There finally has been a long overdue admission that the Climate Leadership & Community Protection Act (Climate Act) might not be affordable. Buffalo TV Station WRGZ 2 On You Side posed questions to the governor that forced Governor Hochul to suggest that a “slow down” on the Climate Act was needed because of affordability concerns.

I noticed this article as I was preparing this article on the New York Department of Public Service (DPS) “broad mandate to ensure access to safe, reliable utility service at just and reasonable rates.” The fact is that Climate Act implementation process pushes ahead because the law says so while at the same time DPS ignores another law that says that there are limits. This is an update to earlier posts about Climate Act Safety Valves and the DPS response to my safety valve recommendations. We shall see if the Governor’s revelation slows the process down.

I am convinced that implementation of the Climate Act net-zero mandates will do more harm than good because the energy density of wind and solar energy is too low and the resource intermittency too variable to ever support a reliable electric system relying on those resources. I have followed the Climate Act since it was first proposed, submitted comments on the Climate Act implementation plan, and have written over 550 articles about New York’s net-zero transition. The opinions expressed in this article do not reflect the position of any of my previous employers or any other organization I have been associated with, these comments are mine alone.

Overview

The Climate Act established a New York “Net Zero” target (85% reduction in GHG emissions and 15% offset of emissions) by 2050. The Climate Action Council (CAC) was responsible for preparing the Scoping Plan that outlined how to “achieve the State’s bold clean energy and climate agenda.” After a year-long review, the Scoping Plan was finalized at the end of 2022. Since then, the State has been trying to implement the Scoping Plan recommendations through regulations, proceedings, and legislation.

Safety Valves

My previous article about safety valves described Public Service Law (PSL) Section 66-P Establishment of a renewable energy program that provides for bounds on implementation. Section 66-p (4) states: “The commission may temporarily suspend or modify the obligations under such program provided that the commission, after conducting a hearing as provided in section twenty of this chapter, makes a finding that the program impedes the provision of safe and adequate electric service; the program is likely to impair existing obligations and agreements; and/or that there is a significant increase in arrears or service disconnections that the commission determines is related to the program”.

I have started following some of the rate cases for electric and gas services which are universally requesting markedly higher rates. Based on what I have found so far program costs to implement the Climate Act mandates are clearly part of the reason that the costs are increasing. The rationale to include those programs is that the Climate Act is a law that requires it. Thus far, DPS has ignored the safety valve provisions of 66-p(4).

As documented in my DPS response to my safety valve recommendations article, DPS Staff said that this issue should be addressed elsewhere:

Finally, the issues raised by Caiazza and Kontogiannis regarding the CLCPA are beyond the scope of this rate case. The Commission has instituted a proceeding to address the CLCPA, and Caiazza and Kontogiannis’ statewide concerns are more appropriately addressed in that proceeding.

There are numerous generic proceedings that were initiated or expanded to comply with the directive for the Commission to establish a renewable energy program.

I researched these other proceedings. The DPS Document and Matter Management (DMM) system is the online repository for all cases before the Public Service Commission. There are thousands of cases in the system and individual cases can have thousands of filings. I used Perplexity AI to generate summaries and references that are documented in a white paper. I entered the following prompts on [1 July 2025]:

- Find all explicit recommendations for affordability related to implementation of the Climate Leadership & Community Protection Act in the New York DPS DMM system.

- Find all explicit recommendations for reliability related to implementation of the Climate Leadership & Community Protection Act in the New York DPS DMM system.

Note that the Perplexity link also includes two other questions: “How does the DMM system document affordability criteria for CLCPA implementation” and “How does the DMM system evaluate household ability to pay energy costs” that I posed to clarify the affordability definition.

DMM Affordability Reference: Case 22-M-0149

Case 22-M-0149: Proceeding on Motion of the Commission Assessing Implementation of and Compliance with the Requirements and Targets of the Climate Leadership and Community Protection Act responds to a Public Service Commission order in May 2022. It required the major utilities to

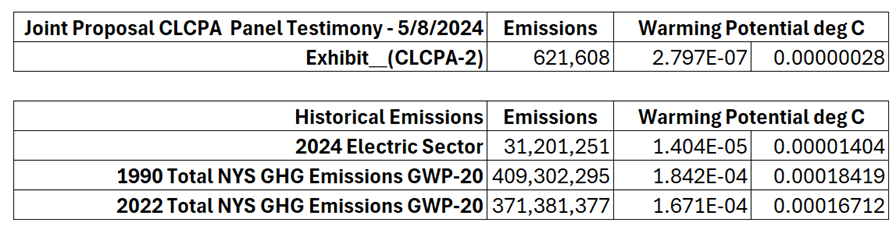

- Develop a proposal for an annual Greenhouse Gas Emissions Inventory Report, including “detailed requirements and the methodology used to calculate total gas system-wide emissions,” and then report annually;

- Include, in all future rate filings, an “assessment of the impacts that the utility’s specific investments, capital expenditures, programs and initiatives included in the rate filing will have on its greenhouse gas emissions from its gas network, specifying the potential emissions impacts of each”;

- “Develop a Greenhouse Gas Emissions Reduction Pathways Study Proposal that analyzes the scale, timing, costs, risks, uncertainties and customer bill impacts of achieving significant and quantifiable reductions in carbon emissions from the use of delivered gas”;

- Describe in all future rate filings, “the investments, programs and initiatives necessary to achieve the objectives described in the Greenhouse Gas Emissions Reduction Pathways Study.”

In addition to the requirements for the major utilities the order included two other items:

- Department of Public Service Staff is directed “to present an annual informational item detailing overall compliance with Climate Leadership and Community Protection Act as discussed in the body of this Order”

- Seek public comment regarding “utility ownership of both distributed energy resources and large-scale renewables contemporaneously with the issuance of this Order.”

The annual informational report description stated:

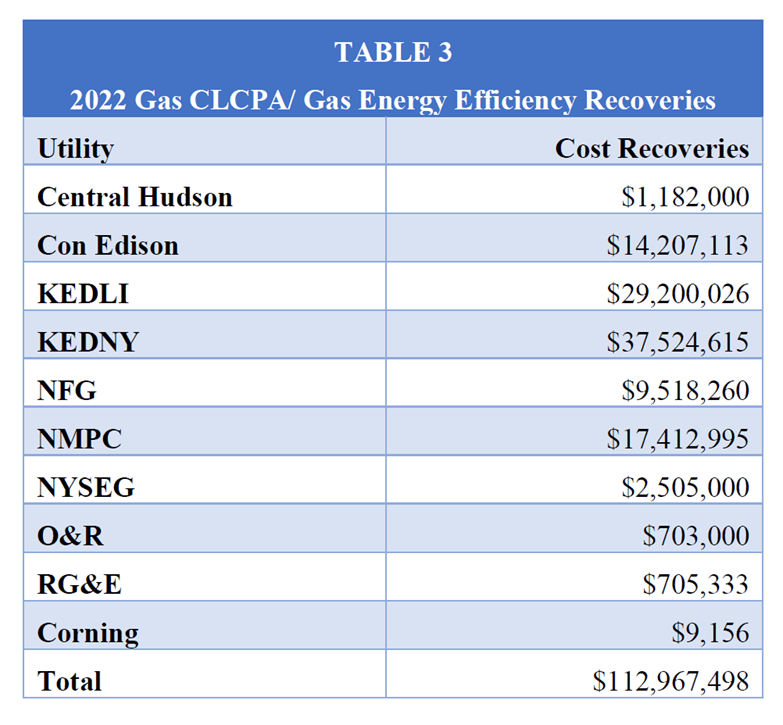

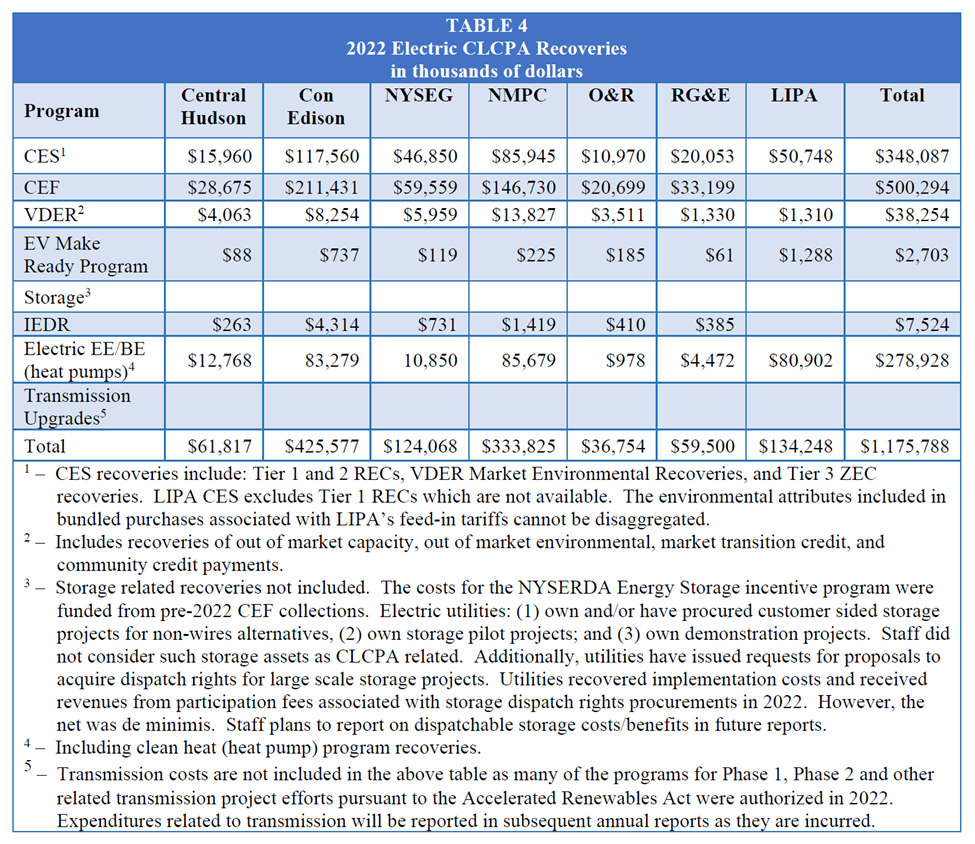

Staff is directed to present to the Commission an annual informational item detailing the Commission’s actions and DPS’ activities associated with overall compliance with the CLCPA mandates. This presentation shall include, but not be limited to, the emissions associated with electric and gas usage in the State, as identified in the annual GHG Emissions Inventory Reports, progress on achieving the targets mandated within the renewable energy program (including the biannual review required by the CLCPA), the cost and benefits to ratepayers of CLCPA investments over the prior calendar year, including the purchase of RECs and ORECs by LSEs, the costs of local and bulk transmission facilities constructed for purposes of facilitating compliance with CLCPA targets, and the cost recovery associated with NE:NY and other energy efficiency programs implemented by the Utilities and NYSERDA.

The annual informational report should be a primary source for assessing the affordability impacts of Climate Act implementation. Unfortunately, the Order included a condition that negates its value. “In the Secretary’s sole discretion, the deadlines set forth in this Order may be extended.” The first annual Informational Report was released in July 2023, but nothing was released in 2024 and to date in 2025. Note that the requirement is just for numbers. There is no affordability mandate to relate the costs to the ability to pay.

The docket for Case 22-M-0149 only had 93 filed documents on July 2, 2025. Most of the filings were related to the GHG Emissions Inventory Report or a request for information about Federal funding for the utility Climate Act work. Earlier this year there were two requests for an update to the annual informational report and a reply from the Department of Public Service as chronicled here.

There is no apparent sense of urgency in this Proceeding. The second annual informational report is a year late and the utility GHG emission inventory report “remains in a proposal stage”. There hasn’t been a response to the last filing on April 14, 2025.

DMM Affordability References: Case 14-M-0565 and Case 23-M-0298

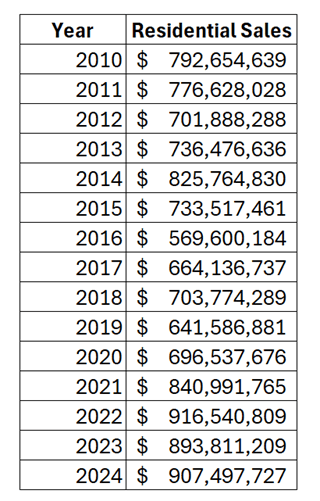

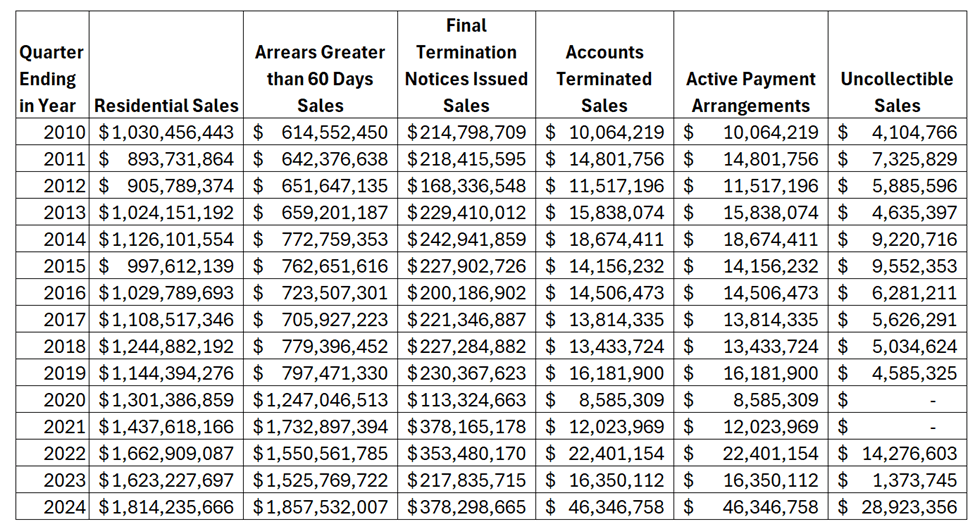

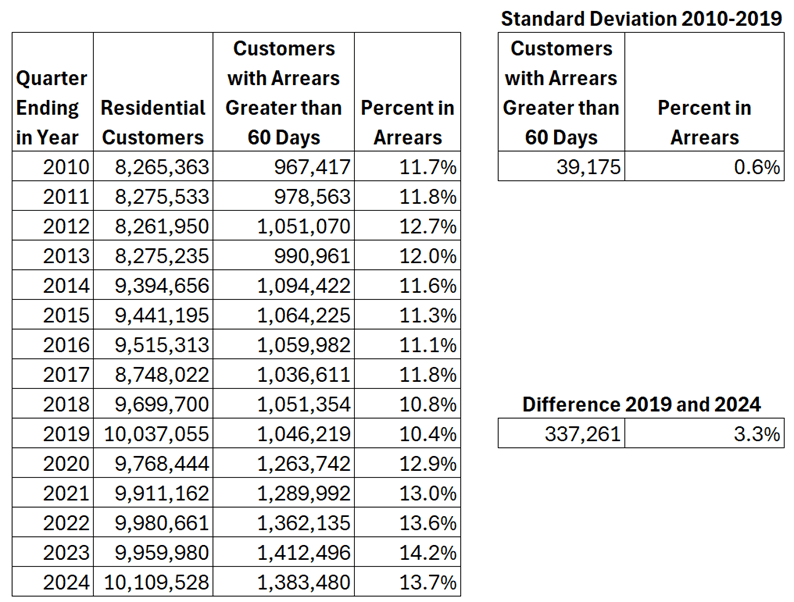

Case 14-M-0565: Proceeding on Motion of the Commission to Examine Programs to Address Energy Affordability for Low Income Utility Customers mandates that major utility companies provide quarterly updates for affordability-related metrics. Notably that includes the number of customers in arrears that is parameter mentioned in PSL 66-P(4).

Case 23-M-0298: In the Matter of Budget Appropriations to Enhance Energy Affordability Programs is closely linked to the other Proceeding. Frankly I am not sure why this is separate. Of note is the March 2025 Staff White Paper on Implementing an Enhanced Energy Affordability Policy. It includes a procedural history that explains how energy affordability has been addressed and proposes a pilot program that builds on existing programs. It does not mention the Climate Act.

These two proceedings address general affordability concerns. They do not directly consider the effect of the Climate Act on affordability.

Discussion

In my opinion, the PSC and DPS have dropped the ball on Climate Act affordability. No one has ever argued that affordability should not be a consideration. The problem is that the Hochul Administration has not bothered to define what is acceptable. A Business Council of New York memo on Climate Act implementation made the point that the “CLCPA only requires the consideration of equitable impacts and cost minimization, in effect making affordability and cost-effectiveness of CLCPA implementation measures a consideration, not a requirement.”

It was inevitable that the impact of the Climate Act on energy affordability would become a political liability. On July 1, 2025 Governor Hochul suggested that a “slow down” on the Climate Act was needed. Buffalo TV Station WRGZ 2 On You Side posed questions to the governor that forced her to admit “At the end of her long response on utility rates and energy strategy, there was this summation from Hochul: “You’re absolutely right. Utility costs are a huge burden for families, and I’ll do whatever I can to alleviate that.” The entire article is well worth a read because it reveals that the Administration has realized that an “all of the above energy strategy” that includes nuclear power is needed.

There is no more direct and immediate impact of Climate Act implementation to New Yorkers than utility bills. Hopefully, the Administration will realize that PSL 66-P(4) safety valve considerations can be interpreted to trigger the PSC to conduct a hearing that could result in a decision to “temporarily suspend or modify the obligations” of the Climate Act. Such a hearing could address modifications to the Climate Act address affordability as well as changes necessary to incorporate nuclear power.

Such a hearing could also address reliability. The PSC has acknowledged that a new category of resources is needed to support the proposed renewable-dependent electric energy system. During periods of extended low wind and solar resource availability dispatchable, emission free resources (DEFR )are needed as backup to keep the lights on. In my opinion, the most promising backup technology is nuclear generation because it is the only candidate resource that is technologically ready, can be expanded as needed and does not suffer from limitations of the Second Law of Thermodynamics. If the only viable DEFR solution is nuclear, then renewables cannot be implemented without it. But nuclear can replace renewables, eliminating the need for a massive DEFR backup resource. Therefore, it would be prudent to pause renewable development until DEFR feasibility is proven because nuclear generation may be the only viable path to zero emissions that can maintain current standards of reliability.

Conclusion

The PSC and DPS have not adequately addressed the necessity to consider the costs of the Climate Act on their “broad mandate to ensure access to safe, reliable utility service at just and reasonable rates.” DPS has not even bothered to update its mandated report on Climate Act costs in over a year. No proceeding has directly addressed the need for safety valve boundaries on costs or reliability. In rate case proceedings DPS says this issue is addressed elsewhere, but my search shows it is mentioned elsewhere but not directly addressed. Even Governor Hochul has figured out that it is time to do this right. Only time will tell whether the PSC acts.