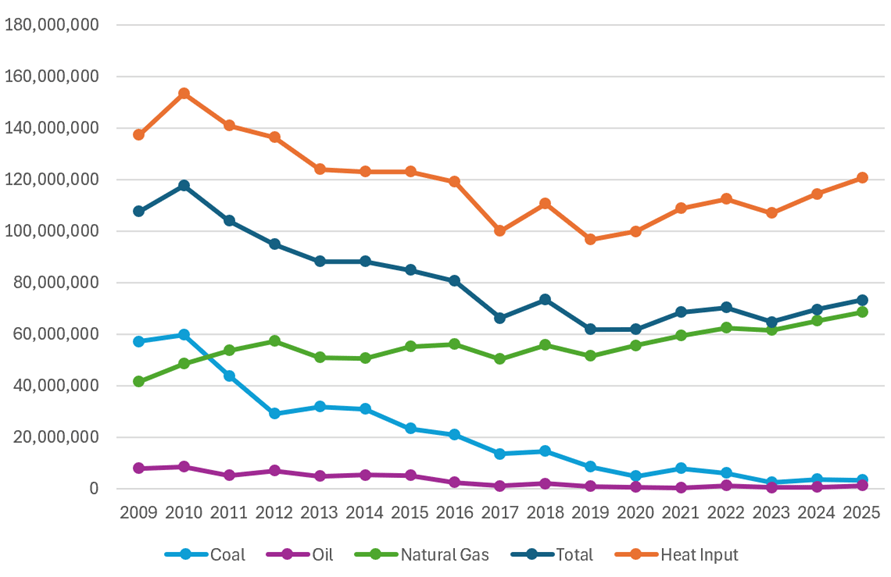

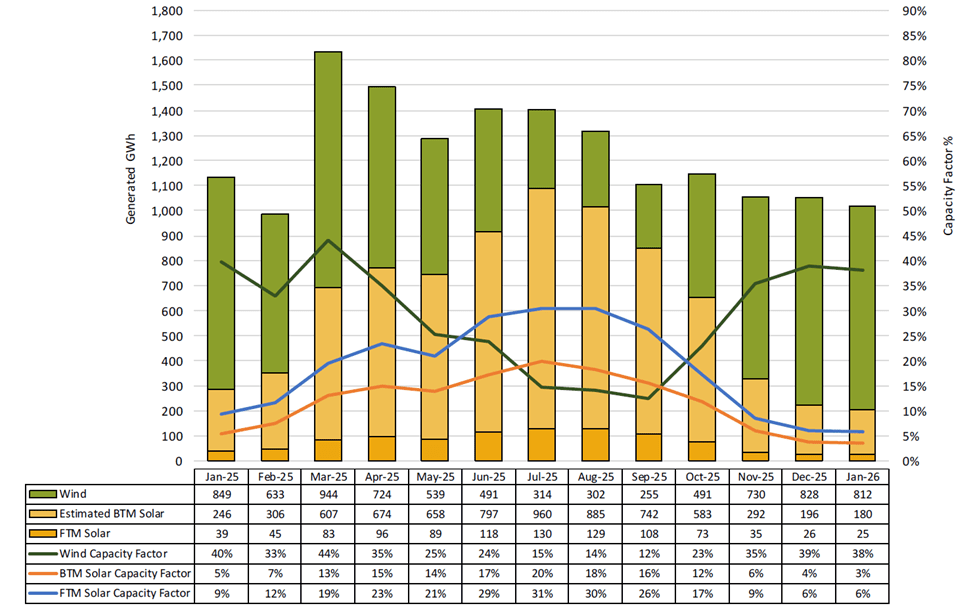

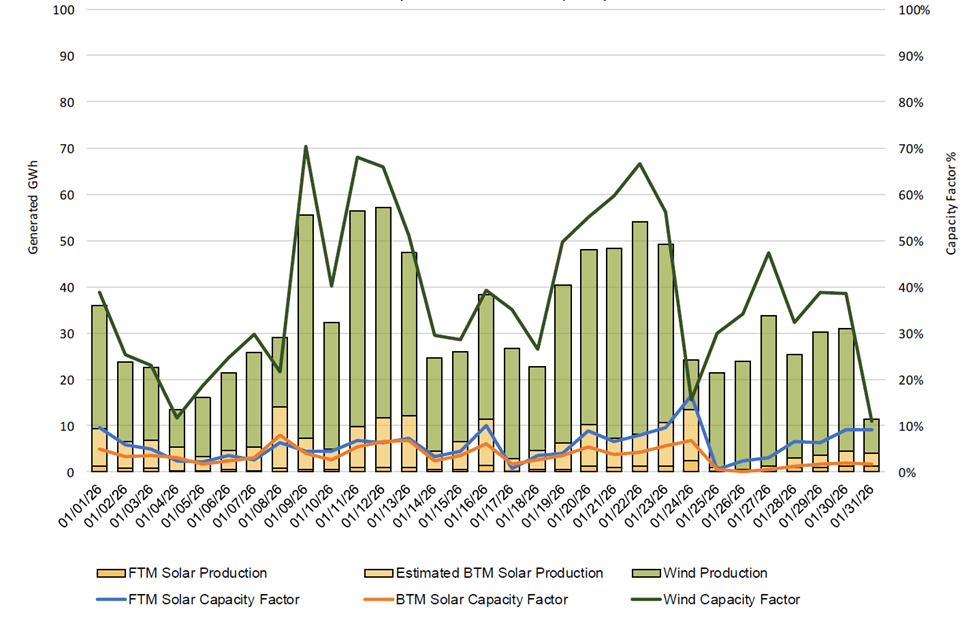

The NYISO January Operations Performance Metrics Monthly Report includes a graph of net statewide wind and solar performance total monthly production and capacity factors (Figure 1). These data show that the January 2026 monthly capacity factors for all New York State wind facilities was 38%, Behind the Meter (BTM) rooftop solar was 3% and the Front of the Meter (FTM) utility-scale solar was 6%. Offshore wind facilities are expected to perform better than onshore wind facilities and this is clearly shown by the South Fork Wind performance.

Figure 1: Net Wind and Solar Performance Total Monthly Production and Capacity Factors

Source: NYISO January Operations Performance Metrics Monthly Report

The article goes on:

Over the course of 2025, South Fork Wind generated electricity on 99 percent of all days and across 90 percent of all hours, according to its developers, the Danish energy company Orsted and the German company Skyborn Renewables. The developers assert that the wind farm generates electricity sufficient to power 70,000 average-size residences.

These claims have the reliability challenge exactly backwards. South Fork Wind did not generate electricity on 1 percent of all days or at least 3 whole days and across 10 percent or 876 of all hours. The problem is that peak loads are commonly associated with high-pressure systems that suppress wind generation. As a result South Fork Wind was likely unavailable when needed most.

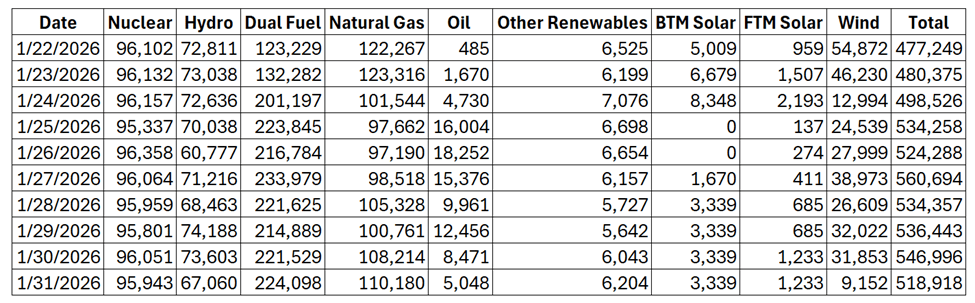

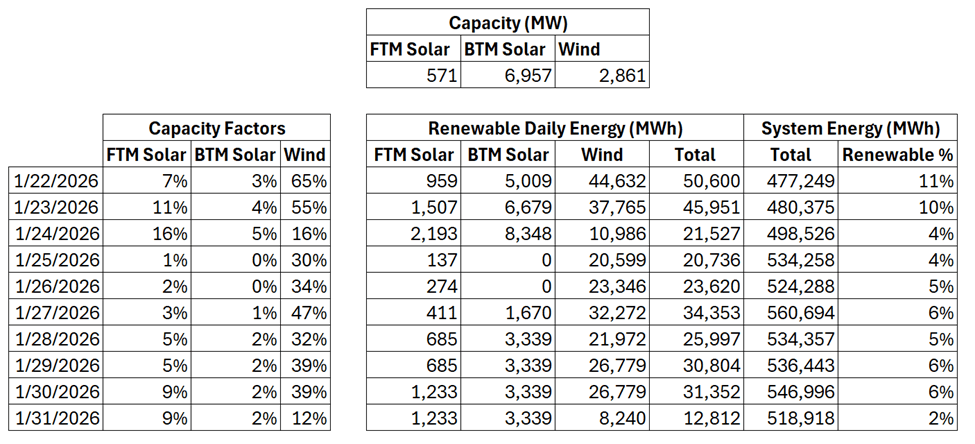

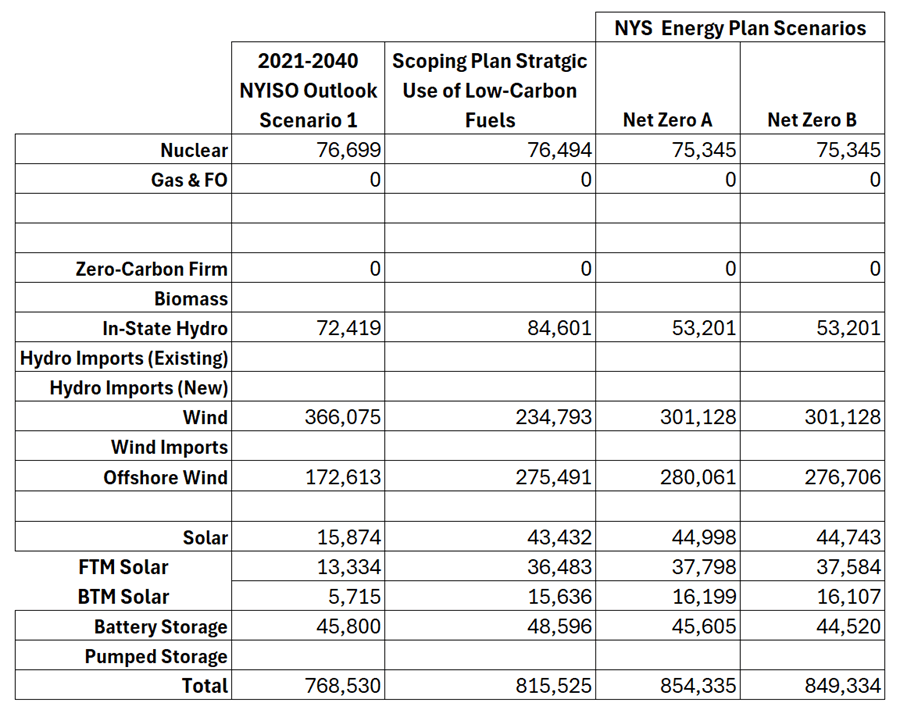

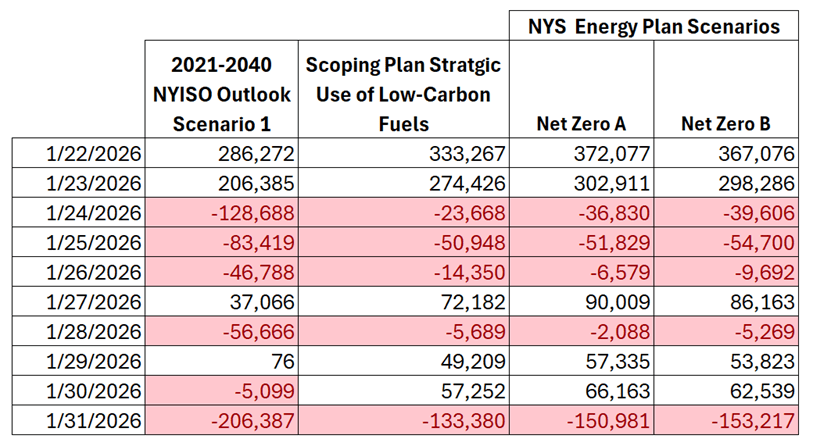

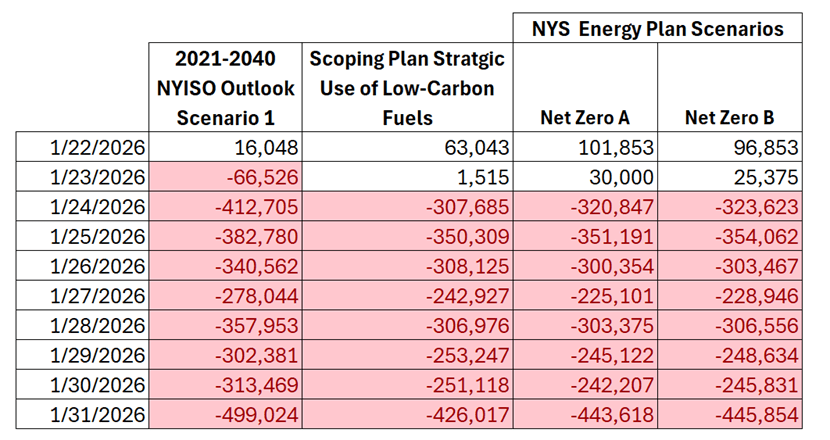

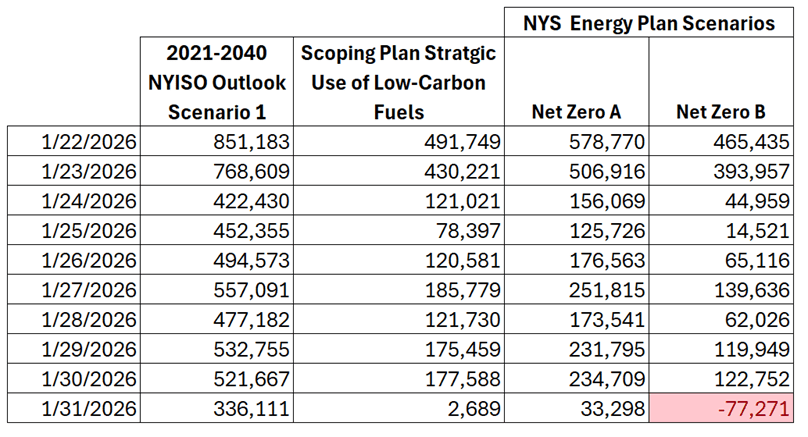

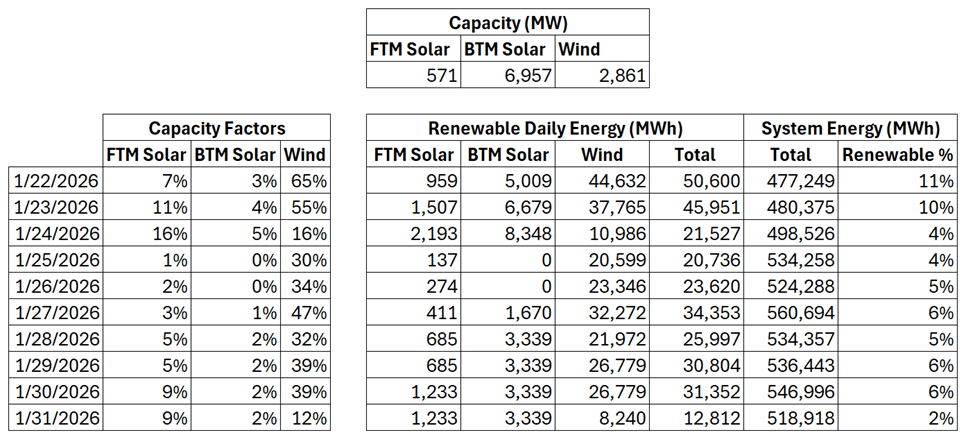

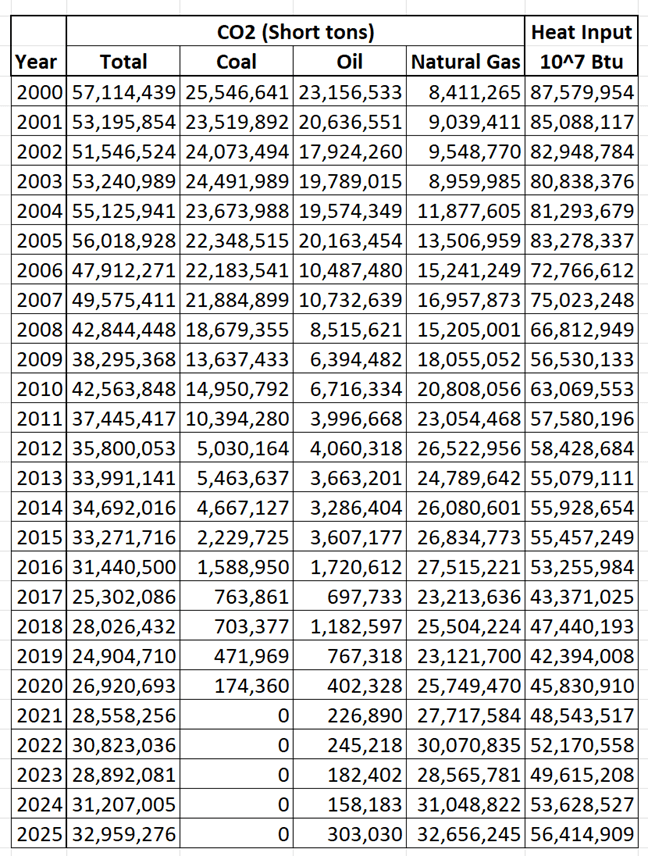

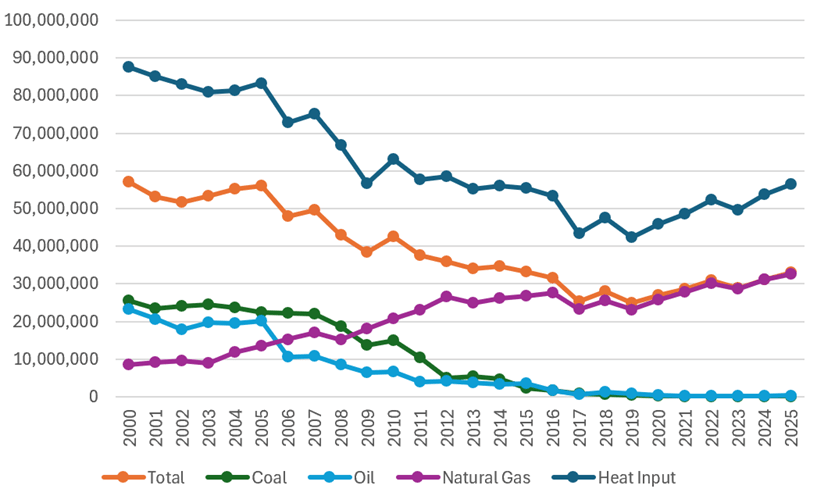

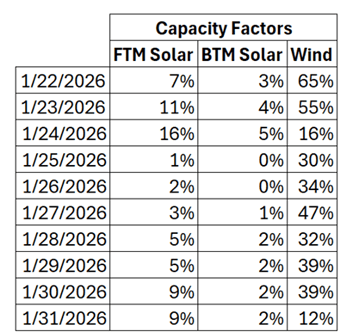

This effect was seen during the January 24 to January 27, 2026 winter storm. Following the storm there was a period of prolonged sub-freezing weather that caused a peak in the electric load. Table 1 lists daily extrapolated statewide capacity factors from Figure 2. Consider January 31 when the statewide capacity factors were BTM solar 2%, FTM solar 9%, and wind 12%. The total daily renewable energy capacity factor was 10% and only provided 2% of the system’s daily load. Data from individual facilities are not available but the hourly statewide data indicate that wind capacity was less than 10% for 13 hours including the morning and evening peak loads.

Table 1: Renewable Resource Capacity Factors

Figure 2: Net Wind and Solar Performance Total Daily Production and Capacity Factors

Source: NYISO January Operations Performance Metrics Monthly Report

Wind Farm Status

The remainder of the article goes on:

Earlier this month, a federal judge handed the Trump administration a fifth consecutive loss in court challenges to its December 2025 order pausing construction of five wind farms along the East Coast. The United States District Court for the District of Columbia granted a preliminary injunction sought by Sunrise Wind L.L.C., another Orsted project, regarding the suspension order issued by the Department of the Interior’s Bureau of Ocean Energy Management. The move allows the construction of Sunrise Wind in federal waters about 30 miles east of Montauk Point to resume immediately while the underlying lawsuit challenging the administration’s order progresses.

The 924-megawatt wind farm’s export cable is to make landfall at Smith Point County Park in Shirley and is to generate electricity sufficient to power nearly 600,000 residences.

The decision follows successful challenges to the administration’s order by the developers of Empire Wind 1, a 54-turbine, 810-megawatt project being built by the Norwegian company Equinor and which is to send electricity to New York City; Revolution Wind, a joint venture between Orsted and Skyborn that is to send electricity sufficient to power 350,000 residences in Connecticut and Rhode Island; Vineyard Wind 1, jointly developed by Avangrid Renewables and Copenhagen Infrastructure Partners, which is nearly complete and has already sent electricity to Massachusetts, and Coastal Virginia Offshore Wind, under development by Dominion Energy.

An Orsted official delivered the statistics on the South Fork Wind farm at the advocacy organization Oceantic Network’s annual International Partnering Forum in Manhattan. It was there that Tim Houston, the premier of Nova Scotia, made a pitch to business executives to invest in offshore wind projects off his province rather than in the United States, where the federal government has repeatedly attempted to kill the nascent offshore wind industry while promoting fossil fuel-derived energy, which scientists say is causing dangerous and accelerating warming of the atmosphere.

“We are a predictable and reliable regulatory jurisdiction,” David MacGregor, associate deputy minister of the Nova Scotia Department of Energy, said at the conference, as quoted in The New Bedford Light, a Massachusetts digital news outlet.

Perhaps demonstrating that the United States under the Trump administration is equally predictable, Interior Secretary Doug Burgum told Bloomberg News that the administration will appeal the five court rulings that thwarted its effort to halt construction of the five offshore wind farms. The administration had cited vague national security concerns, and its December order pausing the wind farms’ construction prompted Gov. Kathy Hochul and the governors of Rhode Island, Connecticut, and Massachusetts to demand that the federal government rescind the order, and prompted the wind farms’ developers to sue the government.

Construction has since resumed on all five wind farms.

In my opinion, the rest of the article is a marketing plea by an offshore wind advocate. I don’t want to waste my time responding.

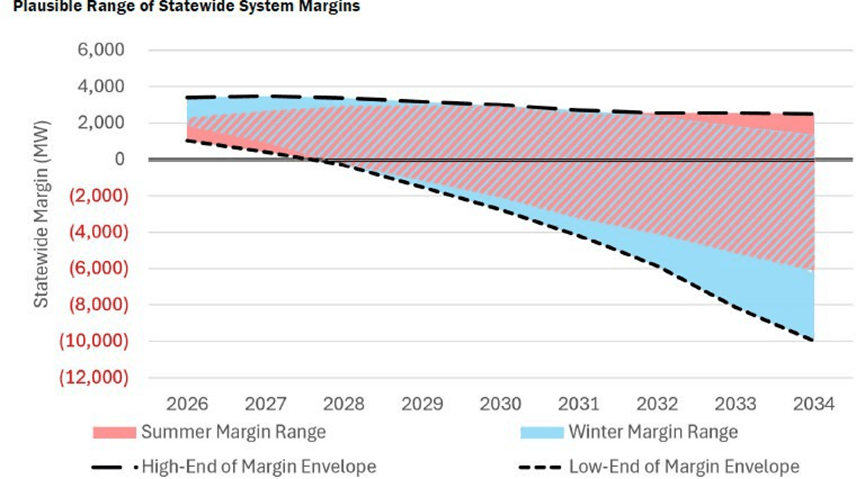

Discussion

If the New York electric system were to rely primarily on wind, solar, and energy storage then this extended period of light winds, low solar availability, and snow-covered solar panels simply cannot provide the power when needed the most. State agencies responsible for electric system reliability agree that a new dispatchable, emissions free resource is needed for these periods but admit that there isn’t any such resource available today. Given that there is no such technology available, proceeding under the assumption that one will magically appear is an enormous risk for reliability.

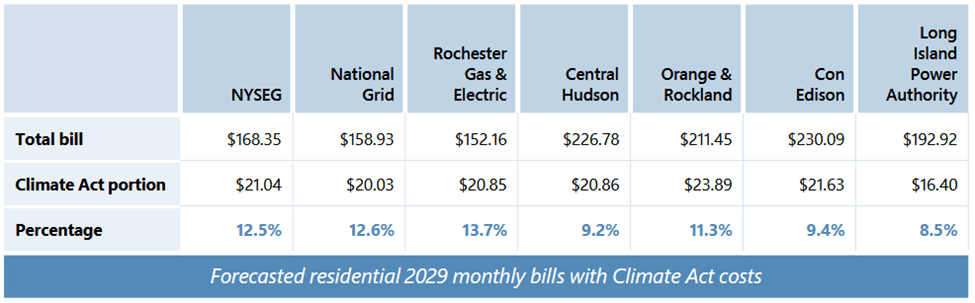

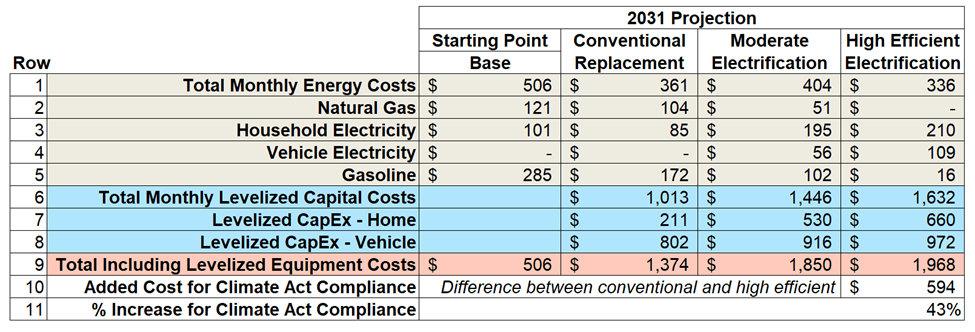

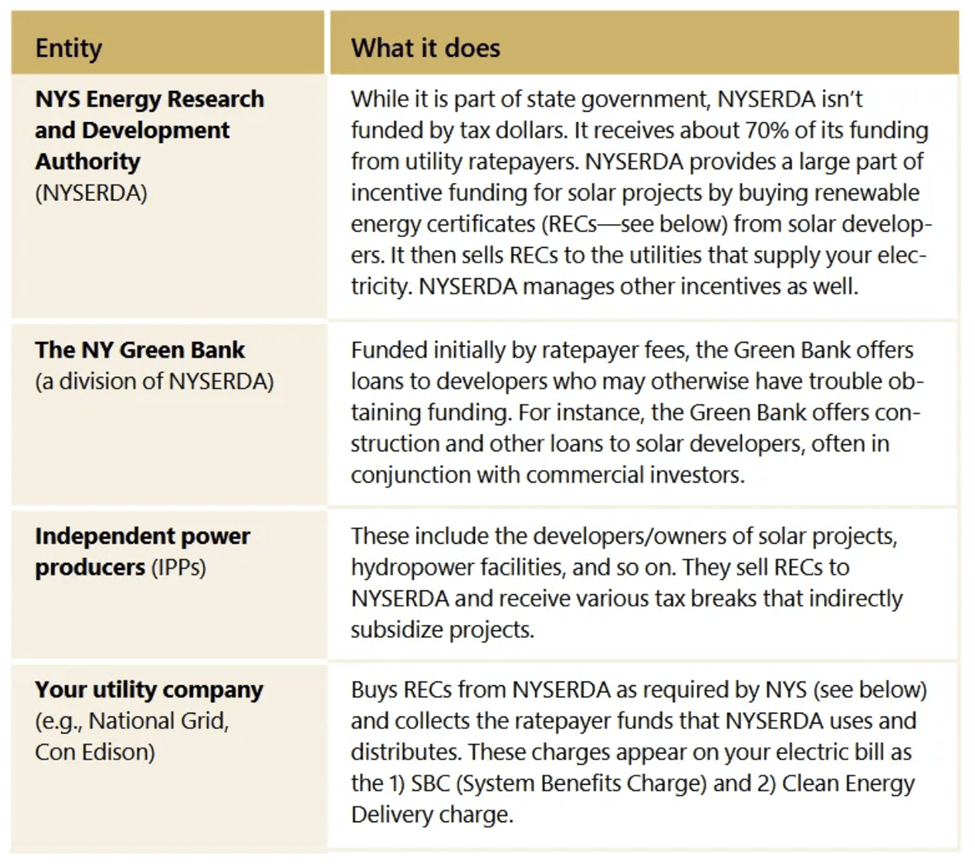

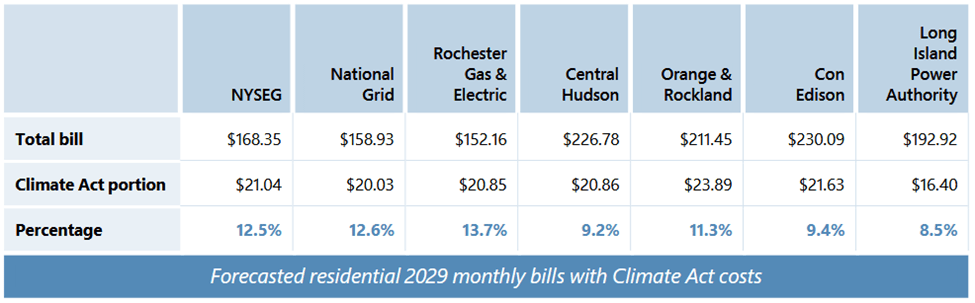

New York currently has an energy affordability crisis because as of December 2024, over 1.3 million households are behind on their energy bills by sixty-days-or-more, collectively owing more than $1.8 billion. Climate Act costs are already between 8.5 and 13.7% of monthly electric bills. The combined weighted average price revised contracts for the offshore wind projects under construction is $150.15/MWh. NYISO reports that the average New York wholesale electric price in 2025 was about 74.40 dollars per MWh, up from 41.81 dollars per MWh in 2024. Those costs do not include the price of dedicated transmission lines to get the energy to where it is needed. Adding offshore wind at costs double the current cost of electricity will only exacerbate the energy crisis.

Conclusion

Claiming that South Fork Wind is a reliable source of electricity is based on fact but is used out of context to manipulate readers into believing that offshore wind is a viable generating resource for New York’s future. Offshore wind is the most expensive source of electricity. Continued funding for a resource that cannot provide energy when needed most is a poor investment.