After spending most of my time dealing with the December rush of comments submitted for various Climate Leadership & Community Protection Act (Climate Act) initiatives, I finally have time for issues that I would like to see resolved in 2025. At the top of the list are concerns associated with the New York Cap-and-Invest Program (NYCI).

I am convinced that implementation of the New York Climate Act net-zero mandates will do more harm than good if the future electric system relies only on wind, solar, and energy storage because of reliability and affordability risks. I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 490 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. It includes an interim 2030 reduction target of a 40% GHG reduction by 2030. Two targets address the electric sector: 70% of the electricity must come from renewable energy by 2030 and all electricity must be generated by “zero-emissions” resources by 2040. The Climate Action Council (CAC) was responsible for preparing the Scoping Plan that outlined how to “achieve the State’s bold clean energy and climate agenda.” The Integration Analysis prepared by the New York State Energy Research and Development Authority (NYSERDA) and its consultants quantified the impact of the electrification strategies. That material was used to develop the Draft Scoping Plan outline of strategies. After a year-long review, the Scoping Plan was finalized at the end of 2022. Since then, the State has been trying to implement the Scoping Plan recommendations through regulations, proceedings, and legislation.

There are many issues that remain unresolved even while the Hochul Administration rushes ahead to build as much solar, wind, and energy storage as possible as quickly as possible. This post poses questions related to NYCI;

The CAC’s Scoping Plan recommended a market-based economywide cap-and-invest program. The program works by setting an annual cap on the amount of greenhouse gas pollution that is permitted to be emitted in New York: “The declining cap ensures annual emissions are reduced, setting the state on a trajectory to meet our greenhouse gas emission reduction requirements of 40% by 2030, and at least 85% from 1990 levels by 2050, as mandated by the Climate Act.” In addition to the declining cap, it is supposed to limit potential costs to New Yorkers, invest proceeds in programs that drive emission reductions in an equitable manner, and maintain the competitiveness of New York businesses and industries.

New York Cap-and-Invest Concerns

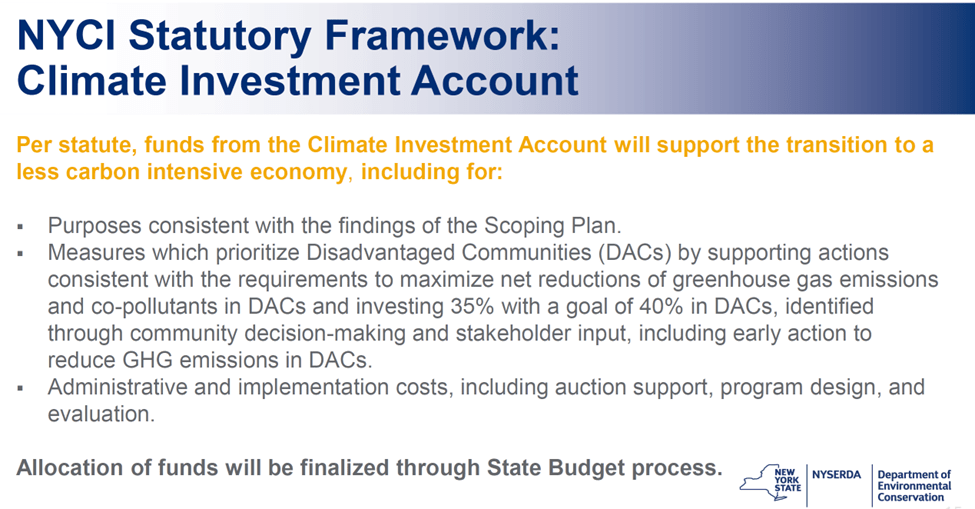

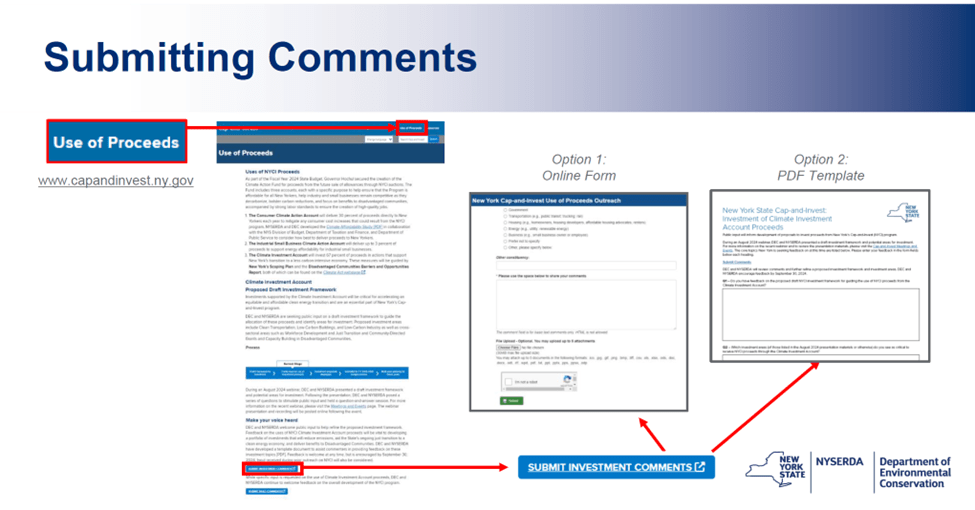

The draft cap-and-invest rule was originally slated for release in summer 2024 after the last public comment period ended in March 2024. The first question is when are the regulations going to come out? At the August 2024 Update on the New York Cap-and-Invest Plan the following slide was included that states that the “Allocation of funds will be finalized through State Budget Process.“ Consequently, I believe that the NYCI regulations will be released in conjunction with the State Budget process that will consume everyone’s attention in Albany for the next couple of months.

There are many questions related to how NYCI fund allocation would be done. At the top of that list is the revenue goals. I don’t see any way to include something in the budget unless they estimate costs. Do not ever forget that these climate initiatives are primarily about scoring political points. Governor Hochul appears to have figured out that the costs of implementing the Climate Act are enormous. I am sure that packaging the costs of NYCI as a benefit and not just another tax is a major reason why the regulations have been delayed. The resulting question is how much will this cost?

Two years ago, the Hochul Administration floated the idea of changing the GHG emissions accounting to the one used by nearly every jurisdiction in the world. That would enable New York to participate in trading programs with other jurisdictions, eliminate the need to develop an entirely new accounting framework, and would reduce the number of allowances in the auction. The last reason was the primary driver because it was alleged that it would reduce costs. There was immediate and intense blowback from environmental organizations and the proposal was dropped. I would not be shocked if it reappears. It is fair to ask how New York will ever be able to participate with other jurisdictions as long as New York insists on a unique accounting system.

The Regional Greenhouse Gas Initiative (RGGI) is often cited as a model for the NYCI program, but last month I showed that RGGI electric sector performance and New York State Energy Research & Development Authority (NYSERDA) investment effectiveness raise concerns. I question whether NYCI can improve on the results shown in NYSERDA reports that indicate RGGI has not been a very effective emission reduction mechanism.

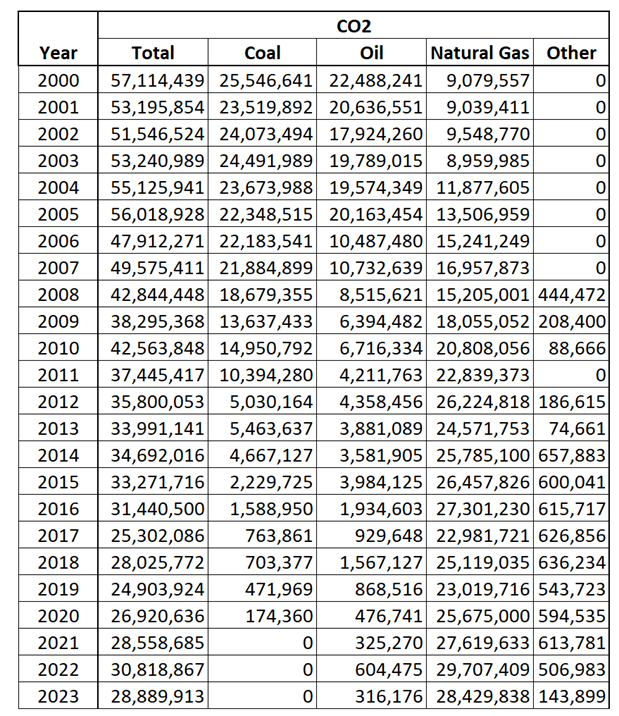

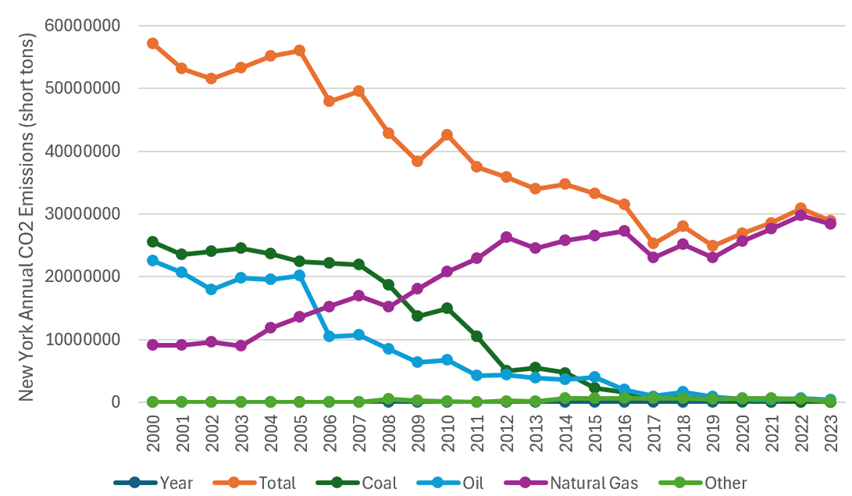

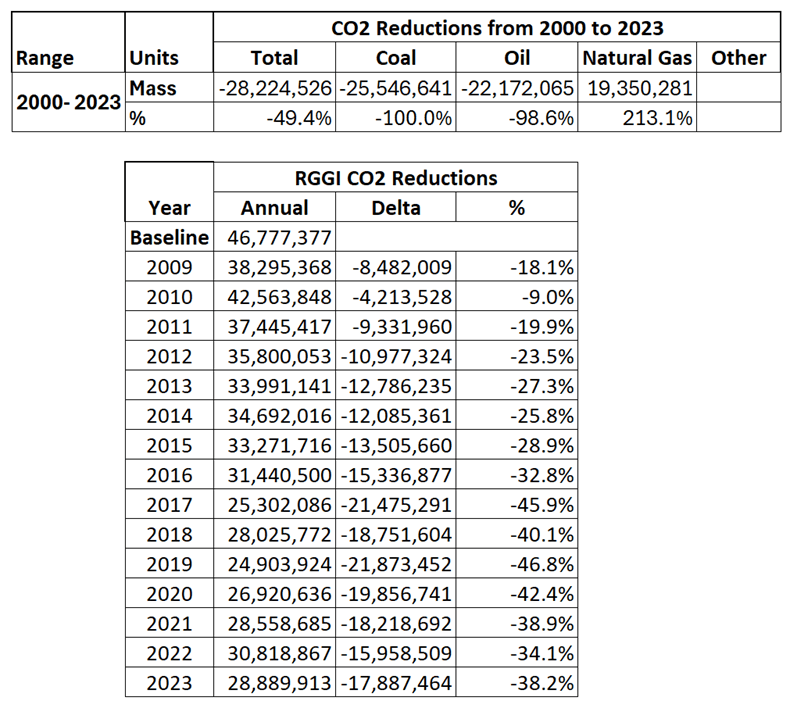

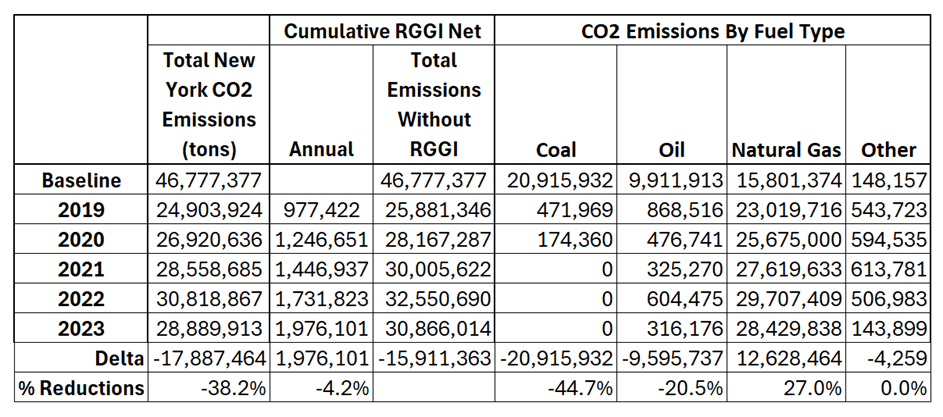

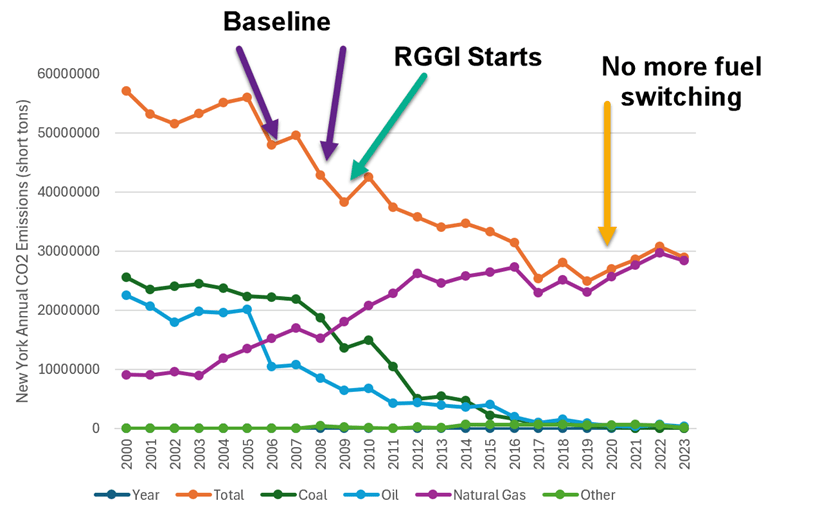

- I evaluated Environmental Protection Agency (EPA) emission data and NYSERDA documentation. The figure below shows that electric sector economic fuel switching from oil and coal to natural gas is the primary reason for the observed reduction in emissions. It also shows that there are no more fuel switching emission reductions possible.

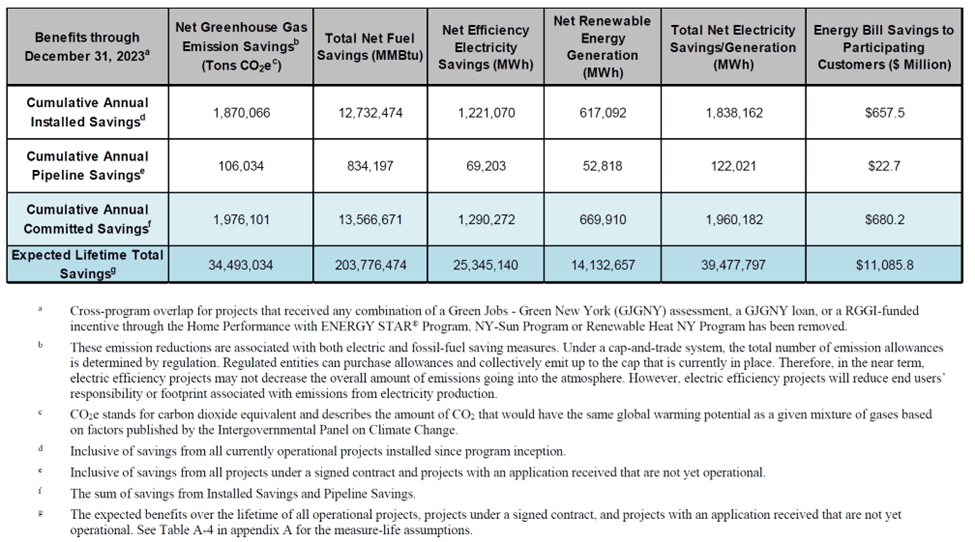

- On a regular basis NYSERDA publishes a status update of the progress of their program activities, implementation, and evaluation. According to the latest update, the total cumulative annual emission savings due to NYSERDA program investments of RGGI proceeds through the end of 2023 is 1,976,101 tons. That means that emissions from RGGI sources in New York would have been only 4.2% higher if the NYSERDA program investments did not occur. I showed that according to the report, cumulative combined costs for those programs was $1,149 million which means that the cost per ton reduced is $582.

- I also showed that the results in the Funding status reports show that since the start of the program NYSERDA has allocated 10% of its investments to programs that directly reduce utility emissions by 199,733 tons, 58% to programs that indirectly reduce utility emissions by 1,205,780 tons, and 32% to programs that will increase utility emissions by 678,804 tons. When those savings that do not affect RGGI source emissions are removed, total savings are 1,297,297 and the emissions from RGGI sources in New York would have been only 2.8% higher if the NYSERDA program investments did not occur.

- The proposed NYSERDA Amendment to the RGGI Operating Plan allocates only 22% to programs that directly, indirectly, or could potentially decrease RGGI-affected source emissions. Programs that will add load that could potentially increase RGGI source emissions total 37% of the investments. Programs that do not affect emissions are funded with 29% of the proceeds and administrative costs total another 8%.

The proposed Amendment to the RGGI Operating Plan indicates that NYSERDA has not incorporated the need to fund RGGI emission reduction programs now that fuel switching is no longer an effective option. Before we start implementing NYCI it is appropriate to check on implementation plans for RGGI. Where does NYSERDA expect the emission reductions necessary for RGGI compliance to come from?

With respect to NYCI and the non-electric sector economy, there are no fuel switching opportunities that will save fuel costs. Has NYSERDA determined how much auction revenue is needed to fund the emission reduction strategies necessary to meet the Climate Act mandates? When that amount is combined with the mandates c to fund benefits to disadvantaged communities and Hochul Administration promises for rebates what is the expected starting cost for the allowance auctions? According to the latest GHG emission inventory, the 2022 GHG emissions were 371.08 MMT CO2e and need to reach 245.47 by 2040 which means that NYS must reduce emissions by 33.8% over 18 years. Will NYCI target auction prices increase to make up for the reduced number of allowances?

In addition to these relatively broad issues there are numerous technical concerns. NYCI is supposed to be an economy-wide program. Does that mean every sector will participate? The electric sector is already covered by RGGI. Will the electric sector be exempt from NYCI or will there be some accounting mechanism to ensure that ratepayer don’t pay twice.

There are technical issues associated with timing for the start of the program. The 2024 Statewide GHG Emission Report released at the end of December covers data from 1990 to 2022. RGGI emissions are reported by the end of the following January and compliance determined 30 days later. Will NYCI mandate reporting similar to that schedule or one compatible with the official inventory. I spent more time than I care to remember dealing with emission inventories during my career and a major concern was compatibility. How will that be resolved in NYCI considering the report timing?

Discussion

California was the first in the nation legislate a “solution” to climate change with its AB32 Global Warming Solutions Act of 2006. I recently posted an article describing the Breakthrough Journal article by Jennifer Hernandez and Lauren Teixeira entitled Time to reset California’s climate leadership. After fourteen years the inevitable effects of reality are getting the attention of the politicians that supported the law. The authors explained:

California’s Democratic Assembly leader Richard Rivas opened the new Legislative session signalling a strong focus on meeting voter concerns about housing and the state’s extraordinarily high cost of living, specifically calling out the state’s climate policies: “California has always led the way on climate. And we will continue to lead on climate,” he told his Assembly colleagues. “But not on the backs of poor and working people, not with taxes or fees for programs that don’t work, and not by blocking housing and critical infrastructure projects. It’s why we must be outcome driven. We can’t blindly defend the institutions contributing to these issues.”

I think it is incumbent upon the Hochul Administration to consider whether the Climate Act will have similar impacts to New York. My analysis of the RGGI program indicates that RGGI is a hidden tax that is not working as advertised. My overarching concern is that any increase in costs is regressive and affects those least able to afford them the most. The Hochul Administration has included promises to reduce those impacts, but the reality is that it is easier said than done. For example, rebates to those adversely affected will lag payments and there is the danger that many in need will not get rebates.

New York’s stakeholder process is another hinderance to effective policy. Comments submitted go off into the bureaucracy and there is no indication which comments are addressed and how. When the regulations come out agencies are not allowed to discuss issues. Revolving issues requires dialogue, and the New York process effectively shuts that down.

There is another stakeholder issue. The desire for inclusivity is a laudable goal and the State has committed to encouraging participation by constituencies that claim that past practices have ignored their concerns. In theory that is great. In practice, if those aggrieved parties demand zero impacts and are unwilling to consider compromises or the existing structure of environmental protections, then the stakeholder process gets mired down, off track, and becomes ineffective. The Hochul Administration has yet to resolve that problem.

Conclusion

The premise for NYCI was that it would be an effective policy that would provide funding and ensure compliance because existing programs worked. The RGGI program results show that cap-and-invest programs can raise money but have not shown success in reducing emissions. My biggest concern is that NYCI has not acknowledged this problem. Past results are no guarantee of future success, especially when past results are not triumphs. This is another instance where I believe that the Climate Act implementation will do more harm than good.